Risk sentiment shifted this week as Moody’s downgraded the US credit rating, weakening the dollar and supporting major currencies and commodities.

The euro climbed toward $1.13 on both the downgrade and a tentative EU-UK post-Brexit deal, while the yen held firm despite Japan’s Q1 contraction. Gold and silver retreated as hopes for a Russia-Ukraine ceasefire eased safe-haven demand. Meanwhile, the British pound rallied past $1.336, backed by strong GDP growth and optimism over new UK-EU trade cooperation. Market focus now turns to upcoming Fed speeches and trade negotiations.

| Time | Cur. | Event | Forecast | Previous |

| 13:00 | USD | FOMC Member Bostic Speaks |

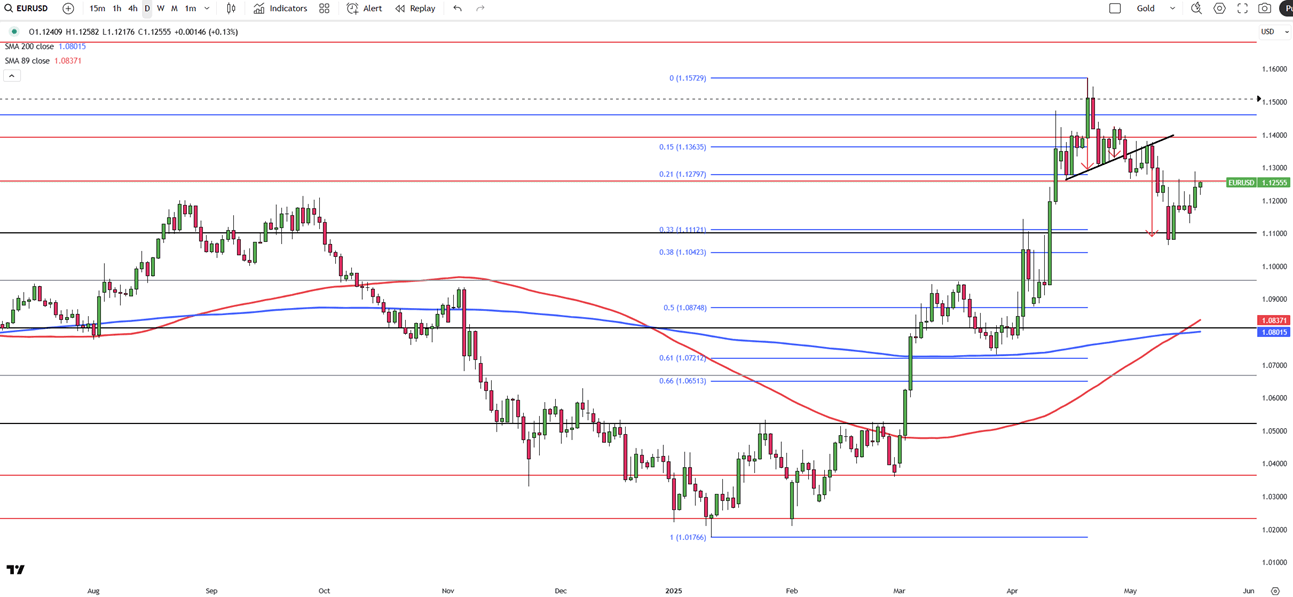

The euro approached the $1.13 mark on Tuesday, extending its rebound from the one-month low recorded on May 12. The rally followed a broad-based weakening in the US dollar after Moody’s downgraded the US credit rating from Aaa to Aa1, citing mounting government debt and widening fiscal deficits. The downgrade sparked investor concerns about long-term US economic stability and pressured dollar-denominated assets.

The EU and UK finalized a provisional agreement addressing key post-Brexit issues such as defense, fisheries, youth mobility, and security cooperation. The deal may pave the way for UK companies to participate in major EU defense projects, marking a potential turning point in EU-UK relations.

The European Central Bank is expected to initiate a rate cut in June, with additional easing possible later in the year. Despite these expectations, the euro has held firm, buoyed by both geopolitical developments and dollar weakness.

