Today, the market landscape cautious as the dollar rallies on Donald Trump’s U.S. presidential election victory, with investors focused on upcoming rate decisions from both the Federal Reserve and the Bank of England.

The EUR/USD remains under pressure with the dollar index hovering near multi-month highs, while the yen is vulnerable as Japanese authorities warn of potential intervention amid dollar strength. Gold and silver, pressured by the stronger dollar and shifting safe-haven sentiment, hold steady as traders await the Fed’s anticipated 25 basis point rate cut and any signals on future monetary easing. Meanwhile, GBP/USD is trading cautiously as the Bank of England’s rate decision looms, with expectations for a cut. This week’s pivotal data releases and central bank meetings are set to shape the next moves across currency and metal markets.

| Time | Cur. | Event | Forecast | Previous |

| 12:00 | GBP | BoE MPC vote cut (Nov) | 8 | 1 |

| 12:00 | GBP | BoE MPC vote hike (Nov) | 0 | 0 |

| 12:00 | GBP | BoE MPC vote unchanged (Nov) | 1 | 8 |

| 12:00 | GBP | BoE Interest Rate Decision (Nov) | 4.75% | 5.00% |

| 12:00 | GBP | BoE MPC Meeting Minutes | | |

| 13:30 | USD | Continuing Jobless Claims | 1,880K | 1,862K |

| 13:30 | USD | Initial Jobless Claims | 223K | 216K |

| 19:00 | USD | FOMC Statement | ||

| 19:00 | USD | Fed Interest Rate Decision | 4.75% | 5.00% |

