Global markets were mixed on Friday as cautious central bank comments and uneven U.S. data shaped investor sentiment. The euro eased after the ECB signaled patience on rate changes, while the yen strengthened amid renewed safe-haven demand as tech stocks slumped.

Gold climbed toward $4,000 per ounce following weak U.S. labor data that revived Fed rate-cut bets. In the U.K., the pound softened after the BoE held rates at 4% with a divided vote, and silver steadied near $48 amid uncertainty over Fed policy direction.

| Time | Cur. | Event | Forecast | Previous |

| 13:30 | USD | Average Hourly Earnings (MoM) (Sep) | - | 0.3% |

| 13:30 | USD | Nonfarms Payrolls (Sep) | - | 22K |

| 13:30 | USD | Unemployment Rate (Sep) | - | 4.3% |

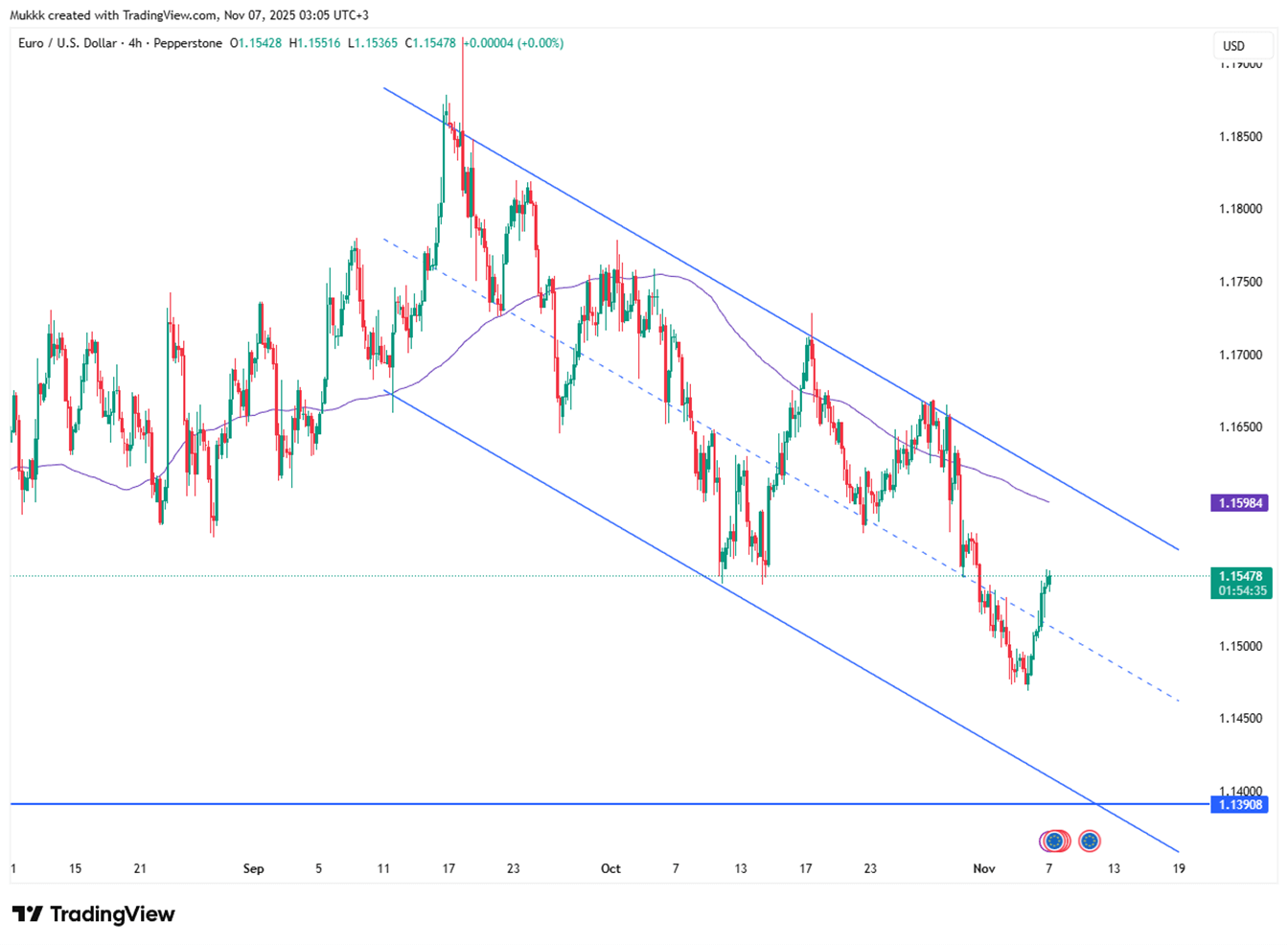

The euro eased slightly on Friday, trimming prior gains as ECB officials maintained a cautious stance on rate policy. Villeroy de Galhau emphasized flexibility in decisions, while Germany’s Nagel urged vigilance on inflation. Vice President de Guindos added that inflation below 2% is likely temporary, signaling a careful approach to future policy changes.

Technically, 1.1490 is the key support, while resistance is seen at 1.1600.

