Markets turned risk-averse on Friday after Israel launched strikes on Iranian targets, escalating Middle East tensions. The US Dollar and Yen gained as safe-haven demand increased, while gold surged above $3,440. EUR/USD and GBP/USD retreated, pressured by the stronger dollar and geopolitical fears.

Meanwhile, silver corrected slightly from recent highs, though rate cut hopes and industrial demand kept it supported. Investors now await further data for clues on monetary policy direction.

| Time | Cur. | Event | Forecast | Previous |

| 06:00 | EUR | German CPI (YoY) (May) | 2.1%(Act) | 2.1% |

| 14:00 | USD | Michigan 1-Year Inflation Expectations (Jun) | - | 6.6% |

| 14:00 | USD | ECB’s Elderson Speaks | - | - |

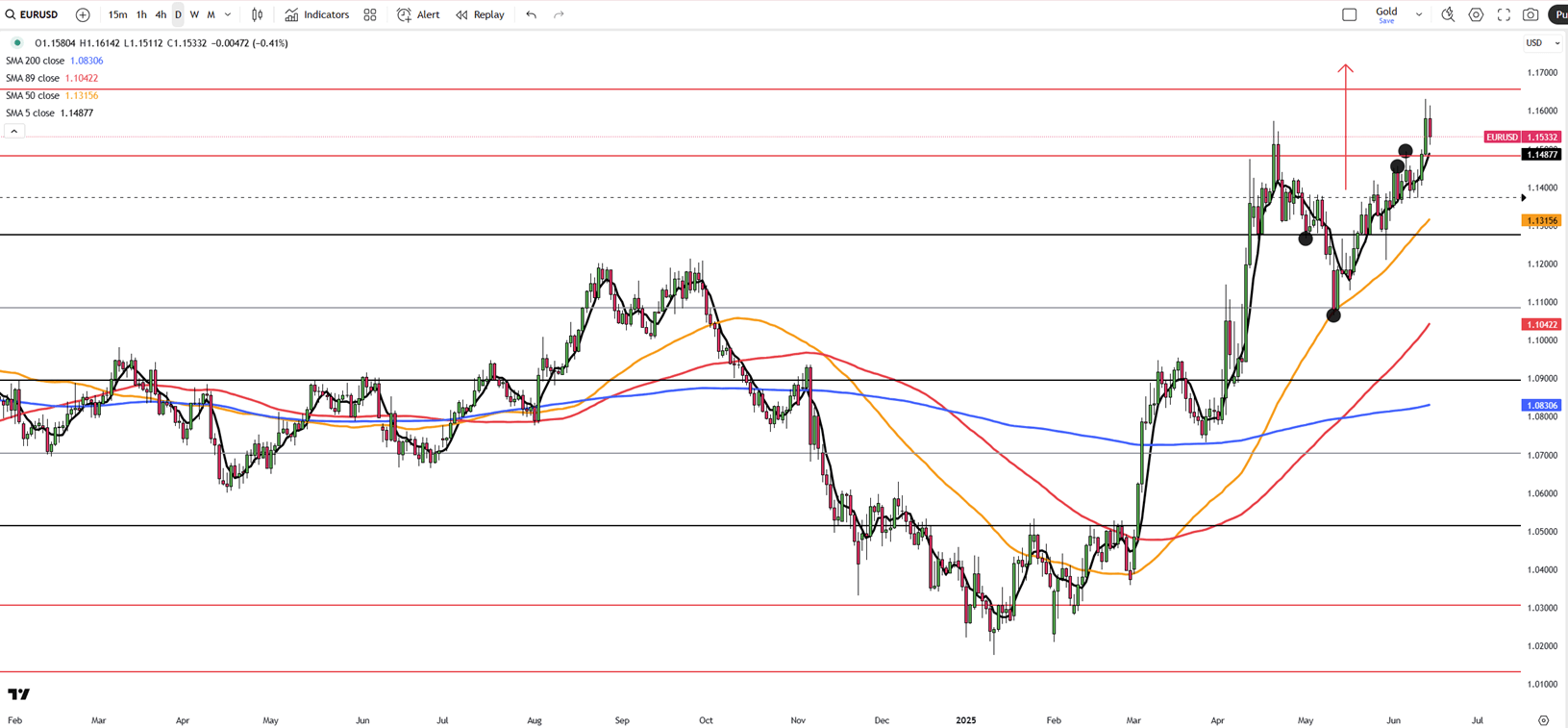

EUR/USD dropped to around 1.1530 on Friday, ending a four-day rally, as safe-haven demand lifted the US Dollar amid rising Middle East tensions.

