U.S. futures steadied Tuesday after Wall Street hit fresh highs, with the S&P 500 and Nasdaq setting records. Optimism came from progress in U.S.-China trade talks, while investors focus on Wednesday’s Fed decision, where a 25 bps cut is widely expected.

Tesla rose 3.6% after Musk’s $1B stock purchase, while Nvidia slipped on Chinese antitrust claims. The dollar index held near 97.3, and Trump pushed for deeper cuts.

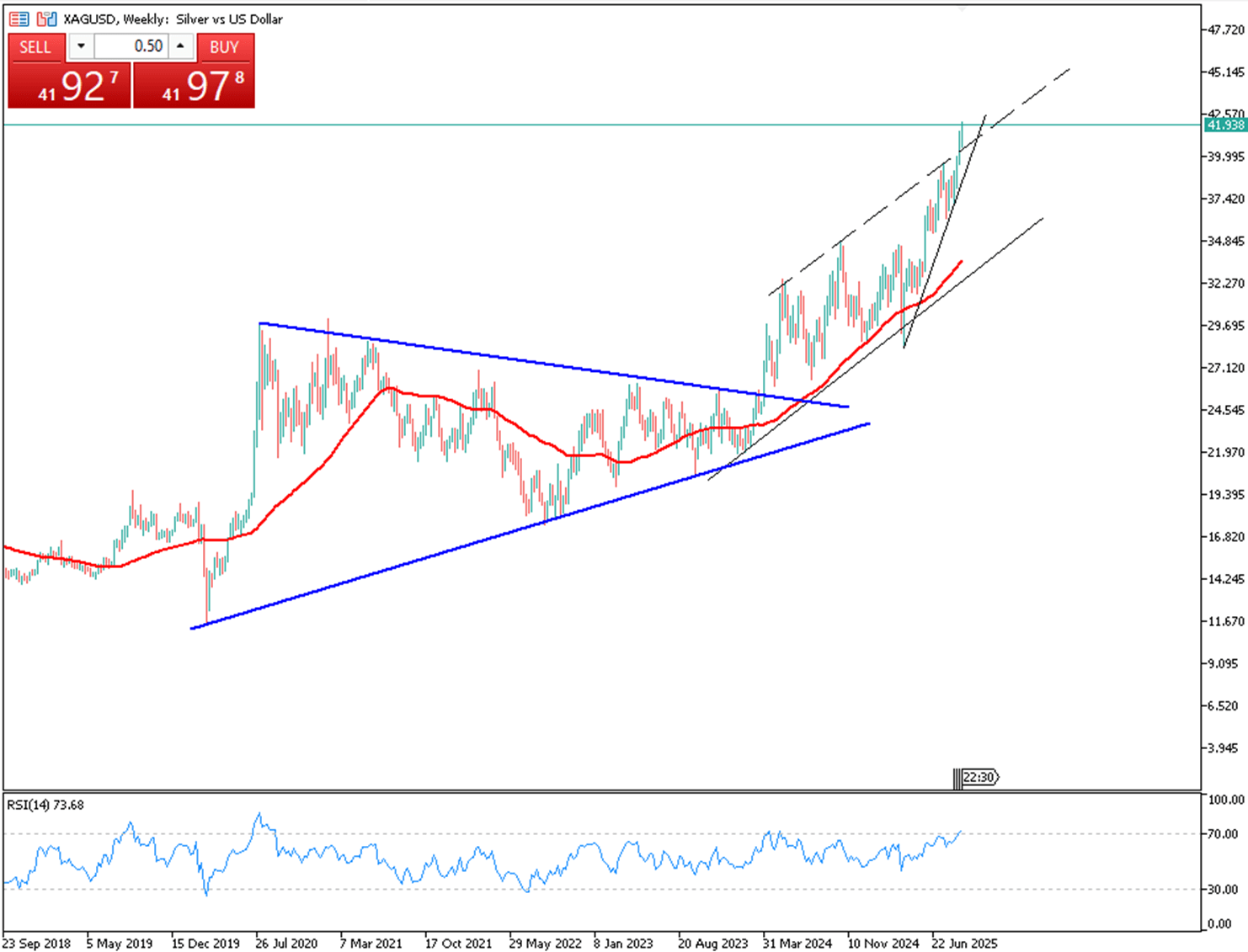

Silver climbed to $42.65, its highest in over a decade, supported by safe-haven demand, a weaker dollar, and Fed easing bets. Gold hovered around $3,670, capped by dollar strength but supported by Chinese data weakness and geopolitical risks.