| R1: 1.1600 | S1: 1.1490 |

| R2: 1.1670 | S2: 1.1430 |

| R3: 1.1710 | S3: 1.1360 |

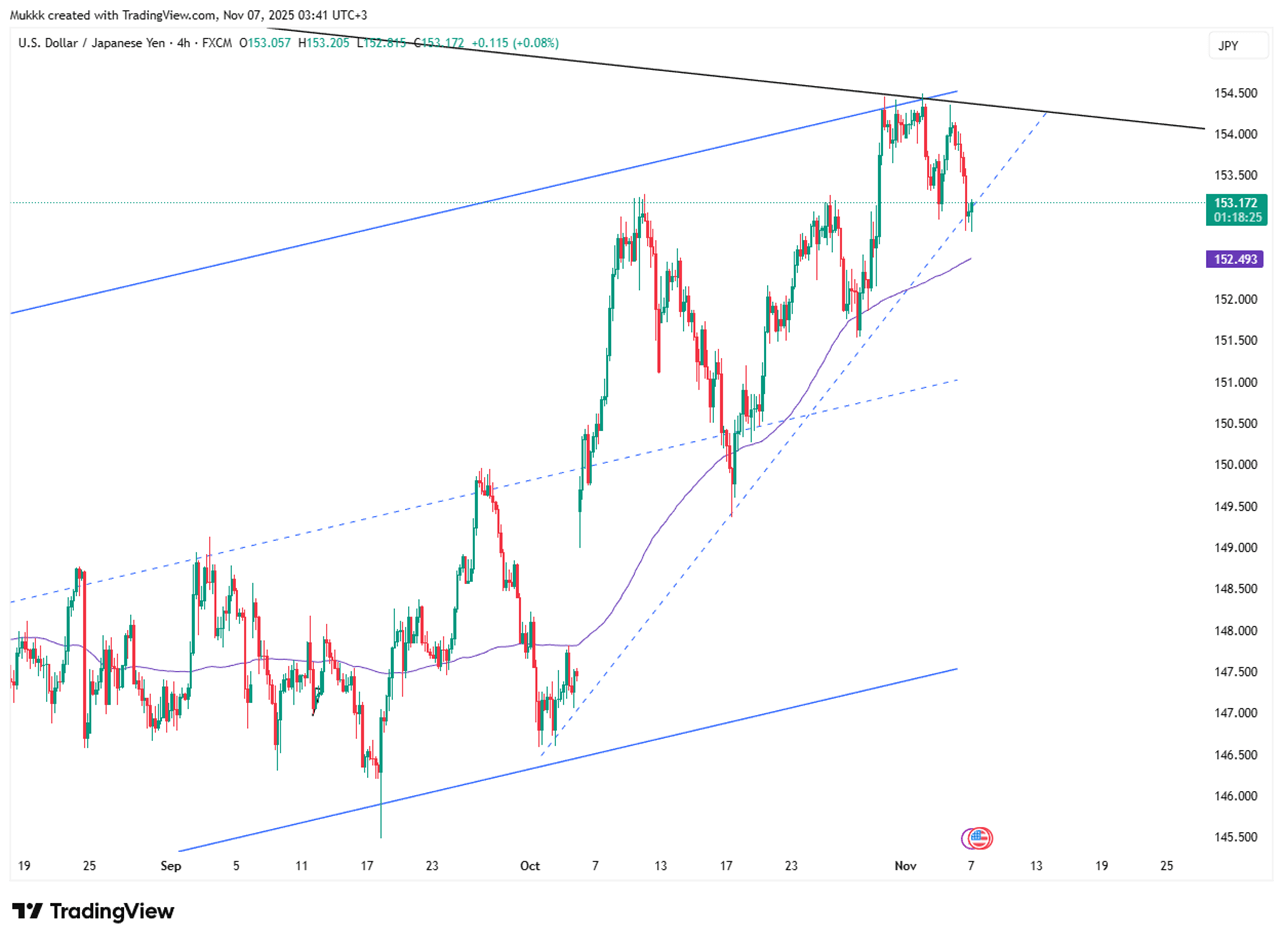

The Japanese yen traded around 153 per dollar on Friday, extending its advance from the previous session as global risk sentiment weakened. Growing worries over inflated AI and tech valuations prompted investors to seek safe-haven assets, lifting the yen. Meanwhile, the U.S. dollar eased after softer labor market indicators strengthened expectations for a forthcoming Federal Reserve rate cut, adding further support to the yen.

Technically, resistance stands near 153.70, while support is firm at 152.50.