Israel struck Iranian targets to weaken its nuclear program, prompting emergency measures. The US denied involvement but warned Iran not to target its assets.

Trump’s plan to expand steel tariffs from June 23 added trade uncertainty, while soft US inflation data kept Fed rate cut hopes alive.

Markets now await the US Michigan Sentiment report for further signals.

Resistance is located at 1.1580, while support is seen at 1.1460.

| R1: 1.1580 | S1: 1.1460 |

| R2: 1.1660 | S2: 1.1390 |

| R3: 1.1700 | S3: 1.1350 |

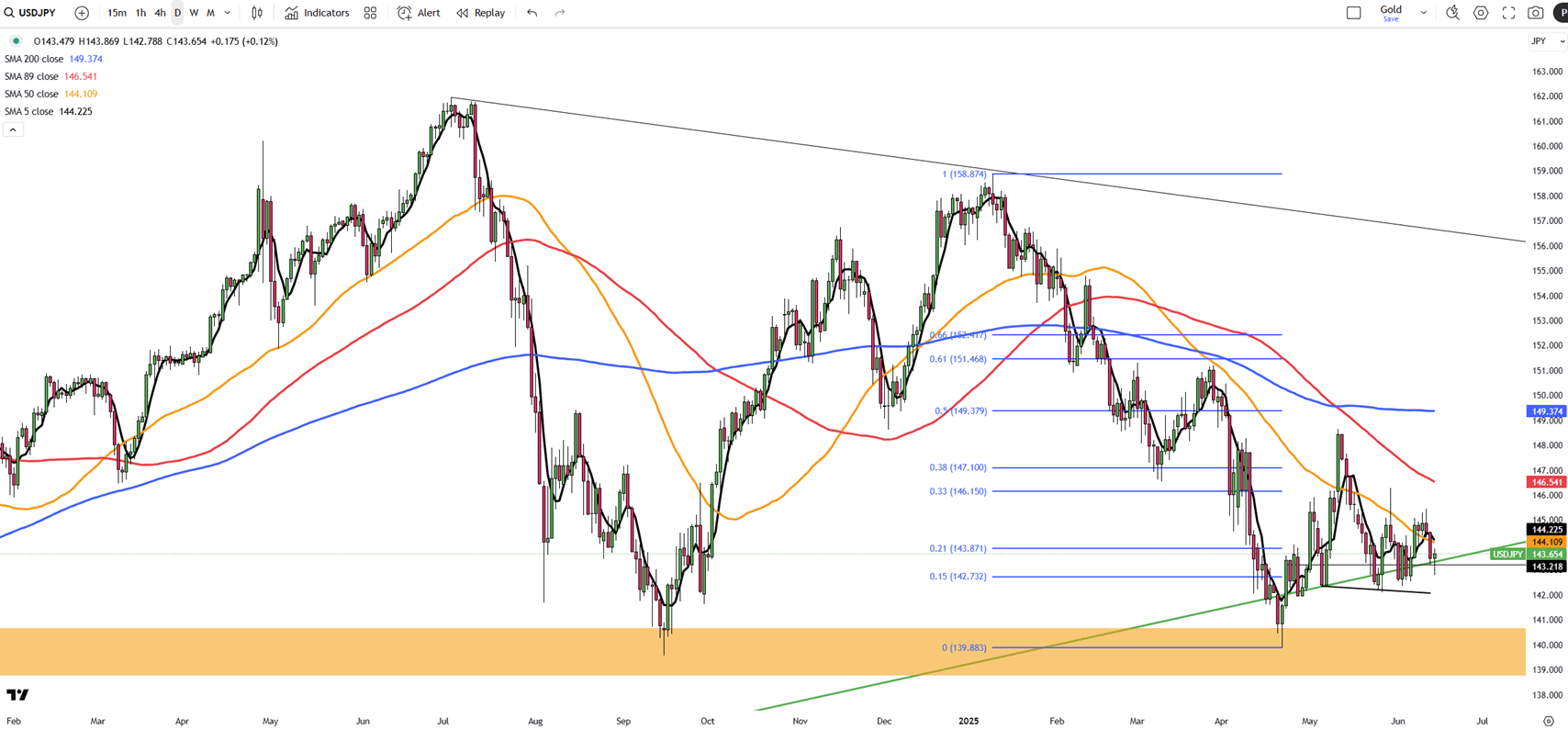

The Japanese yen strengthened to approximately 143 per dollar, marking a third consecutive day of gains as investors turned to safe-haven assets following Israel’s preemptive strike on Iran. The operation, aimed at nuclear facilities, heightened global risk aversion. Adding to market uncertainty were renewed U.S. tariff threats by Trump. Meanwhile, BoJ Governor Ueda reiterated the bank’s readiness to raise interest rates if inflation nears the 2% target.

