The dollar index steadied around 108.4 on Friday, its highest since November 2022, as investors awaited the PCE price index.

Fed Chair Powell noted inflation likely remains above the 2% target following the Fed's 25 basis point rate cut, with fewer cuts expected in 2025. Japan's inflation rose to 2.9% in November, its highest since October 2023, while China's central bank held key lending rates steady for the second month, with the one-year LPR at 3.1%.

| Time | Cur. | Event | Forecast | Previous |

| 07:00 | GBP | Core Retail Sales (Nov) | 0.0% | -0.9% |

| 07:00 | EUR | German PPI(Nov) | 0.3% | 0.2% |

| 13:30 | USD | U.S. Core PCE Price Index (Nov) | 0.2% | 0.3% |

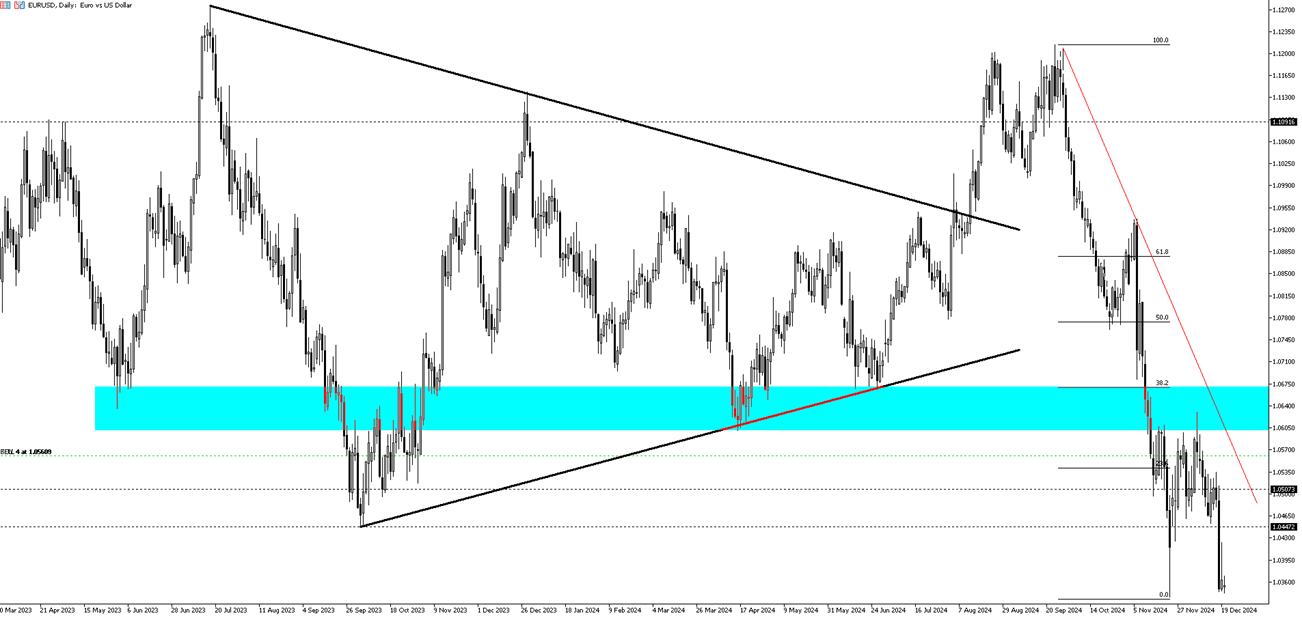

The EUR/USD pair shows a slight downward trend around 1.0360 during the early Asian trading hours on Friday. The pair continues to face pressure as the US Federal Reserve took a less dovish approach, even after reducing interest rates by 25 basis points at its December meeting on Wednesday. Attention will now turn to the US Core Personal Consumption Expenditures (PCE) Price Index data, set to be released later on Friday.

