Global markets rose on Monday, driven by record highs on Wall Street and strong Chinese manufacturing data.

The dollar gained against the yen and pound by expectations of US rate cuts and Trump's comments on BRICS. Markets are focused on upcoming US economic data, including job openings and payrolls, which could influence Federal Reserve policy. The euro faced pressure due to political instability in France, while gold fell under a stronger dollar and oil prices rose. Geopolitical tensions and US Fed decisions continue to shape market sentiment. Investors remain cautious on economic and geopolitical risks.

| Time | Cur. | Event | Forecast | Previous |

| 14:45 | USD | S&P Global US Manufacturing PMI (Nov) | 48.8 | 48.5 |

| 15:00 | USD | ISM Manufacturing PMI (Nov) | 47.7 | 46.5 |

| 15:00 | USD | ISM Manufacturing Prices (Nov) | 55.2 | 54.8 |

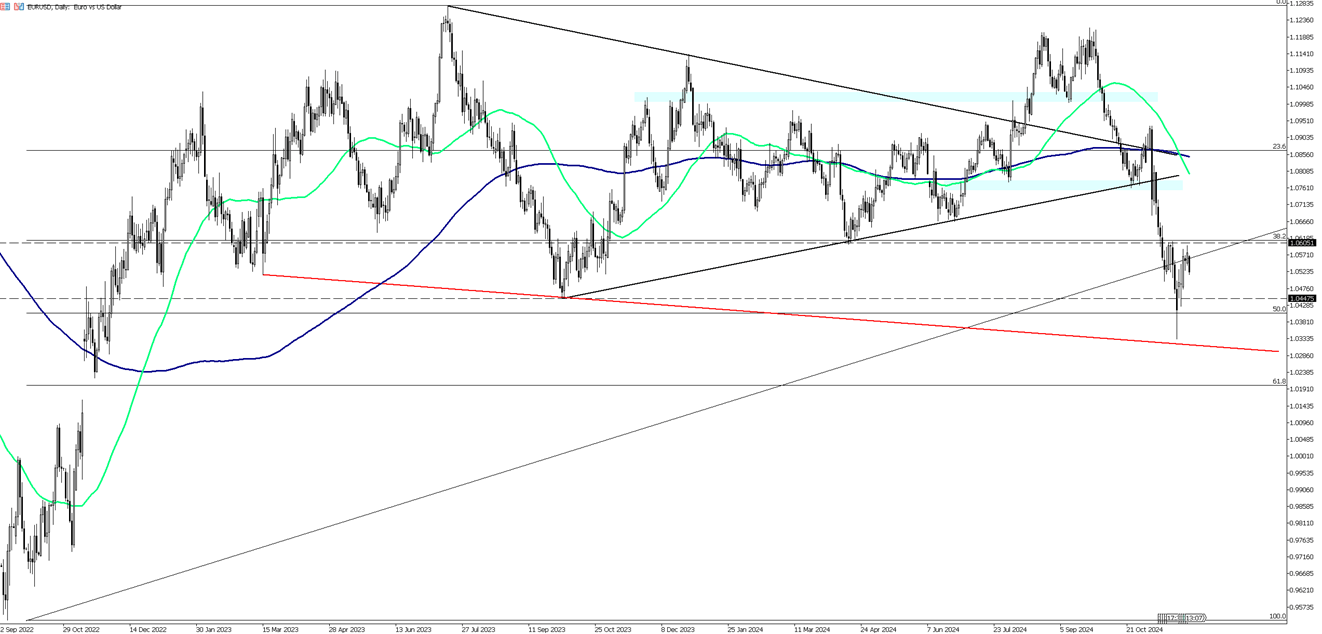

The dollar started the week stronger against the euro. The EUR/USD pair fell to the 1.0520 level. The dollar index rose by 0.5% on Monday, climbing above 106.2 and recovering some of last week's losses. This increase was supported by the continued strength of the US economy and weakening prospects in other regions.

The dollar received additional support after Trump warned BRICS nations of 100% tariffs if they backed or introduced a new currency to rival the dollar. Meanwhile, the euro's decline, triggered by political instability in France, further bolstered the dollar. Leaders of the far-right National Rally party accused the government of rejecting their demands for additional budgetary concessions.

