Markets kicked off the week on cautious footing as investors await key U.S.–China trade negotiations in London. The dollar held firm after a solid U.S. jobs report, while the euro and yen reacted to central bank commentary and revised data.

Gold remained steady amid geopolitical risks, sterling gained on upbeat UK data and defense spending, and silver extended its rally on strong industrial demand and safe-haven flows.

| Time | Cur. | Event | Forecast | Previous |

| 01:30 | CNY | CPI (YoY) (May) | -0.1% (Act) | -0.10% |

| 09:00 | EUR | ECB's Elderson Speaks | ||

| 15:00 | USD | NY Fed 1-Year Consumer Inflation Expectations (May) | 3.60% | |

| 17:00 | USD | Atlanta Fed GDPNow (Q2) | 3.80% | 3.80% |

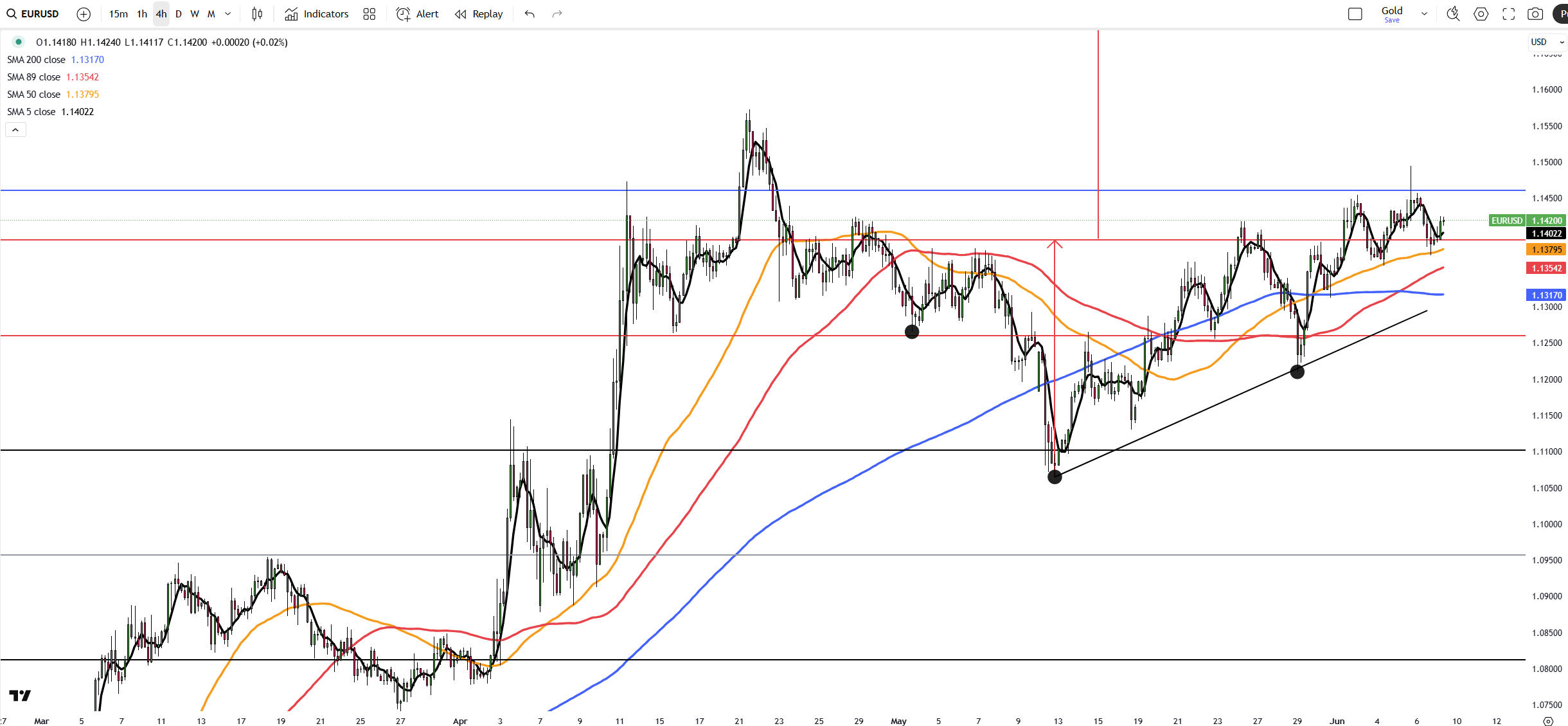

EUR/USD held near 1.1400 on Monday after slipping Friday, as strong US jobs data supported the dollar. May Nonfarm Payrolls rose by 139,000, above the 130,000 forecast but below April’s revised 147,000. Unemployment stayed at 4.2%, while wages rose 3.9%, both beating estimates.

Markets now eye US-China trade talks in London. On the euro side, ECB’s Stournaras said the eurozone achieved a soft landing, with rate cuts nearly done. Lagarde echoed that view but warned of uncertainty and US tariff risks.

The key resistance is located at 1.1460 and the first support stands at 1.1320.

