The EUR/USD struggled near the 1.1000 level on Thursday with inflation concerns and an expected 25 basis point ECB rate cut due to cooling inflation, with the German CPI hitting a three-year low. The US dollar gained modestly after the Fed’s mixed inflation report, supporting Treasury yields and the USD Index. In Japan, the yen weakened to 142.5 per dollar, though it remained strong following signals from the BoJ of gradual rate hikes. Gold held steady at $2,510 as markets now see an 85% chance of a Fed rate cut next week. GBP/USD traded around 1.3045, pressured by soft UK GDP data, while silver climbed toward $29 amid expectations of central bank rate cuts and strong demand in China and the renewable energy sector.

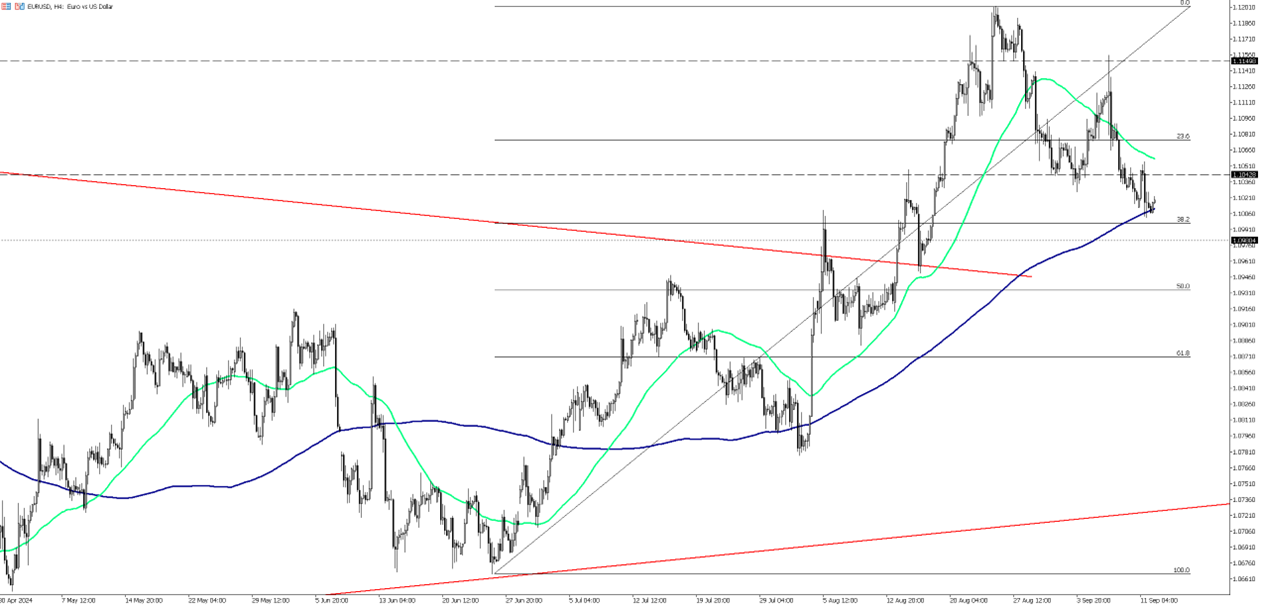

The EUR/USD pair struggled to gain momentum during the Asian session on Thursday, trading within a narrow range just above the 1.1000 psychological level, which is a four-week low reached the previous day. The ECB is widely expected to cut interest rates by 25 basis points, given signs of cooling inflation in the Eurozone. This expectation was reinforced by data showing that the German Consumer Price Index (CPI) fell to its lowest level in over three years in August, hitting the ECB's 2% target. This cooling inflation has weakened the euro, contributing to headwinds for the EUR/USD pair on modest strength in the US dollar. The US CPI report released on Wednesday showed overall easing in consumer prices, but the core CPI indicated persistent underlying inflation, dampening hopes for a larger rate cut by the Federal Reserve next week. This has led to a rise in US Treasury bond yields and a boost in the USD Index (DXY), approaching its monthly peak. Despite this, markets have already factored in the likelihood of the Fed beginning its easing cycle with a 25 basis point rate cut at the September 17-18 FOMC meeting. This, combined with generally positive market sentiment, limits further gains for the safe-haven dollar and provides some support to the EUR/USD pair ahead of the key central bank event. Additionally, the upcoming release of the US Producer Price Index (PPI) could offer new trading opportunities for the EUR/USD pair later in the North American session.