| Time | Cur. | Event | Forecast | Previous |

| 06:00 | GBP | Unemployment Rate (Jul) | 4.7% | 4.7% |

| 12:30 | USD | Core Retail Sales (MoM) (Aug) | 0.4% | 0.3% |

| 12:30 | USD | Retail Sales (MoM) (Aug) | 0.2% | 0.5% |

| 12:30 | CAD | CPI (MoM) (Aug) | 0.1% | 0.3% |

| 17:00 | USD | 20-Year Bond Auction | 4.876% |

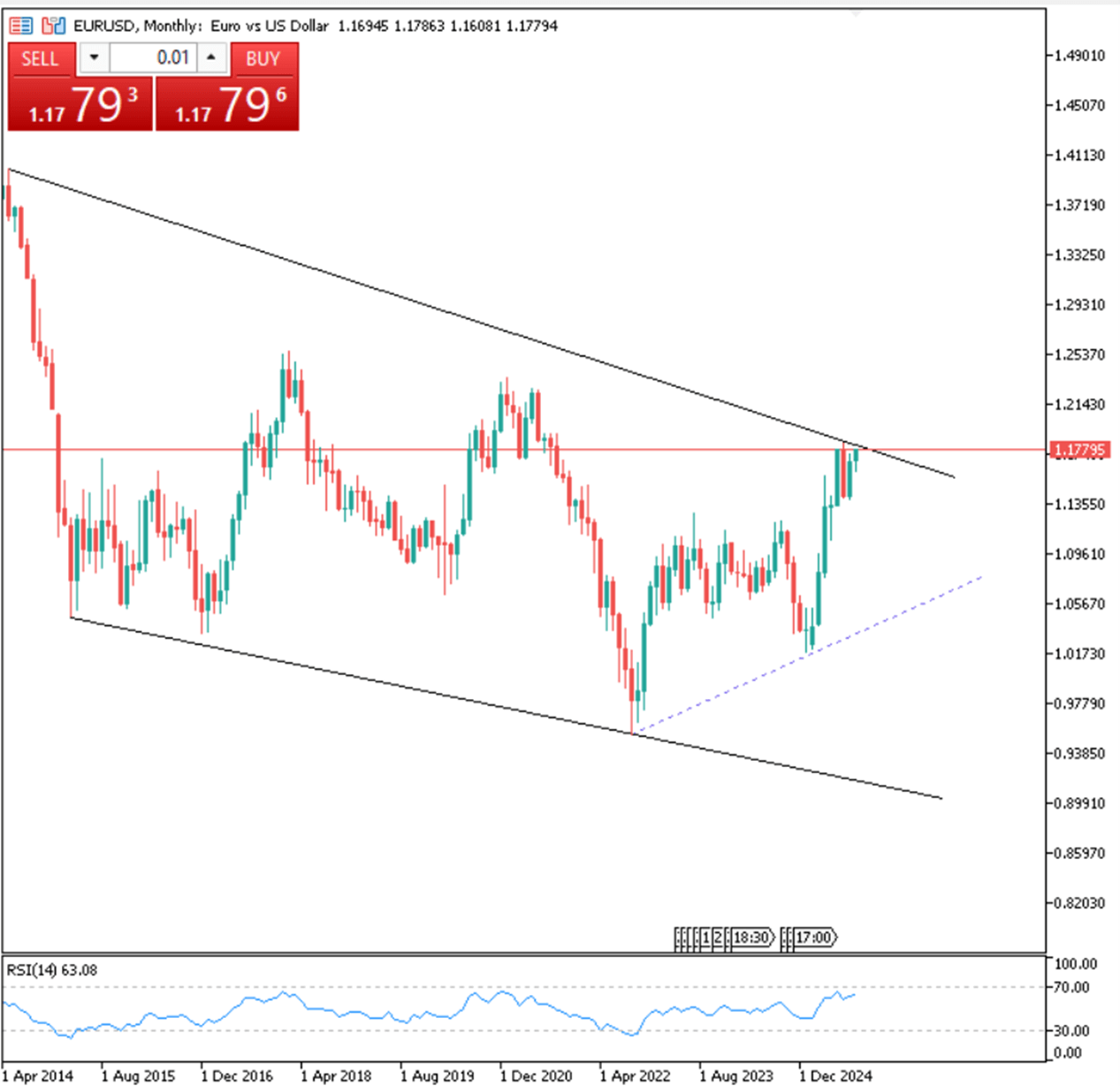

The euro held near $1.17 after Fitch cut France’s rating to A+ from AA-, citing rising debt and political risks as Prime Minister Lecornu prepares budget talks. Attention now turns to central bank meetings, with the Fed expected to cut rates by 25 bps, the BoE and BoJ likely holding steady, and the ECB signaling its easing cycle may be nearing an end.

