Global markets are currently driven by diverging central bank policies, resilient U.S. labor data, and escalating geopolitical risks.

The euro hit its lowest level since December as investors recalibrated 2026 expectations, while the pound held near three-month highs. Mixed U.S. jobs data suggests a cautious Federal Reserve. These factors, alongside unrest in Iran and concerns over central bank independence, fueled safe-haven demand. However, gold hit record highs above $4,570, and silver surged past $83, as fragile sentiment pressures the dollar.

| Time | Cur. | Event | Forecast | Previous |

| All Day | JPY | Japan - Coming of Age (Adults') Day | - | - |

| 21:00 | USD | 10-Year Note Auction | - | 4.175% |

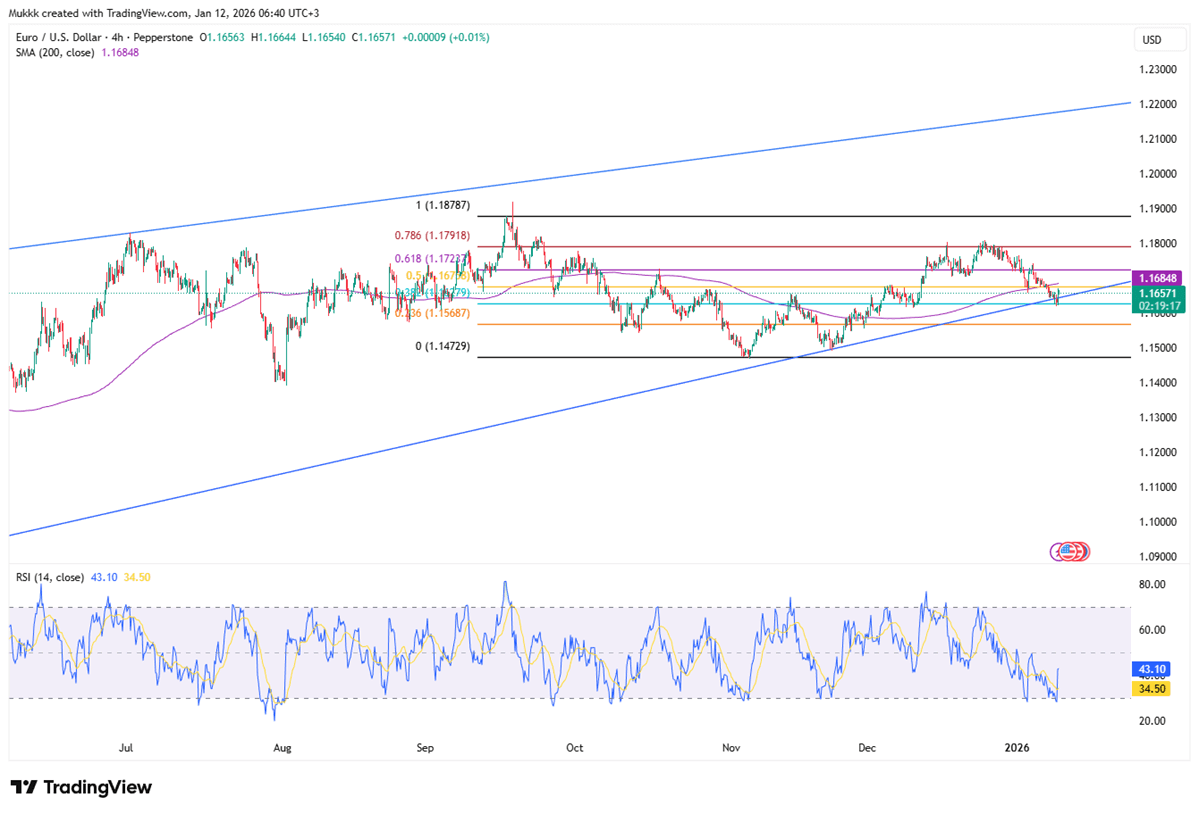

The euro dropped to $1.163, its lowest point since December 9, as investors analyzed new data and adjusted their 2026 policy outlooks. In the U.S., December’s jobs report showed a mixed picture. Nonfarm payrolls grew by 50,000, missing the 60,000 forecast, yet the unemployment rate fell to 4.4%. These figures indicate a resilient labor market, reinforcing expectations that the Federal Reserve will hold interest rates steady during its January meeting.

