Precious metals rallied strongly, with silver surging 2% above $40/oz, its highest since 2011, on expectations of a Fed rate cut. San Francisco Fed President Mary Daly backed easing, while a U.S. court ruling against Trump-era tariffs and China’s 70% jump in solar exports added support. Gold hit a record $3,508/oz as safe-haven demand grew after firm U.S. inflation data.

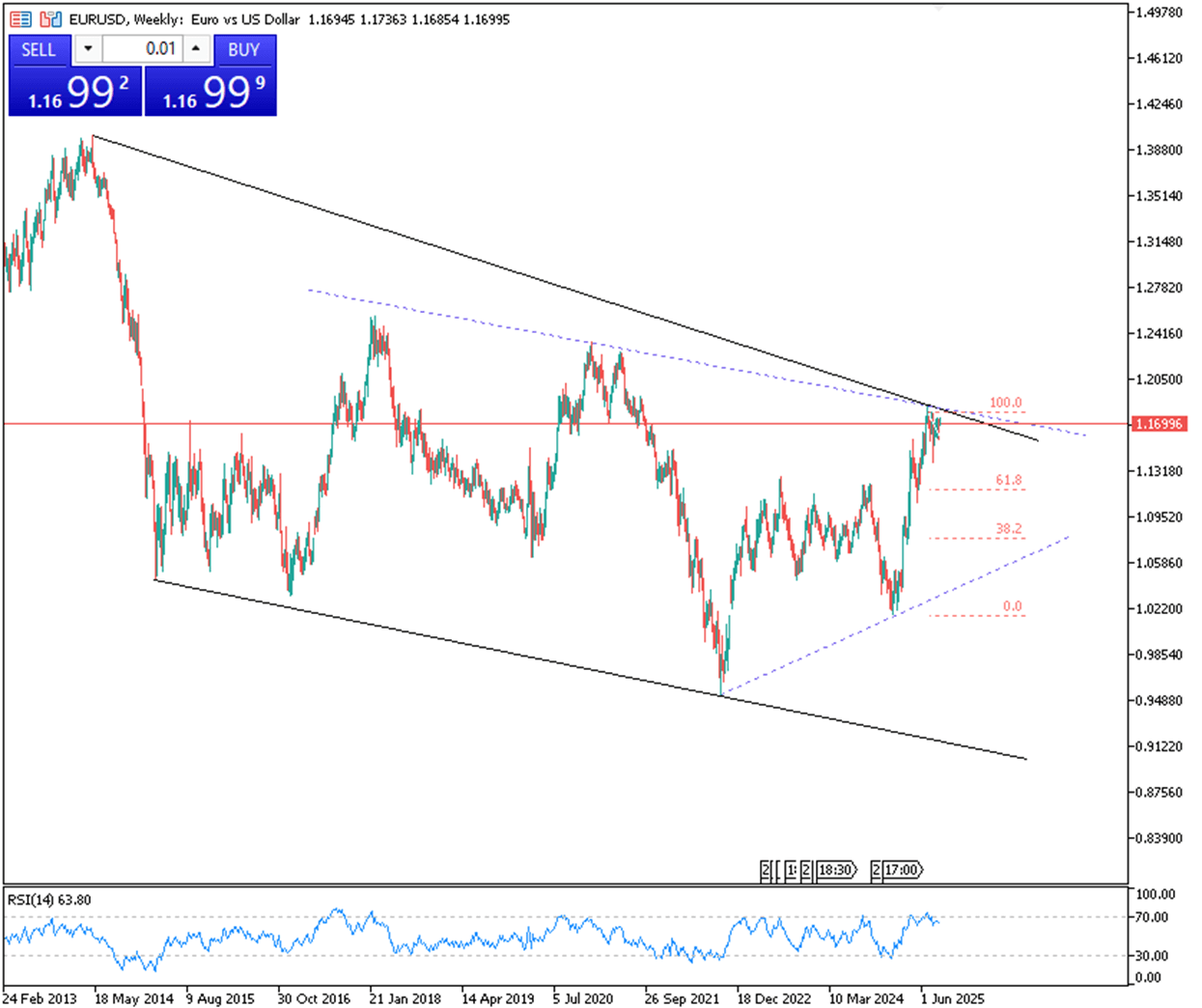

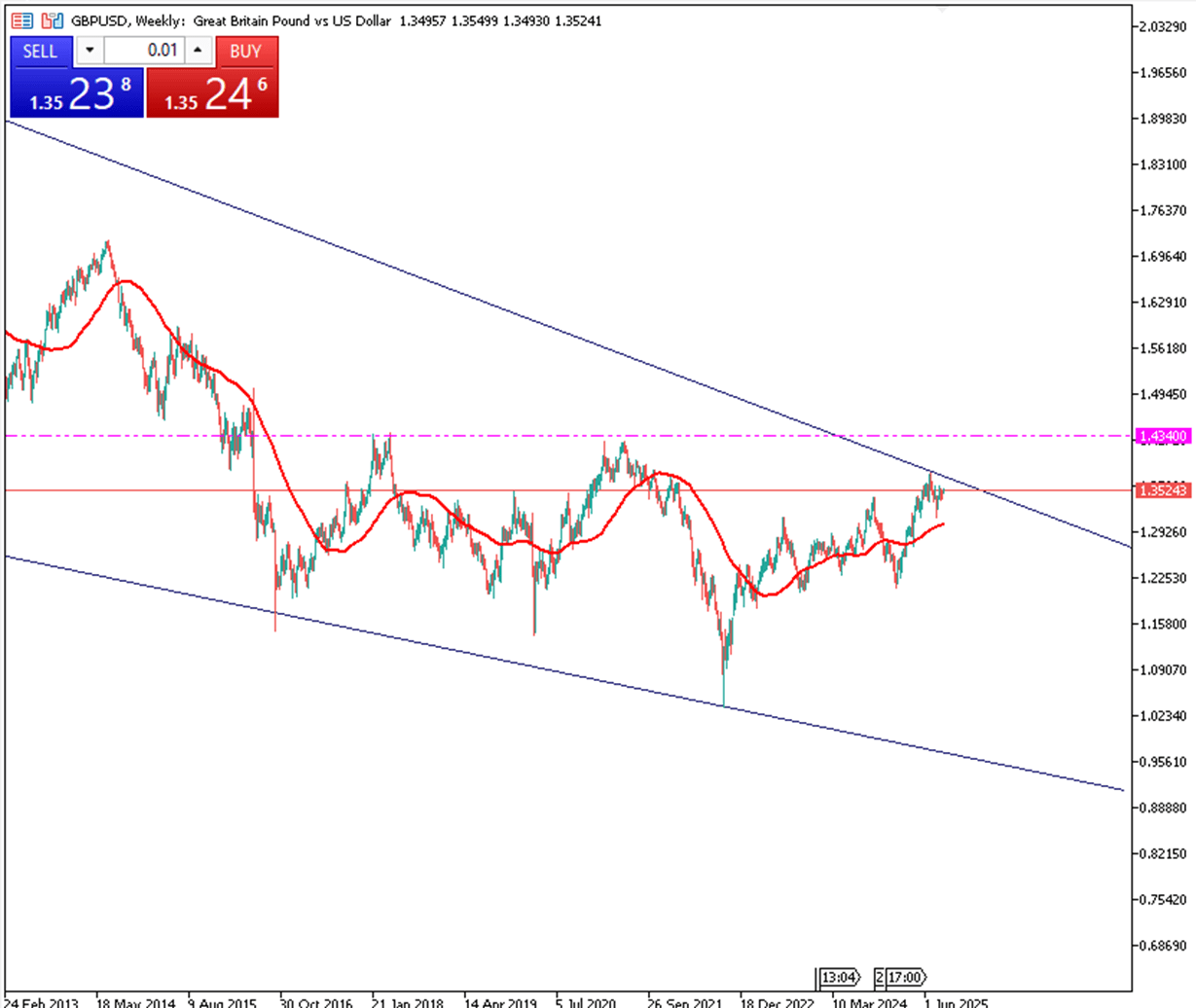

The dollar weakened broadly, lifting the euro above $1.17 for its strongest since late July and keeping the pound above $1.35, its highest since mid-August. Concerns over Fed independence weighed further after a court hearing on Trump’s attempt to remove Governor Cook.

The yen strengthened to 146.8 per dollar as U.S. rate cut bets pressured USD/JPY and domestic data added support. Japan’s Q2 capital spending rose 7.6%, above forecasts.

