The euro stayed near $1.1660 ahead of the Trump-Putin meeting on Ukraine, while the yen climbed to 147 after Japan’s stronger Q2 GDP fueled BOJ hike speculation.

The pound reached $1.36 on strong UK growth, easing chances of further BoE cuts. Gold and silver fell as hotter US producer inflation cut expectations for a 50 bps Fed move in September, with markets now leaning toward 25 bps.

| Time | Cur. | Event | Forecast | Previous |

| 06:00 | USD | Core Retail Sales (MoM)(Jul) | 0.3% | 0.5% |

| 06:00 | USD | Retail Sales (MoM) (Jul) | 0.6% | 0.6% |

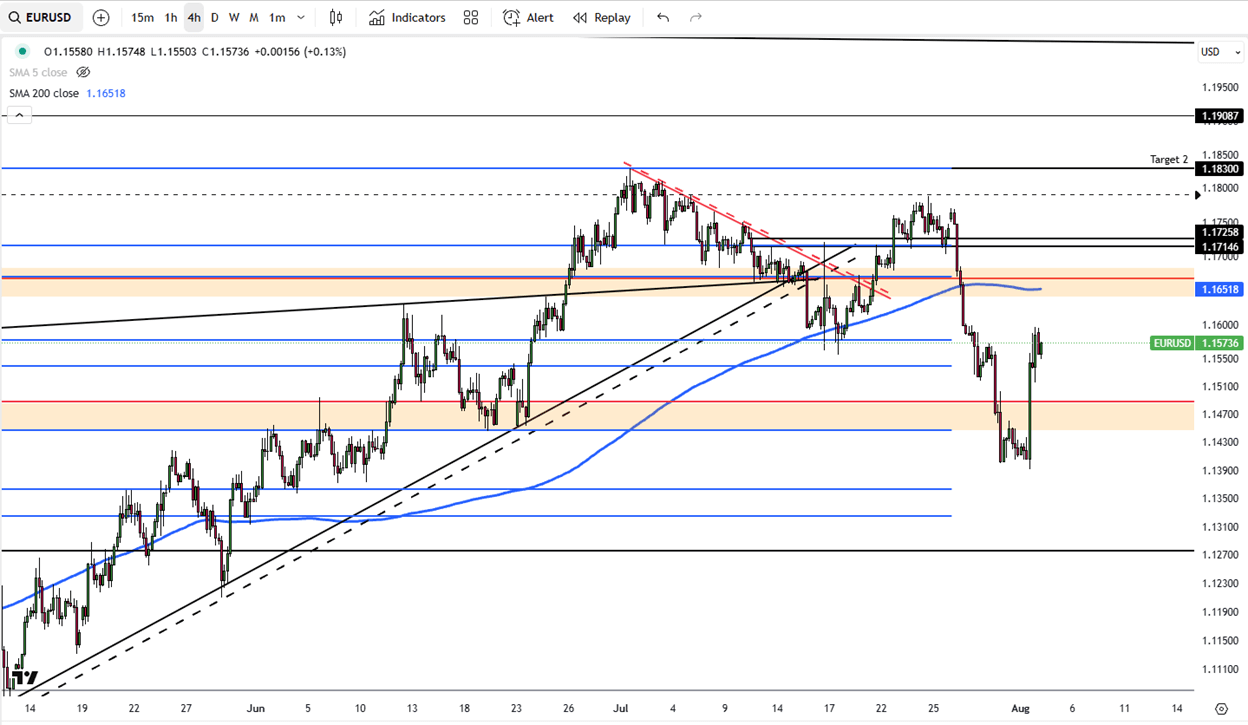

The euro traded just under last month’s highs, as markets weighed economic, political, and monetary drivers. Attention turned to Friday’s meeting between US President Donald Trump and Russian President Vladimir Putin, expected to focus on ending the Ukraine conflict. Reports suggest Ukrainian President Volodymyr Zelensky is unlikely to attend.