| R1: 1.1460 | S1: 1.1320 |

| R2: 1.1500 | S2: 1.1260 |

| R3: 1.1580 | S3: 1.1210 |

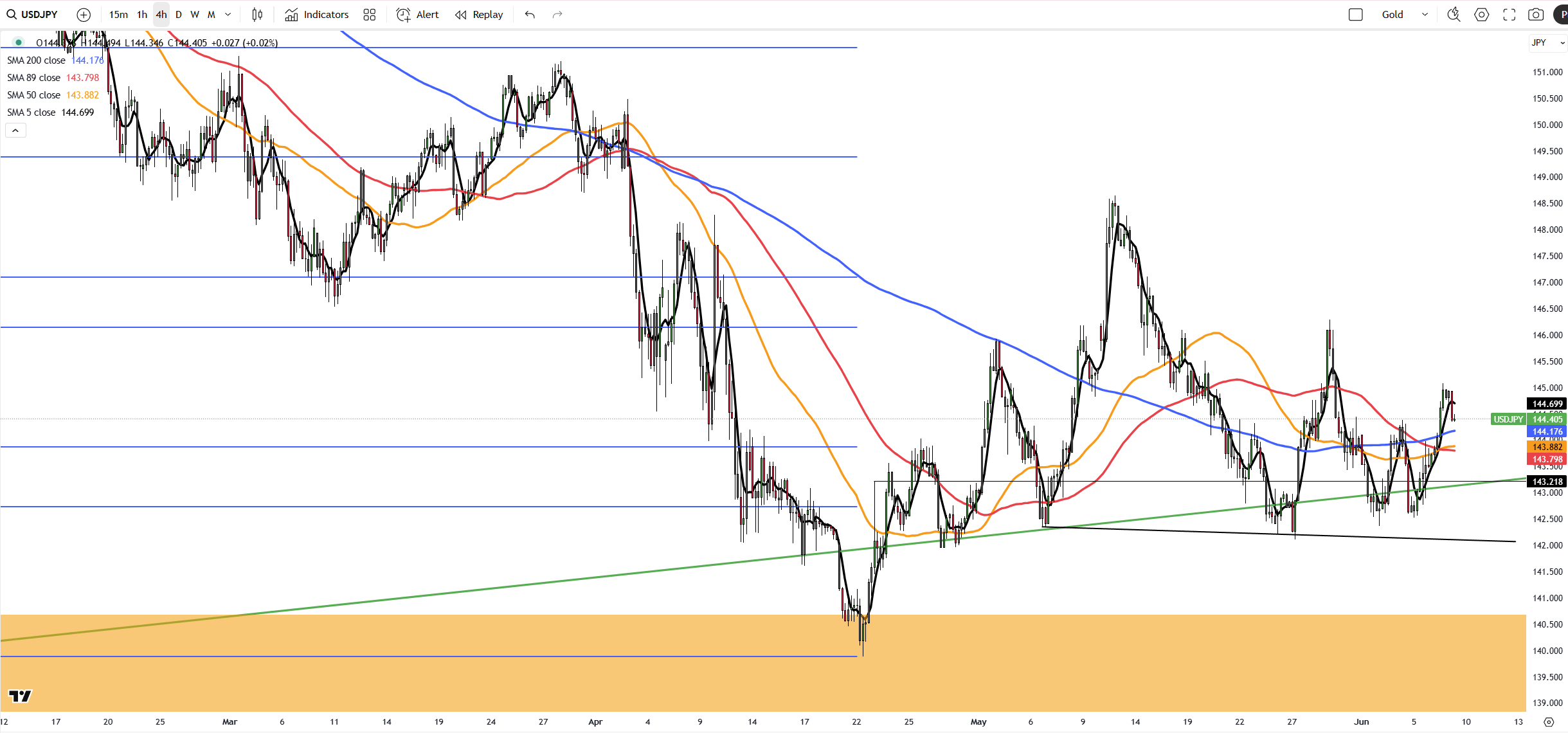

The Japanese yen rose past 144.5 per dollar on Monday, rebounding after two days of losses. Revised data showed that Q1 GDP was flat, better than the earlier -0.2% estimate but down from 0.6% growth in Q4. Japan’s April current account surplus missed expectations. BOJ Governor Ueda reiterated readiness to hike rates if forecasts hold. Markets also await US-China trade talks in London.

The key resistance is at $144.70 meanwhile the major support is located at $142.50.

