The dollar index stayed under pressure on Tuesday as fears of softer foreign demand for US assets, reports of Chinese banks cutting Treasury holdings, expectations of delayed US jobs and inflation data, and a firmer yen on intervention talk weighed on the greenback.

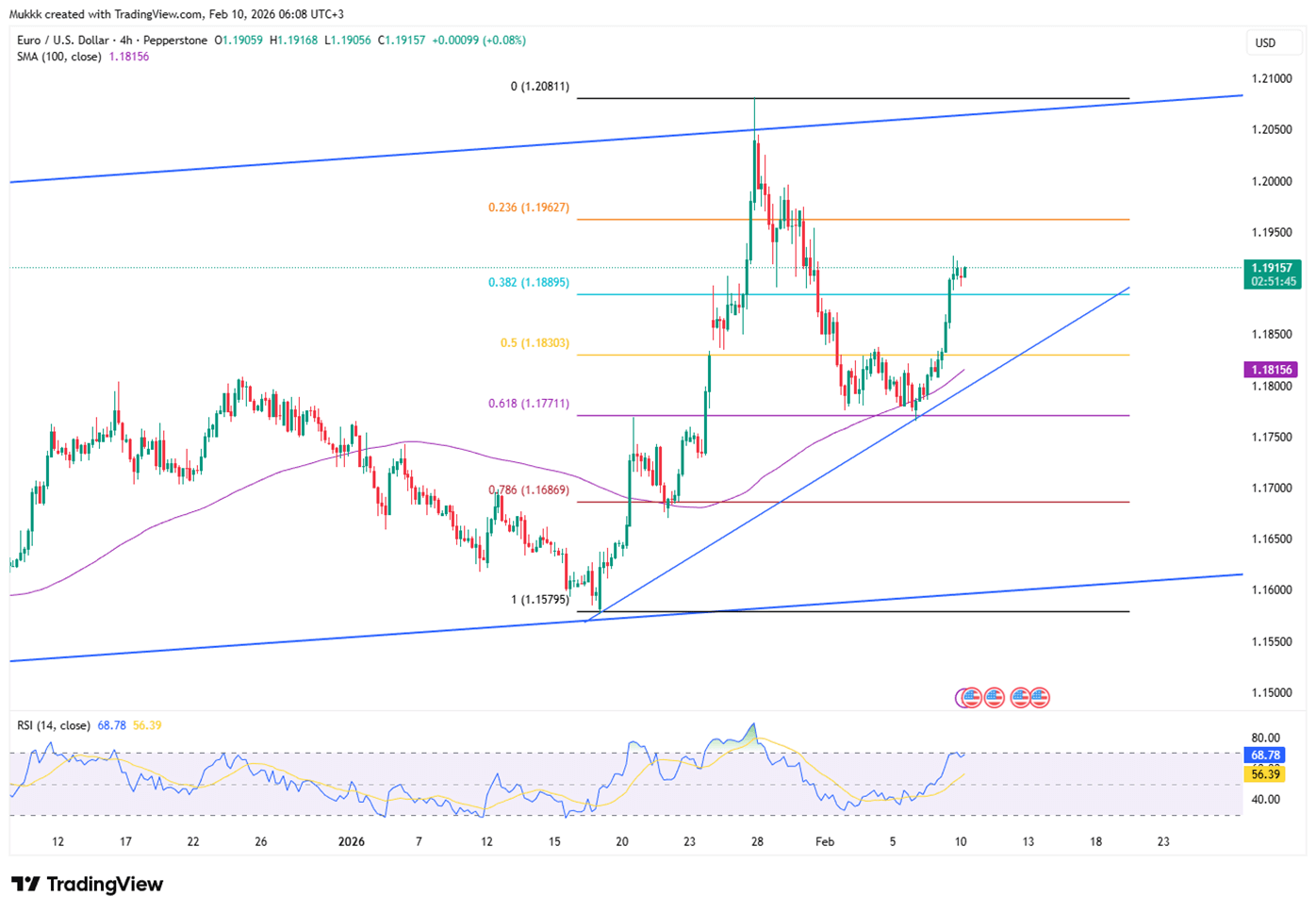

The euro extended gains early this week, breaking above the $1.19 mark against the US dollar as global currency dynamics shifted. The move comes amid renewed dollar weakness, particularly against the yen, following Japan’s political developments. Meanwhile, the European Central Bank maintains a steady stance, expressing confidence in reaching its inflation target. Traders are now turning attention to upcoming U.S. employment and inflation figures, which may shape expectations for future Fed decisions.

