Global markets stabilized on Wednesday after President Trump confirmed he would not remove Fed Chair Powell, easing fears over central bank independence.

The dollar firmed slightly on improved sentiment, pushing EUR/USD back toward 1.1400 and weighing on gold and silver. The yen held steady near 142, and the British pound dipped from recent highs as traders awaited key PMI data from the UK, Eurozone, and U.S. Gold slipped further from its all-time high, while silver eased on risk-on flows and softer trade rhetoric.

| Time | Cur. | Event | Forecast | Previous |

| 8:00 | EUR | HCOB Eurozone Manufacturing PMI (Apr) | 47.4 | 48.6 |

| 8:00 | EUR | HCOB Eurozone Composite PMI (Apr) | 50.3 | 50.9 |

| 8:00 | EUR | HCOB Eurozone Services PMI (Apr) | 50.4 | 51 |

| 8:30 | GBP | S&P Global Composite PMI (Apr) | 50.4 | 51.5 |

| 8:30 | GBP | S&P Global Manufacturing PMI (Apr) | 44 | 44.9 |

| 8:30 | GBP | S&P Global Services PMI (Apr) | 51.4 | 52.5 |

| 13:30 | USD | Fed Waller Speaks | | |

| 13:45 | USD | S&P Global Manufacturing PMI (Apr) | 49 | 50.2 |

| 13:45 | USD | S&P Global Composite PMI (Apr) | | 53.5 |

| 13:45 | USD | S&P Global Services PMI (Apr) | 52.8 | 54.4 |

| 14:00 | USD | New Home Sales (MoM) (Mar) | | 1.80% |

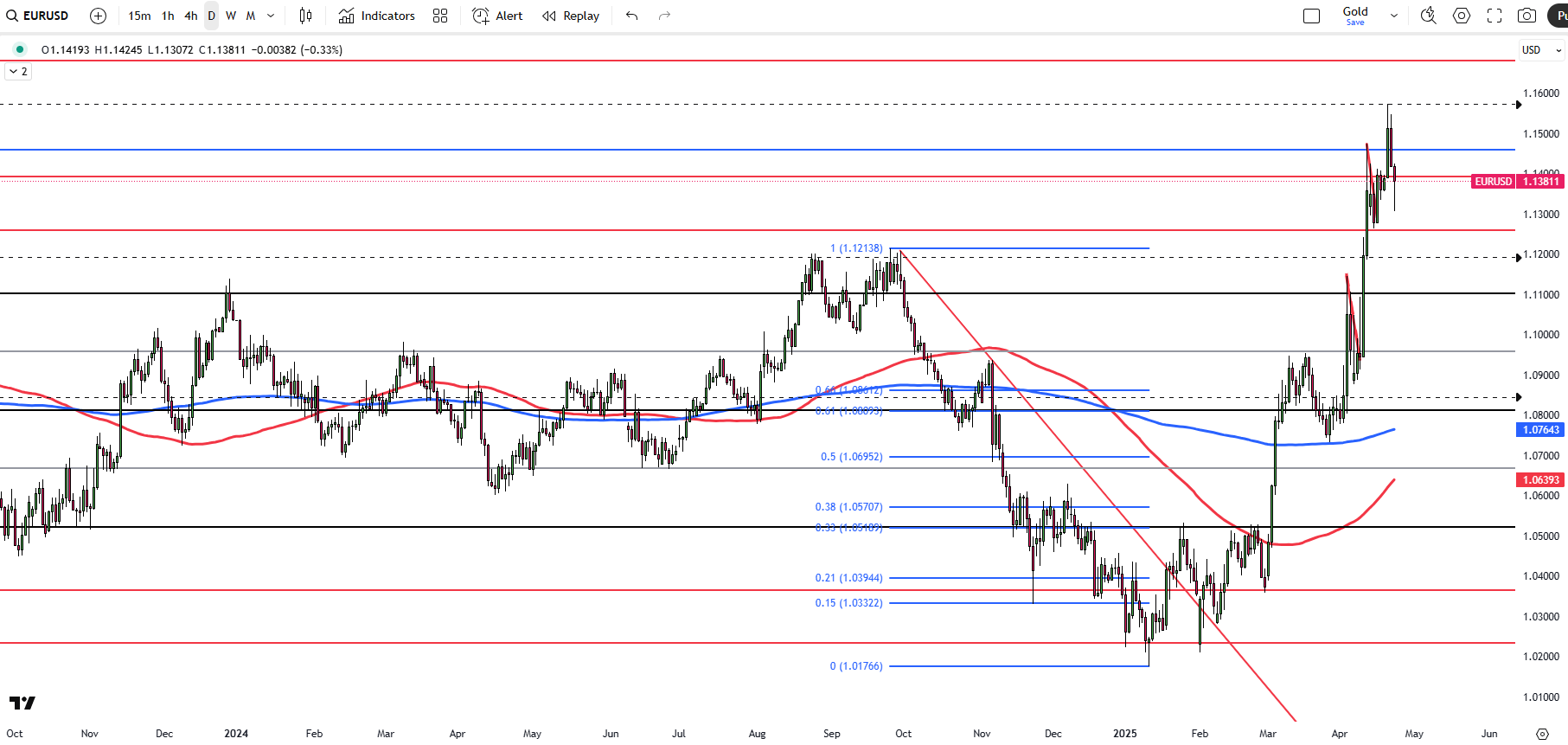

The euro is trading near 1.1400, easing after President Trump confirmed he does not plan to remove Fed Chair Powell. The currency also faced pressure from reduced trade war tensions, which supported the U.S. Dollar Index. Markets now await key PMI data from major Eurozone economies and the bloc overall.

Key resistance is at 1.1460, followed by 1.1580 and 1.1680. Support lies at 1.1260, then 1.1200 and 1.1150.

