Today, markets respond to the Federal Reserve’s recent 25-basis-point rate cut decision. It reflects a flexible approach, with Chair Jerome Powell highlighting a meeting-by-meeting policy stance, unaffected by the recent U.S. election outcome.

As expected, this rate adjustment has influenced currency values and commodity prices, with implications for future market movements. Let’s take a look at the roadmap for potential movements influenced by upcoming inflation data, trade policy shifts, and anticipated central bank actions in December.

| Time | Cur. | Event | Forecast | Previous |

| 9:30 | EUR | ECB McCaul Speaks | | |

| 12:15 | GBP | BoE MPC Member Pill Speaks | | |

| 15:00 | USD | Michigan 1-Year Inflation Expectations (Nov) | | 2.70% |

| 15:00 | USD | Michigan 5-Year Inflation Expectations (Nov) | | 3.00% |

| 15:00 | USD | Michigan Consumer Expectations (Nov) | | 74.1 |

| 15:00 | USD | Michigan Consumer Sentiment (Nov) | 71 | 70.5 |

| 16:00 | USD | FOMC Member Bowman Speaks | | |

| 17:00 | USD | WASDE Report | | |

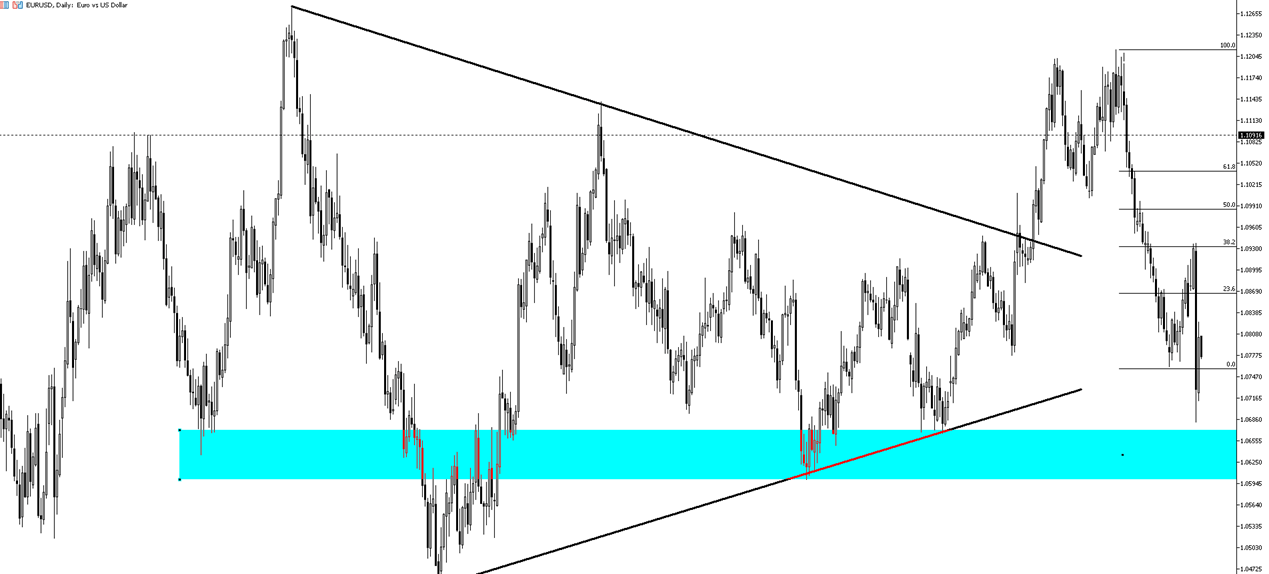

The EUR/USD pair is trading around 1.0776 on Friday, while the dollar index remains steady at around 104.5 as investors digest the Federal Reserve’s latest interest rate decision. The Fed cut the federal funds rate by 25 basis points, as anticipated, with Chair Jerome Powell reiterating that the central bank is not following a predetermined course. He emphasized that future decisions would be made on a meeting basis and noted that the outcome of the upcoming election would not influence policy in the near term. Market expectations are for another quarter-point rate cut in December, although any unexpected inflation or labor market data could shift this outlook. There are fears that Trump’s proposed tariff hikes could reignite inflation, potentially preventing the Fed from continuing to lower rates. The dollar is poised to end the week with modest gains, as traders took profits following the post-election rally.

