The euro stabilized near $1.1720 after two sessions of declines, with attention turning to Eurozone PMI and PPI data as the ECB signaled a steady policy stance.

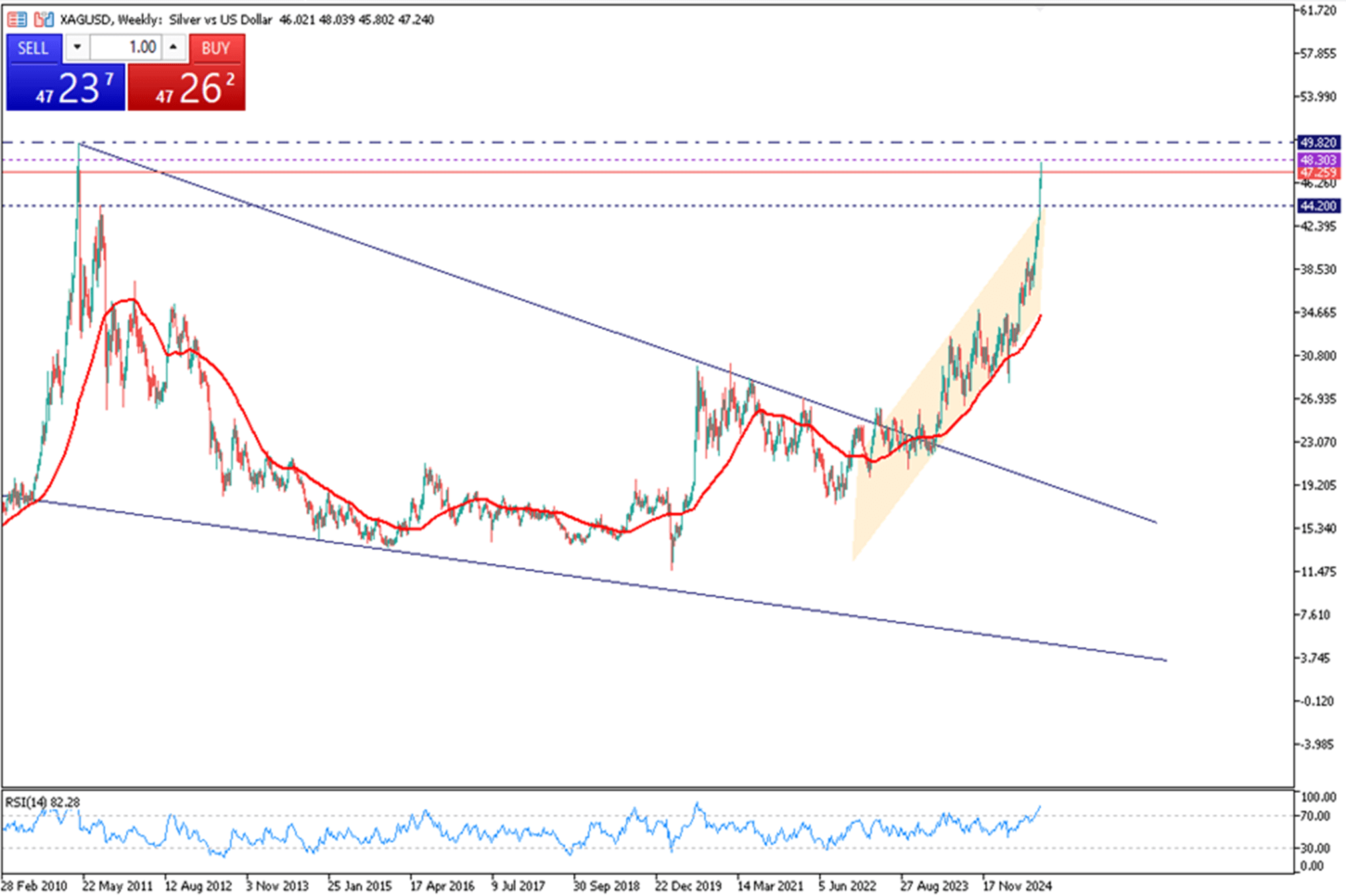

The yen eased to 147.5 per dollar ahead of Japan’s LDP leadership vote, while gold held firm near $3,850 per ounce, extending its safe-haven appeal amid the ongoing U.S. government shutdown. Sterling edged toward $1.3440, supported by a softer dollar, and silver remained in a weekly uptrend, holding close to $47 as Fed cut expectations and supply concerns underpinned demand.