| 19:30 | USD | FOMC Press Conference |

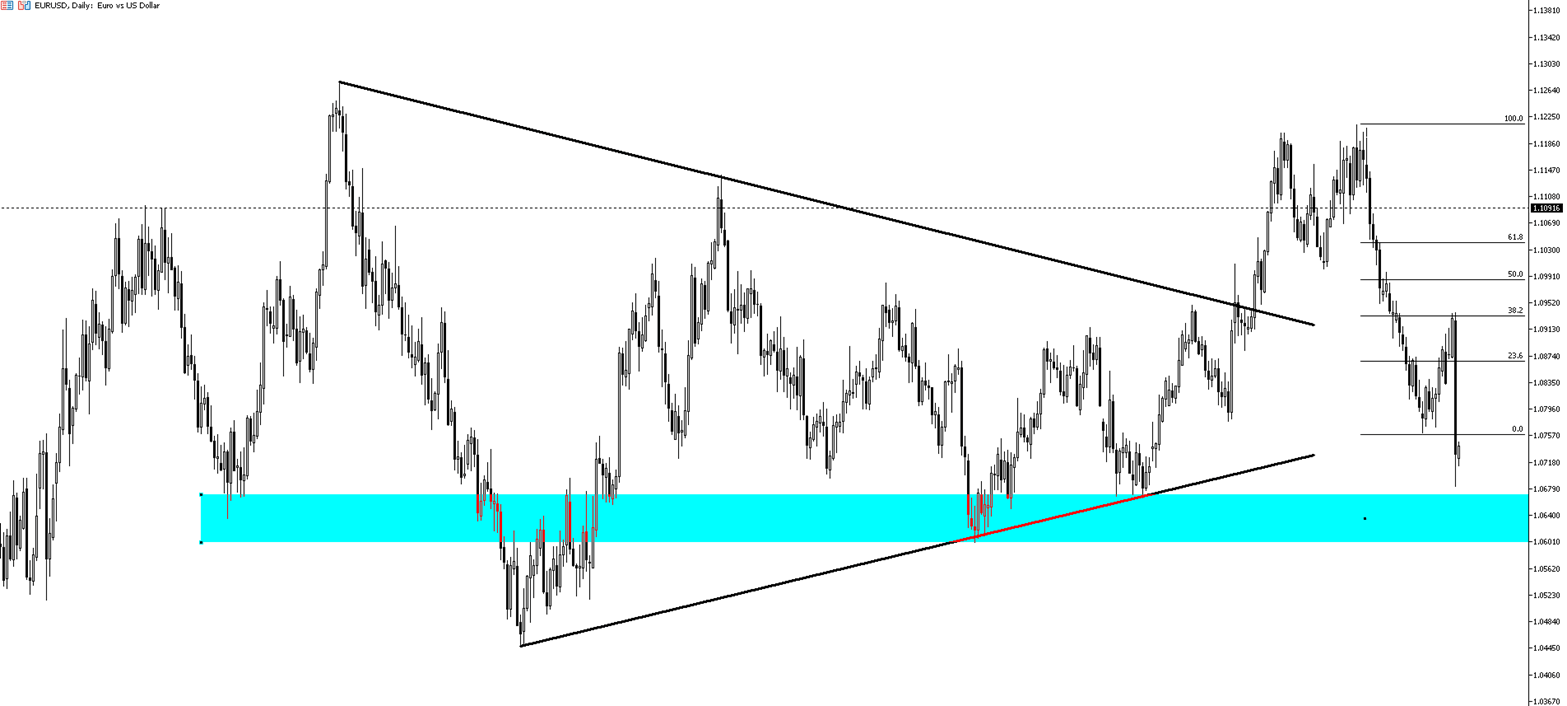

The EUR/USD pair is trading around 1.0750 on Thursday, while the dollar index remains above 105, hovering near a four-month high as investors await the Federal Reserve's latest policy decision. The Fed is widely expected to implement a 25 basis point interest rate cut later today, with traders also looking for hints on whether additional cuts might follow in December. On Wednesday, the dollar surged nearly 2% after Republican Donald Trump secured a decisive victory in the U.S. presidential election. The Republicans also regained control of the Senate, potentially setting the stage for significant legislative changes, although control of the House of Representatives is still uncertain. Trump’s policies are focused on reducing illegal immigration, raising tariffs, cutting taxes, and deregulation. They are viewed as likely catalysts for both economic growth and inflation. The anticipated rise in government spending and increased debt levels further supported the dollar and lifted Treasury yields.

In the EUR/USD pair, the initial resistance level is at 1.0770, followed by 1.0830 and 1.0875 as subsequent resistance points. On the downside, the first support level is 1.0700, which aligns with the 200-day moving average. If this level is breached, the next support levels to watch will be 1.0660 and 1.0600.