Resistance is at 1.1790, with key support at 1.1720.

| R1: 1.1790 | S1: 1.1720 |

| R2: 1.1830 | S2: 1.1670 |

| R3: 1.1880 | S3: 1.1600 |

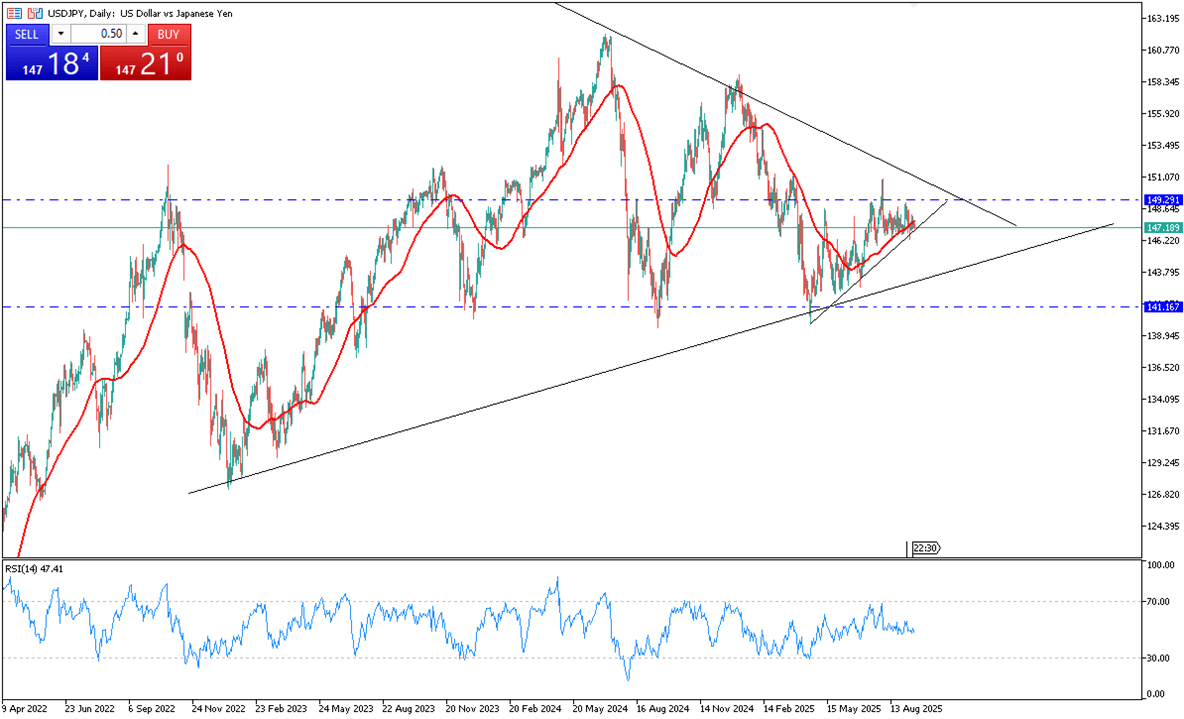

The yen climbed toward 147 per dollar Tuesday, extending gains as the U.S. dollar weakened ahead of the Fed’s expected 25 bps cut. Markets see about 67 bps of easing by year-end on labor and inflation concerns. The BoJ is set to hold its 0.5% rate while monitoring U.S. tariffs and soft domestic data, with core inflation forecast to slip to 2.7%.

For USD/JPY, the nearest resistance is at 148.50, while the immediate support is at 146.70.