| R1: 153.70 | S1: 152.50 |

| R2: 154.40 | S2: 151.60 |

| R3: 155.20 | S3: 150.70 |

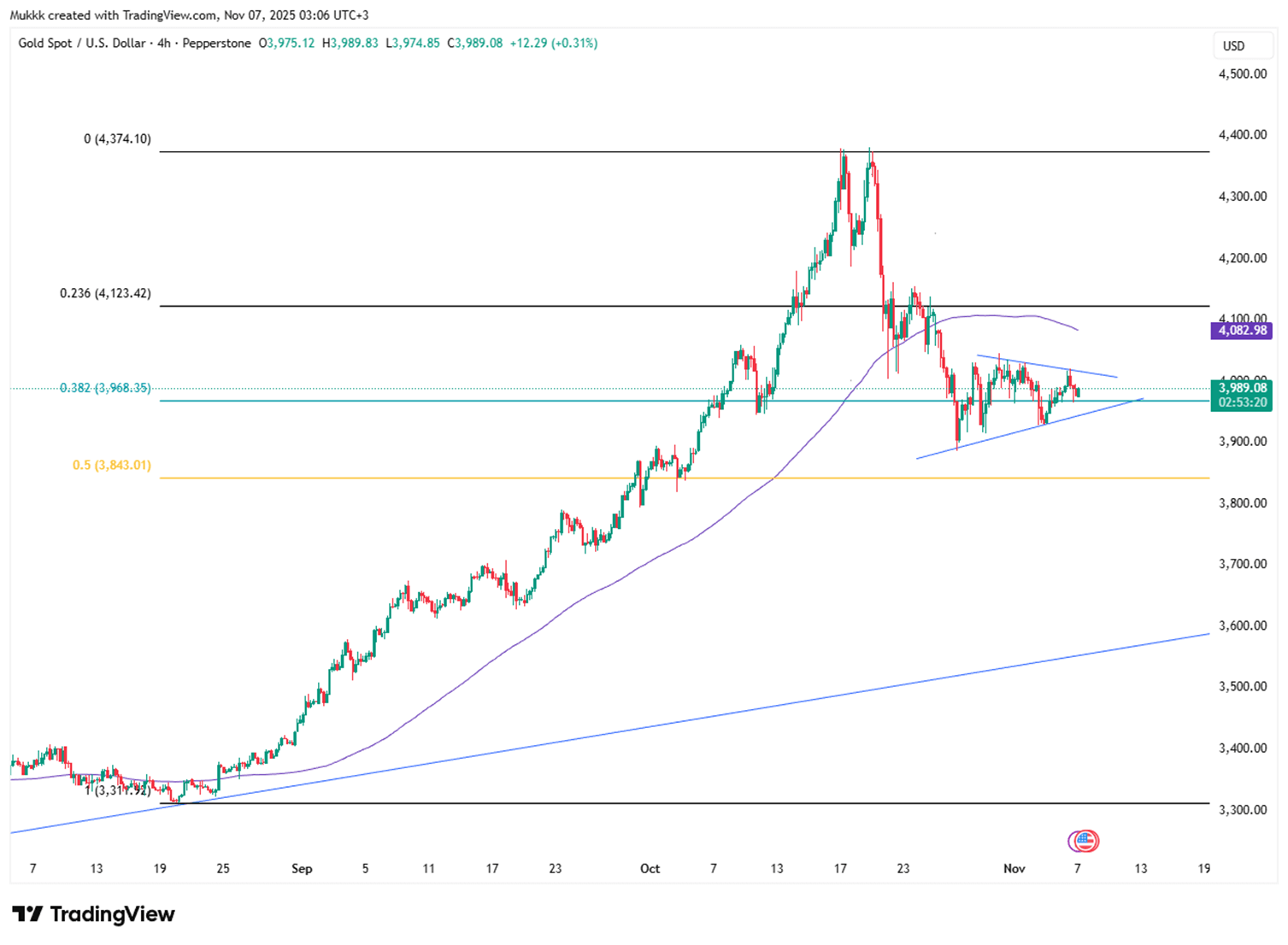

Gold prices climbed toward $4,000 per ounce on Friday after weak US labor data increased expectations of a near-term Fed rate cut. Challenger job cuts tripled in October, the largest jump in over two decades, signaling weaker consumer demand. The data offset optimism from earlier ADP payroll gains and heightened labor market uncertainty amid the government shutdown. Traders now see a 69% chance of a 25 bps cut in December, up from 60% a day earlier.

From a technical perspective, support is around 3930, and resistance is at 4040.