EUR/USD is targeting resistance at 1.1770, with support at 1.1600.

| R1: 1.1770 | S1: 1.1600 |

| R2: 1.1830 | S2: 1.1520 |

| R3: 1.1900 | S3: 1.1350 |

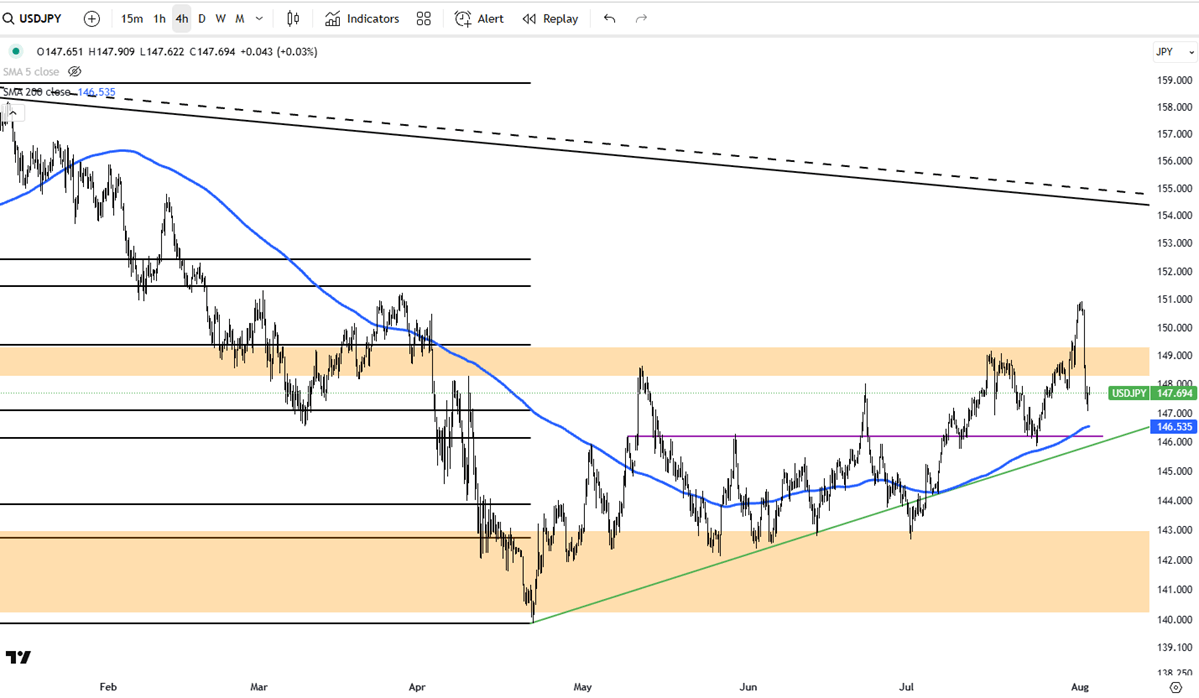

The yen appreciated to nearly 147 per dollar after Japan’s GDP grew 0.3% in Q2, up from 0.1% in Q1, matching forecasts. Growth was driven by net exports, helping offset tariff-related challenges. Speculation about a Bank of Japan rate hike increased following US Treasury Secretary Scott Bessent’s criticism of the BOJ’s slow reaction to inflation pressures.

USD/JPY faces resistance at 148.00, with support at 145.00.