Technically, the first resistance level will be 1.0550, and if broken, the next levels to watch will be 1.0600 and 1.0660. On the downside, 1.0500 is the first support level, and if it breaks, the levels to watch will be 1.0450 and 1.0400.

| R1: 1.0550 | S1: 1.0500 |

| R2: 1.0600 | S2: 1.0450 |

| R3: 1.0660 | S3: 1.0400 |

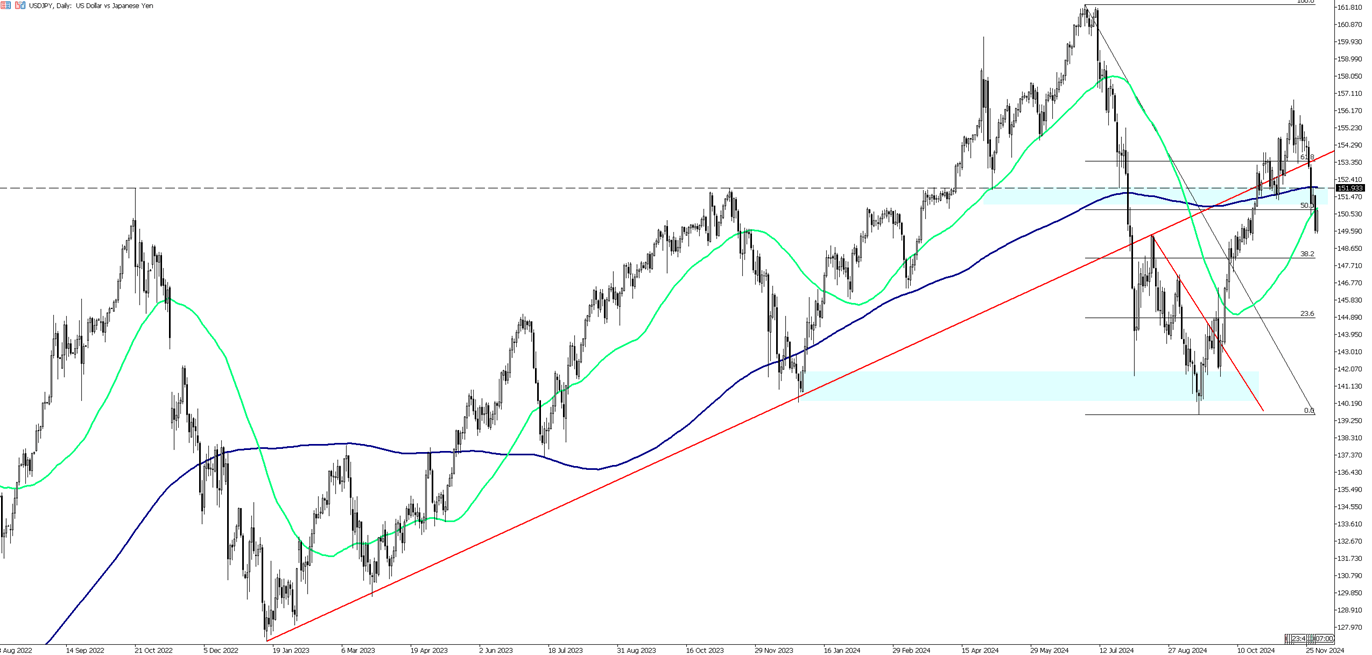

The Japanese yen weakened beyond 150.5 per dollar, giving up some of last week’s gains as uncertainty persisted over the timing of the Bank of Japan’s next interest rate hikes. BOJ Governor Kazuo Ueda mentioned on Saturday that rate increases are "approaching," aligning with expected economic progress. He highlighted the significance of fiscal 2025 wage negotiations in sustaining momentum.

Data released on Monday revealed that Japanese businesses boosted capital spending in the third quarter, reflecting strong corporate confidence and bolstering expectations of an impending rate hike. Market projections now suggest a 63% likelihood of a 25 basis point hike in December, up from roughly 50% a week earlier.