| R1: 4040 | S1: 3930 |

| R2: 4100 | S2: 3860 |

| R3: 4170 | S3: 3800 |

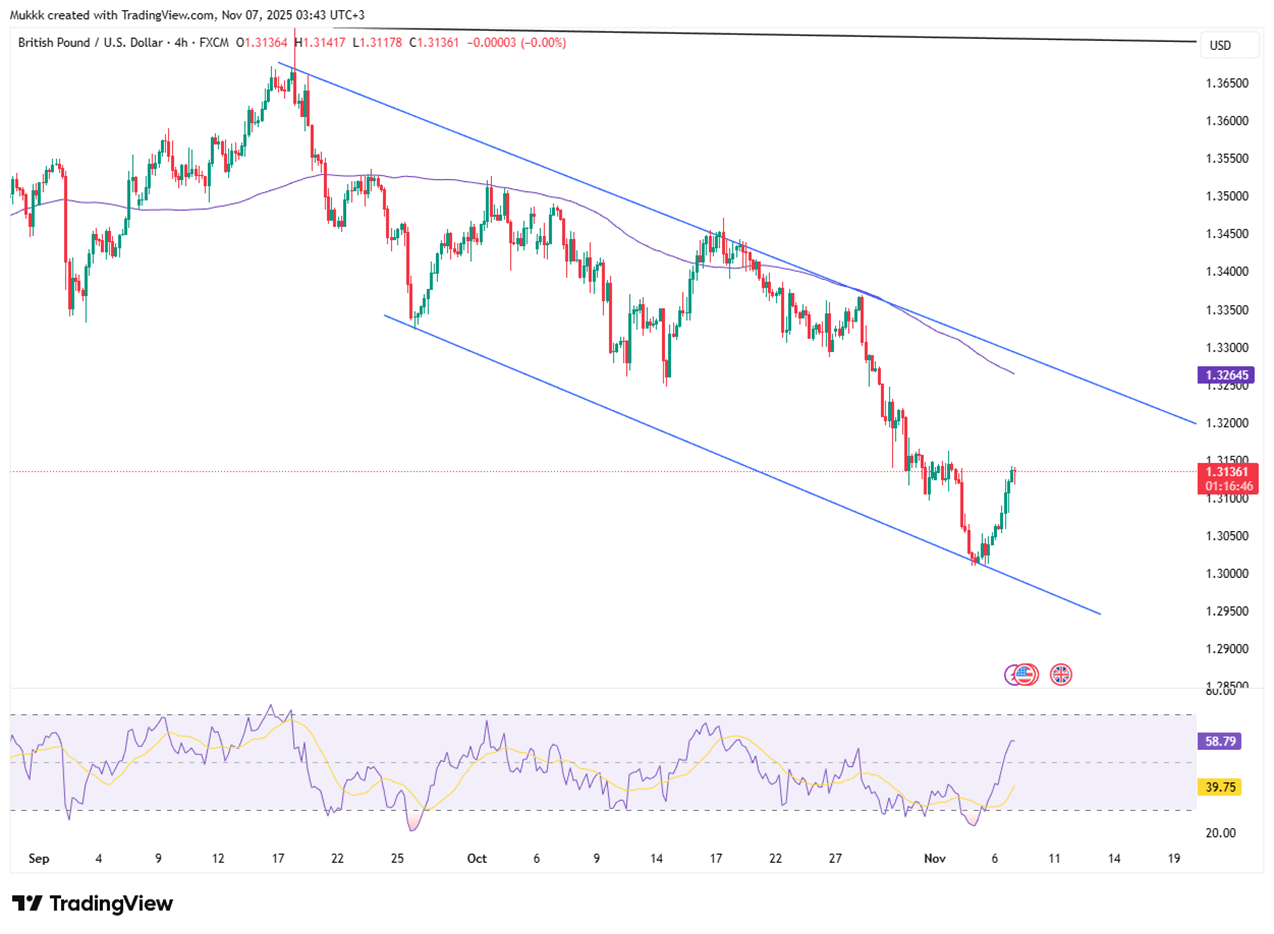

The British pound hovered near $1.305 on Friday, retreating after the Bank of England voted 5–4 to keep rates at 4%. The BoE said inflation has likely peaked, but four members backed a 25 bps cut to 3.75%, showing rising concern over growth. Policymakers noted that inflation risks have eased while weaker demand is adding downside pressure, signaling a more balanced outlook.

From a technical view, support stands near 1.3050, with resistance around 1.3190.