| Time | Cur. | Event | Forecast | Previous |

| All Day | CNY | China - National Day | - | - |

| 09:40 | EUR | ECB President Lagarde Speaks | - | - |

| 10:05 | USD | FOMC Member Williams Speaks | - | - |

| 13:45 | USD | S&P Global Services PMI (Sep) | 53.9 | 54.5 |

| 14:00 | USD | ISM Non-Manufacturing PMI (Sep) | 51.8 | 52.0 |

| 14:00 | USD | ISM Non-Manufacturing Prices (Sep) | - | 69.2 |

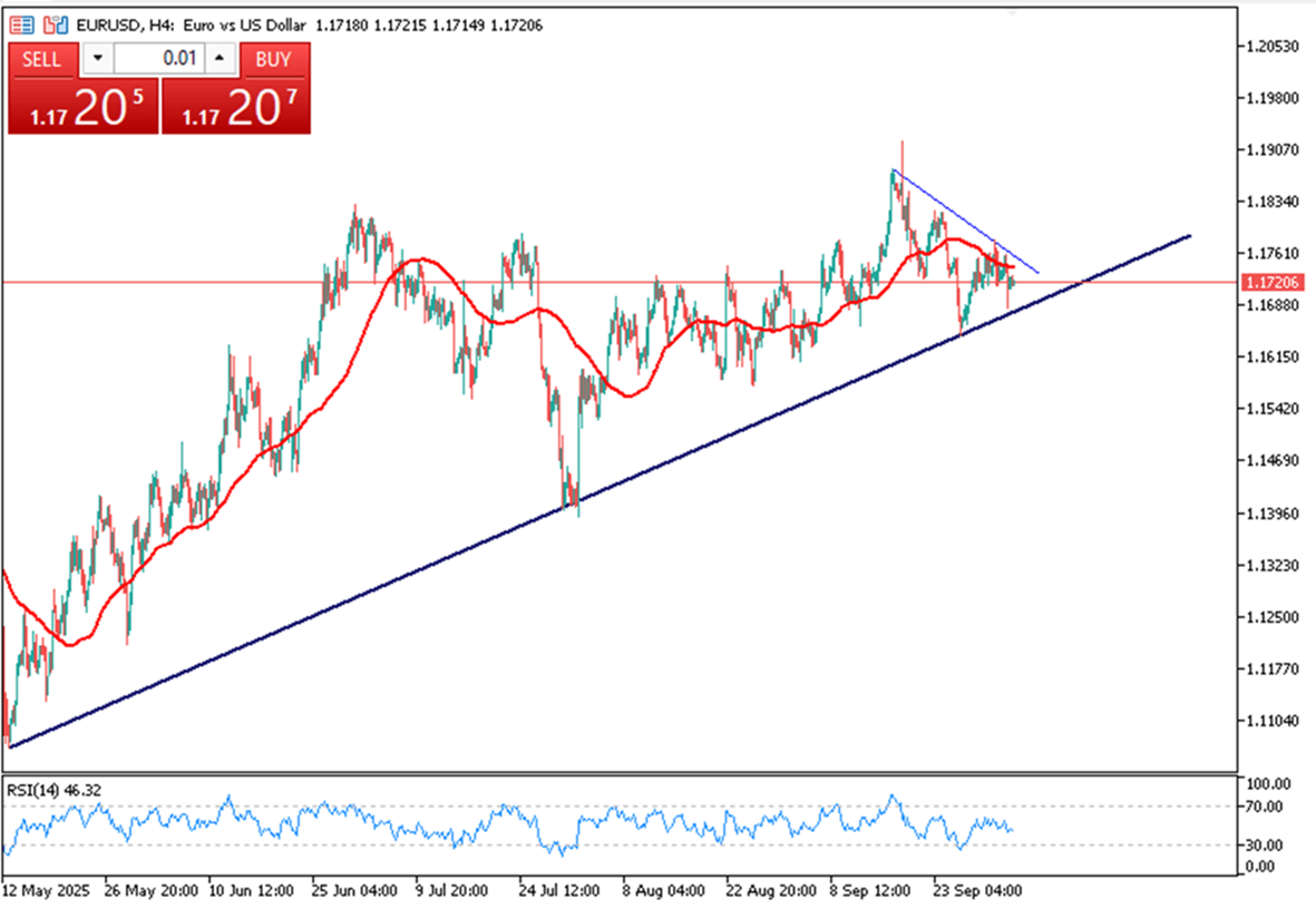

EUR/USD steadied around 1.1720 in Friday’s Asian session after two consecutive days of losses. Attention turned to upcoming HCOB PMI data from Germany and the Eurozone, along with the Eurozone Producer Price Index. ECB policymaker Martins Kazaks remarked that current interest rate levels are appropriate and could remain unchanged.

Technically, 1.1685 is the key support, while resistance is seen at 1.1755 and then 1.1810.

