The dollar starts the week weakening against all major currencies.

Global markets are shaped by concerns over escalating tensions between Russia and Ukraine and uncertainties surrounding the US Federal Reserve's (Fed) monetary policy. Meanwhile, attention is turning to the US growth data set to be released next week.

Adding to the ongoing political tensions, potential conflicts between newly elected US President Donald Trump and the Fed's leadership are contributing to market volatility. Signals from the minutes of the Federal Open Market Committee (FOMC) meeting held on November 6-7, scheduled for release on Tuesday, are expected to provide insights into the Fed's future projections.

| Time | Cur. | Event | Forecast | Previous |

| 18:30 | EUR | ECB’s Lane Speaks | - | - |

| 21:00 | USD | 2- Year Note Action | - | 4.130% |

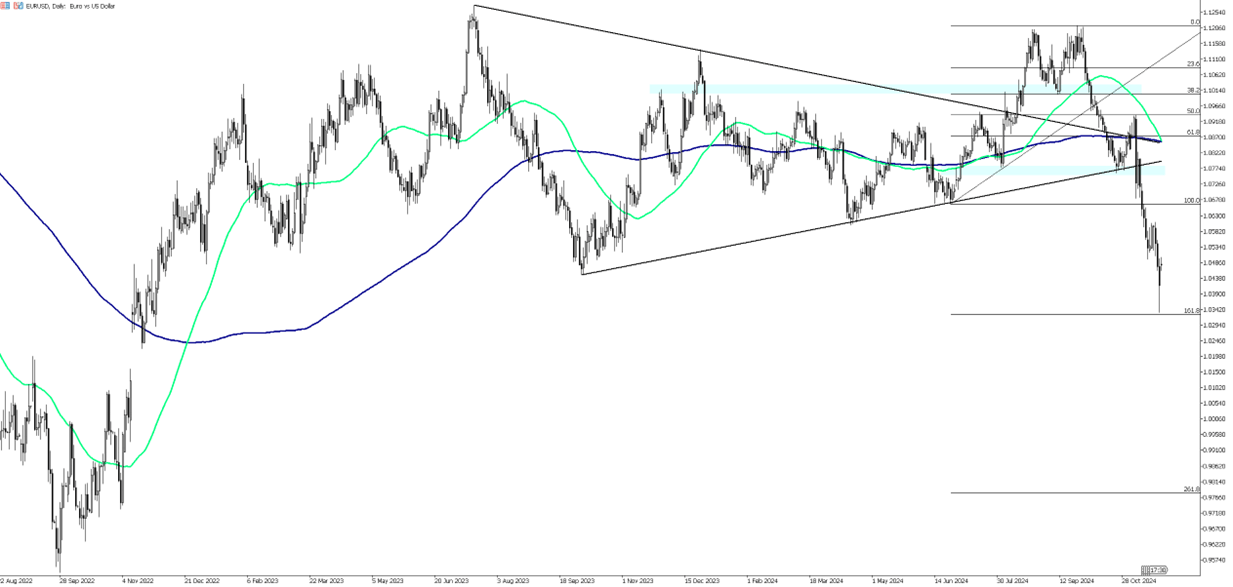

The EUR/USD pair started the week on a positive note, testing the 1.0500 resistance level. The dollar index fell 0.6% on Monday, dipping below 107 and retreating from its recent two-year highs after President-elect Donald Trump selected hedge fund manager Scott Bessent as Treasury Secretary. This announcement reassured investors, as Bessent is expected to focus on economic and market stability despite his support for Trump’s tariff and tax cut plans.

The dollar weakened against all major currencies, with the euro, British pound, Australian dollar, and Japanese yen posting significant gains. Market attention now shifts to the release of the latest FOMC meeting minutes, PCE inflation data, and other key economic indicators, which could shape expectations for future Fed rate decisions. Last week, the dollar surged to a two-year high amid speculation that Trump’s policies could drive inflation, potentially limiting the Fed's ability to lower interest rates.

Support levels for EUR/USD are at 1.0450, with further levels at 1.0400 and 1.0360. On the upside, resistance is at 1.0520, followed by 1.0610 and 1.0640.