| Time | Cur. | Event | Forecast | Previous |

| 0.4% | 0.6% | |||

| Core Retail Sales (MoM) (Dec) | 0.4% | 0.5% |

The EUR/USD pair strengthened early this week, climbing past $1.19 on Tuesday. This rally persists as the US dollar faces pressure from a stronger yen following Japan’s recent elections. Despite the euro's rise, the European Central Bank remains unconcerned. Officials kept rates steady, noting that inflation is on track to meet the 2% target. President Christine Lagarde described recent price trends as encouraging, though she advised caution regarding future data. Markets now await upcoming US employment and inflation reports, which could further influence the dollar's direction.

For EUR/USD, the closest resistance level is at 1.1940, while the initial support is located at 1.1880.

| R1: 1.1940 | S1: 1.1880 |

| R2: 1.1970 | S2: 1.1840 |

| R3: 1.2000 | S3: 1.1780 |

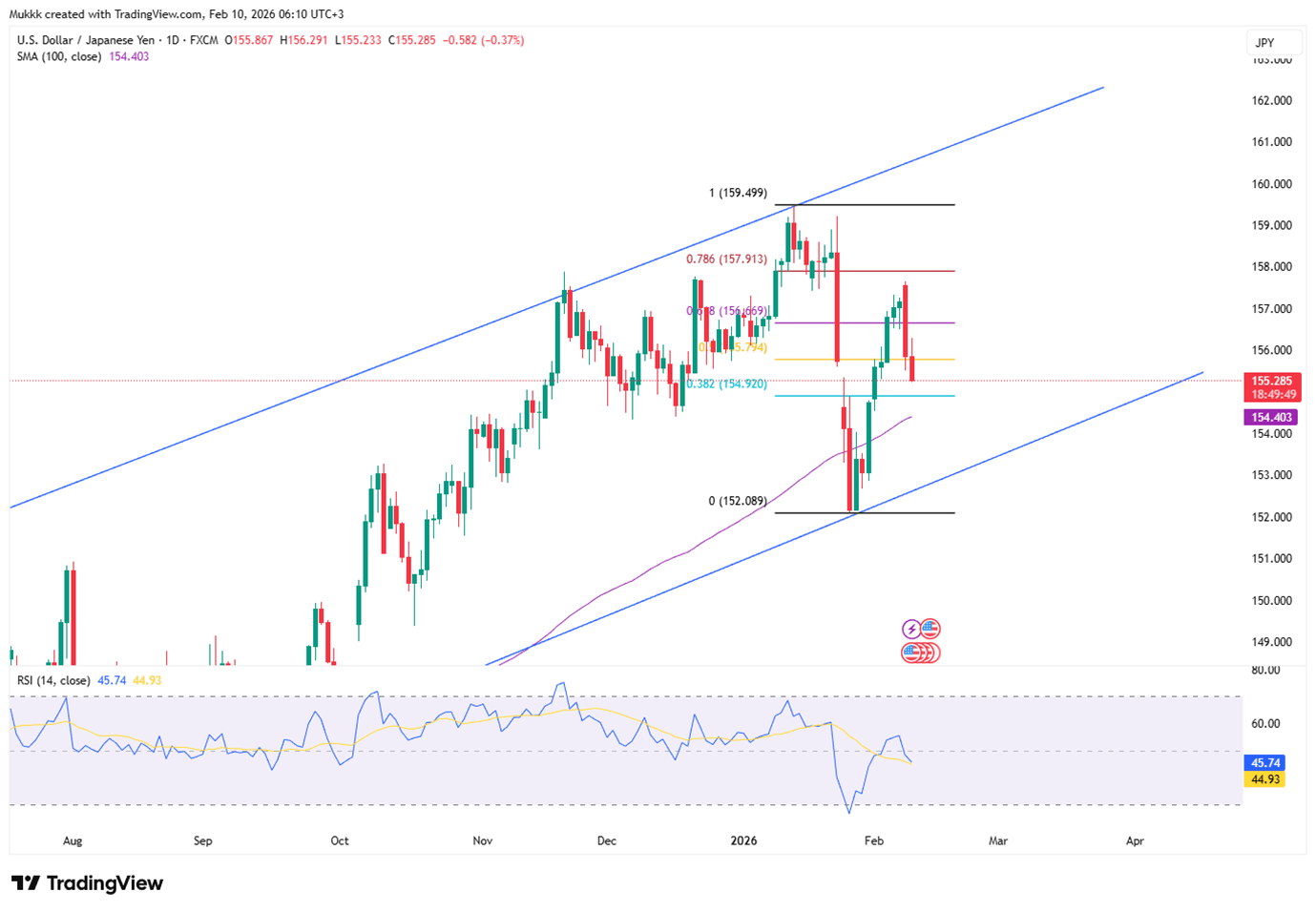

The Japanese yen stayed near 155.7 per dollar on Tuesday. It held onto recent gains after officials offered verbal support for the currency following Prime Minister Sanae Takaichi’s decisive election win. Investors were reassured by her promise that new stimulus measures would not compromise fiscal stability. With a strong majority, the ruling party plans to increase spending and introduce tax relief, such as a temporary food sales tax cut. Additionally, record-breaking performance in Japanese stocks has attracted capital inflows, further supporting the yen despite a selloff in domestic bonds.

Technically, resistance stands near 156.00, while support is firm at 154.50.