| R1: 148.00 | S1: 145.00 |

| R2: 151.50 | S2: 143.00 |

| R3: 152.40 | S3: 140.00 |

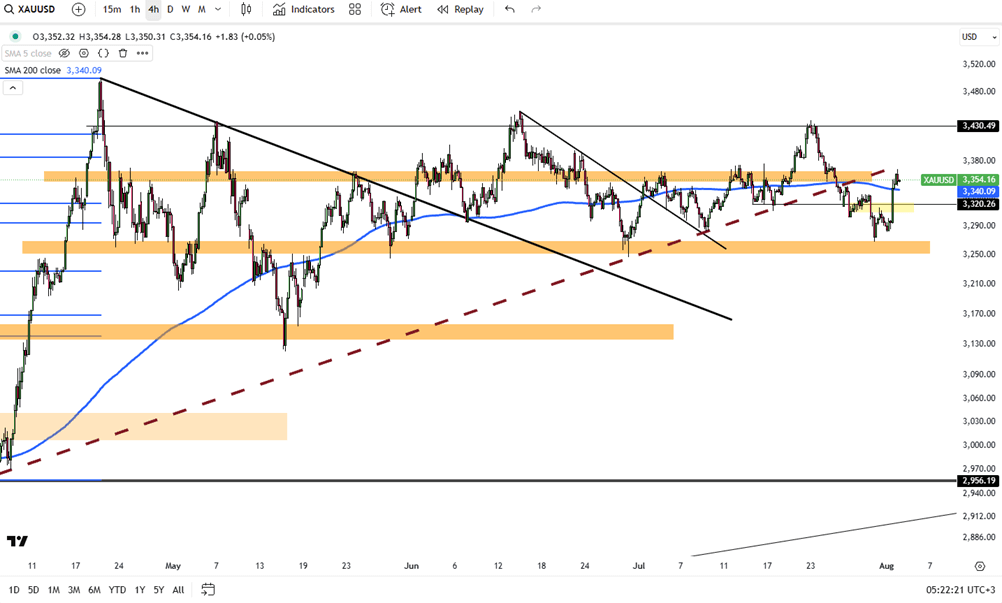

Gold extended losses from the previous session and heading for its weakest week since late June. The retreat followed the US producer price growth in July, the fastest in three years, which signaled that companies are passing higher import costs from tariffs onto consumers. This data shifted market expectations toward a 25 bps Fed rate cut in September, with another in October, as Fed’s Mary Daly dismissed the case for a 50 bps move.

Gold is testing resistance at $3,385, with support at $3,320.

| R1: 3385 | S1: 3320 |

| R2: 3420 | S2: 3275 |

| R3: 3500 | S3: 3230 |

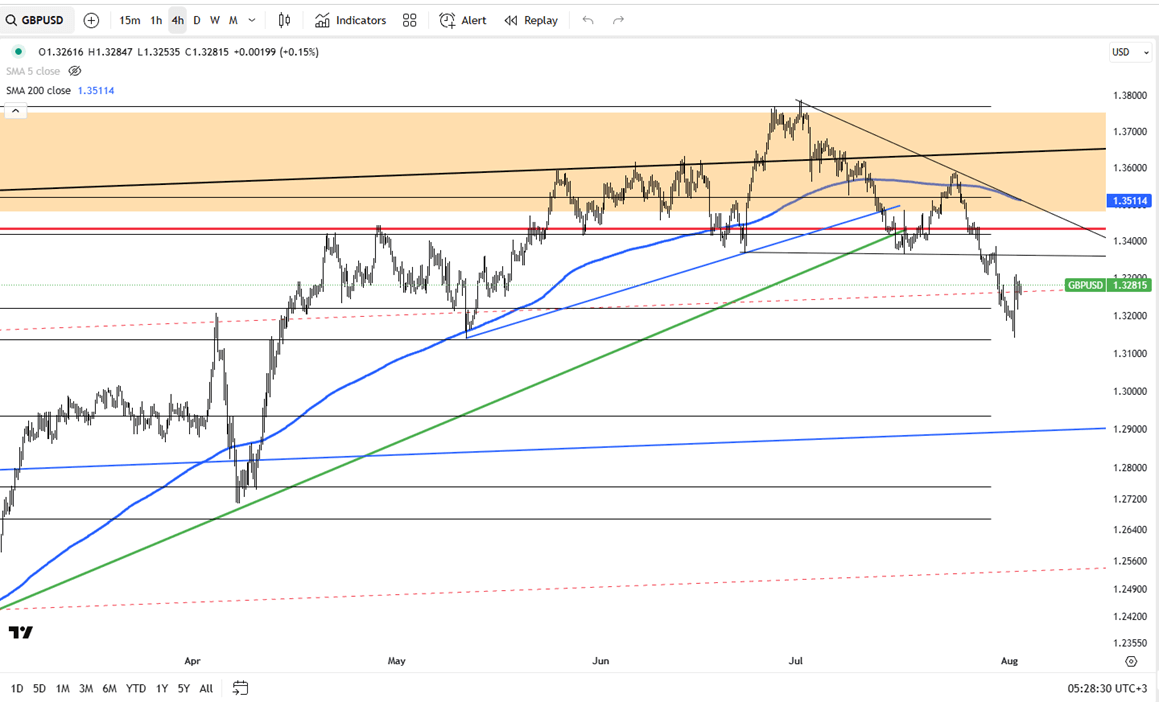

The pound rose to $1.3600, its highest in five weeks, after UK GDP beat forecasts. The economy grew 0.3% in Q2 compared with 0.1% expected, with annual growth reaching 1.2%. June GDP also posted a surprise 0.4% rise. The strong figures reduce the likelihood of further Bank of England cuts after last week’s narrow 5-4 vote for a 25 bps reduction.