Technically, the first resistance level will be 1.0400 level. In case of this level’s breach, the next levels to watch would be 1.0460 and 1.0520. On the downside, 1.0335 will be the first support level. 1.0230 and 1.0200 are the next levels to monitor if the first support level is breached.

| R1: 1.0400 | S1: 1.0335 |

| R2: 1.0460 | S2: 1.0230 |

| R3: 1.0520 | S3: 1.0200 |

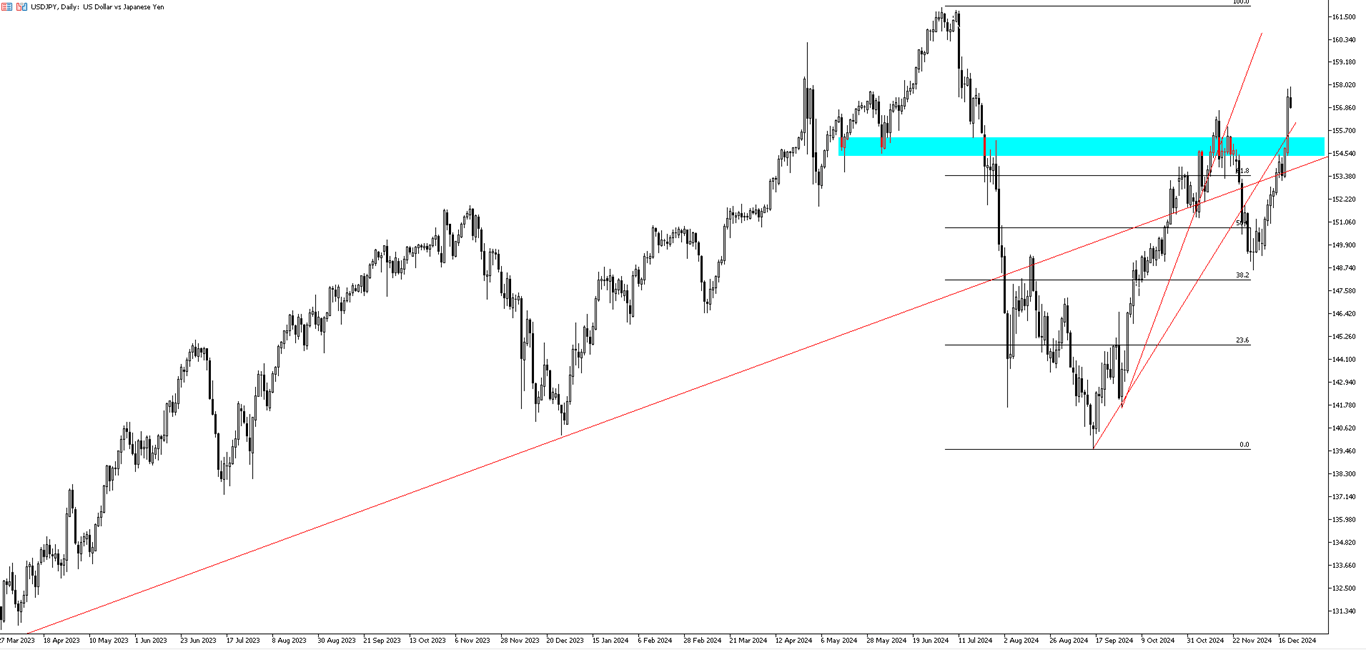

The yen pushed past 157 per dollar after data revealed that Japan's headline inflation climbed to a three-month peak of 2.9% in November, up from 2.3% in October. Core inflation also rose to 2.7%, exceeding market forecasts of 2.6%. These figures bolster expectations for a more hawkish stance from the Bank of Japan. Despite this, the BOJ chose to maintain its interest rates at its December meeting, emphasizing the need to monitor wage growth, global economic uncertainties, and the policies of the incoming US administration. This decision led to a sharp 2% drop in the yen to a five-month low on Thursday. The currency also remained under pressure from a strong US dollar after the Federal Reserve implemented a widely expected 25 basis point rate cut on Wednesday while signaling a slower pace of rate cuts in 2025.