In the EUR/USD pair, the initial resistance level is at 1.0830, followed by 1.0875 and 1.0900 as subsequent resistance points. On the downside, the first support level is 1.0770, which aligns with the 200-day moving average. If this level is breached, the next support levels to watch will be 1.0700 and 1.0660.

| R1: 1.0830 | S1: 1.0770 |

| R2: 1.0875 | S2: 1.0700 |

| R3: 1.0900 | S3: 1.0660 |

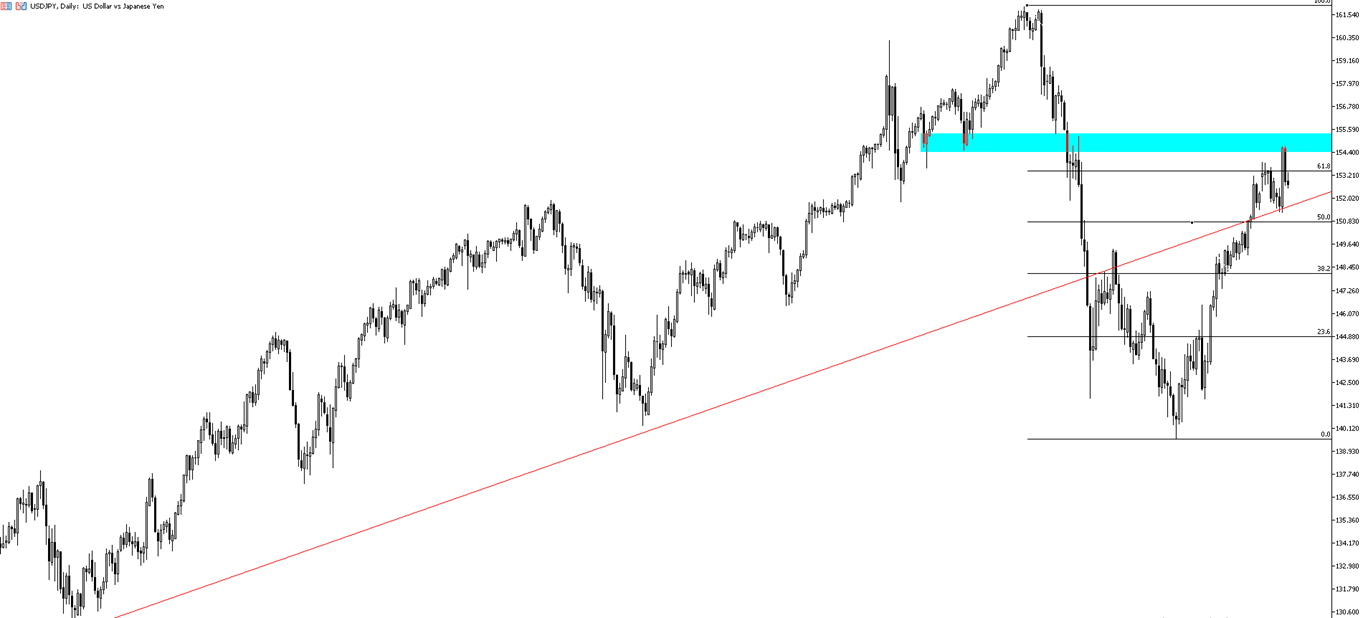

The Japanese yen stabilized around 152.8 per dollar on Friday after Finance Minister Katsunobu Kato indicated that Japan would take "appropriate action" to address excessive fluctuations in the foreign exchange market. Kato reiterated official warnings against speculative currency moves and highlighted that the government is closely monitoring the impact of Donald Trump’s policies on Japan’s economy. His remarks followed a warning from opposition leader Yuichiro Tamaki, who cautioned that Trump’s policies could worsen inflation in the U.S., potentially putting more downward pressure on the yen. On Wednesday, the yen dropped nearly 2%, weighed down by a sharp rally in the dollar following Trump’s decisive victory in the U.S. presidential election. However, the yen recovered about 1% the next day as traders took profits on the dollar, and after the Federal Reserve implemented a 25 basis point rate cut.

In the USD/JPY pair, the first support level is at 152.50, which coincides with the 200-day moving average. If this level is broken, the next support levels to monitor are 152.20 and 151.50. On the upside, resistance levels are at 153.90, 154.50, and 154.90, respectively.