| R1: 1.0520 | S1: 1.0450 |

| R2: 1.0610 | S2: 1.0400 |

| R3: 1.0640 | S3: 1.0360 |

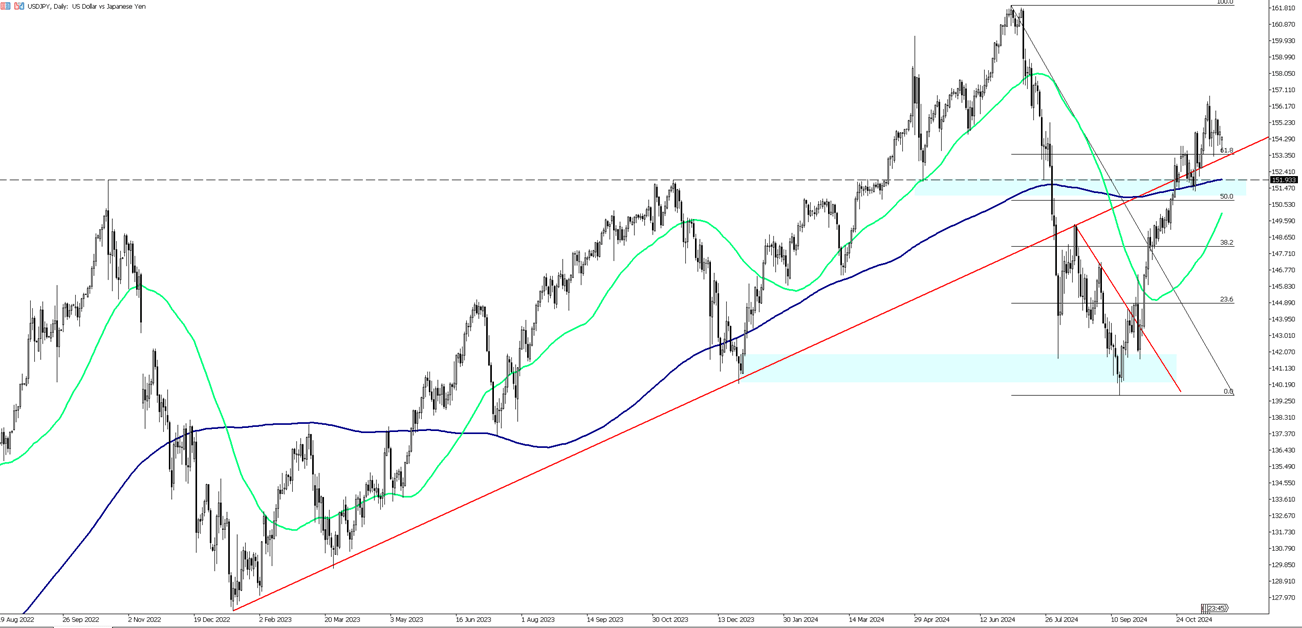

The Japanese yen rose 0.7% to around 153.7 per dollar on Monday, recovering from last week’s losses as the US dollar weakened after President-elect Donald Trump nominated Scott Bessent as Treasury Secretary. Speculation that Bessent will prioritize economic and market stability led traders to unwind “Trump trade” positions. Domestically, the focus is on Tokyo’s upcoming inflation data, a key indicator for nationwide trends, while mixed economic reports last week left Japan's monetary policy outlook unclear.

Bank of Japan Governor Kazuo Ueda hinted at a potential interest rate hike in December, citing concerns over the yen's recent depreciation. Meanwhile, Prime Minister Shigeru Ishiba’s government is reportedly preparing a $90 billion stimulus package to support households facing rising living costs.

For USD/JPY, resistance levels are at 156.10, 157.50, and 158, while support is at 153.60, followed by 152.50 and 151.80.