The key resistance level appears to be 157.30, with a break above it potentially targeting 158.30 and 160.00. On the downside, 153.90 is the first major support, followed by 152.70 and 151.00 if the price moves lower.

| R1: 157.30 | S1: 153.90 |

| R2: 158.30 | S2: 152.70 |

| R3: 160.00 | S3: 151.00 |

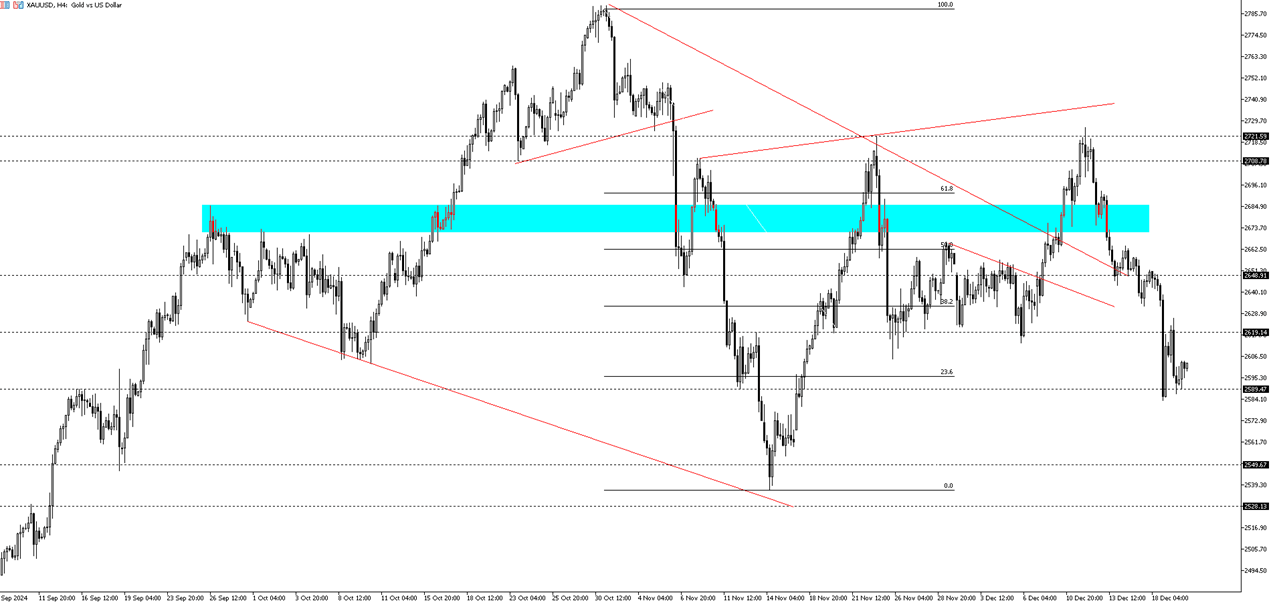

Gold hovered around $2,600 per ounce on Friday, poised for a weekly decline as a hawkish stance from the Federal Reserve weighed on prices. On Wednesday, the Fed indicated a more cautious approach to monetary easing, with its dot plot suggesting only two rate cuts in the coming year. Strong US GDP figures with an upward revision in consumer spending, further reinforced the case for slower easing. This outlook has dampened demand for gold, as limited monetary easing reduces the appeal of non-yielding assets like bullion.

Gold's short-term prospects face headwinds from weakening physical demand in India, where officials expect a substantial drop in gold imports for December. Despite these pressures, gold has gained approximately 25% this year, supported by US monetary easing and robust central bank purchases.

Technically, the first resistance level will be 2625. In case of this level’s breach, the next levels to watch would be 2635 and 2660. On the downside, 2575 will be the first support level. 2530 and 2500 are the next levels to monitor if the first support level is breached.

| R1: 2625 | S1: 2575 |

| R2: 2635 | S2: 2530 |

| R3: 2660 | S3: 2500 |

The GBP/USD pair fell by over 60 pips, pressured by strong US jobs and GDP data, and is testing the 1.2500 level. The US 10-year Treasury yield rose seven basis points to 4.592%, bolstering the dollar's strength against the British pound. The Bank of England (BoE) kept interest rates unchanged in a split decision, with mixed projections for potential rate adjustments in early 2025. During the North American session, the GBP/USD extended its decline, with sellers aiming for a decisive drop below 1.2500. As of now, the pair is down 0.48%, hovering near the 1.2500 mark.

