Global markets opened mixed, with the euro rising above 1.16 after the U.S. government reopened, while investors awaited delayed U.S. data that could shape December Fed expectations; sterling weakened on UK fiscal concerns and growing BoE rate-cut bets, and the yen stayed near multi-month lows despite firmer growth.

China’s disappointing data weighed on regional sentiment as investment, industrial output, and retail sales weakened, pressuring the yuan. Gold held near 4,080 dollars ahead of key U.S. releases and silver approached 54 dollars on supply risks, strong Indian demand, and its new U.S. critical-minerals status.

| Time | Cur. | Event | Forecast | Previous |

| 10:00 | EUR | EU Economic Forecasts | ||

| 13:30 | USD | NY Empire State Manufacturing Index (Nov) | 6.10 | 10.7 |

| 18:00 | USD | FOMC Member Kashkari Speaks | ||

| 20:35 | USD | Fed Waller Speaks |

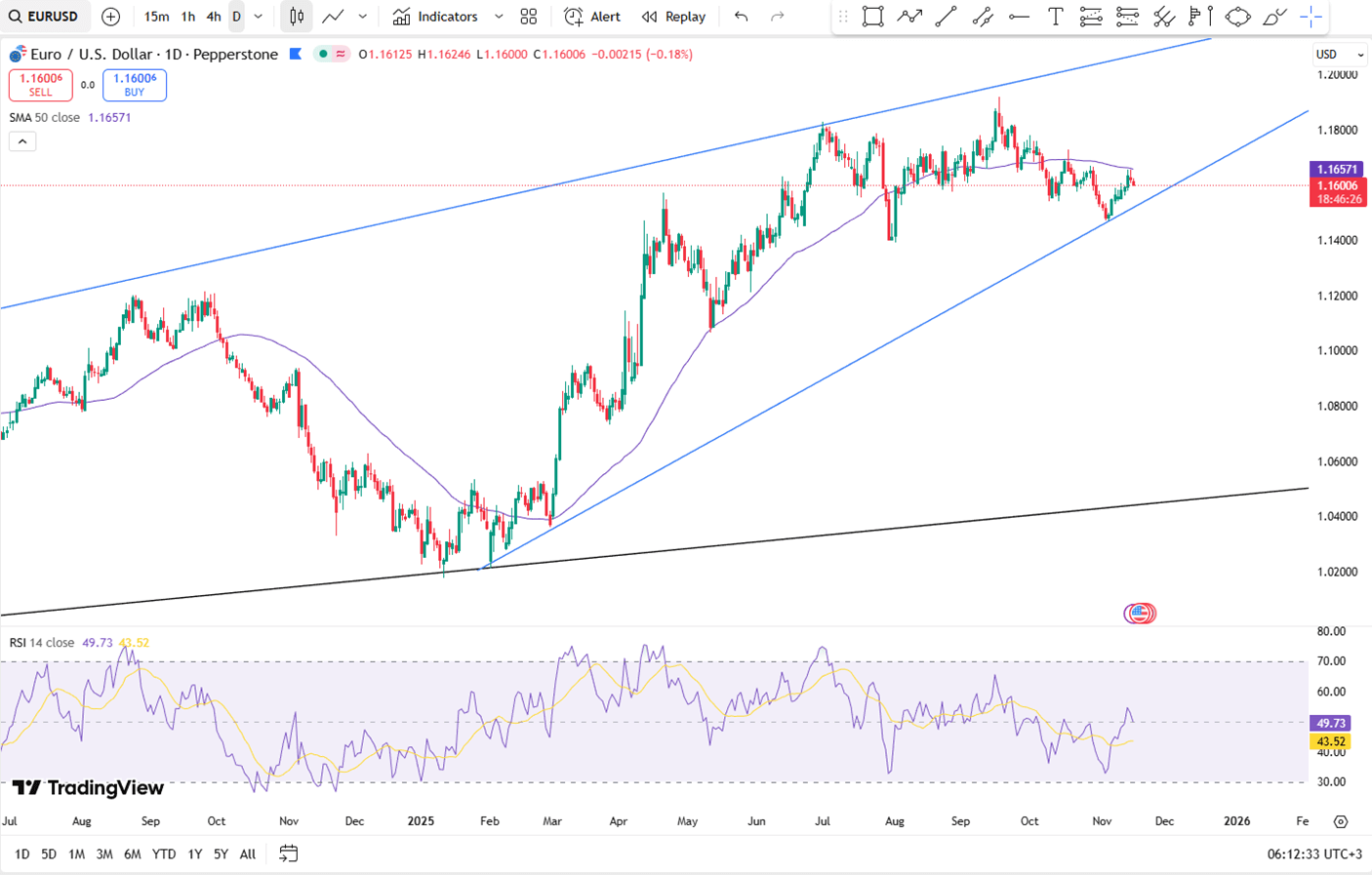

EUR/USD declined for a second straight session, trading near 1.1610 in Monday’s Asian hours as the US Dollar firmed following cautious remarks from the Federal Reserve. Kansas City Fed President Jeffery Schmid said monetary policy must curb demand and is currently “modestly restrictive.” Market pricing now reflects a 46% probability of a 25 bp rate cut in December, compared with 67% last week. The Dollar also gained support after President Trump signed a funding bill ending the 43-day shutdown.

Technically, 1.1580 is the key support, while resistance is seen at 1.1670.