EUR/USD now faces resistance at 1.1260, with further upside barriers at 1.1460 and 1.1580. Support lies at 1.1040, followed by 1.1000 and 1.0960.

| R1: 1.1260 | S1: 1.1040 |

| R2: 1.1460 | S2: 1.1000 |

| R3: 1.1580 | S3: 1.0960 |

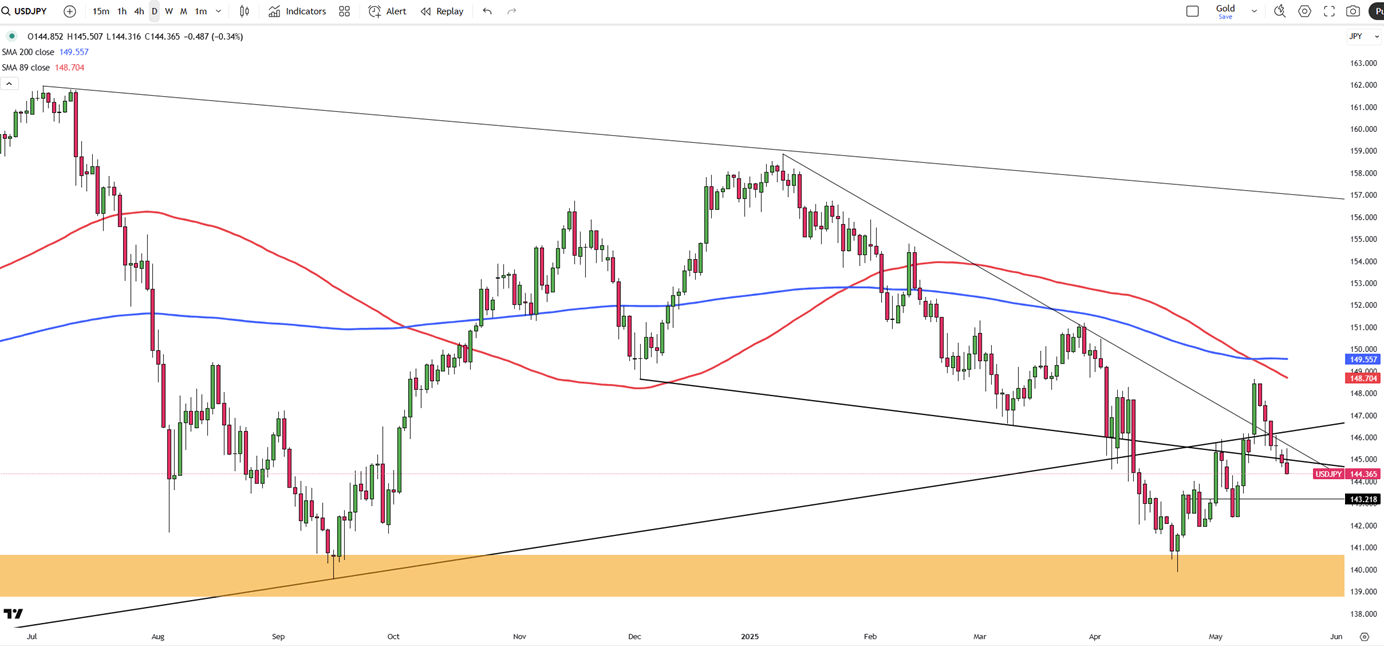

The Japanese yen held firm near 144 per dollar, marking its fourth straight session of gains, bolstered by a weaker US dollar in the wake of Moody’s downgrade of the US credit rating. The move, prompted by fiscal concerns and rising deficits, dented dollar confidence globally.

Despite this, Japan’s own economic data weighed on sentiment, with GDP shrinking by 0.2% in Q1, its first contraction in a year and worse than anticipated. Investors are also closely watching the upcoming Japanese trade data with concerns about the impact of potential new US tariffs. A third round of US-Japan trade talks is set to begin in Washington by the end of the week, led by Japan’s chief negotiator Ryosei Akazawa.