| R1: 1.1460 | S1: 1.1260 |

| R2: 1.1580 | S2: 1.1200 |

| R3: 1.1680 | S3: 1.1150 |

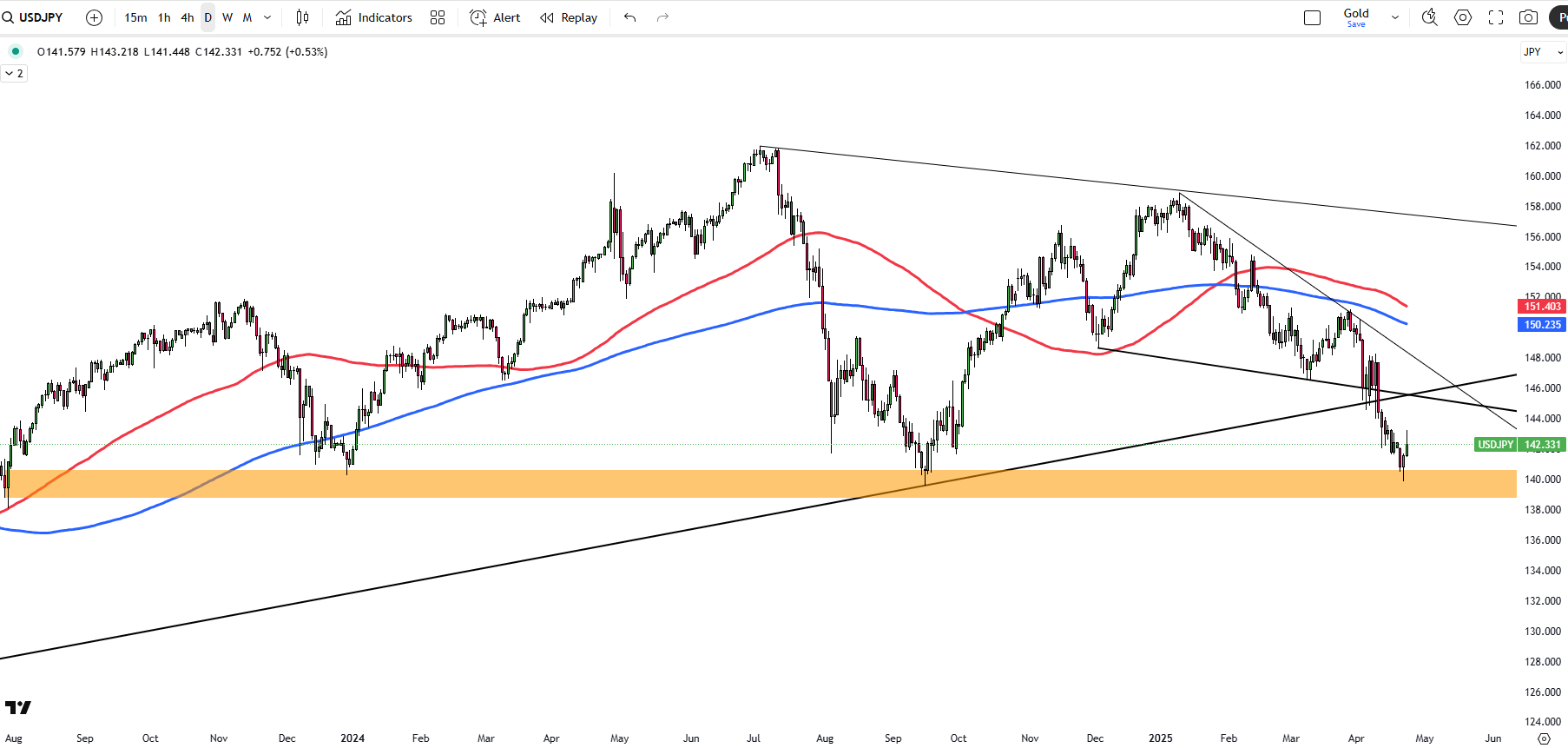

The Japanese yen hovered around 142 per dollar on Wednesday, after falling over 1% the day before. The decline followed a stronger U.S. dollar, driven by easing U.S.-China trade tensions and reduced concerns about Fed independence. Treasury Secretary Scott Bessent called the tariff conflict “unsustainable,” raising hopes for a resolution, though he noted talks would be slow. President Trump added confidence by saying he won’t replace Fed Chair Powell. In Japan, April data showed a return to private sector growth, led by services, rebounding from a March contraction.

Key resistance is at 142.50, with further levels at 144.00 and 145.90. Support stands at 139.70, followed by 137.00 and 135.00.