| R1: 153.90 | S1: 152.50 |

| R2: 154.50 | S2: 152.20 |

| R3: 154.90 | S3: 151.50 |

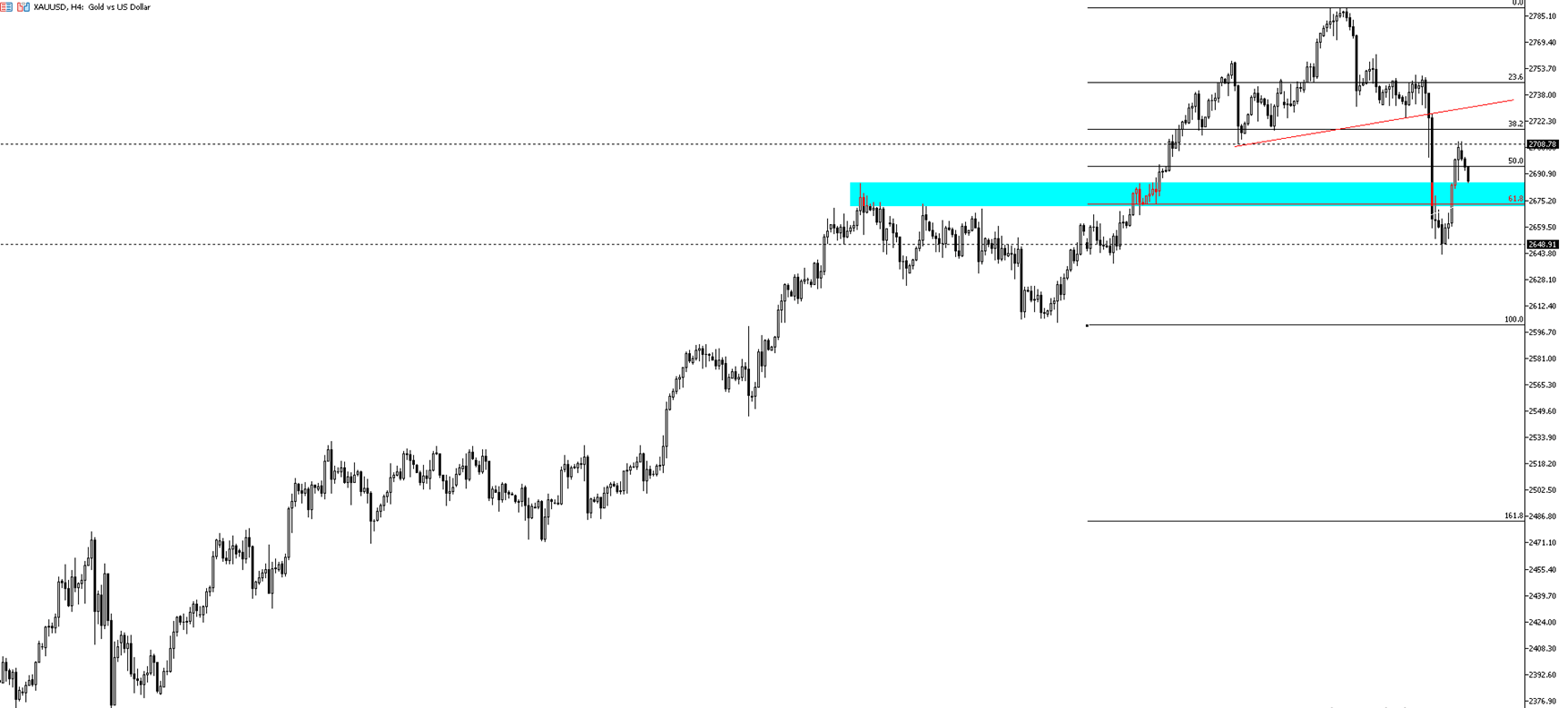

Gold remained near $2,700 per ounce on Friday following the Federal Reserve's decision to cut interest rates by a quarter-point at the end of its two-day policy meeting. The Fed lowered the federal funds target range to 4.50%-4.75% on Thursday, marking the second rate cut this year. Policymakers cited signs of weakening in the labor market and acknowledged that while inflation has moved closer to the central bank’s 2% target, it remains somewhat elevated. In his press conference, Fed Chair Jerome Powell did not provide specific guidance on future rate changes, emphasizing the Fed's flexibility to adjust its policy based on incoming economic data. Powell also stated that the outcome of Tuesday's presidential election, with its focus on broad tariffs, tax cuts, and possible large-scale deportations, is unlikely to affect the Fed’s near-term policy stance.

On the downside, the first support level for gold is at $2,657, followed by $2,635 and $2,600. On the upside, $2,710 serves as a key resistance level, with $2,726 and $2,750 as the next levels to monitor if this resistance is surpassed.