Technically, 1.1620 is the key support, while resistance is seen at 1.1710.

| R1: 1.1710 | S1: 1.1620 |

| R2: 1.1840 | S2: 1.1590 |

| R3: 1.1890 | S3: 1.1520 |

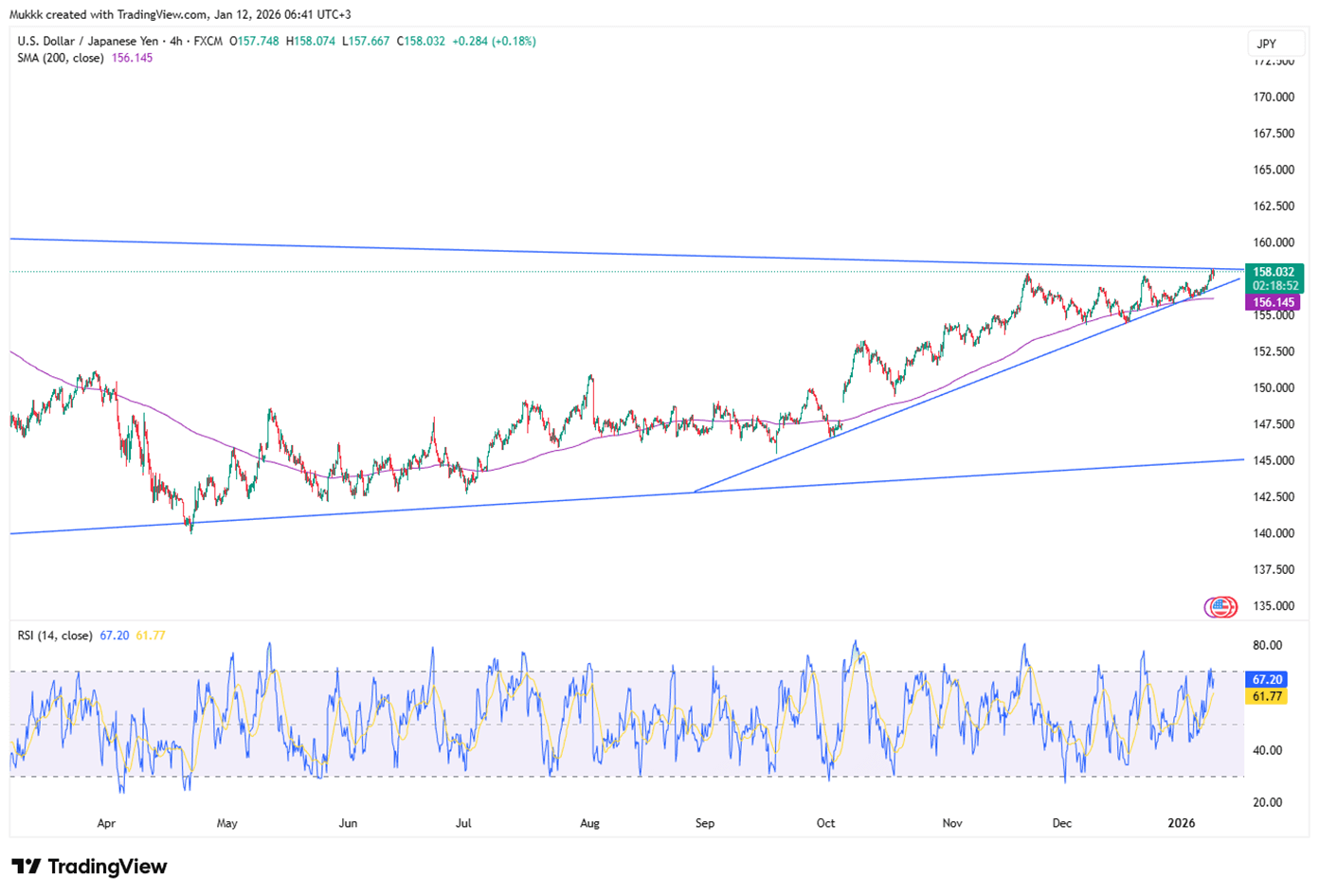

The Japanese yen stabilized around 158 per dollar on Monday, remaining near its lowest level in a year. Trading activity was limited by a local market holiday. Political instability added to the pressure after reports surfaced that Prime Minister Sanae Takaichi’s coalition partner is considering a snap election for mid-February. Furthermore, inconsistent economic data continues to cloud the Bank of Japan’s path toward future rate hikes, keeping the currency weak.

