EUR/USD pushed higher toward 1.1330, lifted by a weaker dollar and cautious optimism around U.S. tariff de-escalation.

The Japanese yen gained strength, slipping USD/JPY below 144.00 as bets on a BoJ rate hike grew. Gold reclaimed ground above $3,300, fueled by renewed U.S. deficit concerns and G7 trade tensions with China. GBP/USD climbed toward 1.3400, with traders awaiting key UK inflation and PMI data, while silver hovered near $33.10.

| Time | Cur. | Event | Forecast | Previous |

| 06:00 | GBP | United Kingdom Inflation Rate | 3.3% | 2.6% |

| 06:00 | GBP | United Kingdom Core Inflation Rate | 3.5% | 3.4% |

| 14:30 | USD | Crude Oil Inventories | -1.069M |

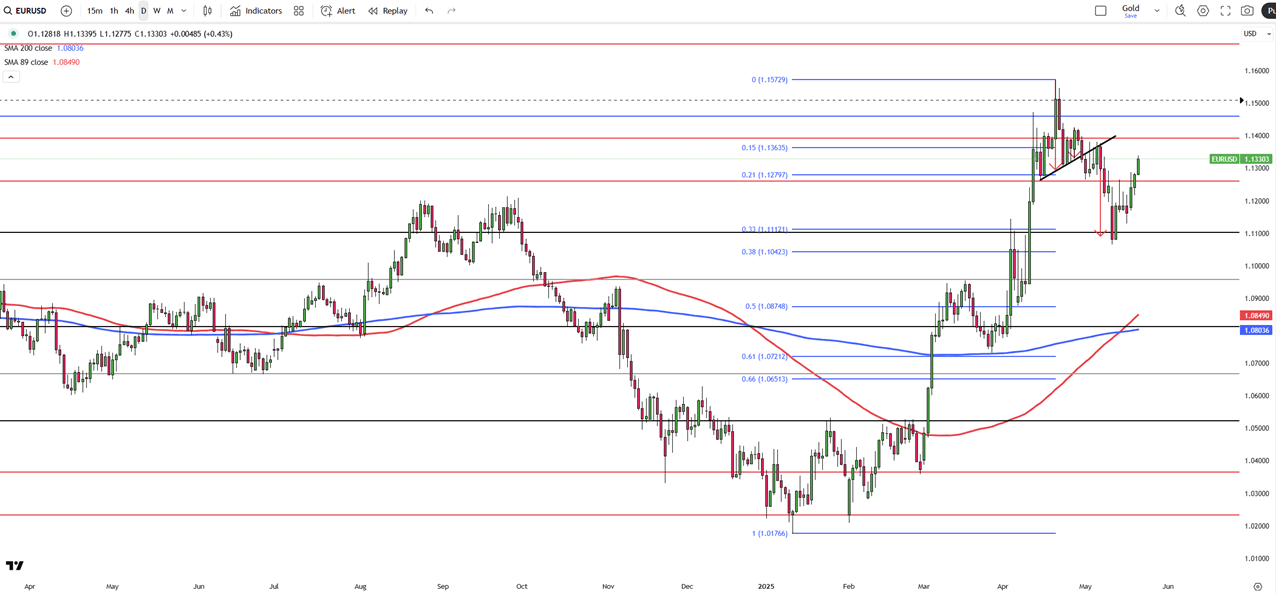

EUR/USD extended its rebound for a third session on Wednesday, approaching the 1.1330 level but still trading well below the recent multi-year high of 1.1575. With European newsflow muted during the G7 summit, market focus has turned to U.S. trade developments. Investors are cautiously optimistic about potential progress in talks that could deter the Trump administration from enforcing aggressive tariff plans.

However, confidence is wavering as the 90-day tariff deadline nears, and no firm trade deals have materialized despite repeated announcements.

Key resistance is seen at 1.1390, with further levels at 1.1460 and 1.1580. First support lies at 1.1260, followed by 1.1100 and 1.1050.