Technically, the first resistance level will be 151.00, and if broken, the next levels to watch will be 152.00 and 153.00. On the downside, 149.40 is the first support level, and if it breaks, the levels to watch will be 148.70 and 148.20.

| R1: 151.00 | S1: 149.40 |

| R2: 152.00 | S2: 148.70 |

| R3: 153.00 | S3: 148.20 |

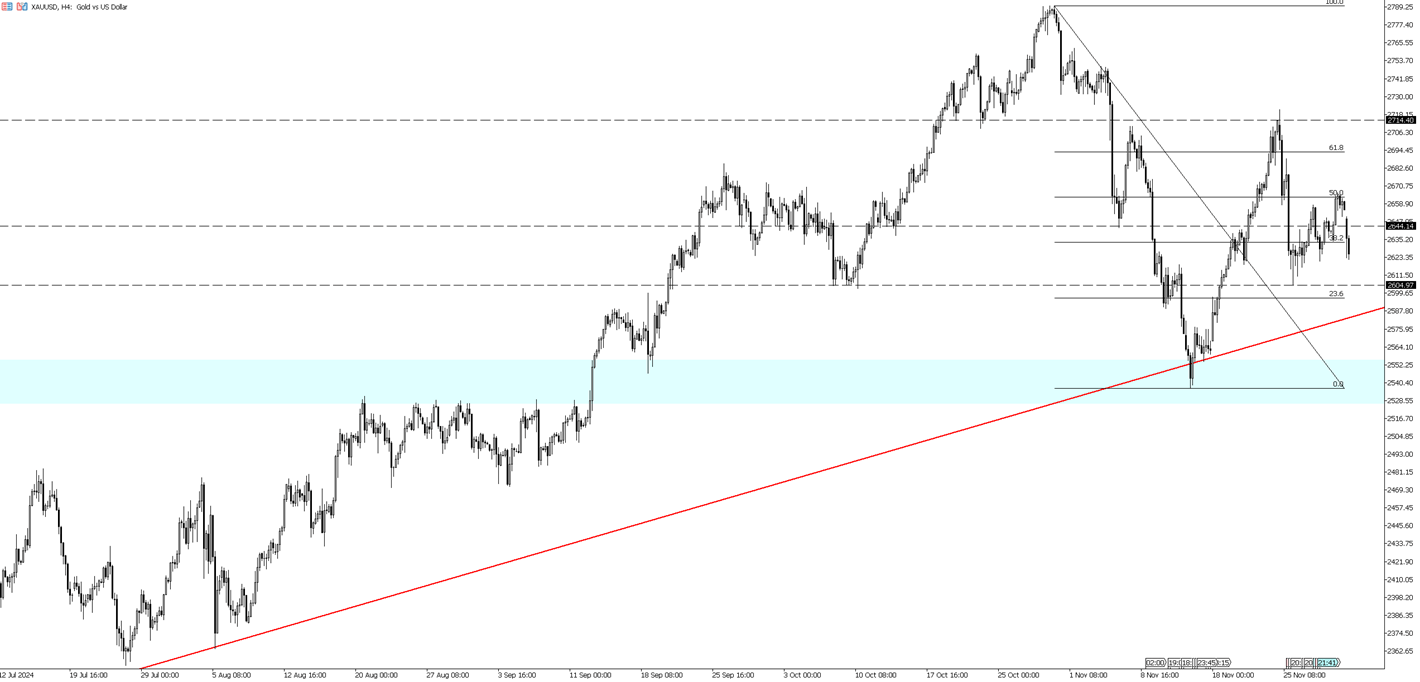

Gold slipped below $2,630 per ounce on Monday, breaking a four-session winning streak, as the US dollar gained strength following President-elect Donald Trump's warning of 100% tariffs on BRICS nations. Investors are now focusing on upcoming US economic indicators for insights into the Federal Reserve's next interest rate decisions. Key releases include job openings, the ADP employment report, and the payrolls report.

Several Fed officials, including Chair Jerome Powell, are set to speak this week. Recent data revealed a pause in the progress of reducing US inflation, indicating a slower pace for the Fed's rate-cut cycle. Markets currently see a 67% probability of a 25bps rate cut at the Fed’s upcoming meeting, with expectations for just two more rate cuts throughout 2025. Meanwhile, on the geopolitical front, a truce between Israel and the Iran-backed Hezbollah appeared to hold, despite reports of ceasefire violations from both sides.