| R1: 156.10 | S1: 153.60 |

| R2: 157.50 | S2: 152.50 |

| R3: 158.00 | S3: 151.80 |

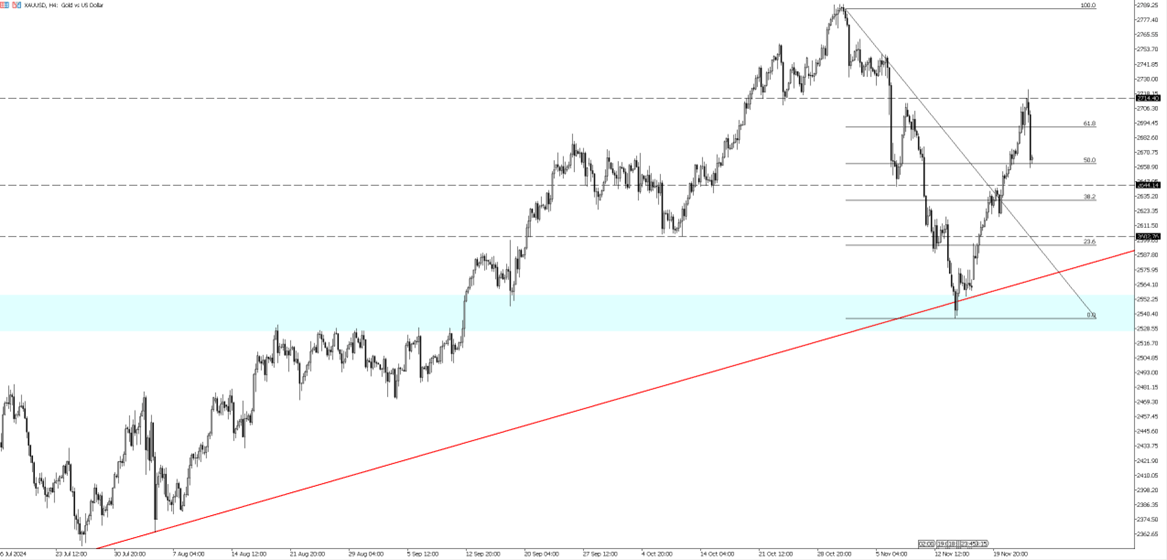

Gold fell below $2,700 per ounce on Monday, likely due to a technical correction after last week’s 6% rally driven by safe-haven demand amid escalating Russia-Ukraine tensions. Russian President Vladimir Putin hinted at deploying a new missile following retaliatory strikes against Ukraine for its use of US- and UK-supplied weapons.

Gold also drew support from a weaker dollar after President-elect Donald Trump nominated Scott Bessent as Treasury Secretary, signaling a cautious stance on tariffs and easing fears of aggressive trade policies. Investors are now focusing on the Federal Reserve’s November meeting minutes, PCE inflation data, and other key US economic reports for clues on future interest rate moves.

For XAU/USD, resistance levels are at 2,692, 2,720, and 2,750, while support levels are at 2,660, 2,630, and 2,590.

| R1: 2692 | S1: 2660 |

| R2: 2720 | S2: 2630 |

| R3: 2750 | S3: 2590 |

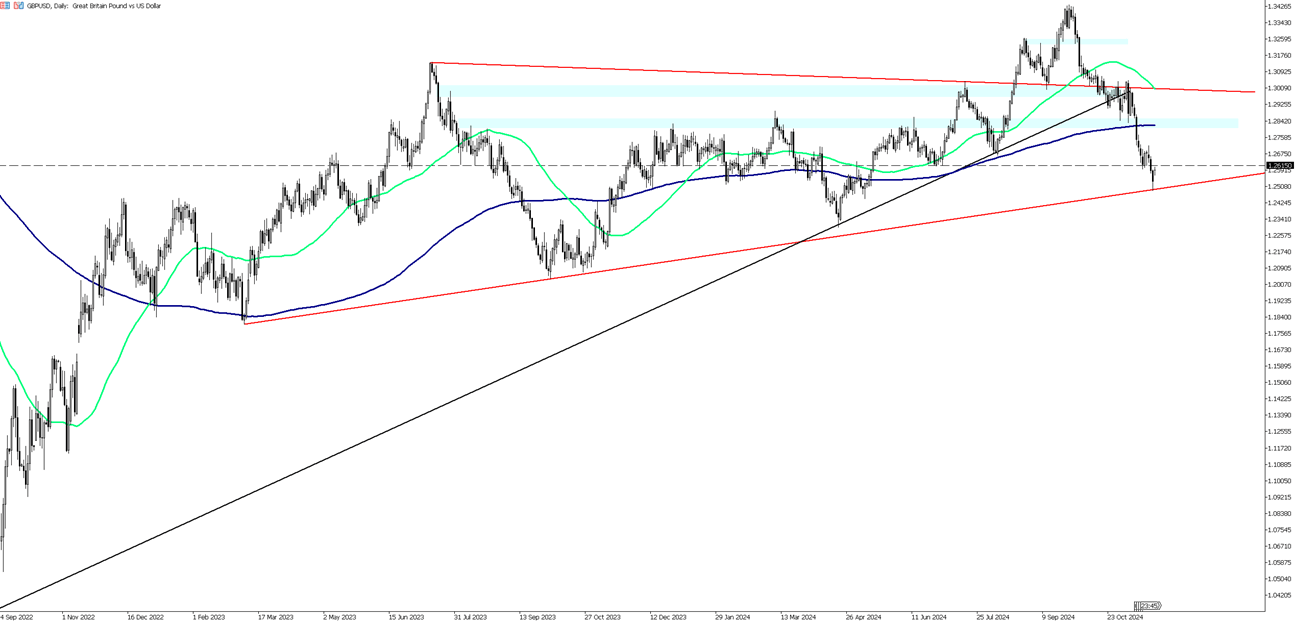

The GBP/USD pair opened the week with a bullish gap, rebounding from a three-day decline that had pushed it below 1.2500 to its lowest level since May. During the Asian trading session, the pair climbed to 1.2600, bolstered by a weaker US Dollar (USD).