Technically, resistance stands near 158.70, while support is firm at 157.50.

| R1: 158.70 | S1: 157.50 |

| R2: 159.40 | S2: 156.80 |

| R3: 160.00 | S3: 154.70 |

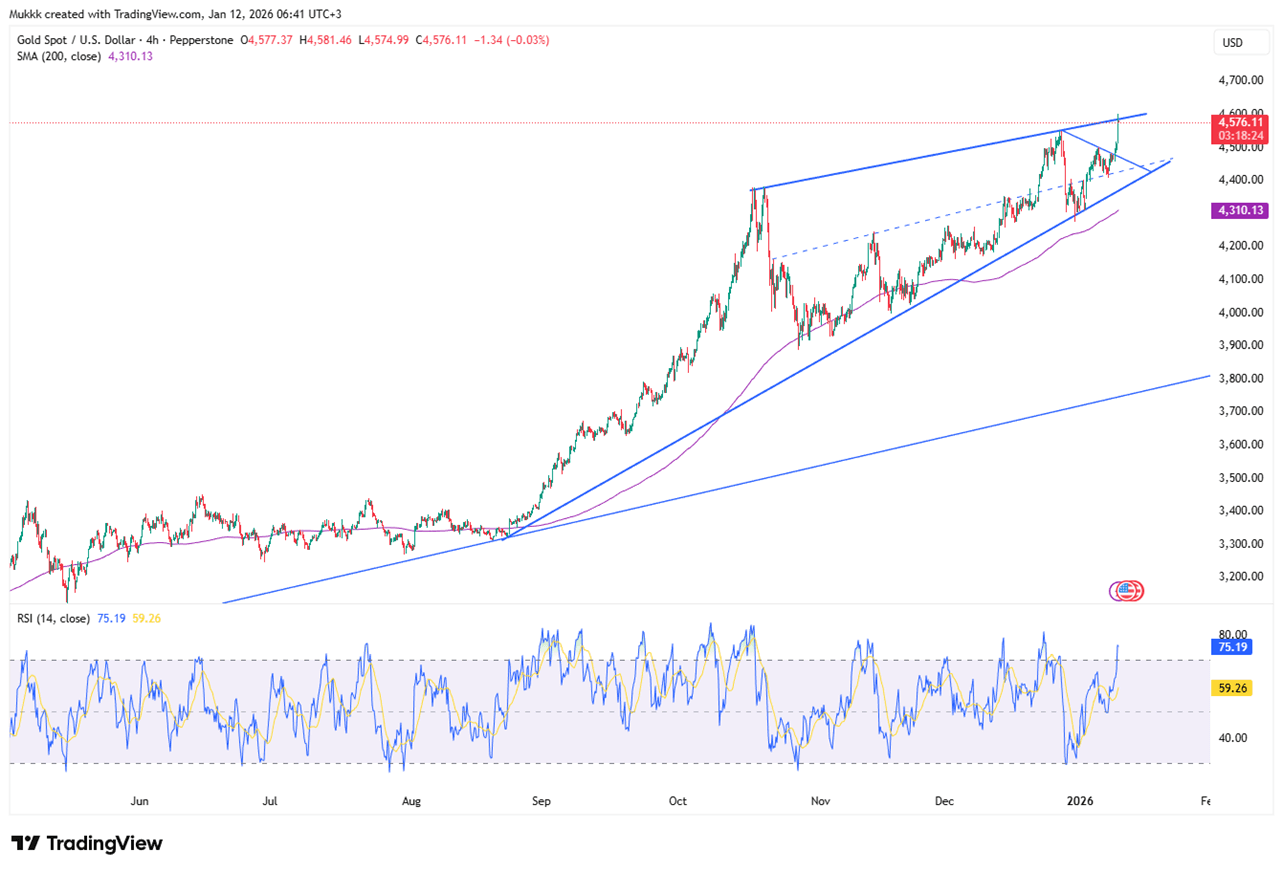

Gold jumped more than 1% to above $4,570 per ounce on Monday, hitting a fresh record amid rising geopolitical tensions and growing concerns over the Federal Reserve’s independence. Iran’s parliament speaker warned the US and Israel against intervention following President Trump’s threats of strikes, as protests in Iran reportedly left hundreds dead. Separately, Fed Chair Jerome Powell said he had been threatened with criminal charges over his Senate testimony last June, calling it part of Donald Trump’s pressure campaign to push the central bank toward rate cuts.