| R1: 1.1670 | S1: 1.1580 |

| R2: 1.1710 | S2: 1.1490 |

| R3: 1.1750 | S3: 1.1430 |

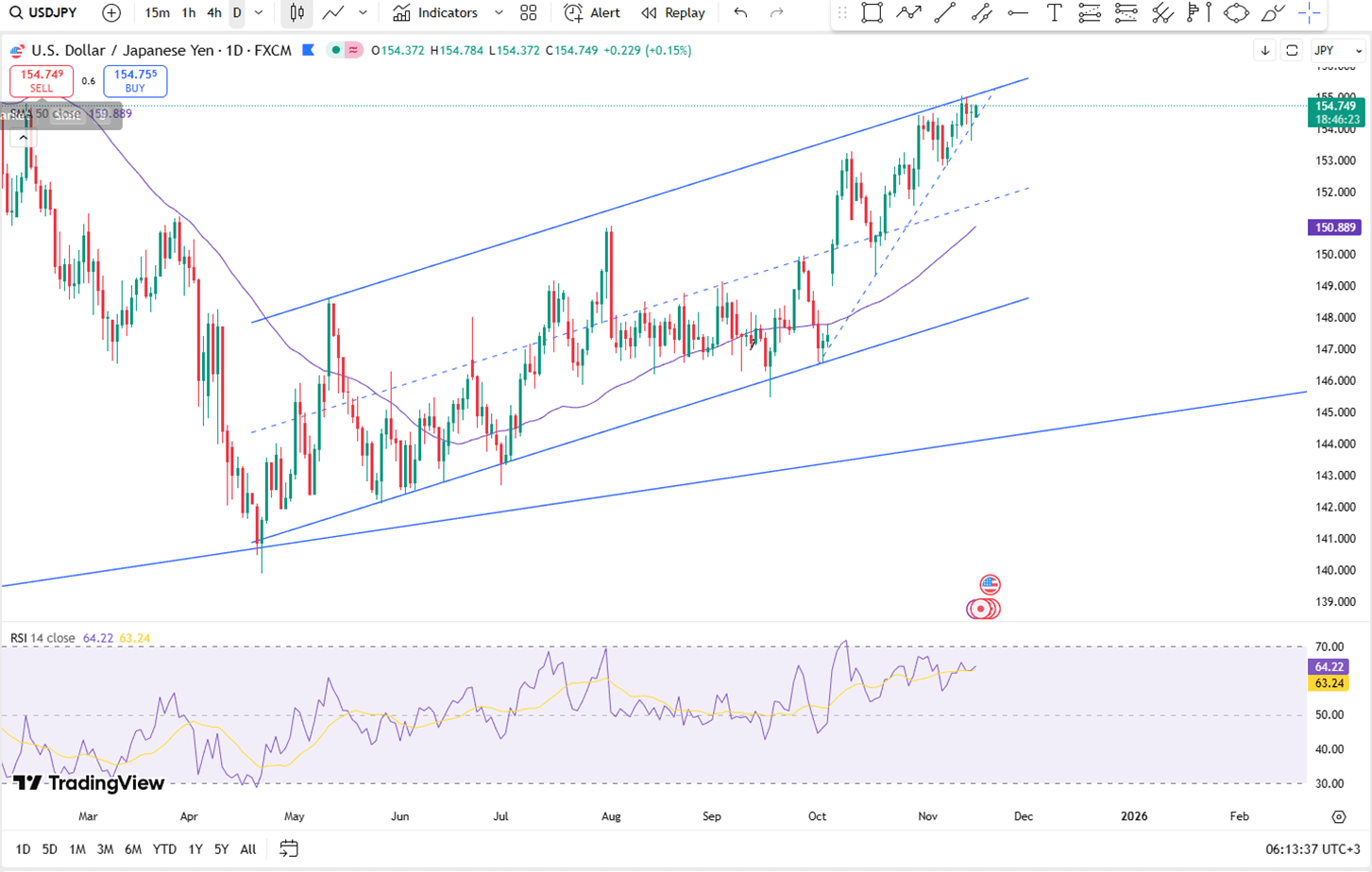

The yen traded around 154.6 per dollar on Monday, close to its weakest level since February, even after Japan’s Q3 GDP contracted 0.4 percent, slightly better than the expected 0.6 percent decline. The currency remained under pressure as Prime Minister Sanae Takaichi called on the BOJ to keep rates low to support growth and price stability. BOJ Governor Kazuo Ueda highlighted firm consumption, rising incomes, and improving labor conditions, noting that underlying inflation is approaching the 2 percent goal and suggesting a potential rate increase.

Technically, resistance stands near 155.20, while support is firm at 154.00.