| R1: 144.70 | S1: 142.50 |

| R2: 146.10 | S2: 142.10 |

| R3: 148.15 | S3: 141.50 |

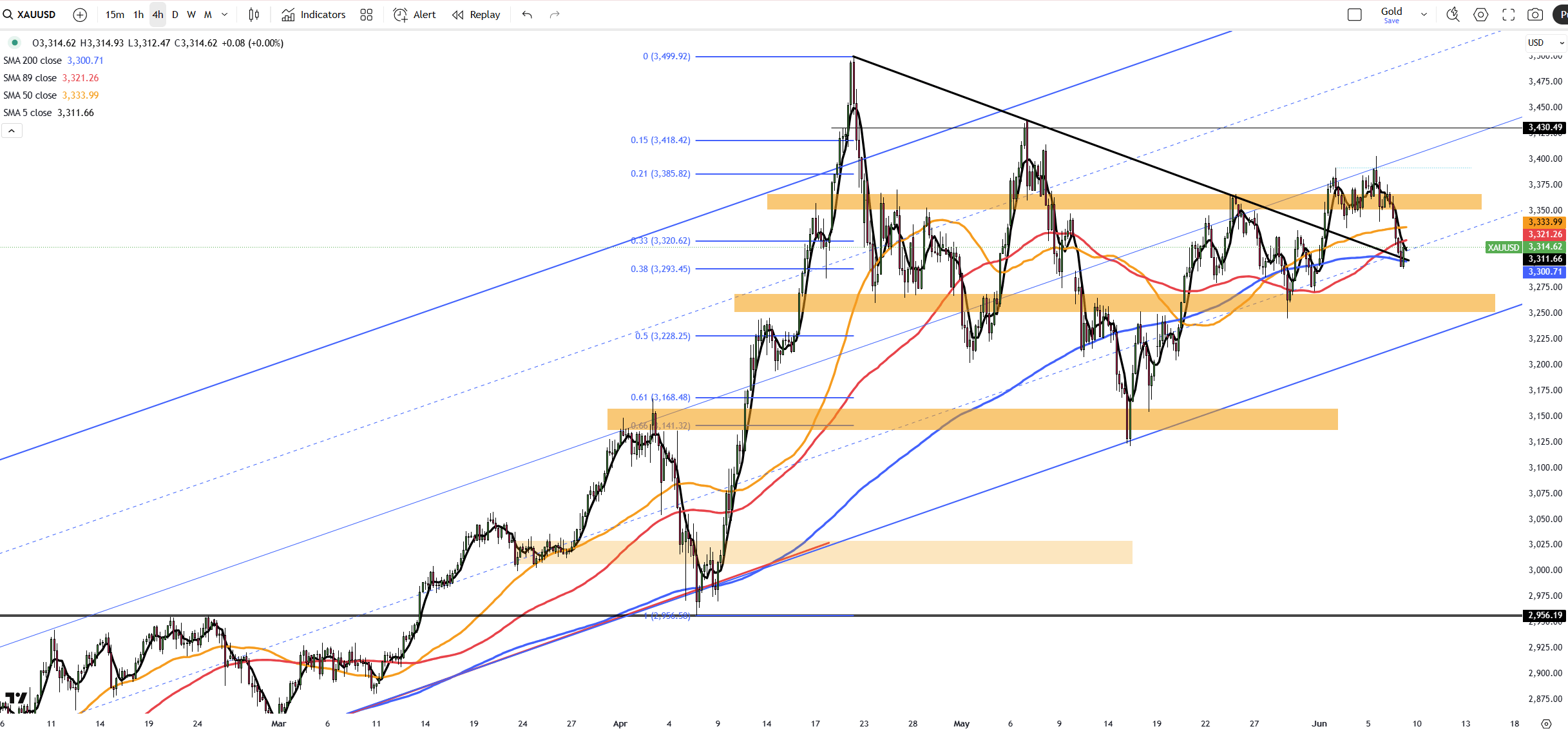

Gold held near $3,310 on Monday after a two-day drop, as markets awaited US-China trade talks in London following a call between Presidents Trump and Xi. Friday’s strong US jobs data eased recession fears and reduced chances of near-term Fed rate cuts. Meanwhile, tensions rose after Russia launched a major strike on Ukraine days after Kyiv’s attack on Russian air bases.

The first critical support for gold is seen at $3300 and the first resistance is located at $3352.