Resistance is at 145.30, while support stands near 142.50.

| R1: 145.30 | S1: 142.50 |

| R2: 146.10 | S2: 142.10 |

| R3: 148.15 | S3: 141.50 |

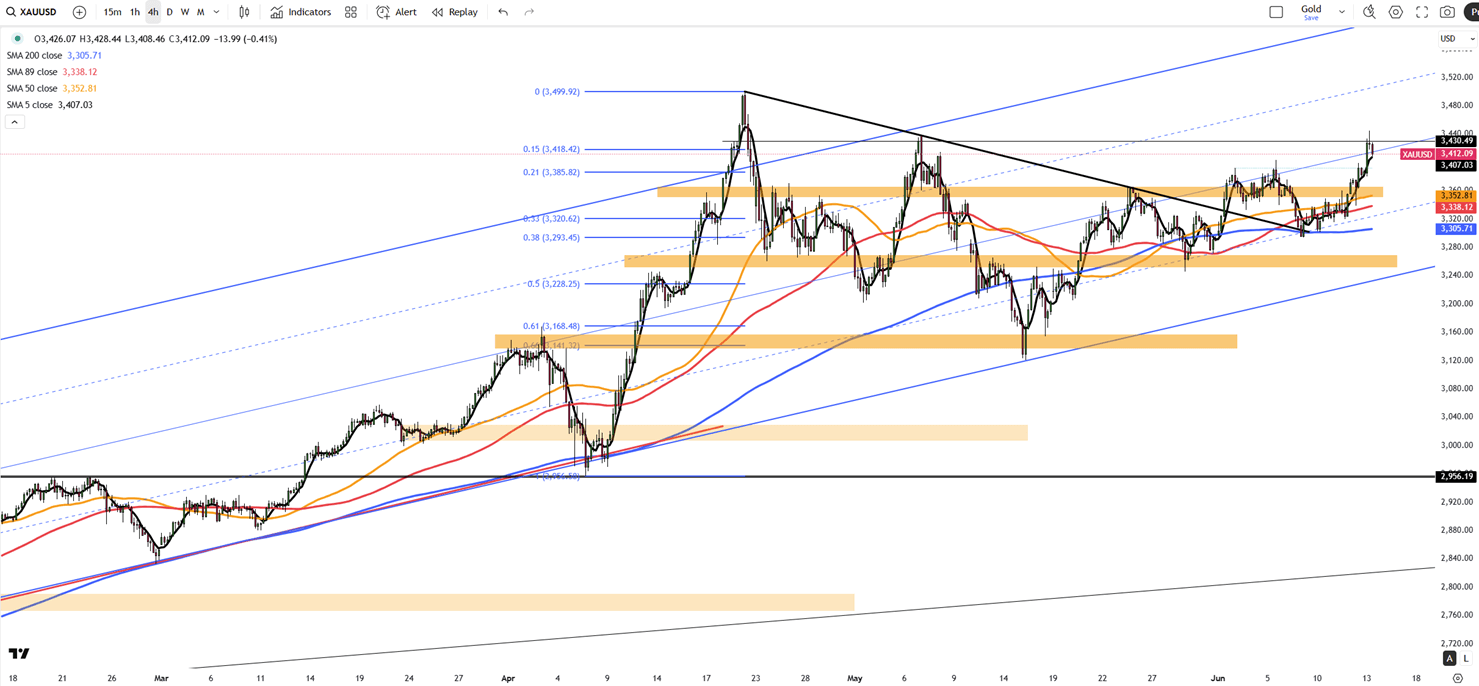

Gold surged more than 1% to exceed $3,440, approaching record levels amid a sharp rise in safe-haven demand. The gains came after Israel's strike on Iran’s nuclear facilities, fueling concerns over a wider regional conflict. Uncertainty surrounding potential US tariffs added to market jitters. Additionally, softer US inflation data increased expectations for Federal Reserve rate cuts, enhancing gold's appeal as a non-yielding asset.