| R1: 1.3190 | S1: 1.3050 |

| R2: 1.3260 | S2: 1.2990 |

| R3: 1.3350 | S3: 1.2870 |

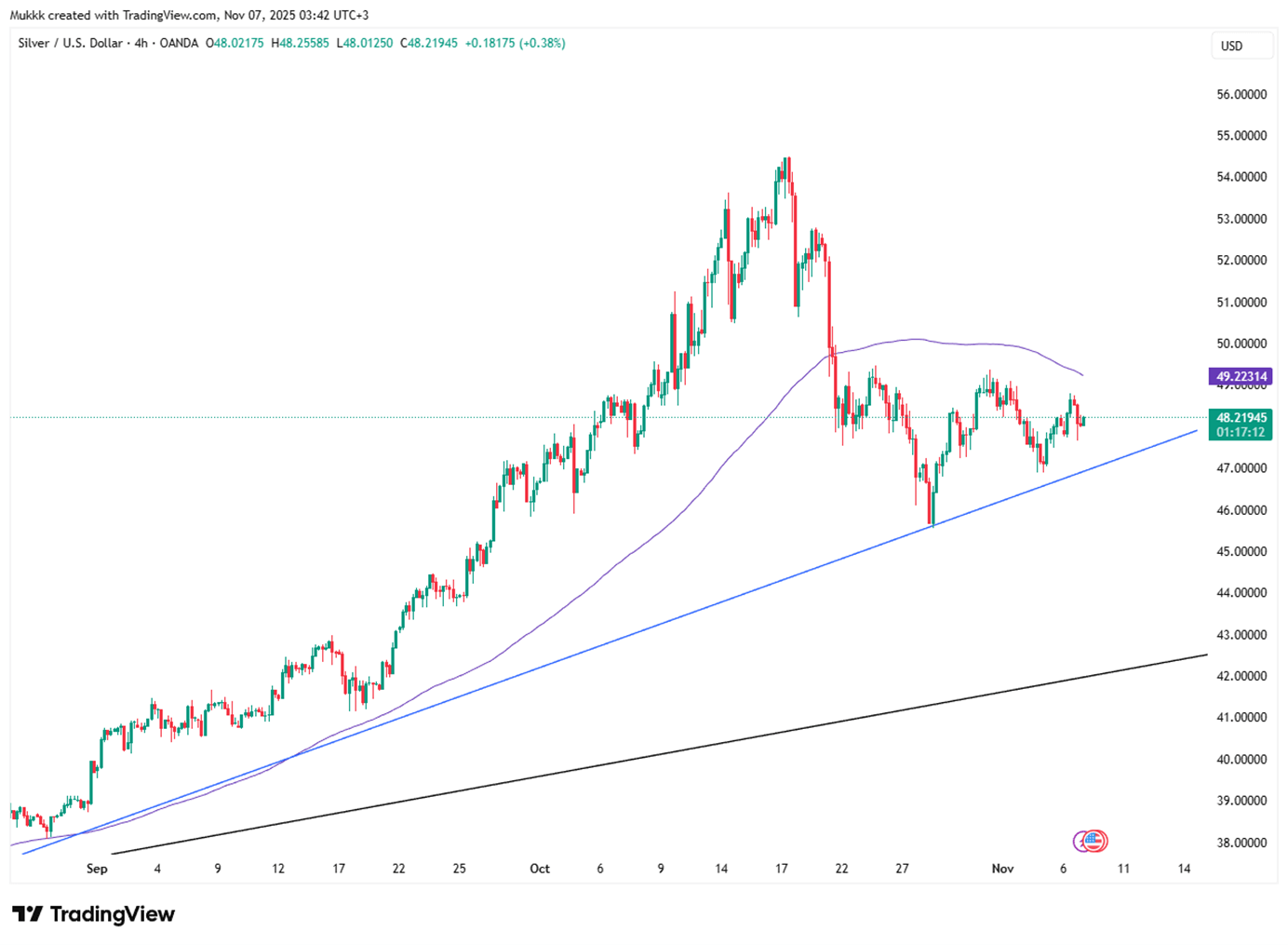

Silver prices were little changed around $48.30 during Friday’s Asian session, losing earlier momentum as investors weighed mixed signals on the US economy. Stronger US data prompted expectations that the Federal Reserve will remain cautious on rate cuts, while delays in key indicators due to the government shutdown fueled uncertainty. Market bets on a December 25 basis-point cut dropped to 62%, sharply down from 90% last week, leading to a more cautious near-term outlook for silver.

From a technical view, resistance stands near $48.70, while support is located around $47.00.

| R1: 48.70 | S1: 47.00 |

| R2: 49.80 | S2: 46.10 |

| R3: 50.40 | S3: 45.60 |

A US court rejected Trump's tariff refund delay as the Dollar (98.5) and 10 year yield (4.04%) held gains amid Middle East escalation and inflation fears.

After Khamenei: Who Will Lead Iran Next?

After Khamenei: Who Will Lead Iran Next?Following the death of Supreme Leader Ali Khamenei, Iran has entered a pivotal transition phase. Senior officials in Tehran are acting swiftly to uphold the existing structure of the Islamic Republic, prioritizing continuity to head off potential internal instability. Despite these efforts, the sudden leadership vacuum has sparked intense political and military maneuvering behind the scenes.

Detail March Starts With Geopolitical Turmoil (2-6 March)

March Starts With Geopolitical Turmoil (2-6 March)Global markets began the week in a state of high alert following coordinated US and Israeli strikes on Iran over the weekend, which resulted in the death of Supreme Leader Ayatollah Ali Khamenei.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!