| R1: 2710 | S1: 2657 |

| R2: 2726 | S2: 2635 |

| R3: 2750 | S3: 2600 |

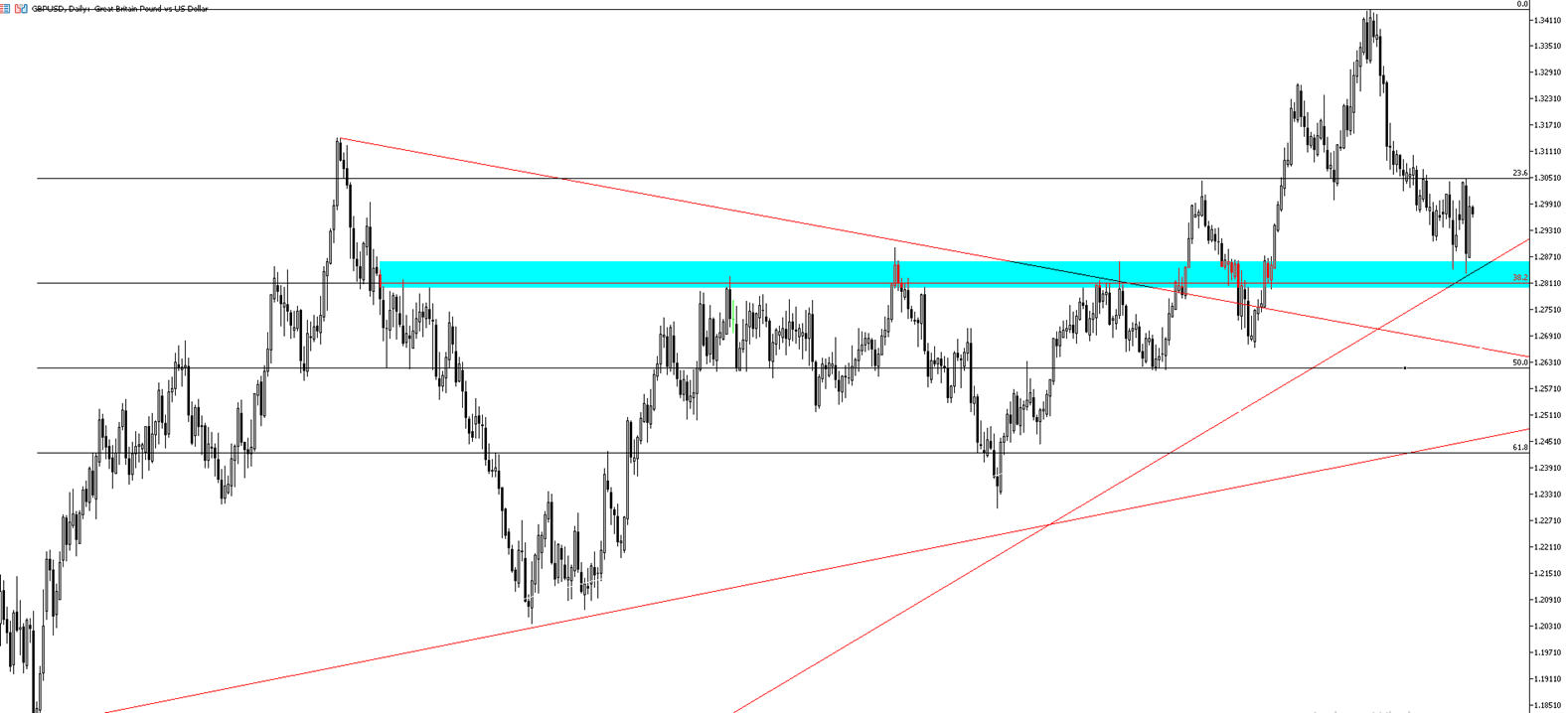

The GBP/USD pair is trading around 1.2970 following yesterday’s decision by the Bank of England to cut its Bank Rate by 25 basis points to 4.75%, as expected. This marks the second rate reduction in four years, following the start of the BoE’s easing cycle in August. Eight out of nine members of the Monetary Policy Committee (MPC) voted in favor of the cut, surpassing expectations of seven votes, with Catherine Mann being the only member to vote for a hold. The decision reflects signs of slowing price growth in the UK economy, as September’s inflation dropped to a more than three-year low of 1.7%. Additionally, services inflation, which typically reflects more persistent price pressures, fell to a two-year low of 4.9%, although it remains elevated. While the BoE expects inflation to continue moderating in the medium term, it anticipates that the Labour Party’s expansionary budget will push inflation up by 0.5 percentage points at its peak. The central bank now forecasts year-end inflation at 2.5% and 2.2% by 2026. The budget is also expected to boost GDP by 0.75% at its peak impact within a year.

On the downside, key support levels for the GBP/USD pair are at 1.2950, 1.2900, and 1.2840. On the upside, resistance levels to watch are at 1.3000, 1.3050, and 1.3100.