| R1: 156.00 | S1: 154.50 |

| R2: 156.80 | S2: 153.80 |

| R3: 157.60 | S3: 153.00 |

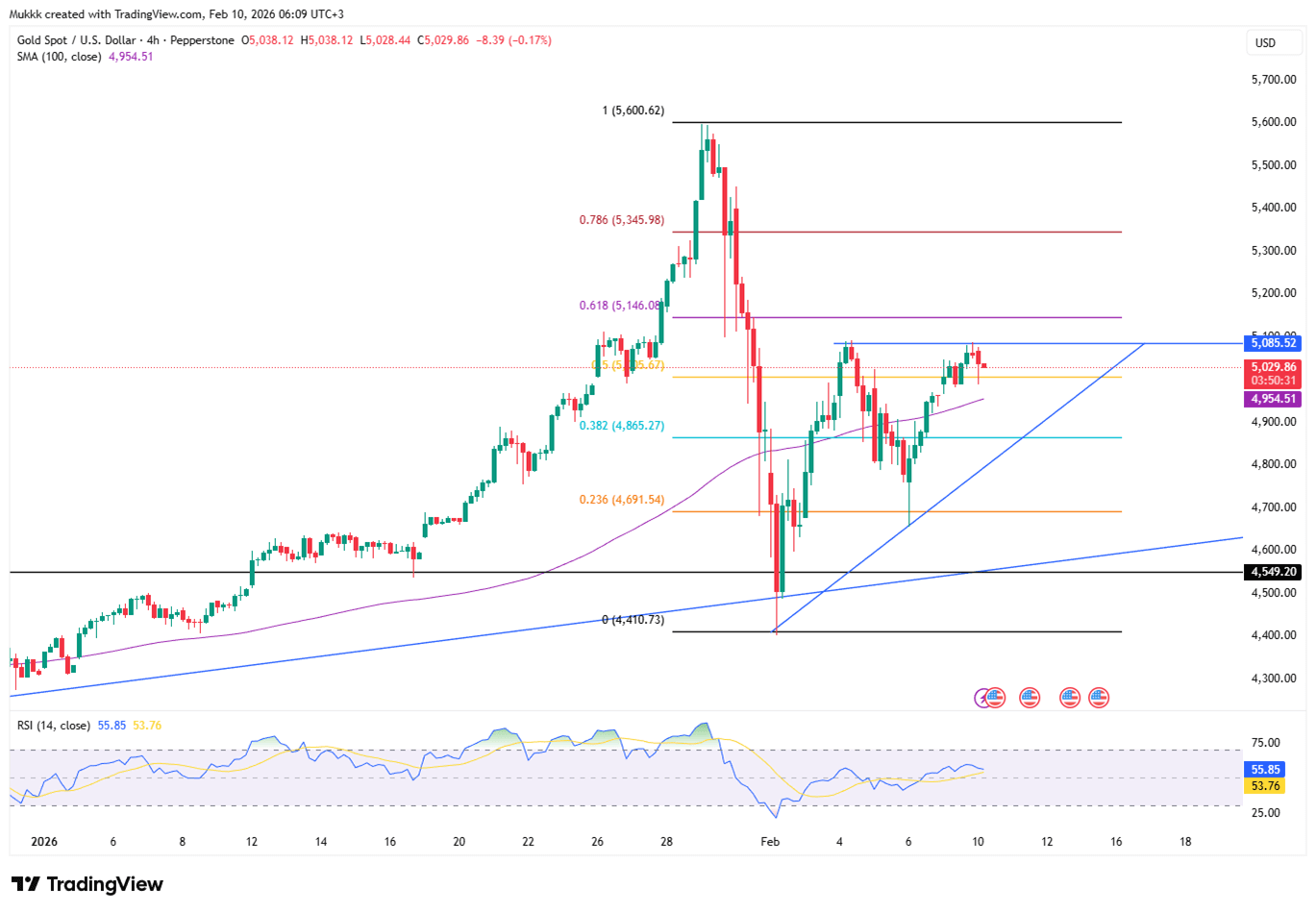

Gold slipped slightly below $5,050 on Tuesday. Despite this minor dip, the metal remains near its highest levels in a week as investors await crucial U.S. economic data. The upcoming non-farm payrolls and inflation reports will likely dictate the Federal Reserve's next moves, especially after White House hints of a potential hiring slowdown. Support for gold remains solid, with markets pricing in at least two rate cuts this year. Furthermore, steady central bank purchases from China and ongoing frictions between the U.S. and Iran continue to drive safe-haven demand.

Gold sees support near $4960, while resistance is around $5095.