| R1: 1.1755 | S1: 1.1685 |

| R2: 1.1810 | S2: 1.1570 |

| R3: 1.1850 | S3: 1.1520 |

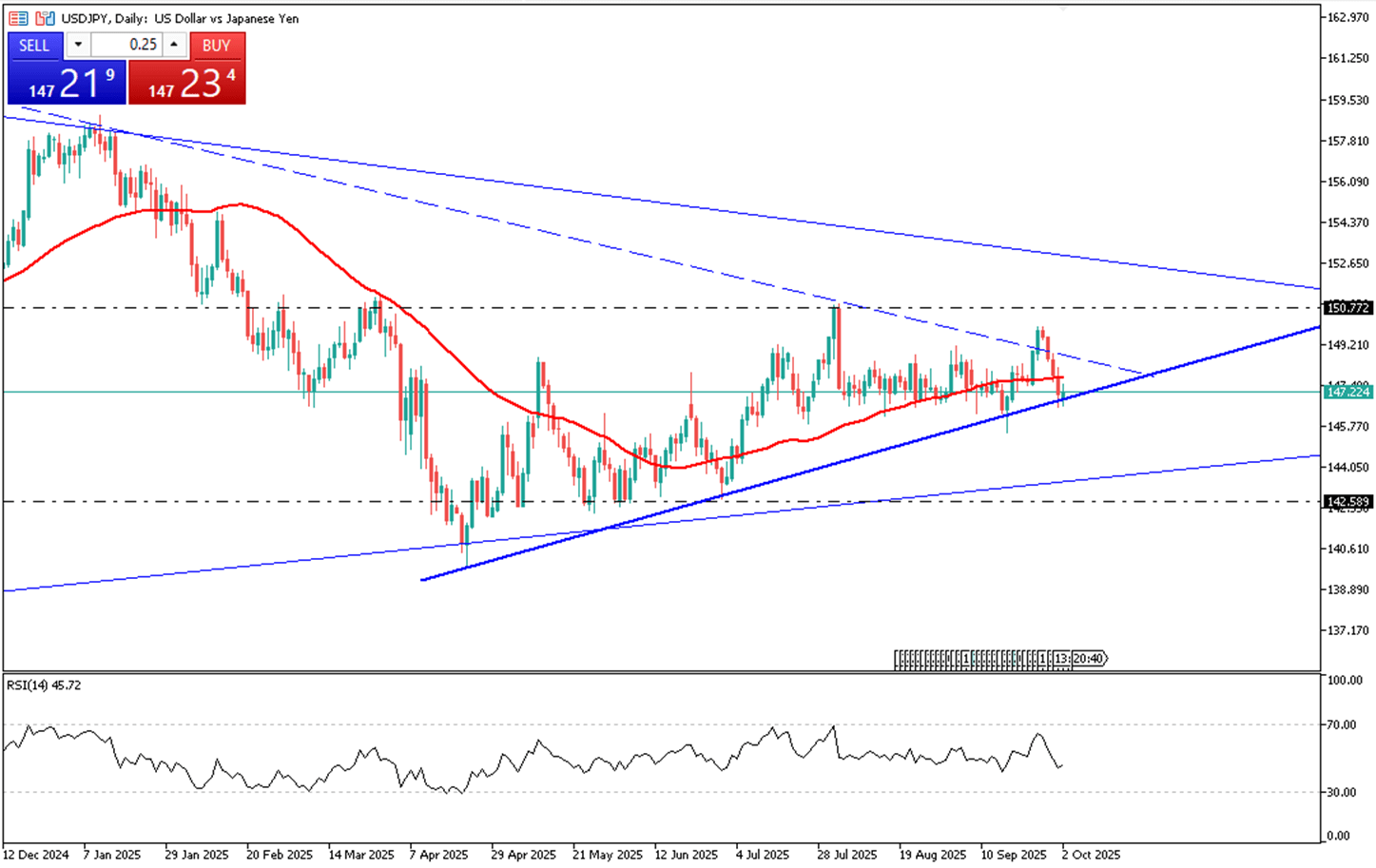

The yen eased to 147.5 per dollar Friday, retreating from a two-week peak. Traders await the LDP’s weekend leadership election to replace ex-PM Shigeru Ishiba, with debate centered on household support versus fiscal restraint, shaping Japan’s fiscal and monetary outlook.

Resistance is at 148.50, while support holds at 146.80.