| R1: 1.1390 | S1: 1.1260 |

| R2: 1.1460 | S2: 1.1100 |

| R3: 1.1580 | S3: 1.1050 |

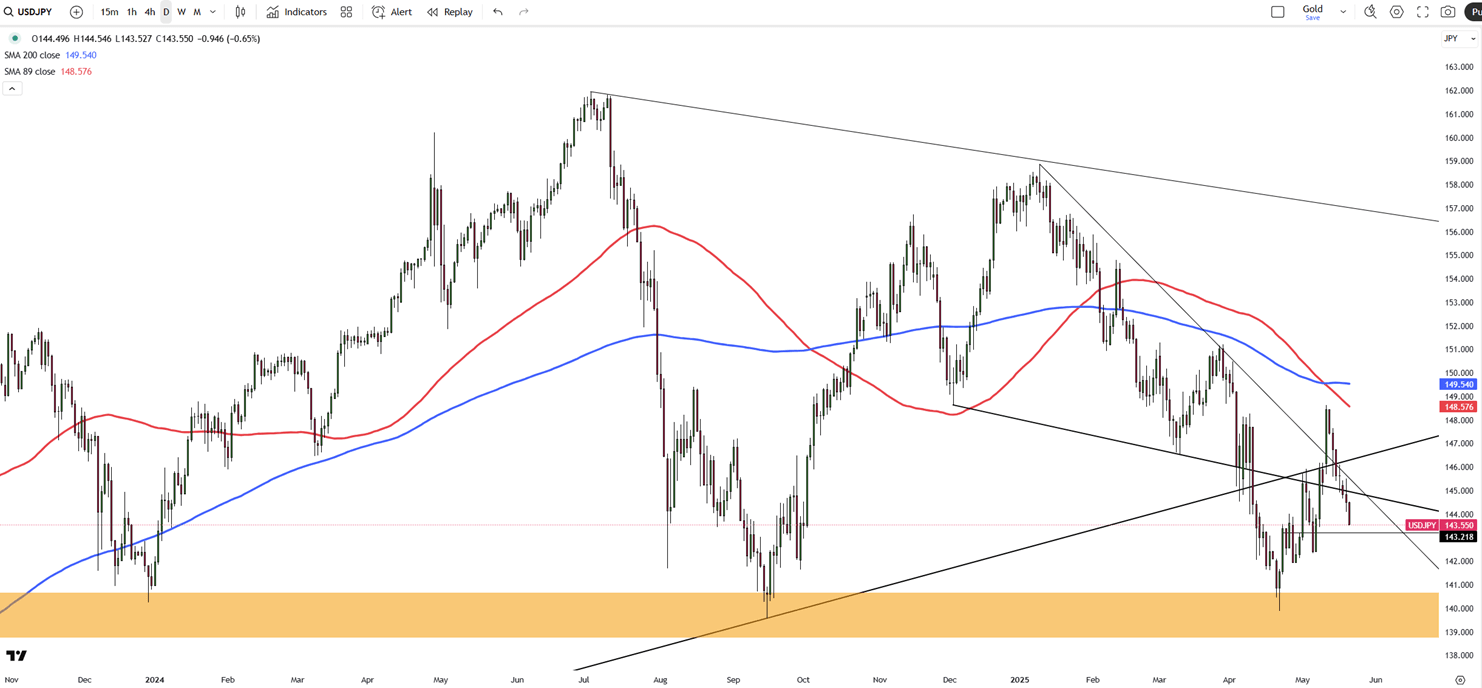

The Japanese Yen strengthened further on Wednesday, driving USD/JPY below 144.00 and marking a two-week low. Markets increasingly expect the Bank of Japan to hike rates again in 2025, spurred by recent hawkish remarks from Deputy Governor Shinichi Uchida and persistent inflation concerns. Rising U.S.-China tensions have also pushed demand for yen.

Meanwhile, optimism around a potential U.S.-Japan trade deal adds to bullish sentiment for the yen, while the U.S. dollar remains under pressure amid expectations for continued Fed rate cuts.

Resistance is located at 148.60, with further upside barriers at 149.80 and 151.20. Support is seen at 139.70, then 137.00 and 135.00.

