The euro slipped to around $1.1620 as political turmoil in France continued to pressure sentiment, while the yen fell past 152 per dollar after weak wage data reduced hopes for Bank of Japan tightening.

Gold extended its record-breaking rally beyond $4,000 amid global uncertainty, though overbought conditions hinted at a possible pullback. Sterling eased to $1.3390 on renewed BoE rate cut expectations, and silver steadied near multi-year highs, with technical indicators suggesting caution despite the ongoing uptrend.

| Time | Cur. | Event | Forecast | Previous |

| All Day | CNY | China – Mid-Autumn Festival | ||

| 14:30 | USD | Crude Oil Inventories | 1.792M | |

| 16:00 | EUR | ECB President Lagarde Speaks | ||

| 17:00 | USD | 10-Year Note Auction | 4.033% | |

| 19:00 | USD | FOMC Meeting Minutes |

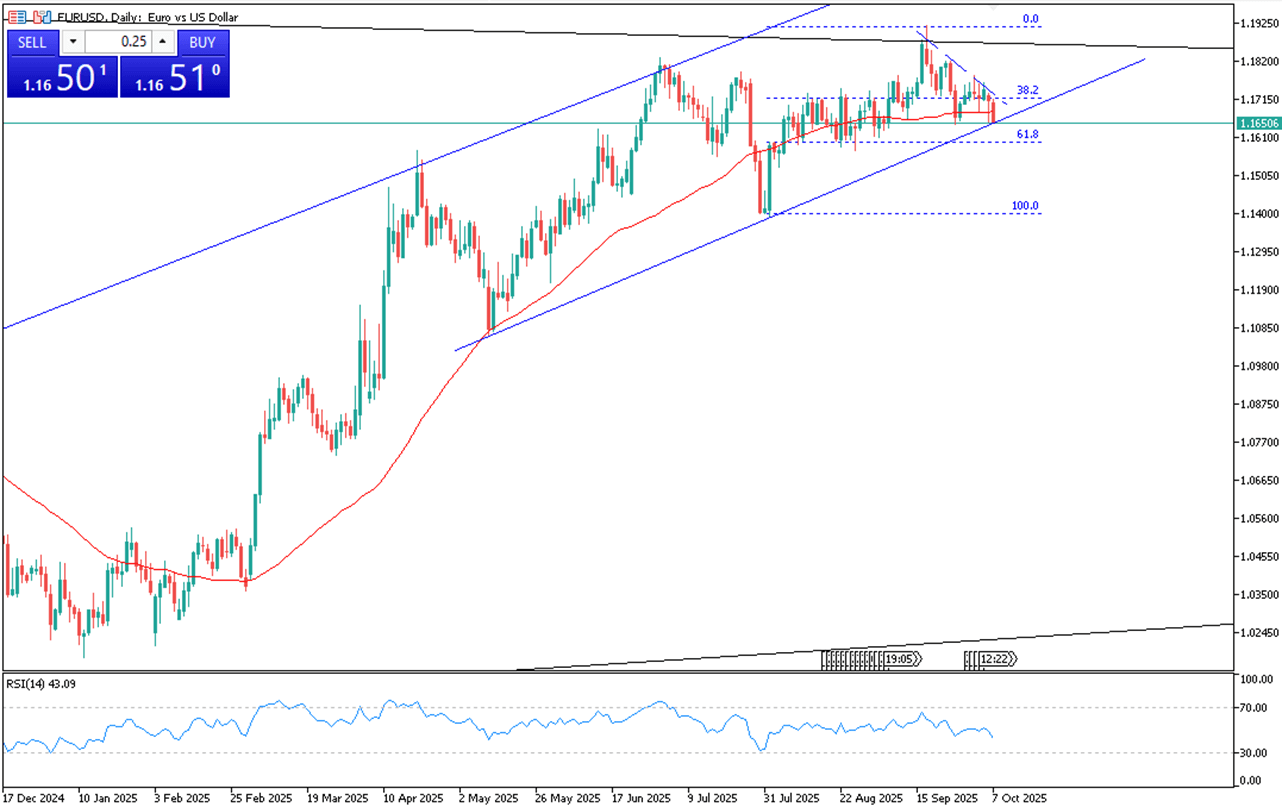

EUR/USD traded slightly lower around 1.1620 during Wednesday’s Asian session. Political instability in France continued to weigh on the euro. Meanwhile, President Trump announced plans to reduce several government programs amid the ongoing shutdown.