| R1: 142.50 | S1: 139.70 |

| R2: 144.00 | S2: 137.00 |

| R3: 145.90 | S3: 135.00 |

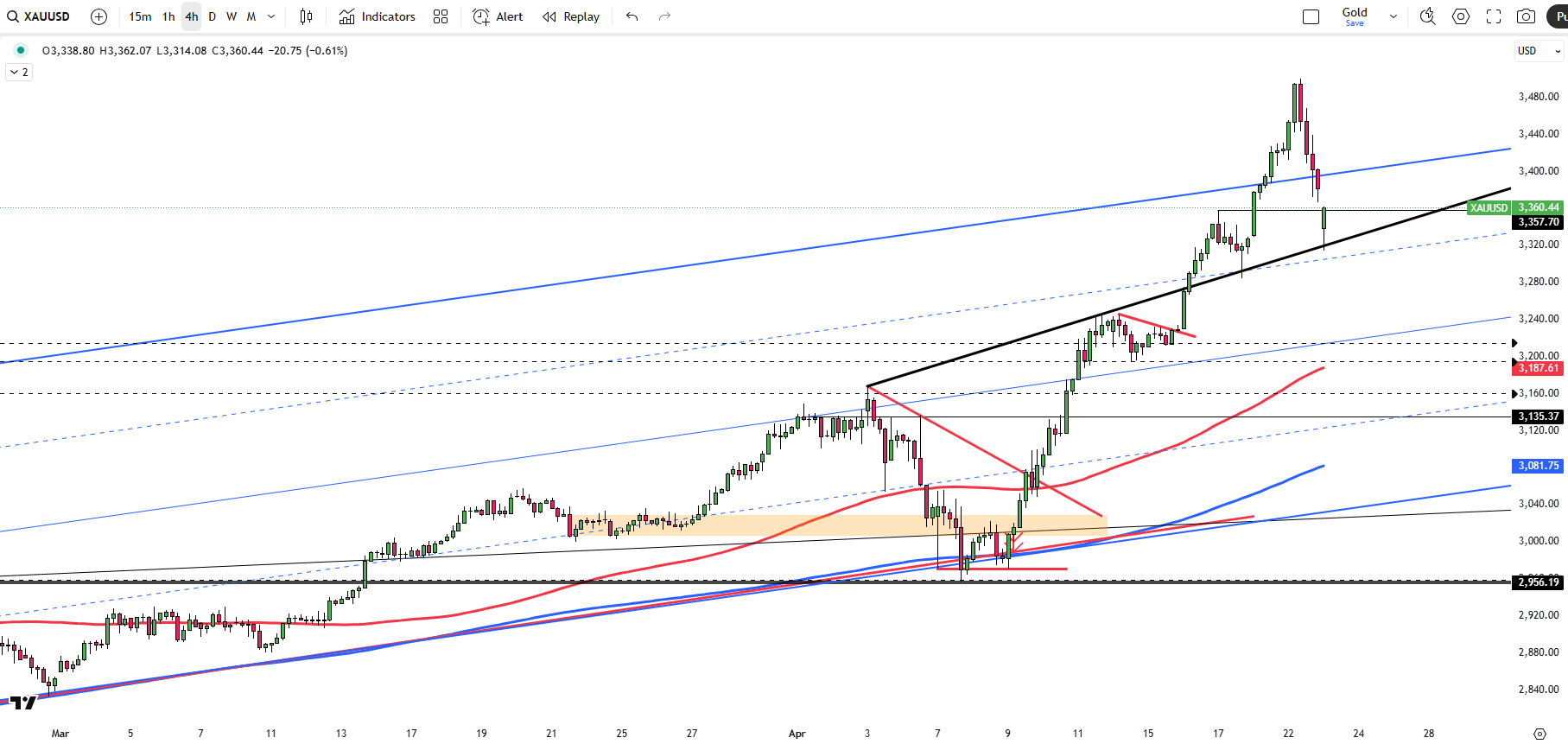

Gold fell below $3,320 per ounce on Wednesday, extending its pullback after hitting a record $3,500 the day before. The decline followed easing U.S.-China trade tensions and reduced concerns over Fed independence. Treasury Secretary Bessent called the tariff standoff unsustainable, and President Trump backed away from removing Fed Chair Powell. Improved risk sentiment weighed on safe-haven demand, though gold remains up about 30% year-to-date.

Key resistance is at $3410, followed by $3,500 and $3,600. Support stands at $3315, then $3290 and $3250.