| R1: 3352 | S1: 3300 |

| R2: 3392 | S2: 3250 |

| R3: 3430 | S3: 3220 |

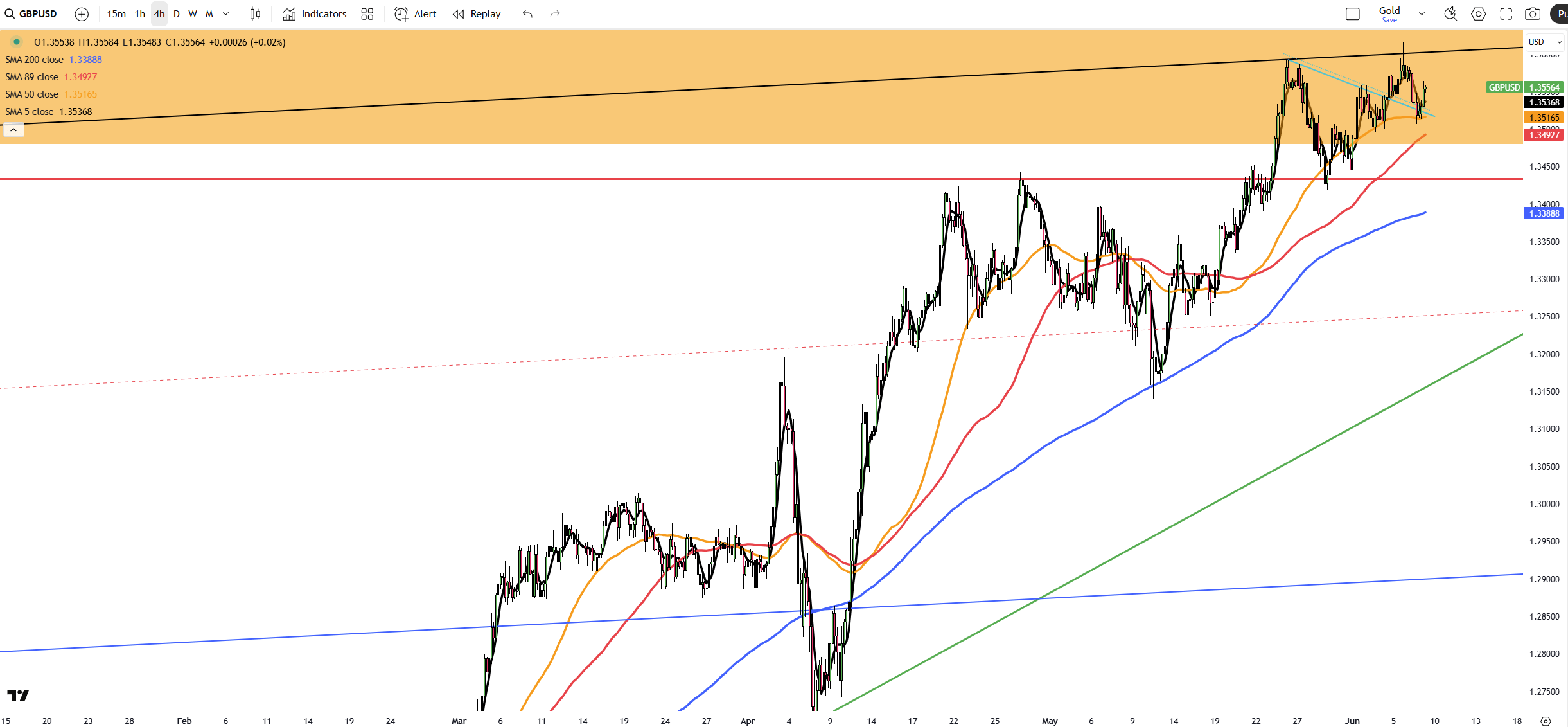

The pound climbed to $1.355, near a three-year high, supported by strong UK data and a new £15B defence plan under the AUKUS pact. UK manufacturing fell less than expected and house prices rose 3.5% in May. The dollar weakened after Trump vowed to double tariffs, while China pushed back on trade claims. Markets now see limited chances of more BoE rate cuts as the UK appears more shielded from global trade risks.

The first critical support for gold is seen at 1.3425 and the first resistance is located at 1.3600.