| R1: 5095 | S1: 4960 |

| R2: 5150 | S2: 4825 |

| R3: 5240 | S3: 4700 |

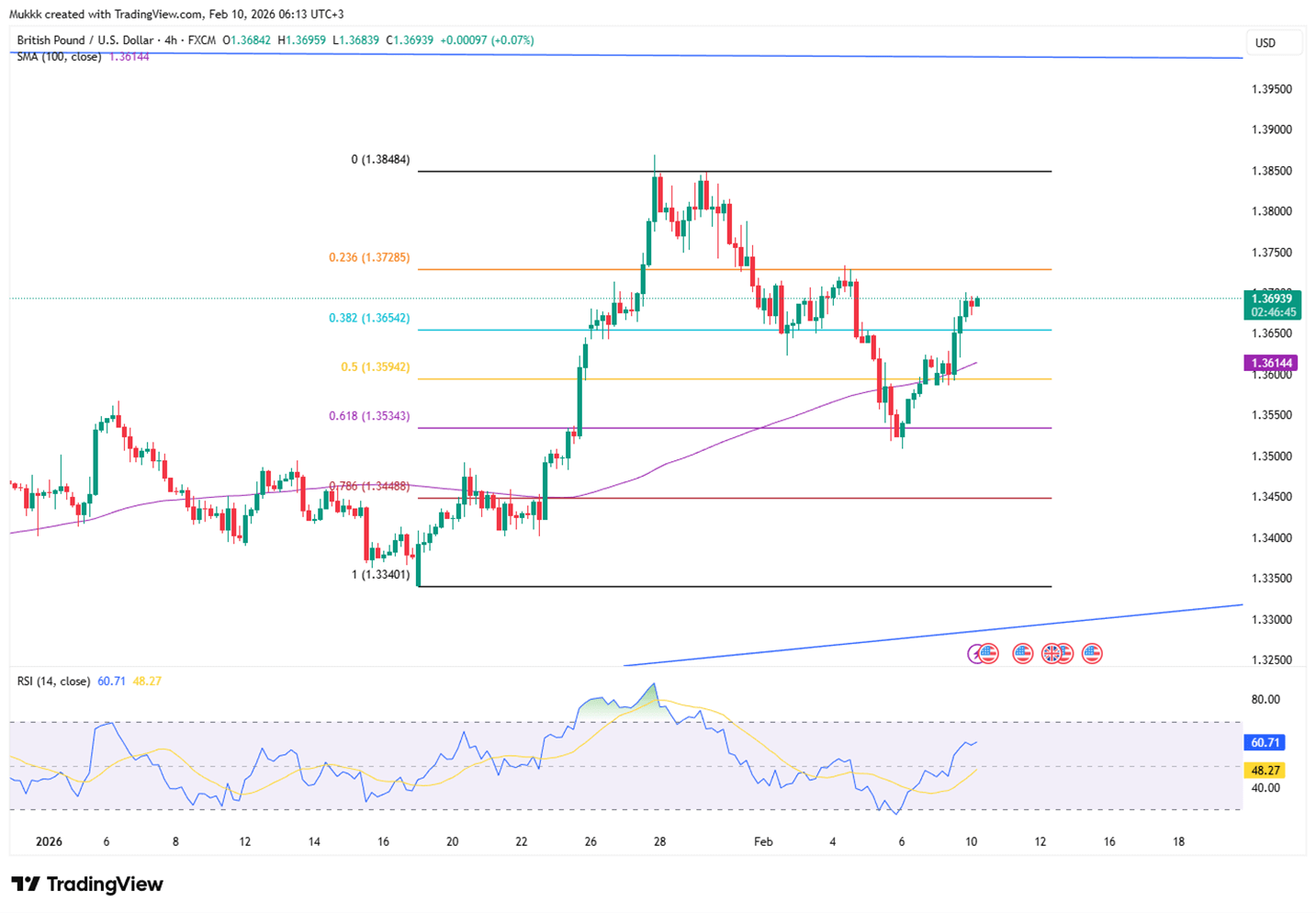

The British pound remained near $1.36 on Tuesday, staying under the four-year highs reached in January. Growing political instability is weighing on the currency. Prime Minister Keir Starmer is facing internal pressure following the exit of his chief of staff and a disputed diplomatic appointment. Meanwhile, the Bank of England's cautious tone has led markets to price in more potential rate cuts. Since inflation is still projected to hit targets by April, there is little momentum to drive sterling significantly higher.

From a technical view, support stands near 1.3650, with resistance around 1.3720.