| R1: 3410 | S1: 3315 |

| R2: 3500 | S2: 3290 |

| R3: 3600 | S3: 3250 |

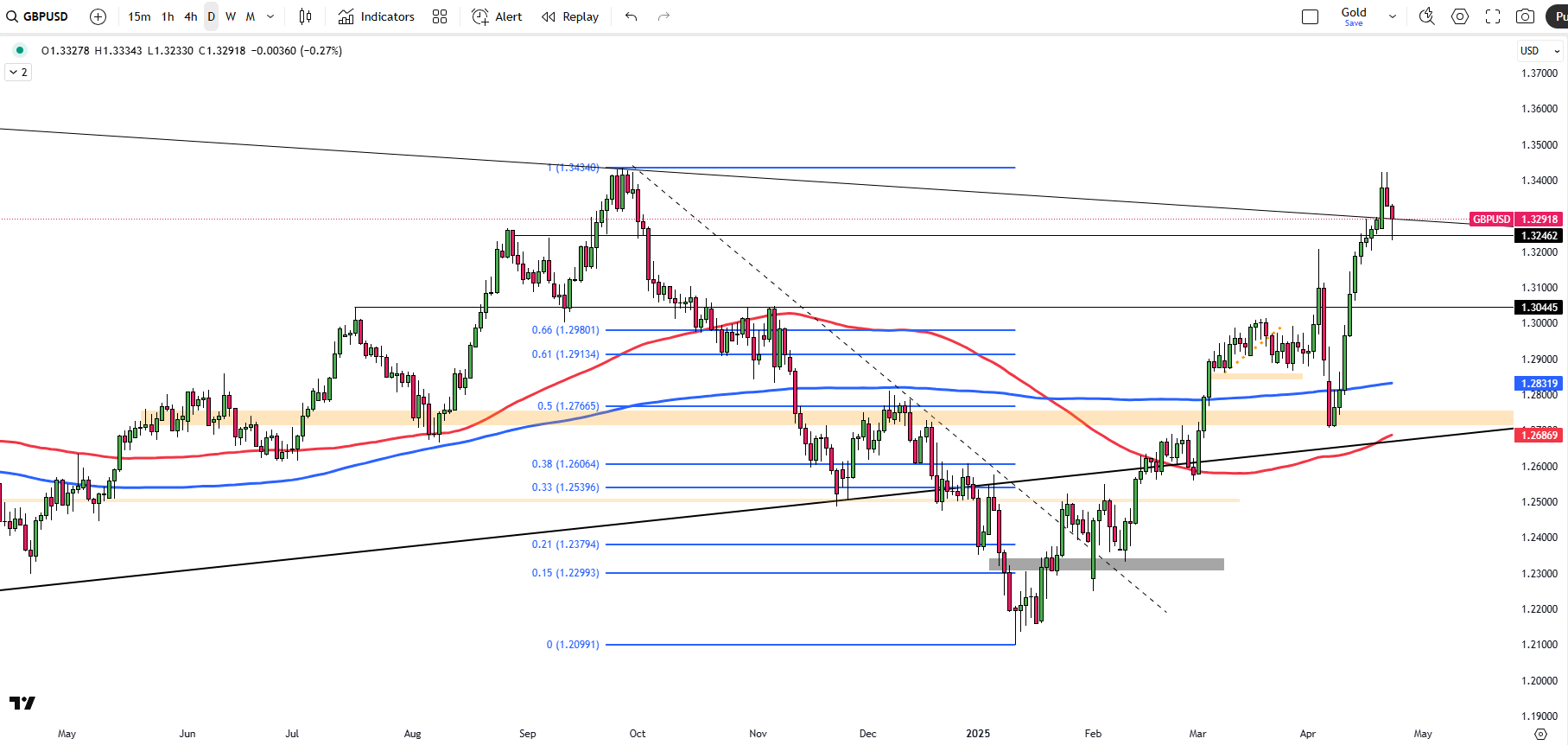

The British pound eased to 1.3280 on Wednesday morning, pulling back from a seven-month high after President Trump reassured markets by stating he does not intend to remove Fed Chair Jerome Powell. Attention now turns to upcoming UK PMI data, which will be key for the pound’s direction, alongside PMI releases from the U.S. and the Eurozone.

If GBP/USD breaks above 1.3430, resistance levels are at 1.3500 and 1.3550. Support is at 1.3200, followed by 1.3050 and 1.2960.