| R1: 1.0770 | S1: 1.0700 |

| R2: 1.0830 | S2: 1.0660 |

| R3: 1.0875 | S3: 1.0600 |

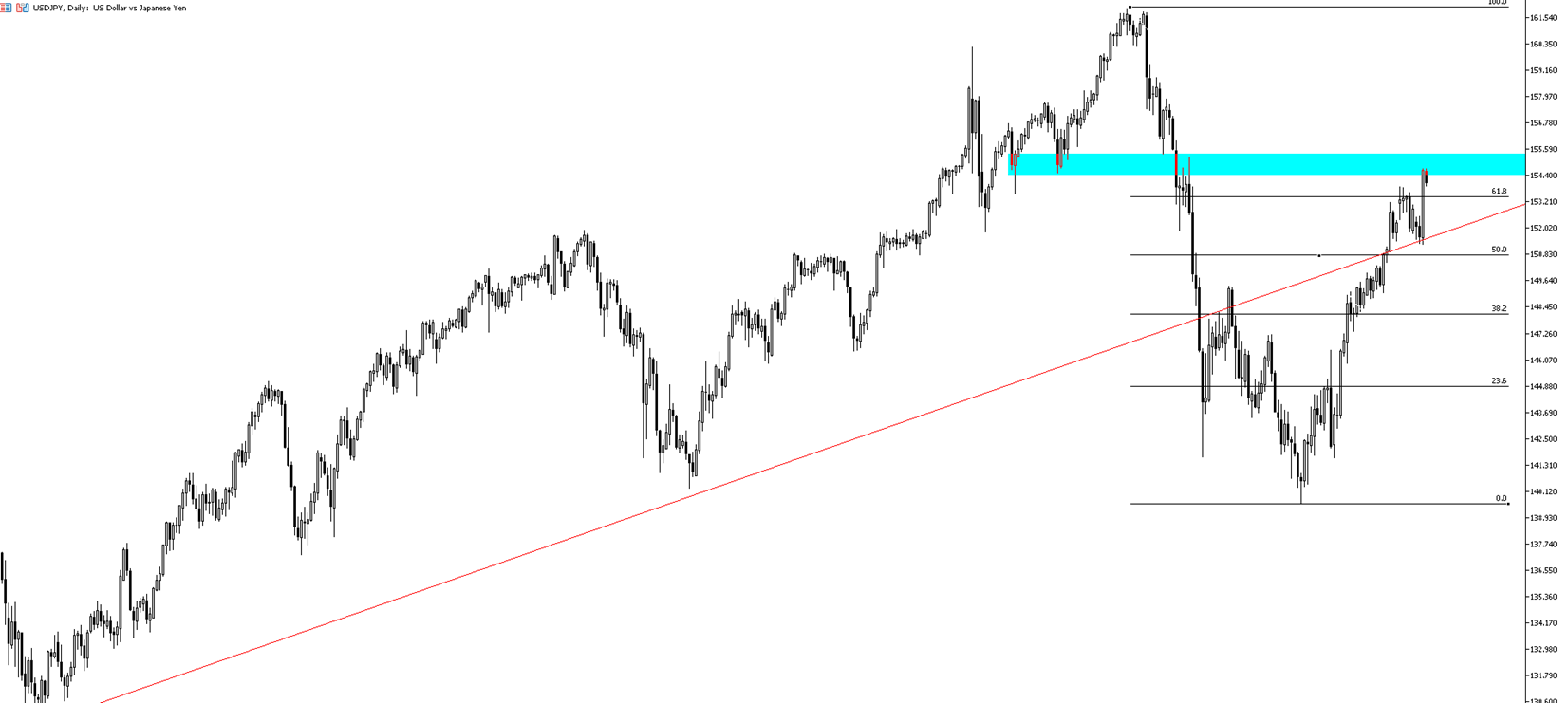

The Japanese yen traded around 154.4 per dollar on Thursday, lingering near a three-month low, raising concerns that Japanese authorities might intervene in the currency markets. Atsushi Mimura, Japan’s top currency official, warned that he is "closely monitoring FX movements with a heightened sense of urgency" and stands "ready to take appropriate action" if excessive volatility continues. The yen dropped nearly 2% on Wednesday, pressured by a sharp rally in the dollar after Republican Donald Trump’s clear victory in the U.S. presidential election. Meanwhile, new data showed Japan's real wages declined 0.1% in September, as consumer inflation accelerated to 2.9%, outpacing the 2.8% rise in nominal wages. These wage figures further complicate the Bank of Japan’s outlook on potential interest rate hikes, which are already clouded by political uncertainty in the country.

In the USD/JPY pair, the first support level is at 153.80, which coincides with the 200-day moving average. If this level is broken, the next support levels to monitor are 152.20 and 151.50. On the upside, resistance levels are at 154.90, 155.70, and 156.60, respectively.