USD/JPY faces immediate resistance at 148.60, with higher levels at 149.80 and 151.20. Key support is seen at 139.70, followed by 137.00 and 135.00.

| R1: 148.60 | S1: 139.70 |

| R2: 149.80 | S2: 137.00 |

| R3: 151.20 | S3: 135.00 |

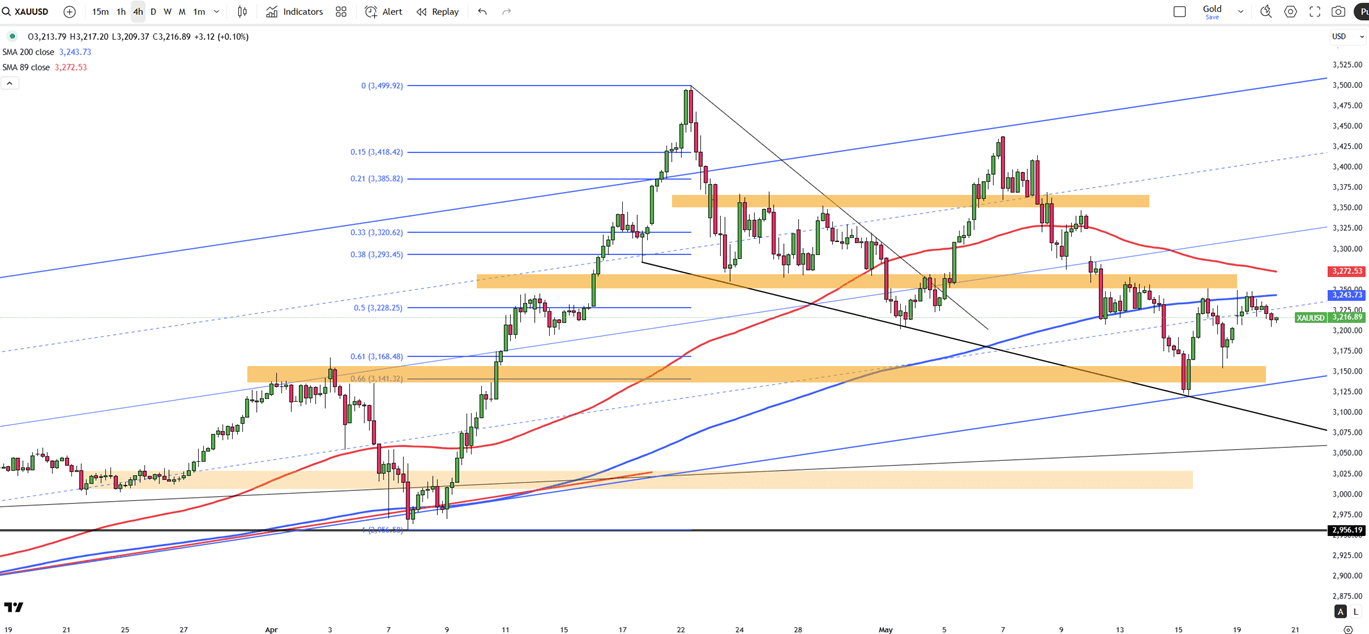

Gold declined below $3,320 per ounce as hopes for a ceasefire between Russia and Ukraine reduced the appeal of safe-haven assets. The drop followed a statement by US President Donald Trump announcing that both nations had agreed to "immediate" talks, potentially without US involvement, after a conversation with Russian President Vladimir Putin.

On Monday, gold had gained 0.6% in response to Moody’s downgrade of the US credit rating to Aa1 from Aaa, which raised concerns about long-term debt sustainability. However, with geopolitical tensions easing and investors awaiting fresh comments from Federal Reserve officials, gold reversed course.