| R1: 1.3430 | S1: 1.3200 |

| R2: 1.3500 | S2: 1.3050 |

| R3: 1.3550 | S3: 1.2960 |

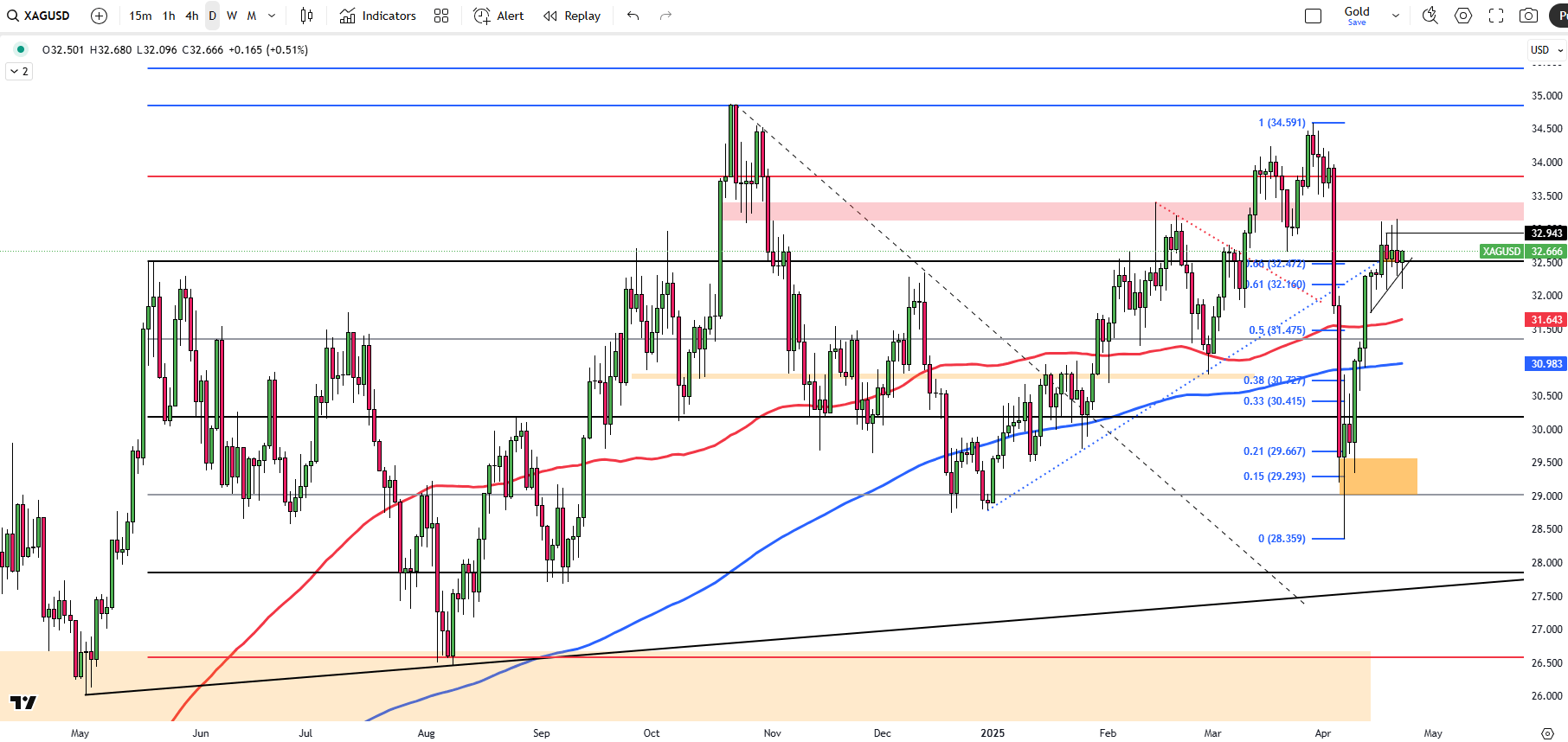

Silver is trading near $32.70 on Wednesday, easing from Tuesday’s high of $33.15 after President Trump reassured markets by confirming Fed Chair Powell will not be removed. His comments also helped reduce tensions around the U.S.-China trade dispute, contributing to the pullback. Later in the day, economic data may influence market direction.

On the upside, resistance levels are seen at $33.15, followed by $33.80 and $34.20. Key support lies at $31.40, with lower levels at $30.20 and $29.00 if further weakness occurs.

| R1: 33.15 | S1: 31.40 |

| R2: 33.80 | S2: 30.20 |

| R3: 34.20 | S3: 29.00 |

Trump Signals Extended Military Campaign

Trump Signals Extended Military CampaignGeopolitical tensions in the Middle East have intensified following recent remarks from Donald Trump suggesting that the ongoing military campaign against Iran may last longer than anticipated. While Trump stated that early operational objectives were achieved ahead of schedule, he acknowledged that broader strategic goals could require additional time and sustained military pressure.

Detail US DST Change March 8 2026

US DST Change March 8 2026Daylight Saving Time will change in the United States on Sunday, March 8, 2026. The trading schedule for various financial instruments will be adjusted to align with U.S. exchange hours.

Detail Dollar Leads Risk-Off (03.06.2026)Global markets remained under pressure as escalating Middle East tensions and rising energy prices strengthened the US dollar and unsettled major currencies.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!