| R1: 1.3000 | S1: 1.2950 |

| R2: 1.3050 | S2: 1.2900 |

| R3: 1.3100 | S3: 1.2840 |

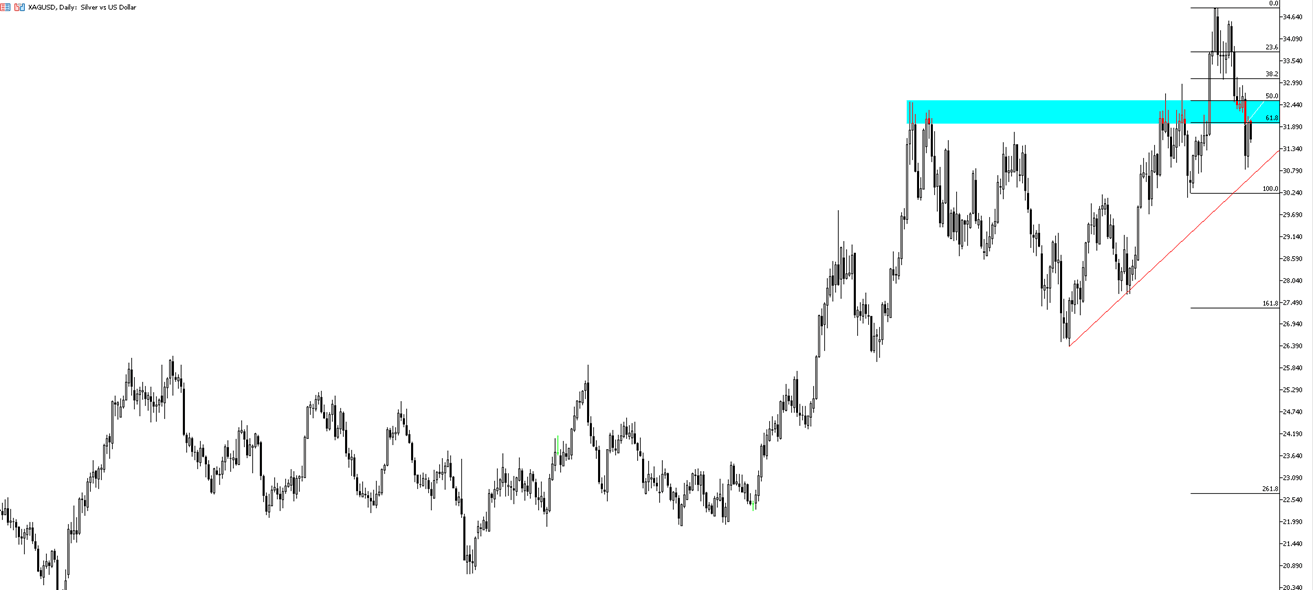

Silver is trading around $31.60 per ounce on Friday morning, following the Federal Reserve’s decision to cut its benchmark rate by 25 basis points to a range of 4.5%-4.75%, as expected. In his press conference, Fed Chair Jerome Powell stated that, in the near term, the outcome of the election "will have no effect" on the Fed's policy decisions. He also pointed out that stronger economic data has reduced "downside risks," though he refrained from commenting on its potential impact on the Fed's December policy stance. Despite this, markets are factoring in a higher interest rate environment as expectations grow that the newly elected U.S. president will pursue policies focused on raising tariffs, cutting taxes, and deregulation. These actions could lead to larger deficits and inflation. Silver prices dropped more than 3% on Wednesday, as Trump's presidential win strengthened the dollar and prompted investors to unwind their positions in safe-haven assets like gold.

On the upside, the critical resistance levels to watch are at 31.70, 32.10, and 32.50. On the downside, 30.80 remains a significant first support level. If this level is breached, the next support levels to monitor are 30.50 and 30.00, respectively.

| R1: 31.70 | S1: 30.80 |

| R2: 32.10 | S2: 30.50 |

| R3: 32.50 | S3: 30.00 |

Global markets remain dominated by geopolitical risk as escalating conflict between the United States, Israel, and Iran fuels a strong shift toward safe-haven assets. The dollar index hit 99.3 Wednesday, rising for a third day as conflict concerns fueled inflation and shifted Fed rate cut expectations from July to September.

A US court rejected Trump's tariff refund delay as the Dollar (98.5) and 10 year yield (4.04%) held gains amid Middle East escalation and inflation fears.

After Khamenei: Who Will Lead Iran Next?

After Khamenei: Who Will Lead Iran Next?Following the death of Supreme Leader Ali Khamenei, Iran has entered a pivotal transition phase. Senior officials in Tehran are acting swiftly to uphold the existing structure of the Islamic Republic, prioritizing continuity to head off potential internal instability. Despite these efforts, the sudden leadership vacuum has sparked intense political and military maneuvering behind the scenes.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!