| R1: 1.3600 | S1: 1.3425 |

| R2: 1.3750 | S2: 1.3165 |

| R3: 1.3850 | S3: 1.2890 |

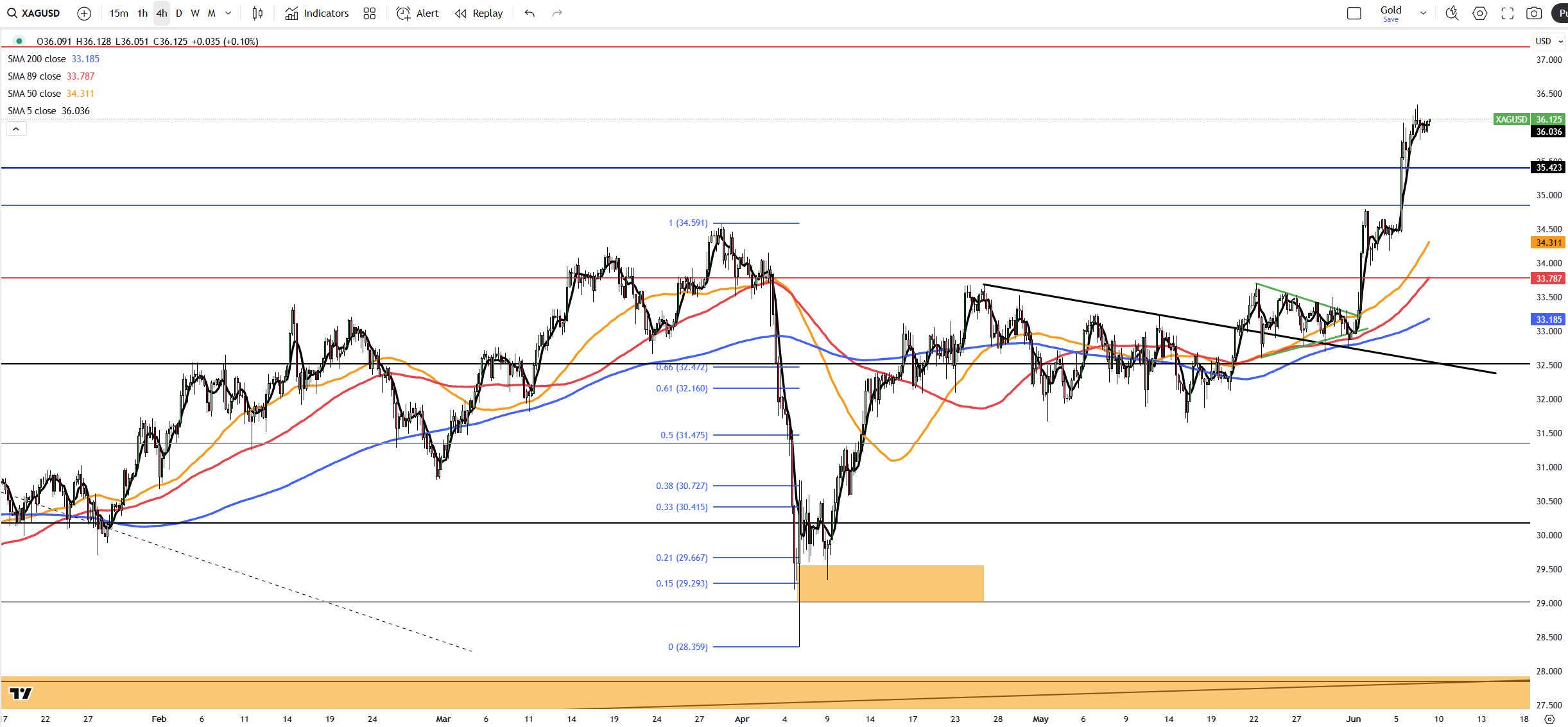

Silver topped $36 per ounce on Friday, the highest since February 2012, supported by strong demand, tight supply, and safe-haven buying. Technical momentum and silver’s key role in solar and electronics supported the rally. The market faces a fifth year of deficits, though the Silver Institute sees a 21% narrowing in 2025. Weaker US data raised Fed rate cut expectations, despite May payrolls beating forecasts with a 139,000 gain.

The first critical support for gold is seen at 35.40 and the first resistance is located at 36.50.

| R1: 36.50 | S1: 35.40 |

| R2: 37.20 | S2: 34.85 |

| R3: 37.50 | S3: 33.80 |

After Khamenei: Who Will Lead Iran Next?

After Khamenei: Who Will Lead Iran Next?Following the death of Supreme Leader Ali Khamenei, Iran has entered a pivotal transition phase. Senior officials in Tehran are acting swiftly to uphold the existing structure of the Islamic Republic, prioritizing continuity to head off potential internal instability. Despite these efforts, the sudden leadership vacuum has sparked intense political and military maneuvering behind the scenes.

Detail March Starts With Geopolitical Turmoil (2-6 March)

March Starts With Geopolitical Turmoil (2-6 March)Global markets began the week in a state of high alert following coordinated US and Israeli strikes on Iran over the weekend, which resulted in the death of Supreme Leader Ayatollah Ali Khamenei.

Detail Geopolitical Shock Triggers Risk-Off Move (03.02.2026)President Trump stated that operations against Iran could last up to four weeks, though he added that developments are proceeding as planned and could wrap up sooner.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!