| R1: 148.50 | S1: 146.80 |

| R2: 150.90 | S2: 145.20 |

| R3: 154.50 | S3: 142.30 |

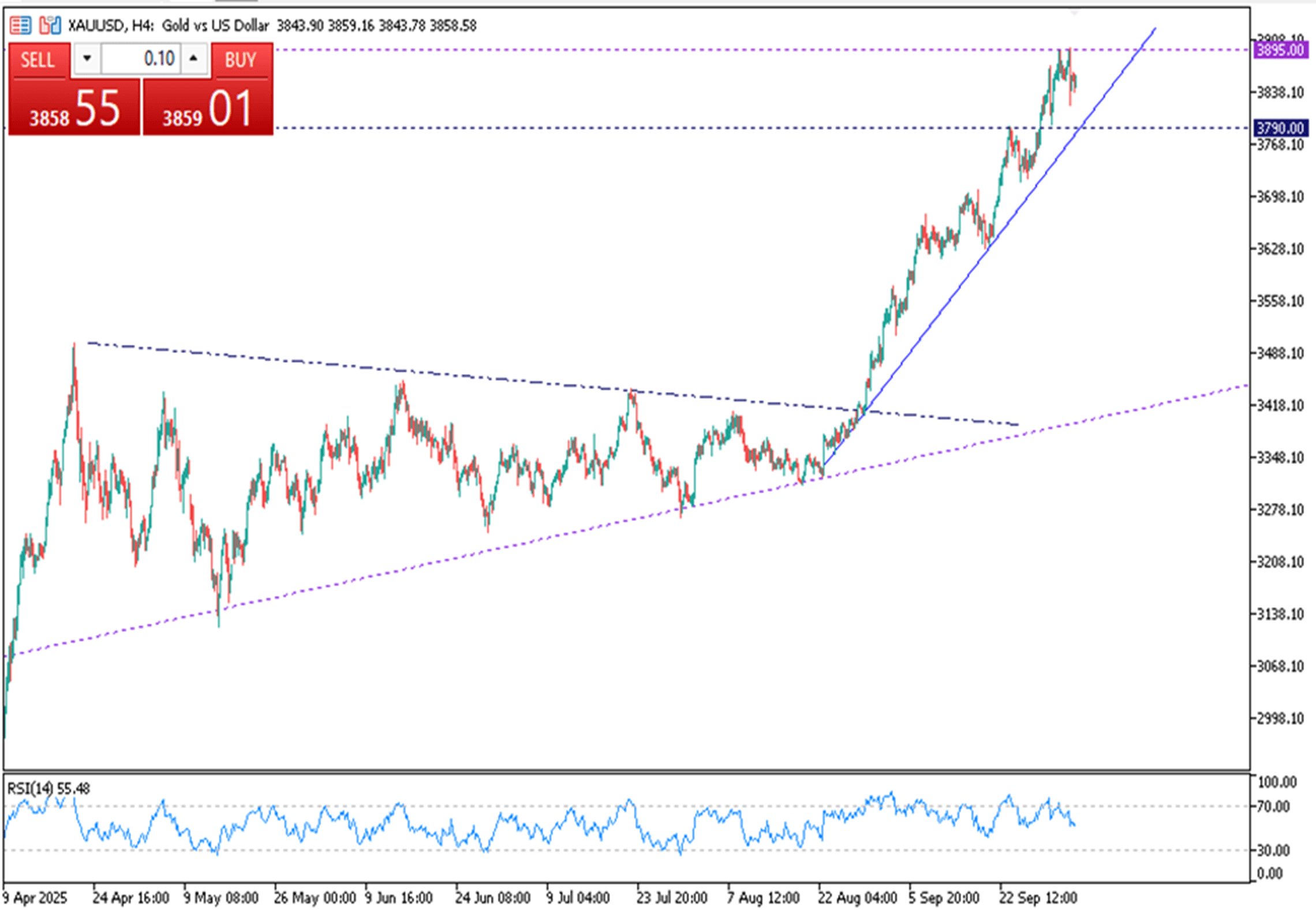

Gold traded near $3,850 per ounce on Friday, on track for a seventh consecutive weekly gain after hitting a fresh high earlier in the week. The metal remained supported by stronger safe-haven demand and expectations of a more dovish Federal Reserve. Uncertainty has intensified with the partial US government shutdown, which threatens federal jobs and could delay key data releases such as non-farm payrolls.

From a technical perspective, support is around 3820, and resistance is at 3868.