In the pair, the first support level is at 1.1015. If this level is breached, the next supports to watch will be 1.1000 and 1.0950. On the upside, the first resistance is at 1.1030; if this level is surpassed, the next targets will be 1.1060 and 1.1100.

| R1: 1.1030 | S1: 1.1015 |

| R2: 1.1060 | S2: 1.1000 |

| R3: 1.1100 | S3: 1.0950 |

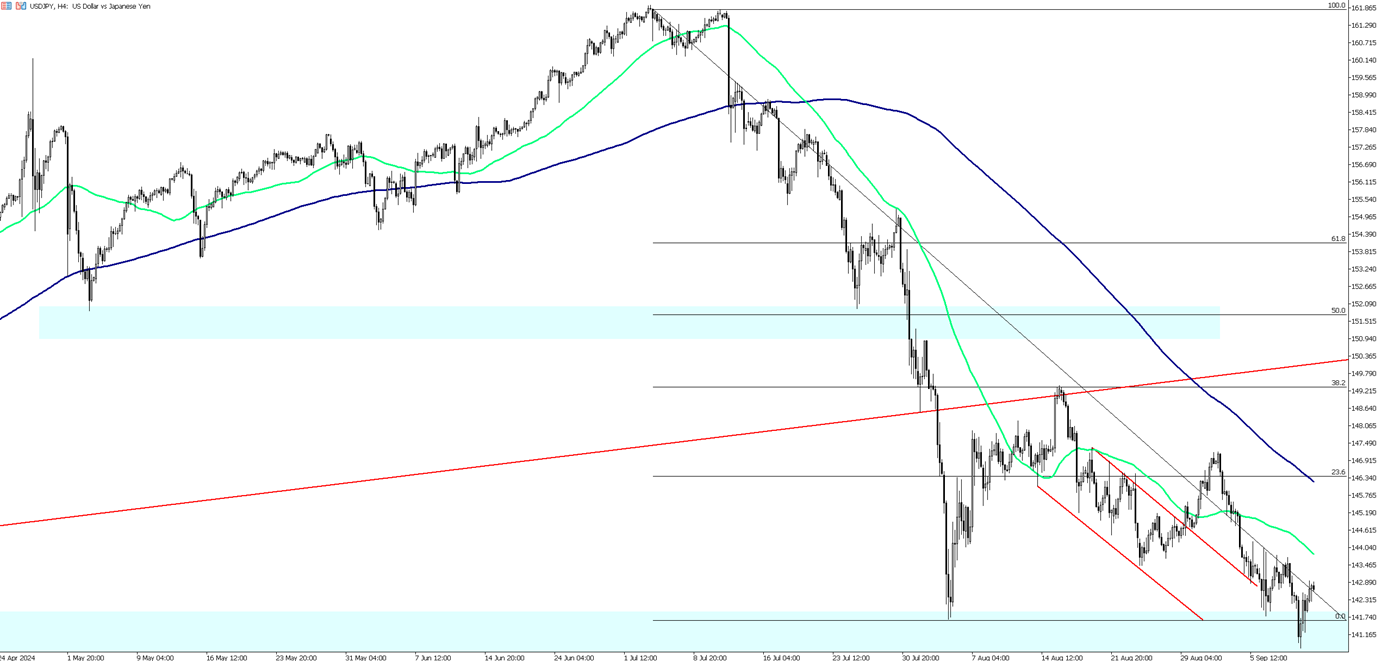

The Japanese yen weakened to about 142.5 per dollar on Thursday as the US dollar gained strength following a mixed US consumer inflation report. The data increased expectations for a modest 25 basis point rate cut by the Federal Reserve next week. Despite the yen's decline, it remained near its highest levels of the year, supported by indications from the Bank of Japan (BoJ) of a gradual rate increase. BoJ board member Naoki Tamura stated that the central bank needs to raise short-term rates to around 1% by fiscal 2026 to consistently achieve its 2% inflation target. Additionally, BoJ board member Junko Nakagawa noted that the central bank plans to continue raising rates if economic conditions and inflation align with forecasts. She highlighted that a tight labor market and rising import prices pose ongoing risks to inflation.