| R1: 155.20 | S1: 154.00 |

| R2: 156.20 | S2: 152.50 |

| R3: 156.90 | S3: 151.60 |

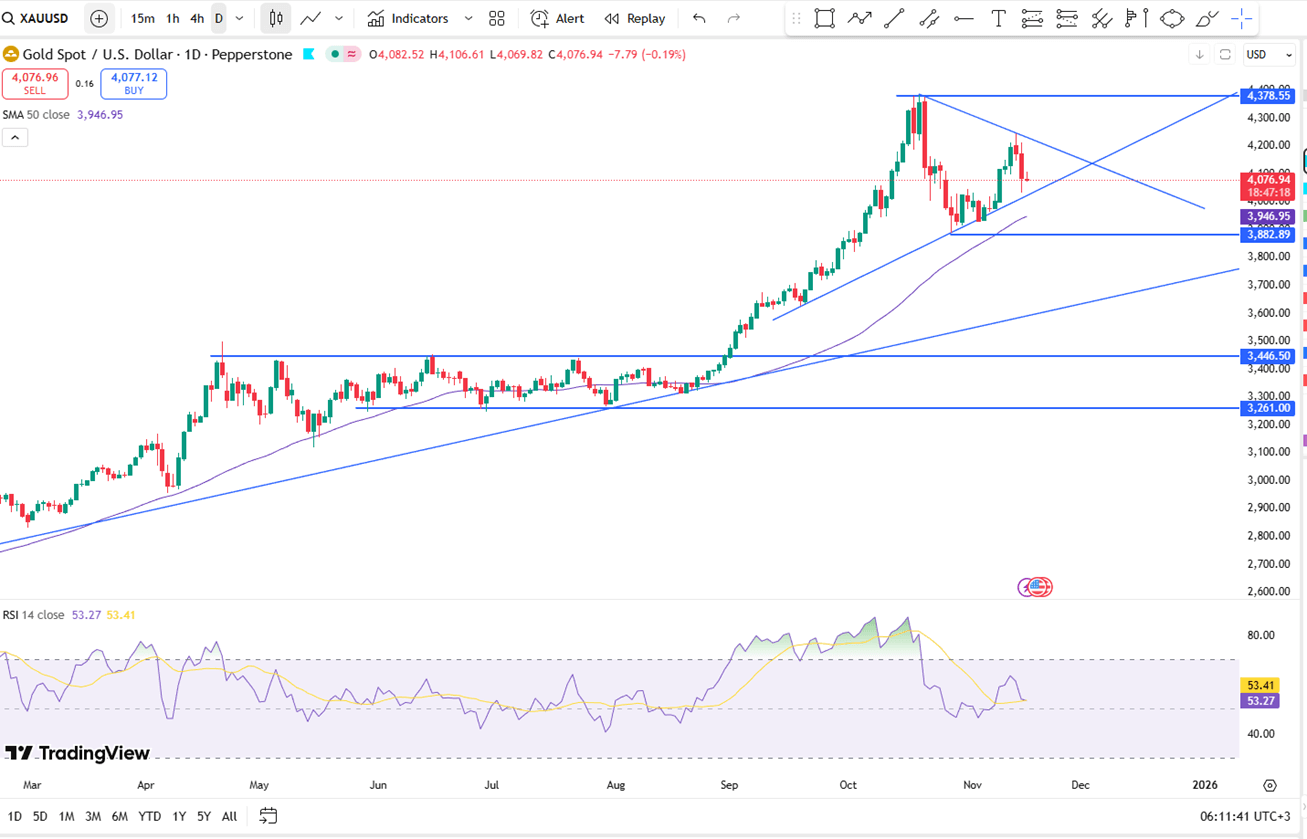

Gold eased after briefly moving above $4,100 on Monday, remaining under pressure for a third session as fading expectations of further Fed rate cuts supported the US Dollar. However, concerns about slowing US economic momentum after the record shutdown continue to leave room for future easing. A softer risk backdrop is helping Gold hold above Friday’s one-week low near $4,032. Traders are cautious ahead of Wednesday’s FOMC Minutes and Thursday’s delayed October NFP report, both important for USD and bullion direction.

From a technical view, support is seen near $4050, while resistance is positioned around $4225.