| R1: 3868 | S1: 3820 |

| R2: 3900 | S2: 3792 |

| R3: 4000 | S3: 3770 |

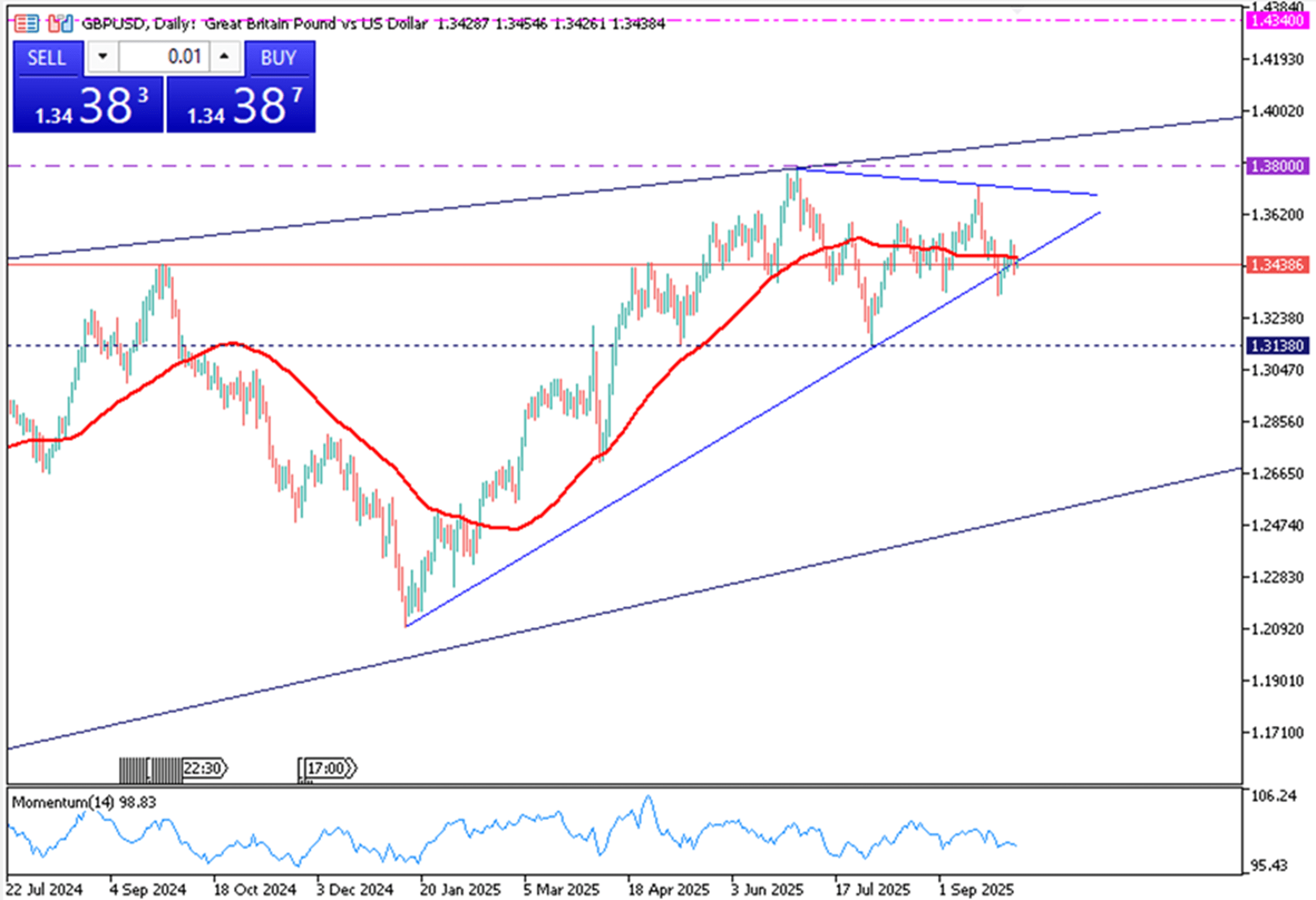

The British pound edged up to around 1.3440 against the US dollar in Friday’s Asian session. GBP/USD advanced as the dollar weakened, pressured by a softer US labor market and the ongoing government shutdown. The Bank of England kept rates unchanged in September, with markets expecting the first cut only in 2026 amid persistent inflation concerns.

Technically, support is at 1.3405, with a break lower exposing 1.3325. Resistance sits at 1.3495 and 1.3525.

| R1: 1.3495 | S1: 1.3405 |

| R2: 1.3525 | S2: 1.3325 |

| R3: 1.3595 | S3: 1.3260 |

Silver slipped below $47 per ounce on Friday but was still set for a seventh straight weekly gain. The metal stayed supported by Fed cut expectations and shutdown uncertainty, with markets pricing in a 25 bps cut this month and another in December. Supply concerns also lifted sentiment, as the Silver Institute projects a fifth consecutive global deficit in 2025.

From a technical perspective, resistance is observed at 47.50, while support is located at 45.95.

| R1: 47.50 | S1: 45.95 |

| R2: 48.30 | S2: 45.20 |

| R3: 50.00 | S3: 44.50 |

Global markets remain dominated by geopolitical risk as escalating conflict between the United States, Israel, and Iran fuels a strong shift toward safe-haven assets. The dollar index hit 99.3 Wednesday, rising for a third day as conflict concerns fueled inflation and shifted Fed rate cut expectations from July to September.

A US court rejected Trump's tariff refund delay as the Dollar (98.5) and 10 year yield (4.04%) held gains amid Middle East escalation and inflation fears.

After Khamenei: Who Will Lead Iran Next?

After Khamenei: Who Will Lead Iran Next?Following the death of Supreme Leader Ali Khamenei, Iran has entered a pivotal transition phase. Senior officials in Tehran are acting swiftly to uphold the existing structure of the Islamic Republic, prioritizing continuity to head off potential internal instability. Despite these efforts, the sudden leadership vacuum has sparked intense political and military maneuvering behind the scenes.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!