| R1: 1.3720 | S1: 1.3650 |

| R2: 1.3780 | S2: 1.3600 |

| R3: 1.3820 | S3: 1.3560 |

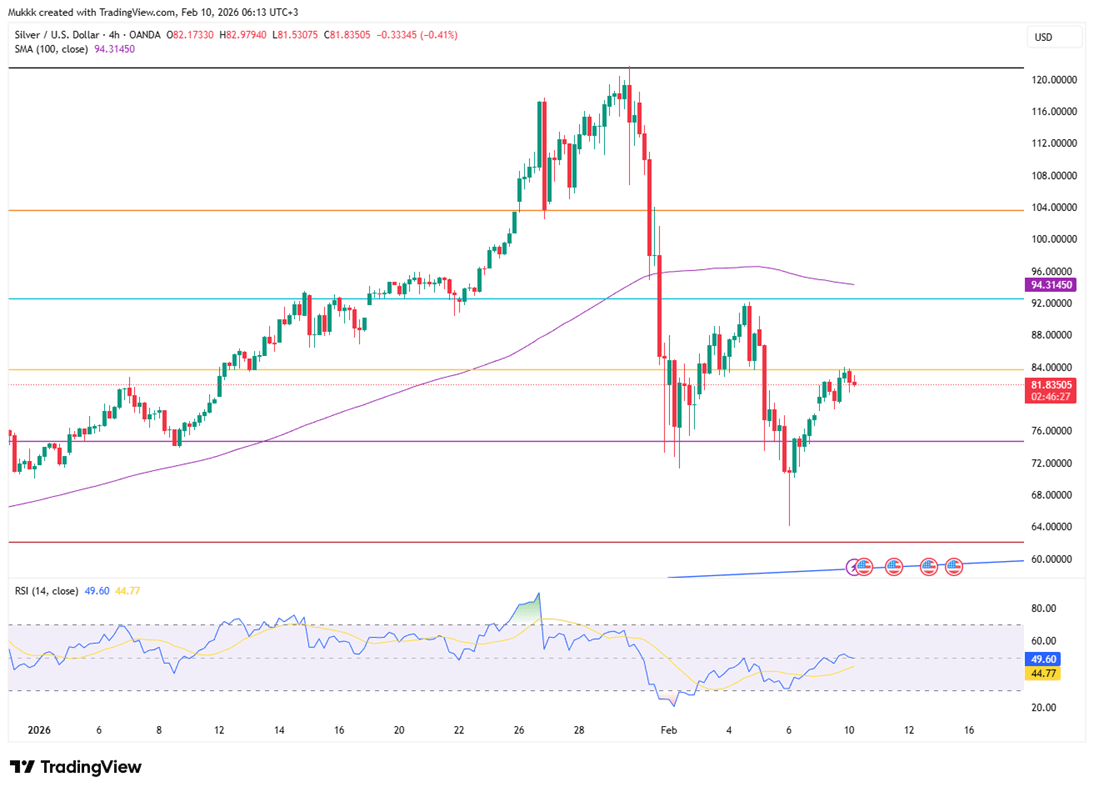

Silver prices fell nearly 2% to under $82 an ounce on Tuesday, ending a brief two-day recovery. The metal remains significantly lower than its record peak in late January, following a massive selloff that wiped out nearly half its value. US Treasury Secretary Scott Bessent attributed the extreme volatility to speculative "unruly" trading, particularly among Chinese investors. Market attention has now turned to this week’s delayed US employment and inflation data. These reports will be vital in determining the Federal Reserve’s next steps, with two interest rate cuts still anticipated later this year.

From a technical view, resistance stands near $83.70 while support is located around $78.70.

| R1: 83.70 | S1: 78.70 |

| R2: 87.60 | S2: 76.10 |

| R3: 90.00 | S3: 73.80 |

Global markets remain dominated by geopolitical risk as escalating conflict between the United States, Israel, and Iran fuels a strong shift toward safe-haven assets. The dollar index hit 99.3 Wednesday, rising for a third day as conflict concerns fueled inflation and shifted Fed rate cut expectations from July to September.

A US court rejected Trump's tariff refund delay as the Dollar (98.5) and 10 year yield (4.04%) held gains amid Middle East escalation and inflation fears.

After Khamenei: Who Will Lead Iran Next?

After Khamenei: Who Will Lead Iran Next?Following the death of Supreme Leader Ali Khamenei, Iran has entered a pivotal transition phase. Senior officials in Tehran are acting swiftly to uphold the existing structure of the Islamic Republic, prioritizing continuity to head off potential internal instability. Despite these efforts, the sudden leadership vacuum has sparked intense political and military maneuvering behind the scenes.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!