From a technical perspective, the first resistance level is at 142.70. If this level is surpassed, the next targets will be 143.80 and 144.50. On the downside, the initial support is at 142.00; if this level is breached, the next support to watch will be 140.50 and 140.00.

| R1: 142.70 | S1: 142.00 |

| R2: 143.80 | S2: 140.50 |

| R3: 144.50 | S3: 140.00 |

Gold held steady near $2,510 per ounce on Thursday as investors assessed the latest US consumer inflation data and adjusted their expectations for a smaller Federal Reserve rate cut next week. The monthly core Consumer Price Index (CPI) rose unexpectedly by 0.3%, surpassing the anticipated 0.2% increase. In contrast, the annual headline inflation rate decelerated to 2.5%, more than expected, while the core rate remained at 3.2%, in line with forecasts. Following these developments, markets now see an 85% chance of a 25 basis point rate cut at the Fed's upcoming meeting, up from about 70% before the data release, according to the CME FedWatch tool. A more accommodative monetary policy typically supports gold prices by lowering the opportunity cost of holding non-yielding bullion. Investors are now looking ahead to the US producer price index and initial jobless claims reports later in the day for additional insights.

Technically, the first support level is at 2,510. If this level is breached, the next supports to watch will be 2,495 and 2,470. On the upside, the initial resistance is at 2,530; if this level is surpassed, the next targets will be 2,550 and 2,585.

| R1: 2530 | S1: 2510 |

| R2: 2550 | S2: 2495 |

| R3: 2585 | S3: 2470 |

The GBP/USD pair is currently under pressure and is trading near 1.3045 as the markets react to the latest US inflation data. Economic reports released during the European session have further weighed on the pound. While headline inflation decreased, the annual core Consumer Price Index (CPI), excluding volatile food and energy prices, held steady at 3.2% in August, matching expectations. However, both the monthly CPI and core CPI increased by 0.2% and 0.3%, respectively, surpassing market forecasts. This has led traders to lower expectations for a 50-basis-point rate cut by the Federal Reserve, with the market now pricing in an 85% chance of a 25-basis-point cut. The GBP's weakness was exacerbated by reports of soft Gross Domestic Product (GDP) figures during the European session. Nevertheless, leading indicators suggest a potential rebound in UK economic activity. This outlook implies that the Bank of England is unlikely to implement a rate cut larger than the anticipated 50 basis points by year-end, which could offer some support for the pound.

For GBP/USD, the initial support lies at 1.3040, followed by 1.3000 and 1.2950 below. On the upside, the first resistance is at 1.3100, with subsequent levels at 1.3140 and 1.3190 if the pair breaks above this resistance.

| R1: 1.3100 | S1: 1.3040 |

| R2: 1.3140 | S2: 1.3000 |

| R3: 1.3190 | S3: 1.2950 |

Silver prices climbed toward $29 per ounce, building on recent gains amid expectations of upcoming interest rate cuts by major central banks. The European Central Bank is anticipated to reduce rates again on Thursday, with market participants watching for indications that further cuts could be on the horizon for October and December. Meanwhile, the Federal Reserve is expected to ease its policy at its meeting next week, likely implementing a modest 25 basis point rate cut following a mixed US inflation report for August. Additionally, investors are evaluating demand prospects in China, a major consumer of silver, in light of recent economic data, and are also considering trends in the renewable energy sector, where silver is used in solar panels.

From a technical perspective, the first resistance level to watch is 29.00. If silver breaks above this level, the next resistance levels to watch will be 29.50 and 30.00, respectively. On the downside, the initial support level is at 28.40, with subsequent support levels at 27.70 and 27.20.

| R1: 29.00 | S1: 28.40 |

| R2: 29.50 | S2: 27.70 |

| R3: 30.00 | S3: 27.20 |

Currency markets remained volatile as ongoing Middle East tensions continued to shape global sentiment.

Hormuz Blockade Rattles Markets (09 - 13 March)

Hormuz Blockade Rattles Markets (09 - 13 March)Global sentiment was dominated this week by the second week of the war with Iran and the effective blockade of the Strait of Hormuz, driving Brent crude prices above $100/barrel. Despite a catastrophic US labor report showing a loss of 92,000 jobs in February, safe-haven demand pushed the US Dollar Index to 99.1. The energy shock has ignited fears of "stagflation," particularly in Europe and Japan, as soaring fuel costs threaten to reverse recent disinflationary trends.

Detail Oil Shock Drives Dollar Higher (03.09.2026)Global markets opened the week under pressure as escalating Middle East tensions and disruptions in the Strait of Hormuz pushed oil prices above $100 per barrel.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!