XAU/USD now finds resistance at $3,250, with further levels at $3,300 and $3,350. On the downside, support is seen at $3,120, followed by $3,030 and $2,956.

| R1: 3250 | S1: 3120 |

| R2: 3300 | S2: 3030 |

| R3: 3350 | S3: 2956 |

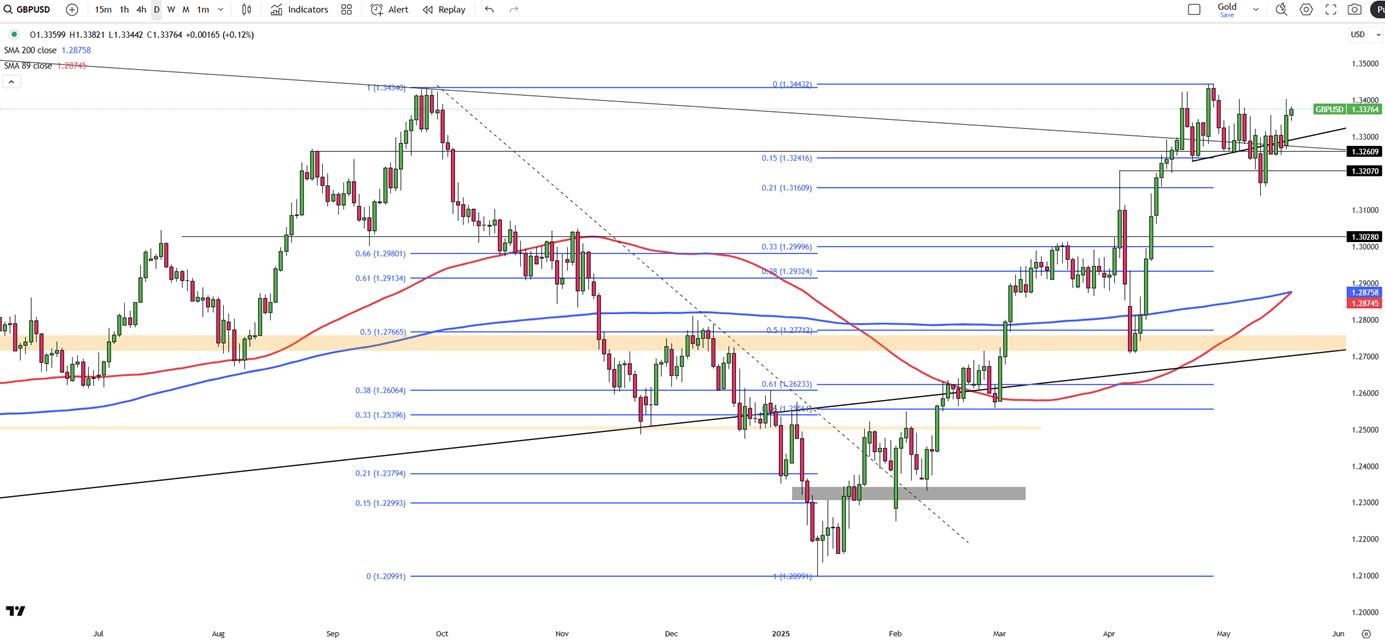

The British pound rallied past $1.336, reaching a one-week high and inching closer to its April peak of $1.34. The move was fueled by renewed optimism after the UK and EU reached a comprehensive post-Brexit agreement covering energy cooperation, defense partnerships, and fisheries rights through 2038.

Supporting the pound further, recent UK data exceeded expectations. GDP rose 0.7% in Q1 and 1.3% annually, easing pressure on the Bank of England to cut interest rates aggressively. Although rate reductions remain on the table, the strength of the economic rebound gives policymakers more flexibility.

Despite some concerns about rising unemployment and slowing wage growth, the upbeat GDP print has helped offset fears of an impending recession. Meanwhile, the US dollar continued to weaken following Moody’s credit downgrade, providing additional support to the pound.