| R1: 154.50 | S1: 153.80 |

| R2: 155.70 | S2: 152.20 |

| R3: 156.60 | S3: 151.50 |

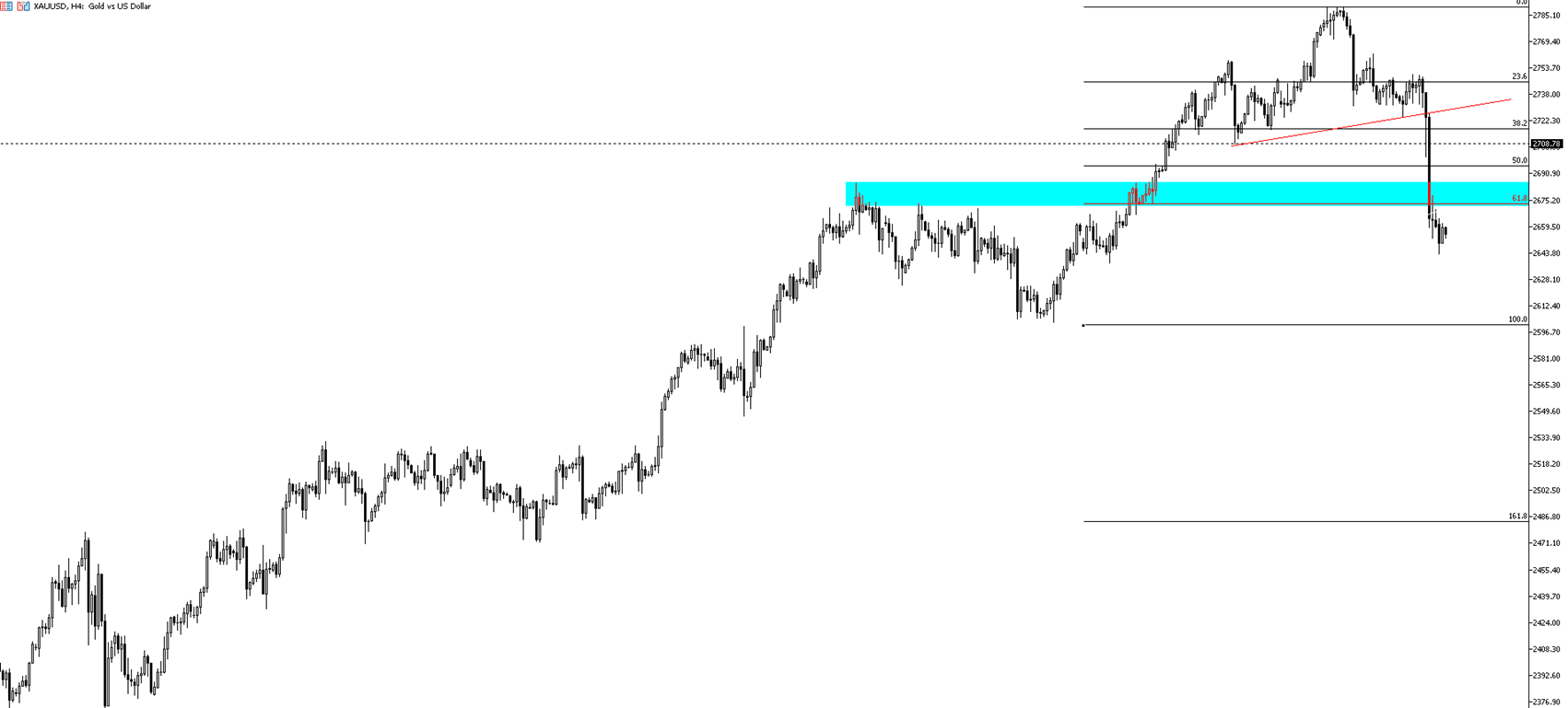

Gold held steady at around $2,650 per ounce on Thursday, after dropping more than 3% to a three-week low in the previous session, weighed down by a stronger dollar following Donald Trump's U.S. presidential victory. Trump's win has prompted traders to exit safe-haven gold positions, with expectations of higher interest rates from the Federal Reserve reducing the metal's appeal. Trump's campaign promises, which included policies on immigration, raising tariffs, tax cuts, and deregulation, have fueled concerns about larger deficits and inflation, further pressuring gold. Attention is now shifting to the Federal Reserve’s upcoming monetary policy announcement later in the day, where a 25 basis point rate cut is widely anticipated.

On the downside, the first support level for gold is at $2,635, followed by $2,600 and $2,570. On the upside, $2,670 serves as a key resistance level, with $2,695 and $2,715 as the next levels to monitor if this resistance is surpassed.