Technically, the first resistance level will be 2630, and if broken, the next levels to watch will be 2675 and 2710. On the downside, 2600 is the first support level, and if it breaks, the levels to watch will be 2575 and 2545.

| R1: 2630 | S1: 2600 |

| R2: 2675 | S2: 2575 |

| R3: 2710 | S3: 2545 |

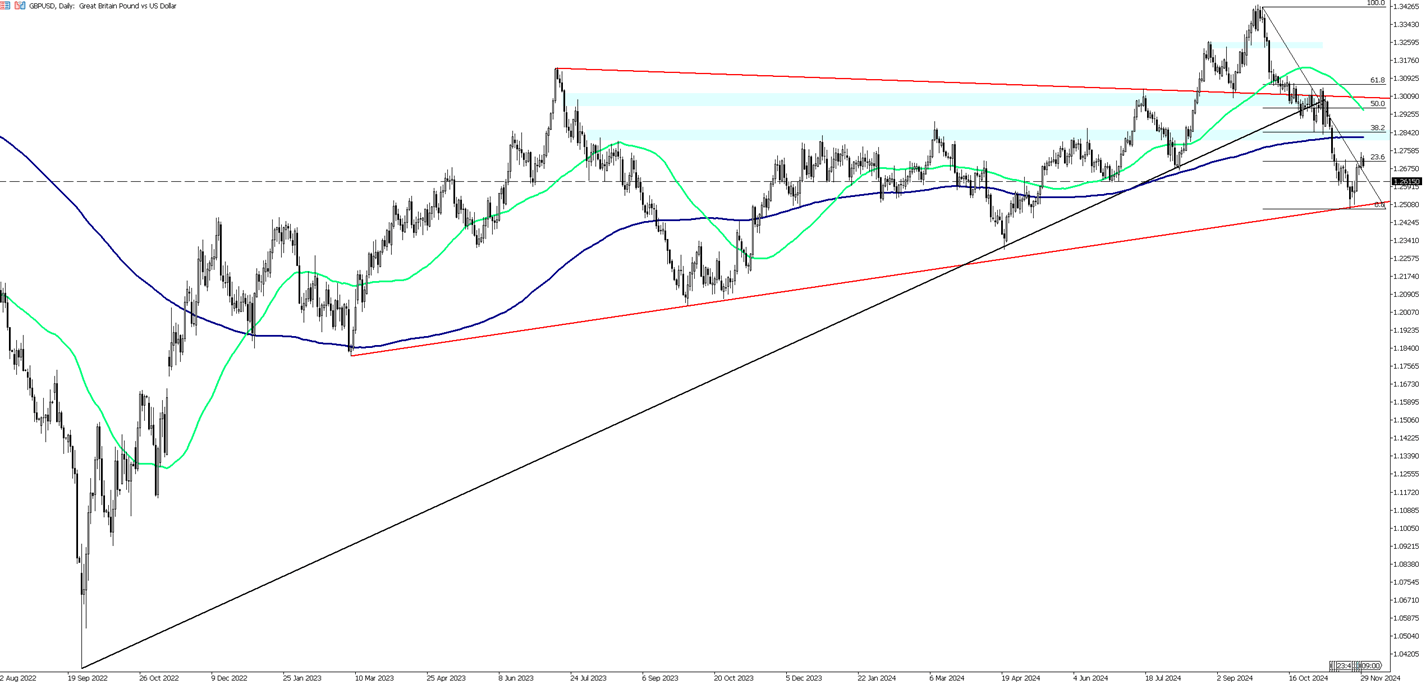

The GBP/USD pair is facing downward pressure as the US dollar strengthens, rebounding from recent lows against both the yen and the pound. This rise in the dollar is largely due to expectations surrounding the US Federal Reserve's monetary policy, with markets pricing in a 67% chance of a 25bps rate cut in December. Meanwhile, political uncertainty in the UK, compounded by risks in the broader European economy, is adding to the pressure on the pound. The euro's weakness, tied to concerns about the French government's stability, also impacts GBP/USD. Investors are watching closely for key US economic data, including payroll reports, which could further affect the dollar's trajectory. Despite the pound reaching a recent high of $1.2750, it has since slid, reflecting market caution. The broader geopolitical context, including concerns over potential trade wars and fiscal policy under President-elect Trump, is also influencing market sentiment. With the US economic outlook in focus, the GBP/USD pair remains volatile and sensitive to upcoming developments.