Resistance is seen at $3,430, while support holds at $3,350.

| R1: 3430 | S1: 3350 |

| R2: 3500 | S2: 3300 |

| R3: 3600 | S3: 3250 |

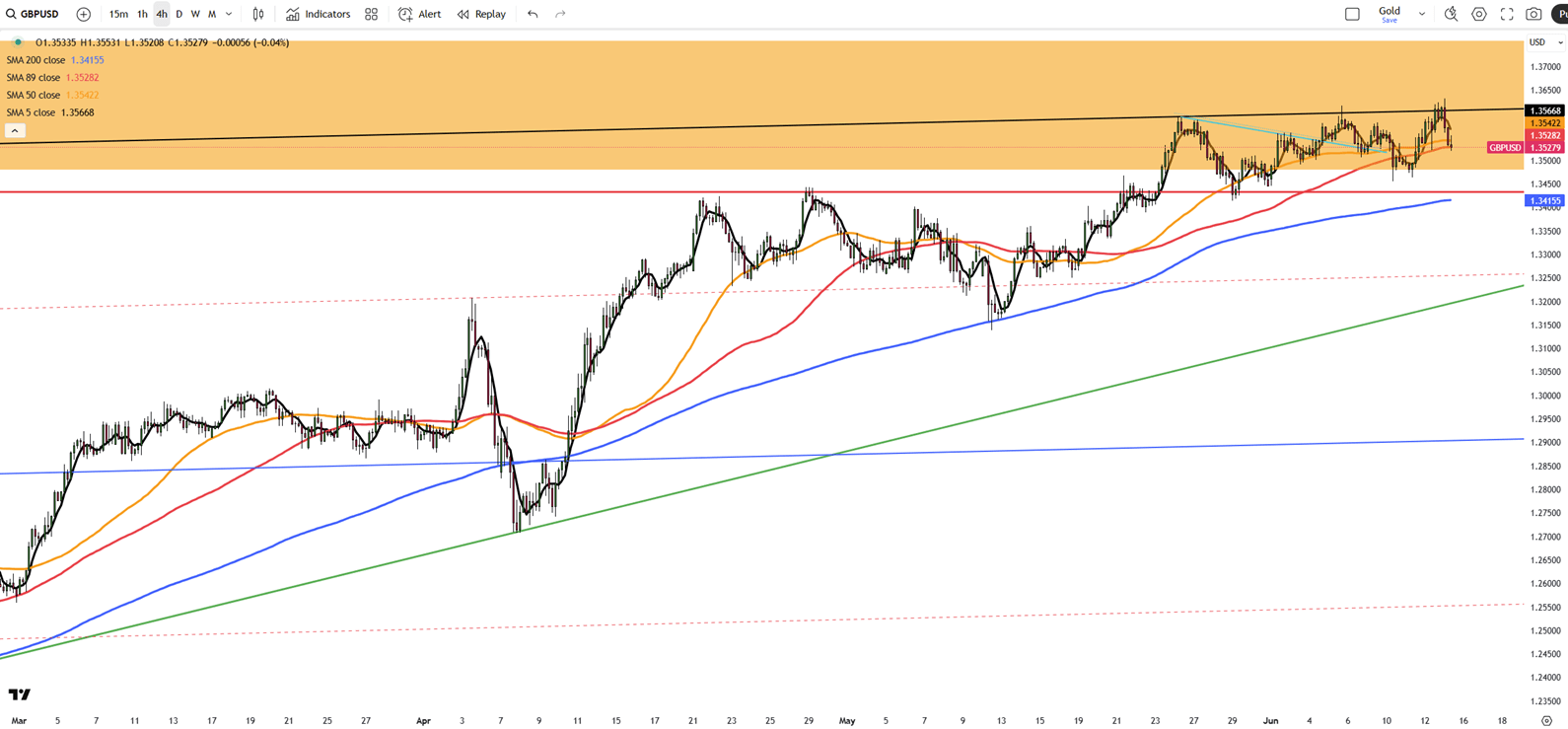

GBP/USD fell to around 1.3530 early Friday as escalating tensions in the Middle East supported demand for the US Dollar. Israel’s preemptive strike on Iran raised fears of retaliation, with Iranian officials warning of severe consequences for both the US and Israel, pressuring risk-linked currencies like the Pound. However, weaker US PPI data limited further USD strength. May’s PPI increased just 0.1%, below the 0.2% forecast, while the core PPI also came in softer. Attention now turns to the upcoming Michigan consumer sentiment report.