The US Dollar Index (DXY), which measures the USD against a basket of major currencies, retreated from a two-year high as traders took profits amid a sharp decline in US Treasury bond yields. Additionally, a global risk-on rally in equity markets further weighed on the safe-haven dollar, providing additional upward momentum for the GBP/USD pair.

In the GBP/USD pair, the first resistance level is at 1.2620, followed by 1.2680 and 1.2720. On the downside, the first support level is at 1.2550, with subsequent supports at 1.2520 and 1.2475.

| R1: 1.2620 | S1: 1.2550 |

| R2: 1.2680 | S2: 1.2520 |

| R3: 1.2720 | S3: 1.2475 |

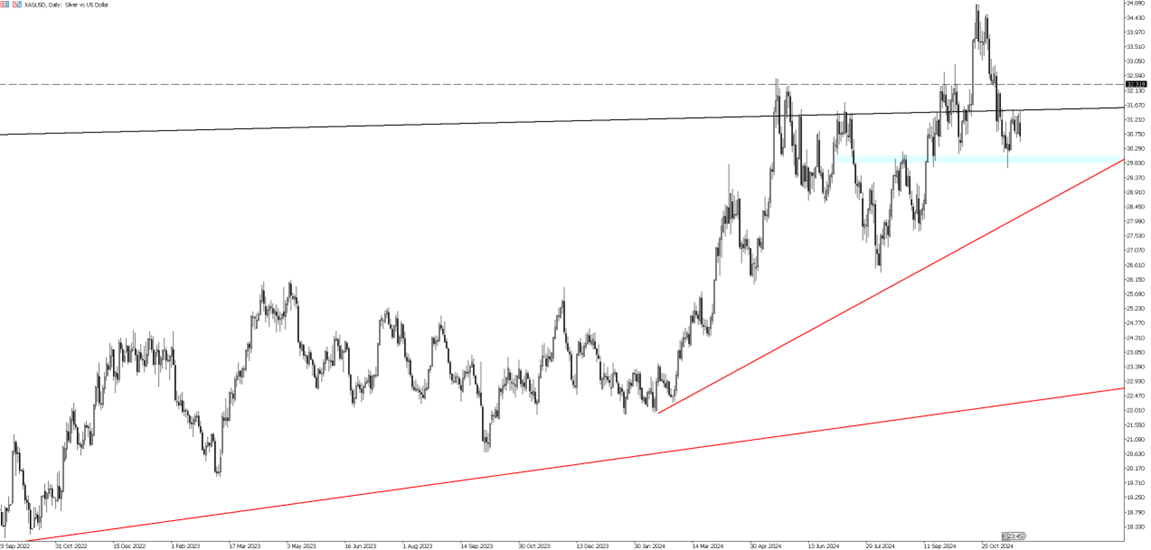

Silver (XAG/USD) pulled back to around $30.80 per ounce during the Asian session on Monday but may regain momentum as a safe-haven asset amid escalating Russia-Ukraine tensions. On Friday, Russian President Putin confirmed a hypersonic missile strike on Dnipro in retaliation for Ukraine’s attack on Russian territory with US and UK-supplied weapons, potentially supporting silver prices if tensions persist.

Silver could also benefit from a weaker US Dollar after President-elect Trump nominated Scott Bessent as Treasury Secretary, easing fears of aggressive trade policies. However, downward pressure remains due to the higher opportunity cost of holding non-yielding assets, following strong US PMI data that tempered expectations for rate cuts. The CME FedWatch Tool now shows a 50.9% probability of a quarter-point rate cut, down from 61.9% last week.

For silver, resistance levels are at 31.00, 31.55, and 32.10, while support levels are at 30.20, 29.85, and 29.30.

| R1: 31.00 | S1: 30.20 |

| R2: 31.55 | S2: 29.85 |

| R3: 32.10 | S3: 29.30 |

Global markets remain dominated by geopolitical risk as escalating conflict between the United States, Israel, and Iran fuels a strong shift toward safe-haven assets. The dollar index hit 99.3 Wednesday, rising for a third day as conflict concerns fueled inflation and shifted Fed rate cut expectations from July to September.

A US court rejected Trump's tariff refund delay as the Dollar (98.5) and 10 year yield (4.04%) held gains amid Middle East escalation and inflation fears.

After Khamenei: Who Will Lead Iran Next?

After Khamenei: Who Will Lead Iran Next?Following the death of Supreme Leader Ali Khamenei, Iran has entered a pivotal transition phase. Senior officials in Tehran are acting swiftly to uphold the existing structure of the Islamic Republic, prioritizing continuity to head off potential internal instability. Despite these efforts, the sudden leadership vacuum has sparked intense political and military maneuvering behind the scenes.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!