The pair's first resistance level will be 1.2550. If this level is breached, the next levels to watch would be 1.2600 and 1.2680. On the downside, 1.2475 will be the first support level. If the first support level is breached, 1.2400 and 1.2350 are the next levels to monitor.

| R1: 1.2550 | S1: 1.2475 |

| R2: 1.2600 | S2: 1.2400 |

| R3: 1.2680 | S3: 1.2350 |

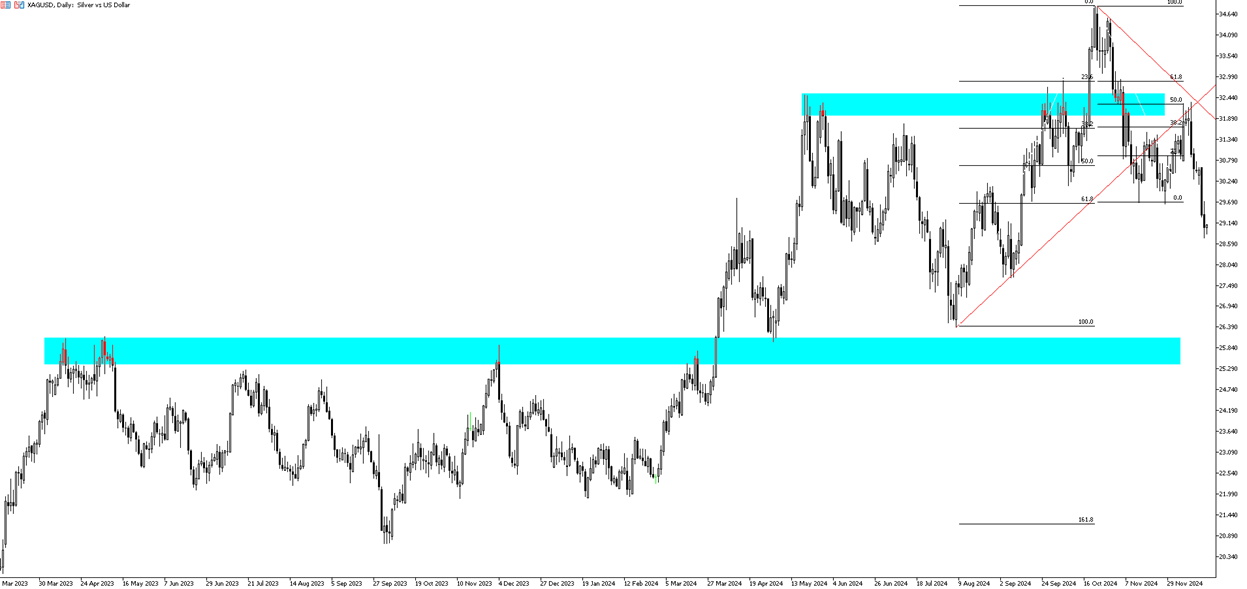

Silver (XAG/USD) extends its decline from December 12, trading near $28.90 per troy ounce during Friday's Asian session. In the previous session, the grey metal hit a new three-month low of $28.74. Non-yielding assets like silver face downward pressure as central banks stress the importance of caution regarding further rate cuts. Fed Chair Jerome Powell highlighted this caution, noting that inflation is expected to stay above the Federal Reserve's 2% target for the foreseeable future.

Technically, the first resistance level will be 29.85. The next levels to watch in the case of a breakout would be 30.20 and 30.70. On the downside, 28.75 will be the first support level. If the first support level is breached, 28.00 and 27.00 are the next levels to observe.

| R1: 29.85 | S1: 28.75 |

| R2: 30.20 | S2: 28.00 |

| R3: 30.70 | S3: 27.00 |

Trump Signals Extended Military Campaign

Trump Signals Extended Military CampaignGeopolitical tensions in the Middle East have intensified following recent remarks from Donald Trump suggesting that the ongoing military campaign against Iran may last longer than anticipated. While Trump stated that early operational objectives were achieved ahead of schedule, he acknowledged that broader strategic goals could require additional time and sustained military pressure.

Detail US DST Change March 8 2026

US DST Change March 8 2026Daylight Saving Time will change in the United States on Sunday, March 8, 2026. The trading schedule for various financial instruments will be adjusted to align with U.S. exchange hours.

Detail Dollar Leads Risk-Off (03.06.2026)Global markets remained under pressure as escalating Middle East tensions and rising energy prices strengthened the US dollar and unsettled major currencies.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!