| R1: 2715 | S1: 2700 |

| R2: 2735 | S2: 2685 |

| R3: 2758 | S3: 2670 |

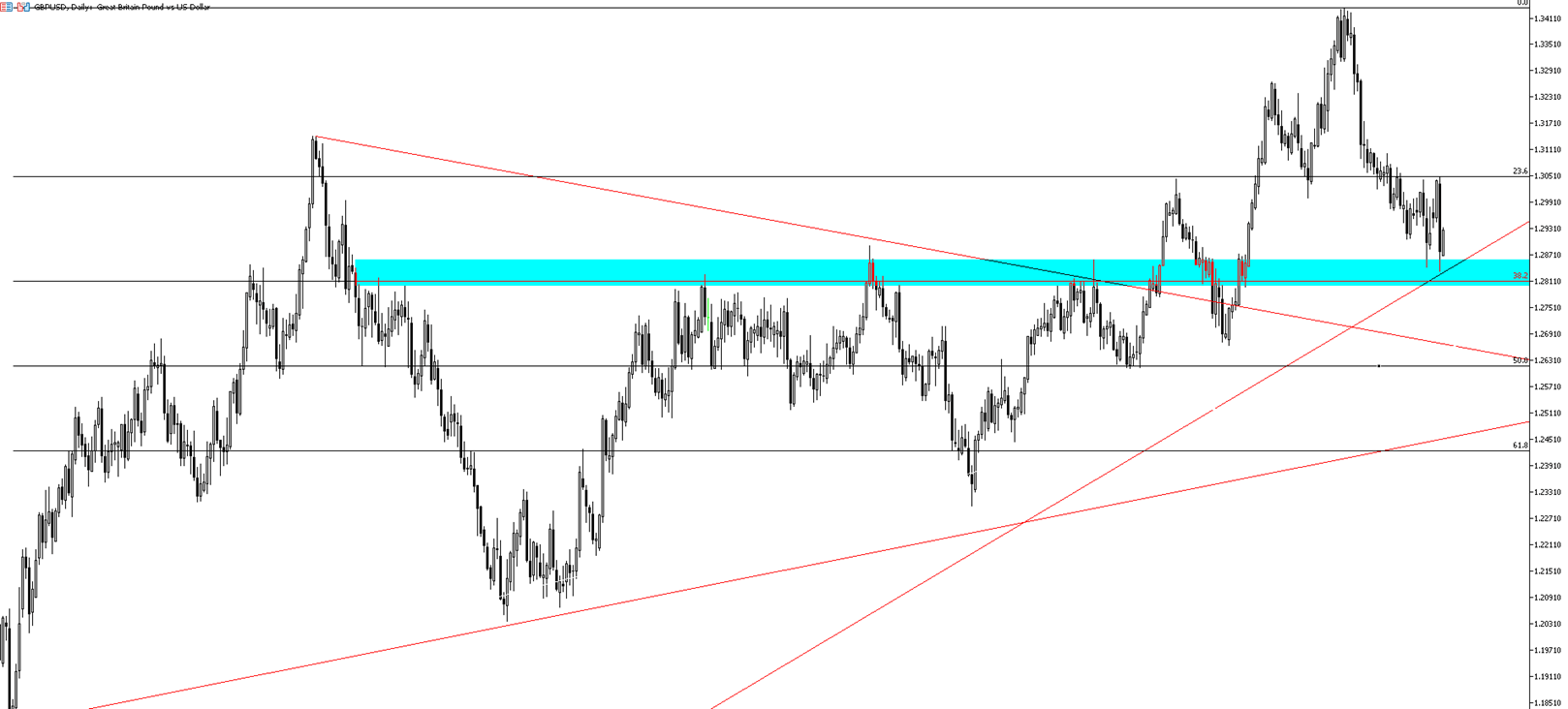

The GBP/USD pair is trading around 1.2930 after yesterday's sell off. Today is expected to be volatile with the Bank of England (BoE) and the Federal Reserve (Fed) both making interest rate decisions later. The BoE is widely expected to cut rates by 25 basis points. Additionally, economic data such as initial jobless claims and continuing claims will play a significant role in determining the direction of the pair.

On the downside, key support levels for the GBP/USD pair are at 1.2900, 1.2840, and 1.2800. On the upside, resistance levels to watch are at 1.2950, 1.3000, and 1.3050.