Technically, 1.1613 is the key support, while resistance is seen at 1.1715 and then 1.1785.

| R1: 1.1715 | S1: 1.1613 |

| R2: 1.1785 | S2: 1.1570 |

| R3: 1.1850 | S3: 1.1520 |

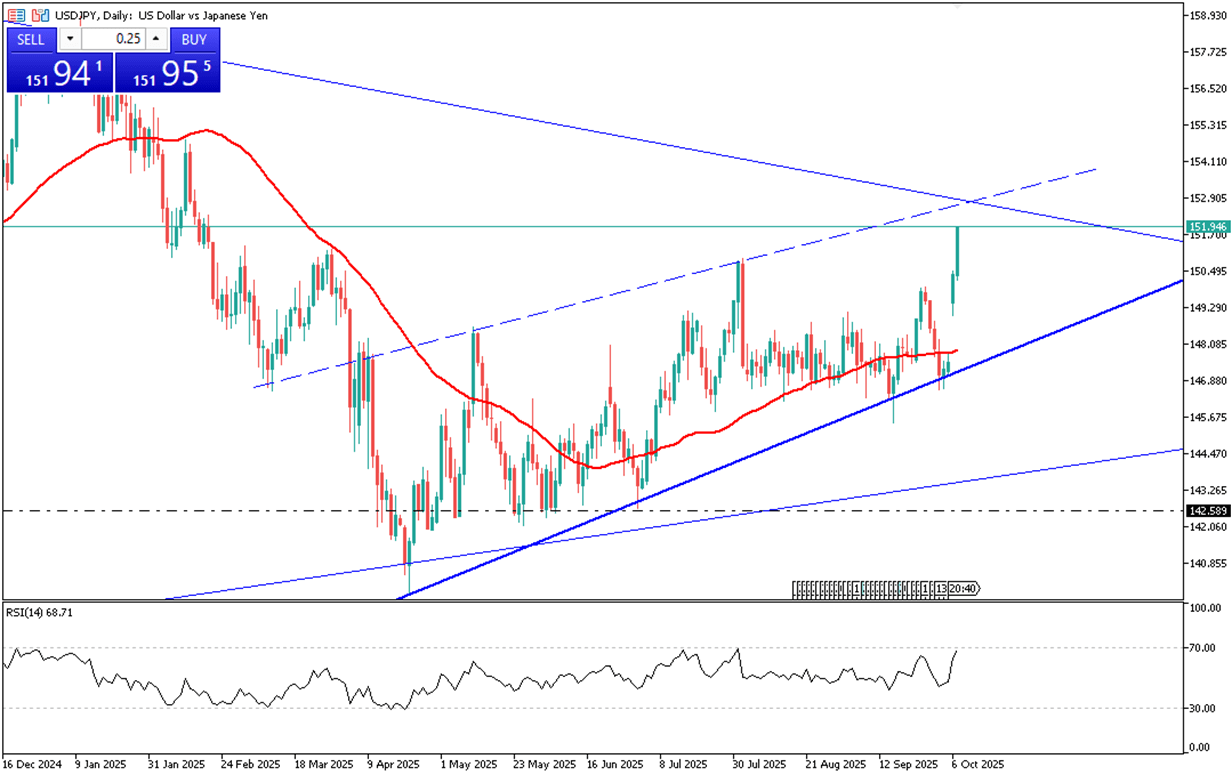

The Japanese yen fell past 152 per dollar on Wednesday, its weakest level since February, after soft wage data reduced expectations for Bank of Japan rate hikes. Real wages declined 1.4% year-on-year in August, the eighth consecutive drop as inflation outpaced pay growth. Meanwhile, pro-stimulus lawmaker Sanae Takaichi’s leadership win reinforced expectations of continued fiscal support and accommodative monetary policy.