Technically, the first resistance level will be 1.2720, and if broken, the next levels to watch will be 1.2750 and 1.2800. On the downside, 1.2650 is the first support level, and if it breaks, the levels to watch will be 1.2600 and 1.2550.

| R1: 1.2720 | S1: 1.2650 |

| R2: 1.2750 | S2: 1.2600 |

| R3: 1.2800 | S3: 1.2550 |

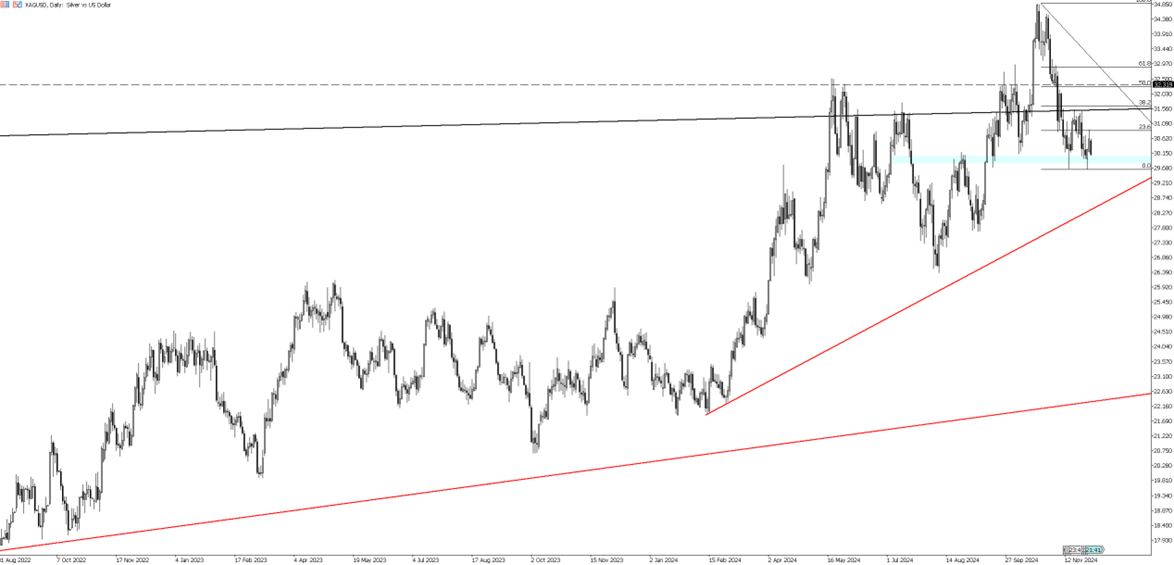

Silver (XAG/USD) fell 1.3% to $30.10 per ounce as the US dollar strengthened, making the metal more expensive for other currency holders. The market is awaiting key US economic data, including job openings and payrolls, which could influence the Federal Reserve's monetary policy. While silver remains a hedge against inflation, higher interest rates dampen its appeal. The Fed is expected to cut rates by 25bps in December, which may support silver. Despite some demand in India, overall physical silver demand remains subdued, especially in major markets like China. Silver’s outlook will depend on future US economic data and rate decisions.

The first resistance level will be 31.00, and if broken, the next levels to watch will be 31.40 and 32.00. On the downside, 29.80 is the first support level, and if it breaks, the levels to watch will be 29.10 and 28.80.

| R1: 31.00 | S1: 29.80 |

| R2: 31.40 | S2: 29.10 |

| R3: 32.00 | S3: 28.80 |

Oil Tanker Attacks Create Volatility

Oil Tanker Attacks Create VolatilityRecent strikes on oil tankers in the Persian Gulf have exposed the extreme vulnerability of global energy supplies. Footage of burning vessels near the Iraqi coastline has saturated financial media, serving as a reminder to market participants of the risks inherent in the region. Whenever tensions escalate in this region, energy traders immediately begin pricing in the possibility of supply disruptions.

Detail Dollar Leads as Markets Reprice Risk (03.12.2026)Currency markets remained under pressure as energy-driven inflation concerns and ongoing geopolitical tensions continued to support the U.S. dollar.

Global markets remained cautious as investors weighed the economic impact of the ongoing Middle East conflict and volatile energy prices.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!