Markets remain focused on upcoming U.S. labor data, which will guide the Fed’s next move and shape global sentiment.

| Time | Cur. | Event | Forecast | Previous |

| 09:00 | EUR | CPI (YoY) (Aug) | 2.0% | 2.0% |

| 13:45 | USD | S&P Global Manufactuing PMI (Aug) | 53.3 | 49.8 |

| 14:00 | USD | ISM Manufacturing PMI (Aug) | 48.9 | 48.0 |

| 14:00 | USD | ISM Manufacturing Prices (Aug) | 65.1 | 64.8 |

| 18:00 | U.S. President Trump Speaks |

EUR/USD slipped to around 1.1695 in Tuesday’s Asian trade, ending a three-day rally as the stronger dollar weighed. Traders now await Eurozone HICP inflation data and the U.S. ISM Manufacturing PMI for direction. The currency also faced pressure from the Russia–Ukraine conflict, after Russian drone strikes cut power to nearly 60,000 people and President Zelenskyy vowed retaliation, raising energy costs and geopolitical risks in Europe.

The resistance sits at 1.1750, with support at 1.1630.

| R1: 1.1750 | S1: 1.1630 |

| R2: 1.1820 | S2: 1.1525 |

| R3: 1.1900 | S3: 1.1390 |

The Japanese yen weakened further in Asian trading on Tuesday, with USD/JPY climbing to a near one-week high around 147.85. Uncertainty over the Bank of Japan’s next rate move, alongside stronger Asian equities, weighed on demand for the safe-haven currency. A modest rebound in the U.S. dollar also added support. While markets still expect a BoJ hike before year-end, the Fed is widely anticipated to cut rates in September. This policy gap may limit yen losses, though doubts over Fed independence and upcoming U.S. data could cap a stronger dollar recovery.

The resistance stands at 148.80, with support at 146.50.

| R1: 148.80 | S1: 146.50 |

| R2: 150.90 | S2: 145.80 |

| R3: 154.50 | S3: 144.00 |

Gold extended gains for a sixth session in Asian trading on Tuesday, hitting a fresh record high as Fed rate cut bets drove demand for the non-yielding asset. Tariff uncertainty and geopolitical tensions added safe-haven support. Still, XAU/USD struggled to hold above $3,500 amid a modest dollar rebound. Overbought signals also prompted caution, with traders awaiting key U.S. data later this week, including Friday’s Nonfarm Payrolls report, for direction.

Gold resistance stands at $3,520, with support at $3,470.

| R1: 3520 | S1: 3470 |

| R2: 3580 | S2: 3400 |

| R3: 3640 | S3: 3320 |

GBP/USD eased to around 1.3520 in Asian trade on Tuesday, reversing earlier gains as the dollar firmed on persistent inflation concerns that cloud Fed easing prospects. Traders now look to the ISM Manufacturing PMI and this week’s key labor data, ADP Employment, Average Hourly Earnings, and Nonfarm Payrolls, for policy signals. Still, the downside may be limited, with CME FedWatch showing an 89% chance of a 25 bps September cut, up from 84% last week, underscoring strong expectations for easing despite short-term dollar strength.

The resistance is at 1.3595, with support at 1.3390.

| R1: 1.3595 | S1: 1.3390 |

| R2: 1.3650 | S2: 1.3250 |

| R3: 1.3770 | S3: 1.3155 |

Silver started the week strongly, with spot prices extending their rally for a fifth straight session, breaking above $40.00 to reach fresh 14-year highs, last seen in September 2011. At the time of writing, the metal is consolidating near $40.70, with thin trading conditions prevailing due to the U.S. Labor Day holiday.

Resistance is at $41, with support at $39.80

| R1: 41.00 | S1: 39.80 |

| R2: 41.75 | S2: 38.00 |

| R3: 42.50 | S3: 37.25 |

The dollar index stabilized near 98.8 Thursday as a reported U.S. submarine sinking of an Iranian warship near Sri Lanka and the sixth day of the U.S.–Israeli campaign fueled fears of a prolonged, inflationary conflict.

Global markets remain dominated by geopolitical risk as escalating conflict between the United States, Israel, and Iran fuels a strong shift toward safe-haven assets. The dollar index hit 99.3 Wednesday, rising for a third day as conflict concerns fueled inflation and shifted Fed rate cut expectations from July to September.

A US court rejected Trump's tariff refund delay as the Dollar (98.5) and 10 year yield (4.04%) held gains amid Middle East escalation and inflation fears.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!