Resistance is at 153.70, while support holds at 150.90.

| R1: 153.70 | S1: 150.90 |

| R2: 154.80 | S2: 149.20 |

| R3: 156.00 | S3: 147.80 |

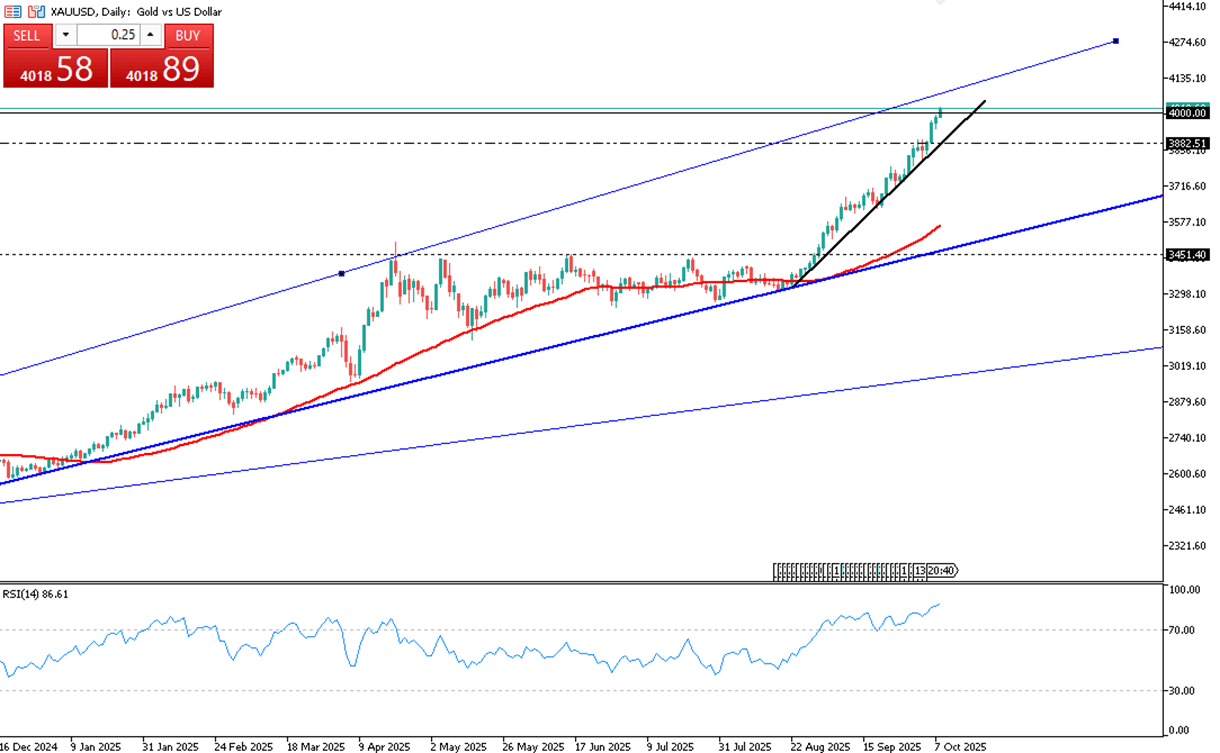

Gold’s strong rally persisted, with prices firmly surpassing the key $4,000 level. Ongoing global uncertainty continues to push investors toward safe-haven assets such as the US dollar and gold. However, the metal appears significantly overbought on the daily chart, indicating a potential short-term correction before resuming its upward trend.

From a technical perspective, support is around 3985, and resistance is at 4021.