| R1: 4225 | S1: 4050 |

| R2: 4240 | S2: 4020 |

| R3: 4295 | S3: 4000 |

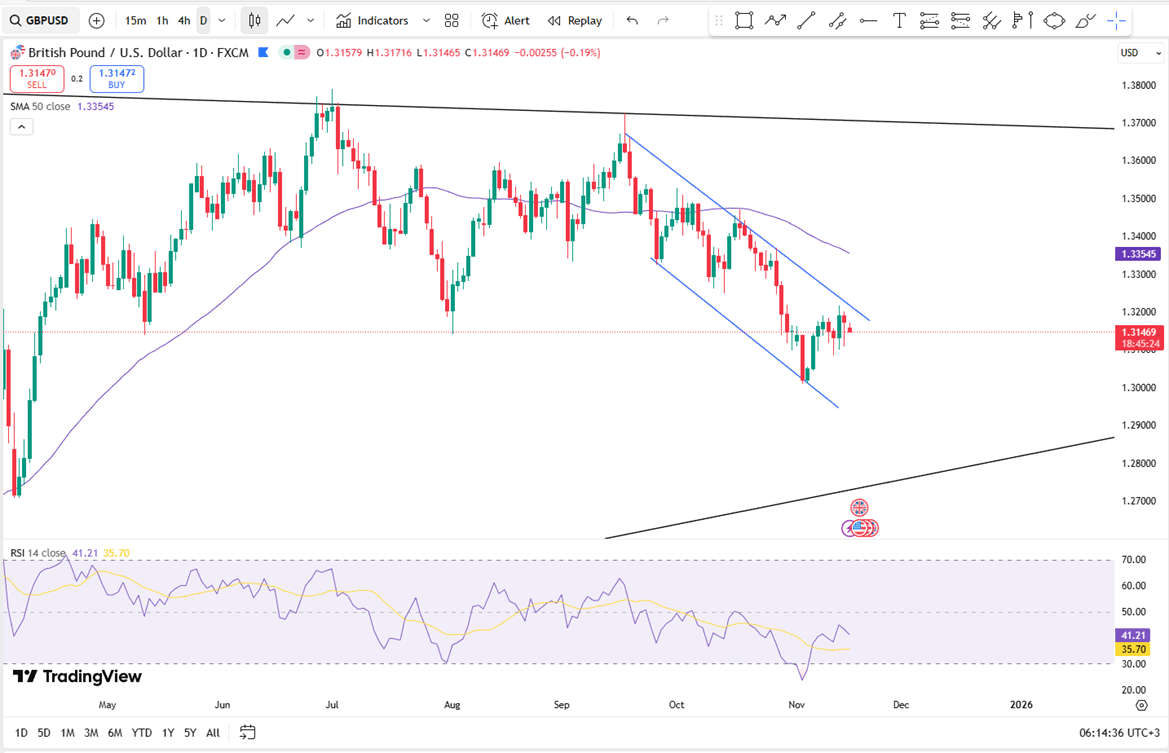

GBP/USD dipped toward 1.3155 in Monday’s Asian session as the Pound weakened on concerns over the UK’s fiscal position and recent soft economic readings. Reports that Prime Minister Keir Starmer and Finance Minister Rachel Reeves dropped plans to raise income tax ahead of the November 26 budget added to the pressure. Slowing wage growth and softer GDP have strengthened expectations of a December BoE rate cut, with markets assigning nearly an 80% chance of a 25-bp reduction, further weighing on the Pound.

From a technical view, support stands near 1.3050, with resistance around 1.3190.