| R1: 148.50 | S1: 146.70 |

| R2: 150.90 | S2: 145.80 |

| R3: 154.50 | S3: 144.00 |

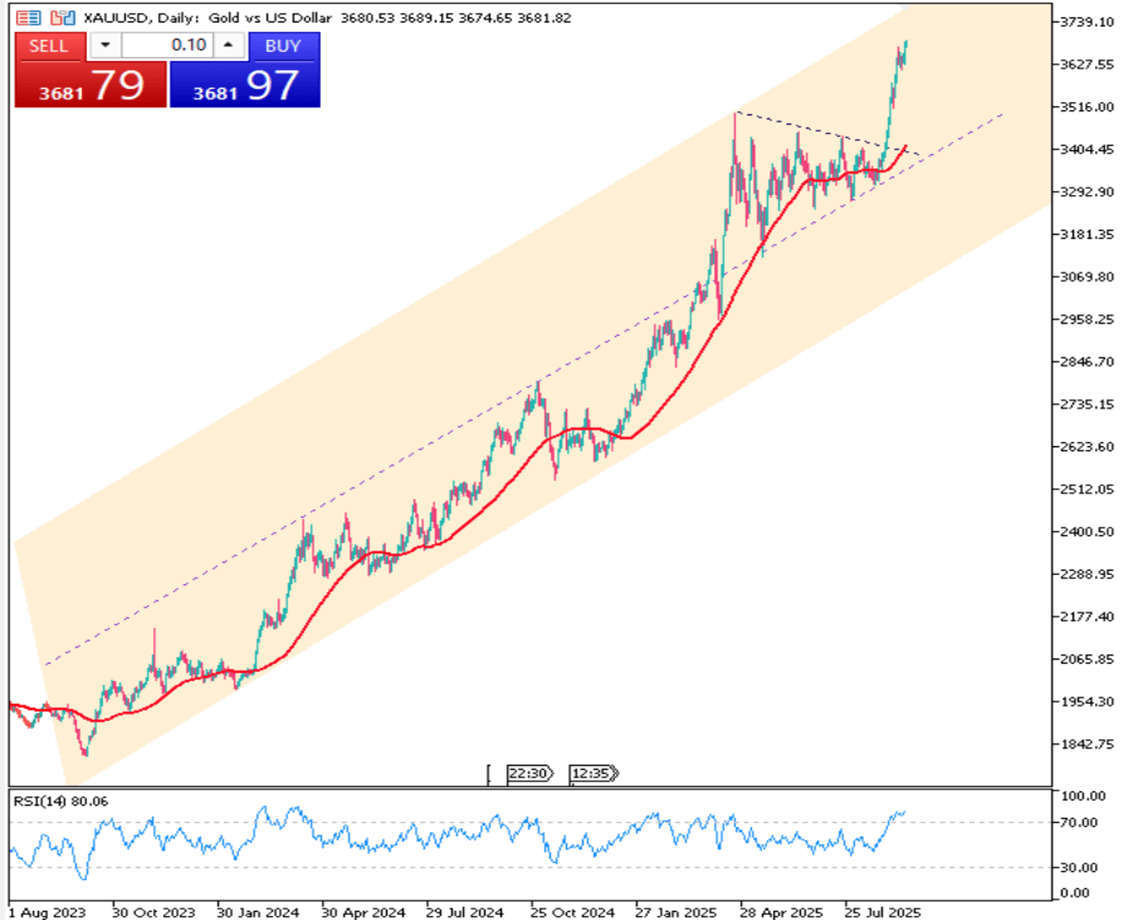

Gold held near $3,680 on Tuesday, close to record highs, as markets awaited the Fed’s two-day meeting. A 25 bps cut is widely expected, with speculation that the easing cycle could extend into 2026. Traders focus on Powell’s remarks, updated forecasts, and the dot plot for guidance, while U.S. retail sales and industrial output data will also shape the outlook.

Gold is currently facing resistance around $3,700, with strong support near $3,650.