| R1: 1.2870 | S1: 1.2800 |

| R2: 1.2900 | S2: 1.2740 |

| R3: 1.2950 | S3: 1.2700 |

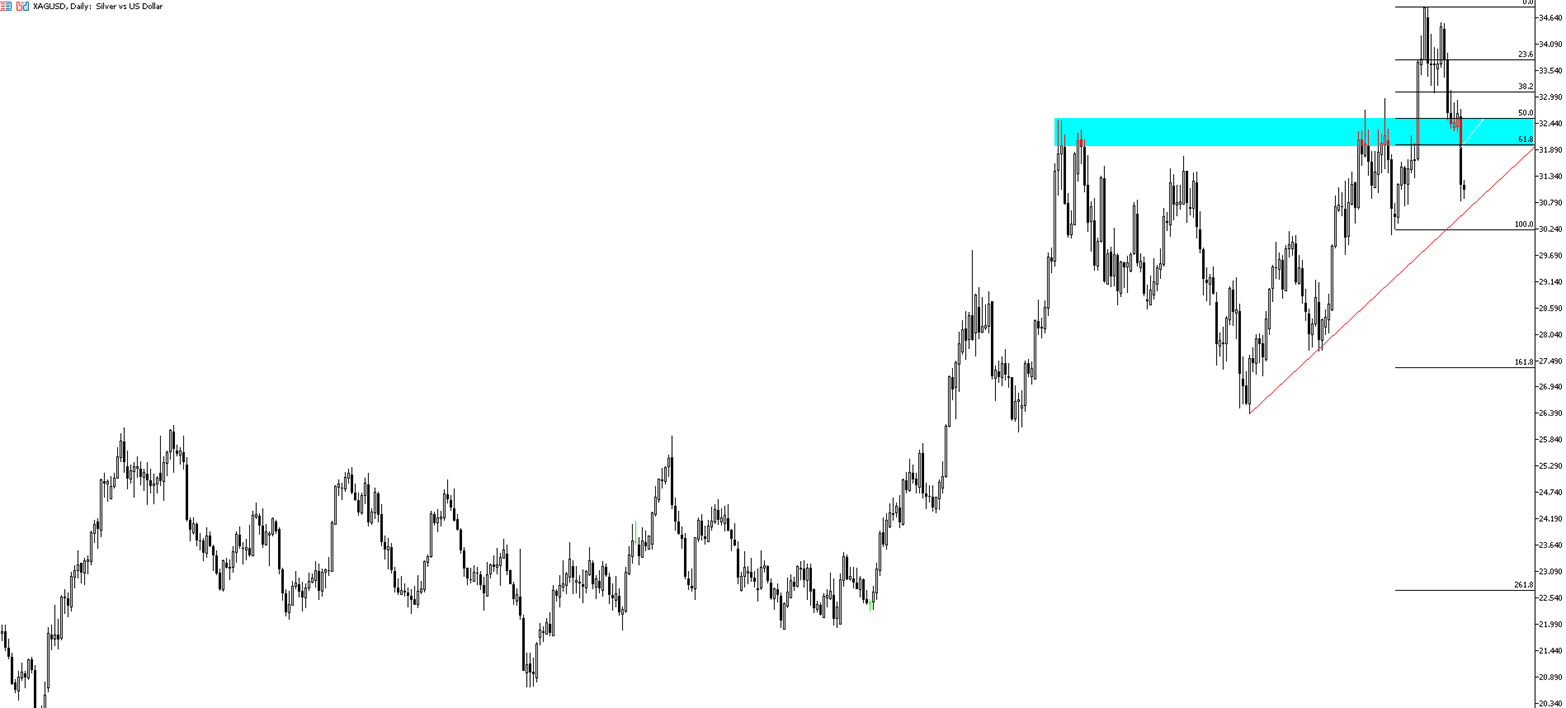

Silver is trading around $31.10 after yesterday’s sell-off. Concerns about weaker Chinese demand for precious metals following Trump’s election contributed to the decline in prices. However, the upcoming interest rate decision later today is expected to influence the direction of precious metals.

On the upside, the critical resistance levels to watch are at 31.70, 32.10, and 31.70. On the downside, 30.80 remains a significant first support level. If this level is breached, the next support levels to monitor are 30.50 and 30.00, respectively.

| R1: 32.10 | S1: 31.50 |

| R2: 32.50 | S2: 30.90 |

| R3: 33.00 | S3: 30.50 |

Currency markets remained volatile as ongoing Middle East tensions continued to shape global sentiment.

Hormuz Blockade Rattles Markets (09 - 13 March)

Hormuz Blockade Rattles Markets (09 - 13 March)Global sentiment was dominated this week by the second week of the war with Iran and the effective blockade of the Strait of Hormuz, driving Brent crude prices above $100/barrel. Despite a catastrophic US labor report showing a loss of 92,000 jobs in February, safe-haven demand pushed the US Dollar Index to 99.1. The energy shock has ignited fears of "stagflation," particularly in Europe and Japan, as soaring fuel costs threaten to reverse recent disinflationary trends.

Detail Oil Shock Drives Dollar Higher (03.09.2026)Global markets opened the week under pressure as escalating Middle East tensions and disruptions in the Strait of Hormuz pushed oil prices above $100 per barrel.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!