Resistance is at 1.3600, with support around 1.3425.

| R1: 1.3600 | S1: 1.3425 |

| R2: 1.3750 | S2: 1.3165 |

| R3: 1.3850 | S3: 1.2890 |

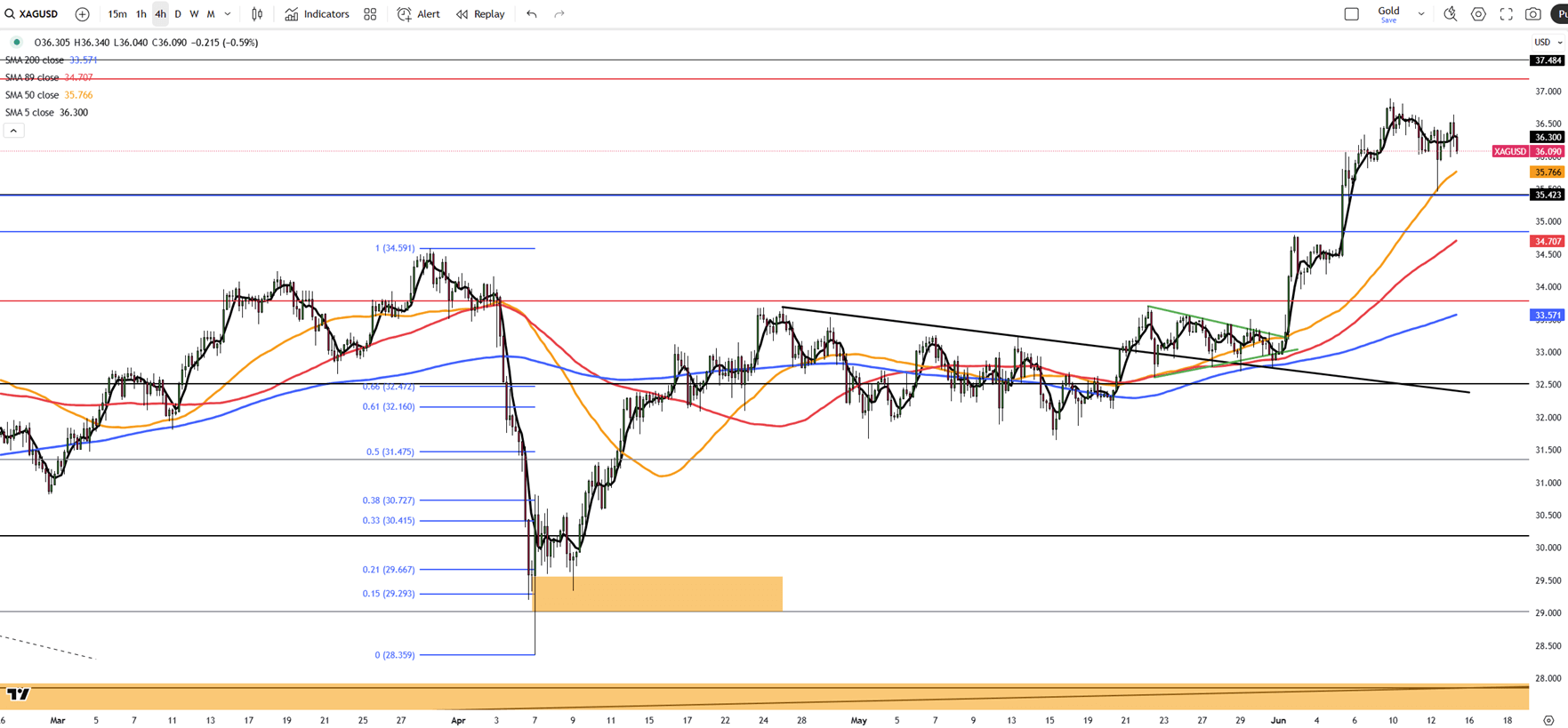

Silver slipped toward $36 per ounce as investors locked in gains after hitting a 13-year high. The metal remains supported by strong industrial demand, supply deficits, and safe-haven interest during global uncertainty. Industrial uses, especially in solar and electronics, account for over half of the demand. A fifth consecutive annual supply deficit is expected, though the Silver Institute sees the gap narrowing by 21% in 2025. Softer U.S. inflation data for May also increased expectations of Fed rate cuts beginning in September, helping sustain interest in precious metals.

Resistance is set at 36.90, while support stands at 35.40.

| R1: 36.90 | S1: 35.40 |

| R2: 37.20 | S2: 34.85 |

| R3: 37.50 | S3: 33.80 |

Bond Market Pushback Takes Center Stage

Bond Market Pushback Takes Center StageMarkets are almost fully pricing in another Federal Reserve rate cut this week, yet the US bond market continues to move in the opposite direction.

Detail Central Bank Expectations Reset the Tone (8-12 December)

Central Bank Expectations Reset the Tone (8-12 December)Traders adjusted positioning before the Federal Reserve’s December decision and evaluated fresh signals from the ECB, BoE and BOJ.

Detail Futures Stall, 10-Year Yield Pushes Above 4.1% (12.08.2025)US stock futures were flat on Monday ahead of the Fed’s meeting, with markets pricing an 88% chance of a 25 bp cut on Wednesday.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!