| R1: 3700 | S1: 3650 |

| R2: 3730 | S2: 3600 |

| R3: 3760 | S3: 3550 |

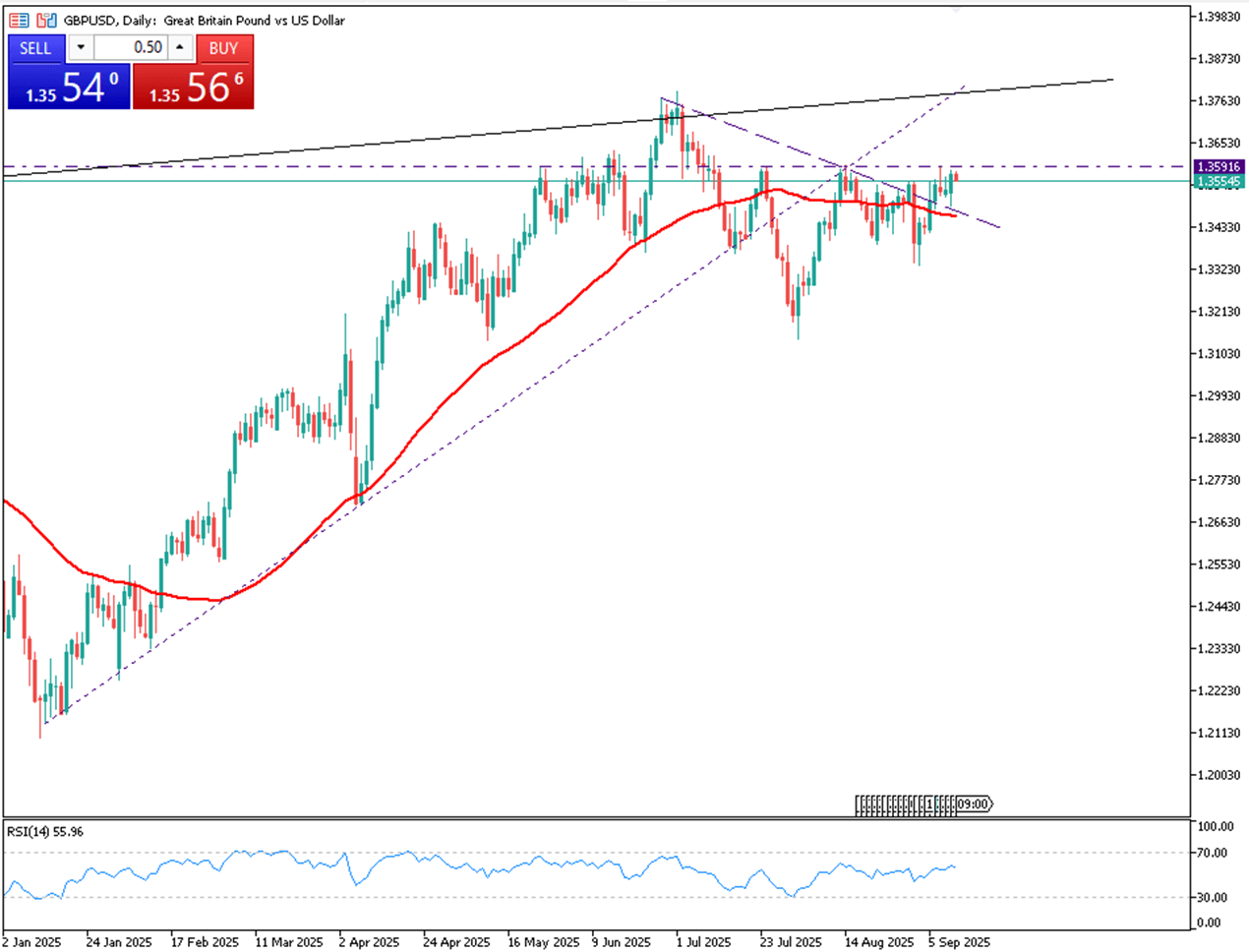

The British pound climbed above $1.360 on Tuesday, nearing a 10-week high ahead of central bank meetings and key UK data. The BoE is expected to hold rates at 4% on Thursday while slowing its £100 billion bond unwind. UK inflation for August is seen at 3.8%, with jobs and retail sales also due this week. Markets assign a one-in-three chance of a rate cut by December. Meanwhile, the Fed is widely expected to cut rates by 25 bps on Wednesday, with at least two more cuts priced in by year-end.

The first resistance is seen at 1.3680, with nearby support beginning at 1.3570.

| R1: 1.3680 | S1: 1.3570 |

| R2: 1.3730 | S2: 1.3500 |

| R3: 1.3780 | S3: 1.3450 |

Silver consolidated just above $42 in Tuesday’s Asian session, holding near its highest since September 2011. The four-week rally has paused as traders await the Fed’s policy decision, with stretched RSI signaling limited room for fresh gains and the risk of sideways trade or a mild pullback.

The first resistance is at $43.00 and the support is at $41.50.

| R1: 43.00 | S1: 41.50 |

| R2: 43.70 | S2: 40.60 |

| R3: 44.40 | S3: 39.20 |

Oil Tanker Attacks Create Volatility

Oil Tanker Attacks Create VolatilityRecent strikes on oil tankers in the Persian Gulf have exposed the extreme vulnerability of global energy supplies. Footage of burning vessels near the Iraqi coastline has saturated financial media, serving as a reminder to market participants of the risks inherent in the region. Whenever tensions escalate in this region, energy traders immediately begin pricing in the possibility of supply disruptions.

Detail Dollar Leads as Markets Reprice Risk (03.12.2026)Currency markets remained under pressure as energy-driven inflation concerns and ongoing geopolitical tensions continued to support the U.S. dollar.

Global markets remained cautious as investors weighed the economic impact of the ongoing Middle East conflict and volatile energy prices.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!