GBP/USD is seeing resistance at 1.3620, with initial support at 1.3340.

| R1: 1.3620 | S1: 1.3340 |

| R2: 1.3750 | S2: 1.3260 |

| R3: 1.3850 | S3: 1.3000 |

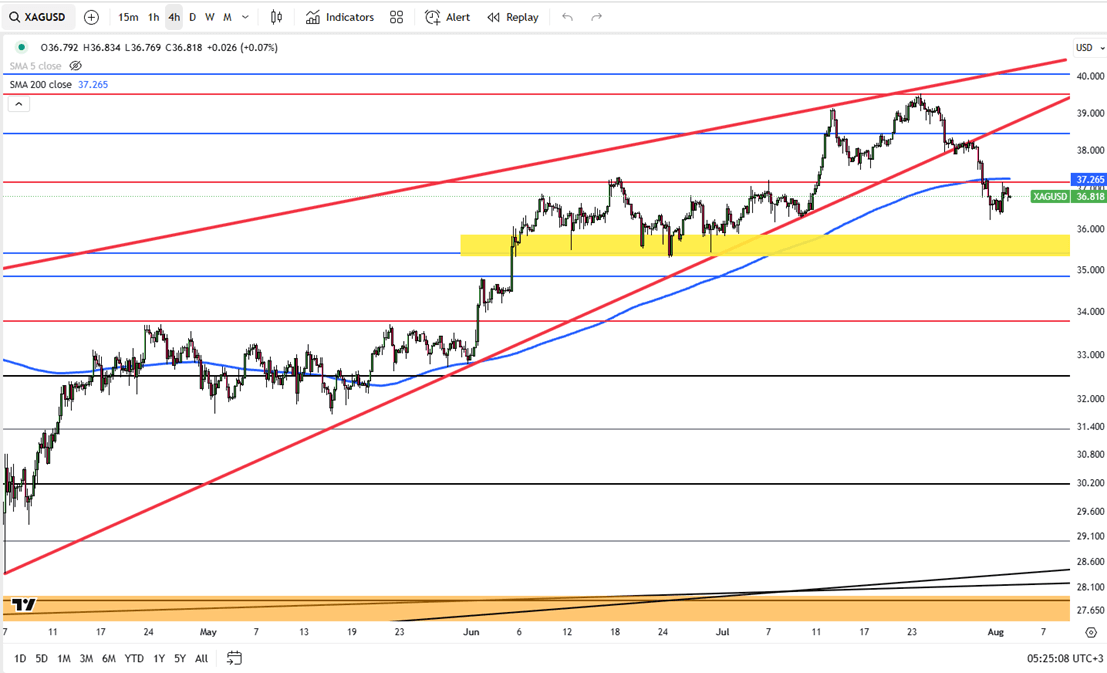

Silver prices held just below $38 per ounce after dropping more than 1% in the prior session, pressured by US producer inflation and jobless claims, which showed 224,000 versus 228,000 forecast. While markets still price over a 90% chance of a 25 bps Fed cut next month, expectations for a larger 50 bps move have been erased.

Silver is testing resistance at $39.50, with support at $36.75.

| R1: 39.50 | S1: 36.75 |

| R2: 40.50 | S2: 35.50 |

| R3: 41.20 | S3: 33.90 |

Global markets remain dominated by geopolitical risk as escalating conflict between the United States, Israel, and Iran fuels a strong shift toward safe-haven assets. The dollar index hit 99.3 Wednesday, rising for a third day as conflict concerns fueled inflation and shifted Fed rate cut expectations from July to September.

A US court rejected Trump's tariff refund delay as the Dollar (98.5) and 10 year yield (4.04%) held gains amid Middle East escalation and inflation fears.

After Khamenei: Who Will Lead Iran Next?

After Khamenei: Who Will Lead Iran Next?Following the death of Supreme Leader Ali Khamenei, Iran has entered a pivotal transition phase. Senior officials in Tehran are acting swiftly to uphold the existing structure of the Islamic Republic, prioritizing continuity to head off potential internal instability. Despite these efforts, the sudden leadership vacuum has sparked intense political and military maneuvering behind the scenes.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!