| R1: 4021 | S1: 3985 |

| R2: 4050 | S2: 3940 |

| R3: 4100 | S3: 3810 |

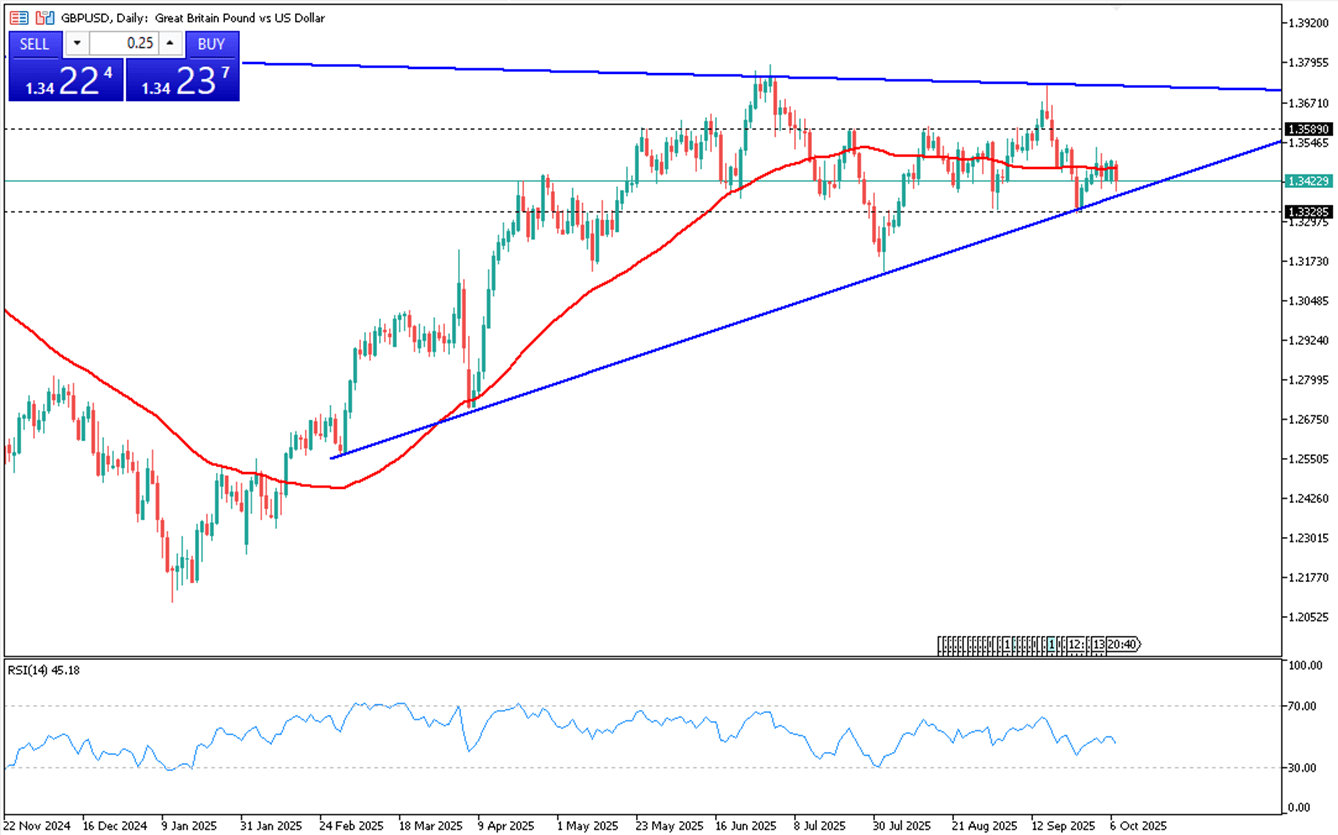

GBP/USD eased around 1.3390 in early European trade on Wednesday. Expectations of further Bank of England rate cuts later this year pressured the Pound Sterling. Meanwhile, market participants awaited indications of a possible resolution to the ongoing U.S. federal government shutdown.

For GBP/USD, the initial resistance is located at 1.3488, while the closest support stands at 1.3325.

| R1: 1.3488 | S1: 1.3325 |

| R2: 1.3556 | S2: 1.3300 |

| R3: 1.3669 | S3: 1.3256 |

Silver continued to attract buyers, holding near the multi-year high reached earlier this week. The formation of an ascending channel signals a solid short-term uptrend. However, the daily RSI remains in overbought territory, indicating that bullish traders should proceed cautiously.

From a technical perspective, resistance is observed at 48.90, while support is located at 47.95.

| R1: 48.90 | S1: 47.95 |

| R2: 50.20 | S2: 46.20 |

| R3: 51.50 | S3: 44.40 |

Trump Signals Extended Military Campaign

Trump Signals Extended Military CampaignGeopolitical tensions in the Middle East have intensified following recent remarks from Donald Trump suggesting that the ongoing military campaign against Iran may last longer than anticipated. While Trump stated that early operational objectives were achieved ahead of schedule, he acknowledged that broader strategic goals could require additional time and sustained military pressure.

Detail US DST Change March 8 2026

US DST Change March 8 2026Daylight Saving Time will change in the United States on Sunday, March 8, 2026. The trading schedule for various financial instruments will be adjusted to align with U.S. exchange hours.

Detail Dollar Leads Risk-Off (03.06.2026)Global markets remained under pressure as escalating Middle East tensions and rising energy prices strengthened the US dollar and unsettled major currencies.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!