GBP/USD now faces resistance at 1.3450, with higher targets at 1.3550 and 1.3700. Support is located at 1.3160, followed by 1.3000 and 1.2960.

| R1: 1.3450 | S1: 1.3160 |

| R2: 1.3550 | S2: 1.3000 |

| R3: 1.3700 | S3: 1.2960 |

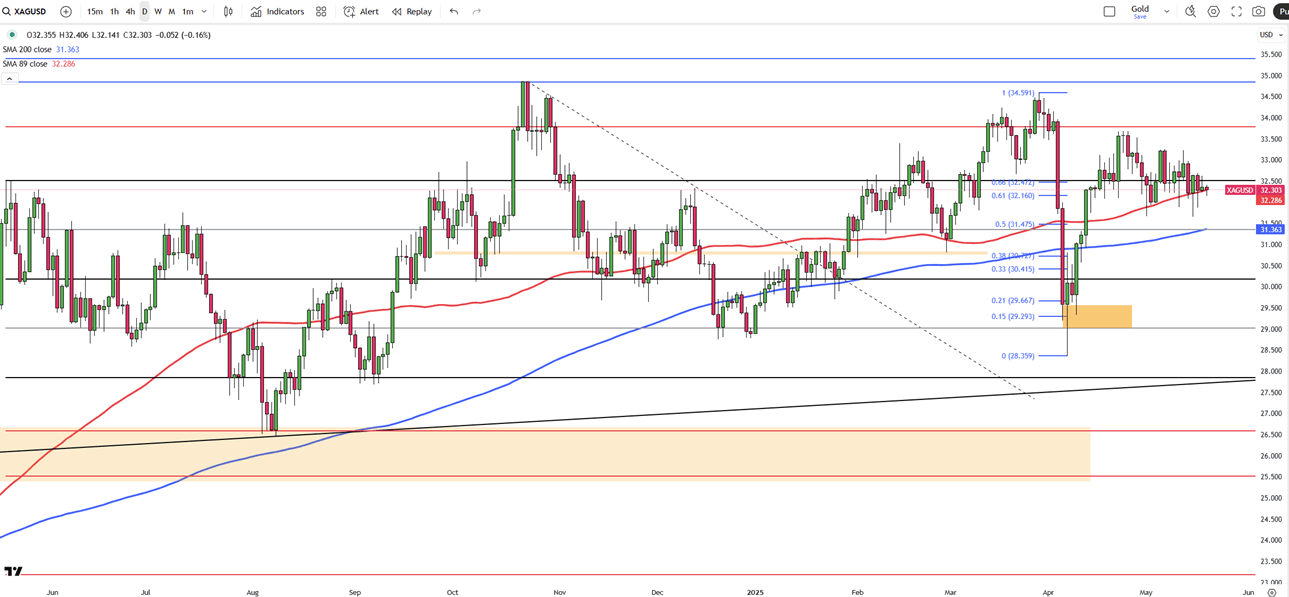

Silver hovered around $32.20 per ounce during Tuesday’s Asian session, easing for a third consecutive day as safe-haven demand faded. The hopes for a Russia-Ukraine ceasefire, announced by U.S. President Trump after a call with President Putin, tempered market uncertainty and weighed on silver’s appeal.

However, losses were limited following Moody’s downgrade of the U.S. credit rating and a series of weak economic data, including CPI, PPI, and retail sales. These reinforced expectations for two Fed rate cuts this year, likely starting in September, according to the CME FedWatch Tool projections.

Strong industrial demand, especially from the solar sector, continues to support silver’s longer-term outlook. Markets now look for upcoming Fed speeches for further direction.

XAG/USD faces resistance at $32.50, with higher levels at $33.80 and $34.20. Support is seen at $31.40, followed by $30.20 and $29.80.

| R1: 32.50 | S1: 31.40 |

| R2: 33.80 | S2: 30.20 |

| R3: 34.20 | S3: 29.80 |

Global markets remained cautious as investors weighed the economic impact of the ongoing Middle East conflict and volatile energy prices.

Currency markets remained volatile as ongoing Middle East tensions continued to shape global sentiment.

Hormuz Blockade Rattles Markets (09 - 13 March)

Hormuz Blockade Rattles Markets (09 - 13 March)Global sentiment was dominated this week by the second week of the war with Iran and the effective blockade of the Strait of Hormuz, driving Brent crude prices above $100/barrel. Despite a catastrophic US labor report showing a loss of 92,000 jobs in February, safe-haven demand pushed the US Dollar Index to 99.1. The energy shock has ignited fears of "stagflation," particularly in Europe and Japan, as soaring fuel costs threaten to reverse recent disinflationary trends.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!