| R1: 1.3190 | S1: 1.3050 |

| R2: 1.3260 | S2: 1.2990 |

| R3: 1.3350 | S3: 1.2870 |

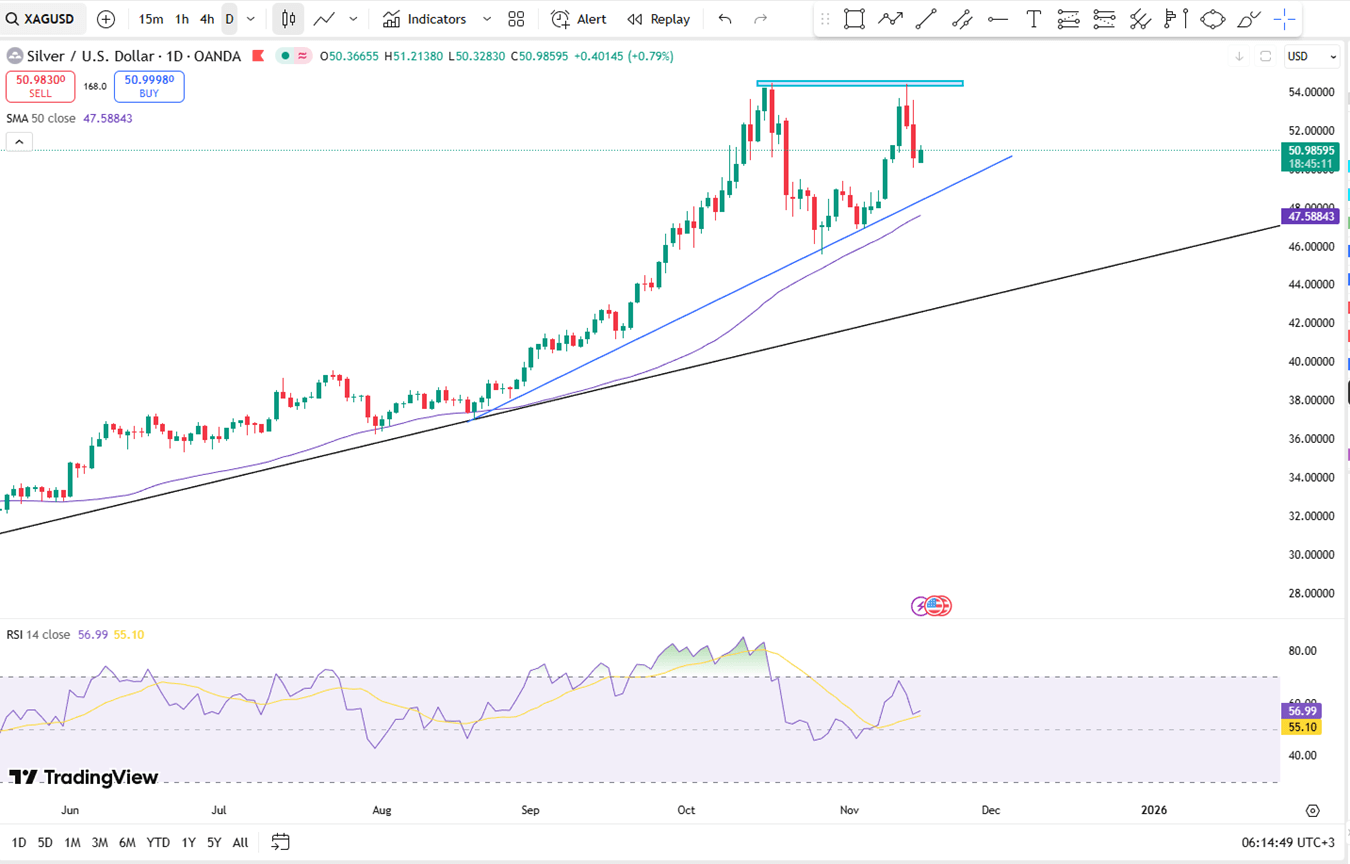

Silver (XAG/USD) inched higher toward $51.00 in Monday’s Asian trade, supported by lingering uncertainty after the US government shutdown ended. Attention now turns to scheduled remarks from several Fed officials later today. Markets are also preparing for a backlog of delayed US data, with Thursday’s Nonfarm Payrolls report seen as a key indicator for the December Fed decision. Any signs of labor-market weakness may weigh on the US Dollar and lend support to the USD-priced metal.

From a technical view, resistance stands near $54.40, while support is located around $47.70.

| R1: 54.40 | S1: 47.70 |

| R2: 55.00 | S2: 45.70 |

| R3: 55.50 | S3: 44.00 |

A US court rejected Trump's tariff refund delay as the Dollar (98.5) and 10 year yield (4.04%) held gains amid Middle East escalation and inflation fears.

After Khamenei: Who Will Lead Iran Next?

After Khamenei: Who Will Lead Iran Next?Following the death of Supreme Leader Ali Khamenei, Iran has entered a pivotal transition phase. Senior officials in Tehran are acting swiftly to uphold the existing structure of the Islamic Republic, prioritizing continuity to head off potential internal instability. Despite these efforts, the sudden leadership vacuum has sparked intense political and military maneuvering behind the scenes.

Detail March Starts With Geopolitical Turmoil (2-6 March)

March Starts With Geopolitical Turmoil (2-6 March)Global markets began the week in a state of high alert following coordinated US and Israeli strikes on Iran over the weekend, which resulted in the death of Supreme Leader Ayatollah Ali Khamenei.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!