Gold sees support near $4510, while resistance is around $4600.

| R1: 4600 | S1: 4510 |

| R2: 4640 | S2: 4450 |

| R3: 4700 | S3: 4300 |

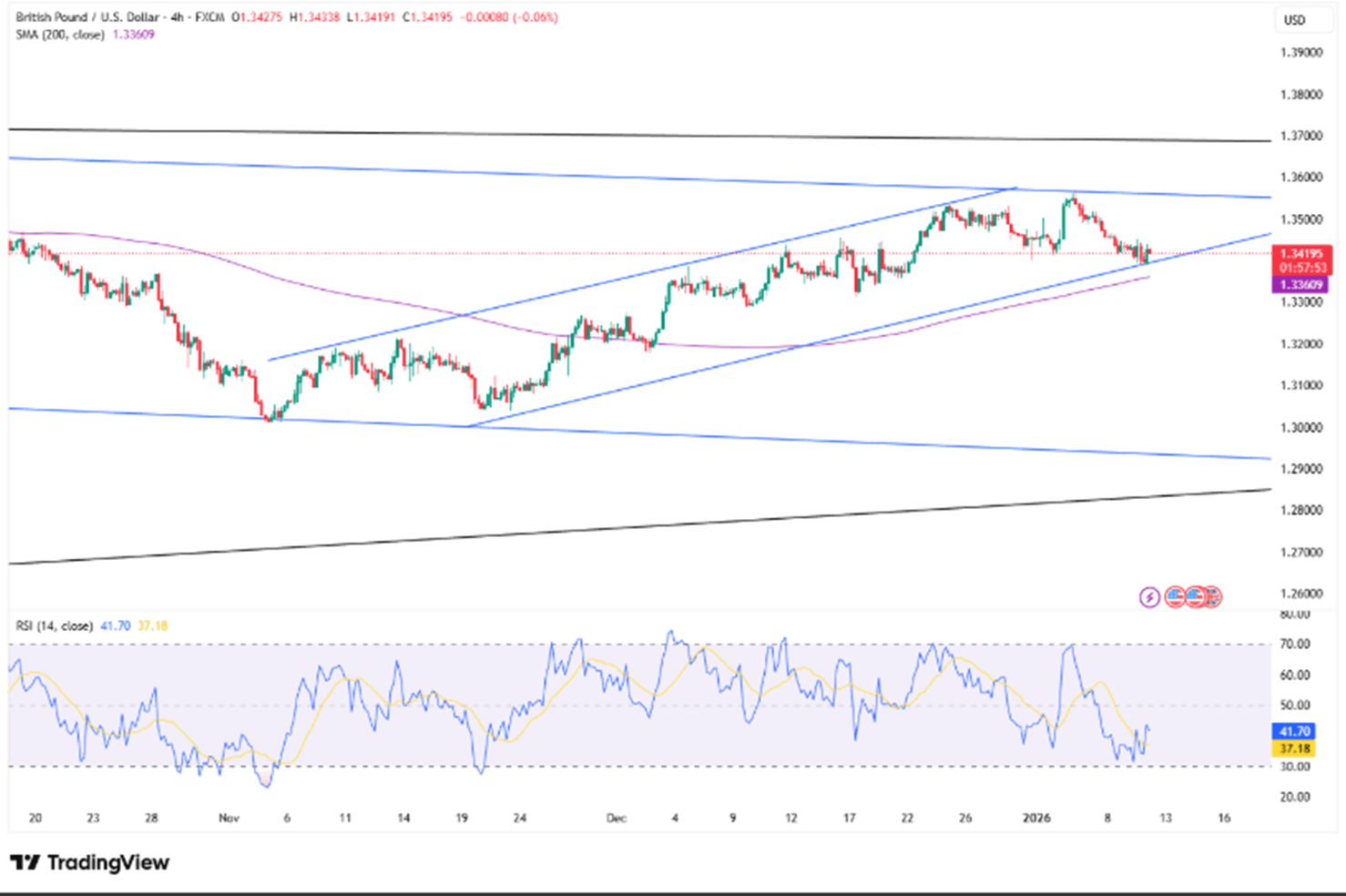

The British pound remained steady around $1.3420, maintaining its position near the recent three-month peak of $1.352. This strength stems from contrasting policy outlooks; while the Bank of England remains cautious, markets expect at least two Federal Reserve rate cuts this year. This anticipated U.S. easing continues to dampen dollar demand, providing a relative advantage for sterling.

From a technical view, support stands near 1.3390, with resistance around 1.3470.

| R1: 1.3470 | S1: 1.3390 |

| R2: 1.3510 | S2: 1.3340 |

| R3: 1.3620 | S3: 1.3290 |

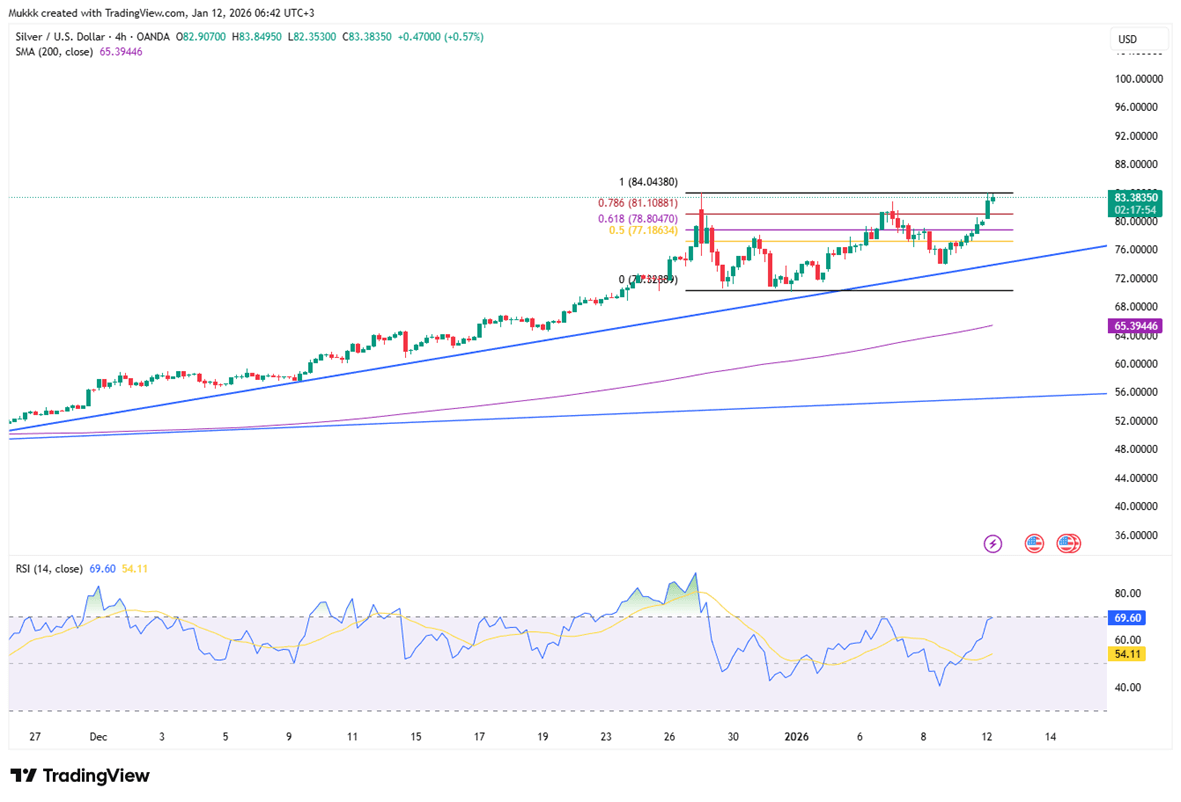

Silver surged over 4% on Monday, reaching a new record high above $83 per ounce. This rally is fueled by anticipation of U.S. interest rate cuts and intensifying geopolitical risks, which have heightened safe-haven demand. Investors are specifically monitoring nationwide protests in Iran, where reports indicate hundreds have died during three weeks of escalating unrest.

From a technical view, resistance stands near $84.00 while support is located around $72.20.

| R1: 84.00 | S1: 81.50 |

| R2: 85.50 | S2: 79.90 |

| R3: 86.80 | S3: 77.00 |

Global markets remain dominated by geopolitical risk as escalating conflict between the United States, Israel, and Iran fuels a strong shift toward safe-haven assets. The dollar index hit 99.3 Wednesday, rising for a third day as conflict concerns fueled inflation and shifted Fed rate cut expectations from July to September.

A US court rejected Trump's tariff refund delay as the Dollar (98.5) and 10 year yield (4.04%) held gains amid Middle East escalation and inflation fears.

After Khamenei: Who Will Lead Iran Next?

After Khamenei: Who Will Lead Iran Next?Following the death of Supreme Leader Ali Khamenei, Iran has entered a pivotal transition phase. Senior officials in Tehran are acting swiftly to uphold the existing structure of the Islamic Republic, prioritizing continuity to head off potential internal instability. Despite these efforts, the sudden leadership vacuum has sparked intense political and military maneuvering behind the scenes.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!