| R1: 148.60 | S1: 139.70 |

| R2: 149.80 | S2: 137.00 |

| R3: 151.20 | S3: 135.00 |

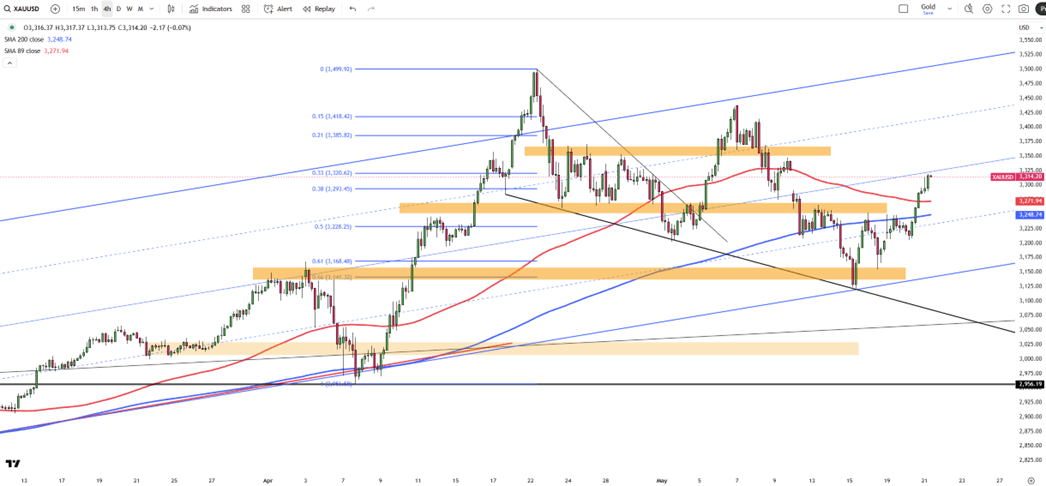

Gold regained ground on Wednesday as investors sought the safety of precious metals with renewed U.S.-China tensions and ongoing fiscal concerns. Moody’s downgrade of U.S. credit and the proposed extension of Trump-era tax cuts have raised fears of a ballooning deficit, weakening the dollar, and increasing demand for gold.

Additionally, reports that G7 nations may jointly impose tariffs on low-value Chinese goods have fueled risk-off sentiment. Gold climbed to an eight-day high just above $3,300.

Immediate resistance lies at $3,320, followed by $3,370 and $3,440. Support begins at $3,250, then $3,150, and $3,025.

| R1: 3320 | S1: 3250 |

| R2: 3370 | S2: 3150 |

| R3: 3440 | S3: 3025 |

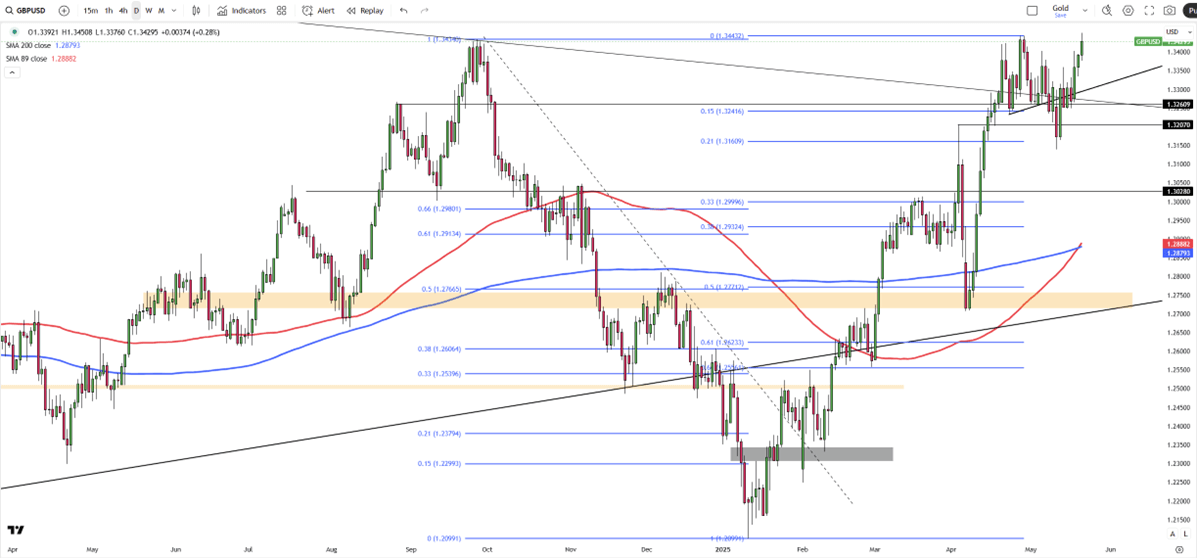

GBP/USD edged higher toward 1.3400, supported by dollar softness and cautious optimism before UK economic data. Markets are awaiting April’s CPI on Wednesday and both UK and U.S. PMI data on Thursday.

Trade developments remain a major driver of sentiment, with investors hoping the U.S. administration will scale back tariff threats, though little progress has been seen with the 90-day deadline approaching.

UK inflation is expected to rise, with monthly CPI seen at 1.1% and annual CPI reaching 3.3%, while core CPI may tick up to 3.6%. Thursday’s PMI data could further influence the pair, with modest UK strength and mixed U.S. figures forecast.

Resistance is at 1.3450, with higher levels at 1.3550 and 1.3700. Support stands at 1.3250, followed by 1.3150 and 1.3000.

| R1: 1.3450 | S1: 1.3250 |

| R2: 1.3550 | S2: 1.3150 |

| R3: 1.3700 | S3: 1.3000 |

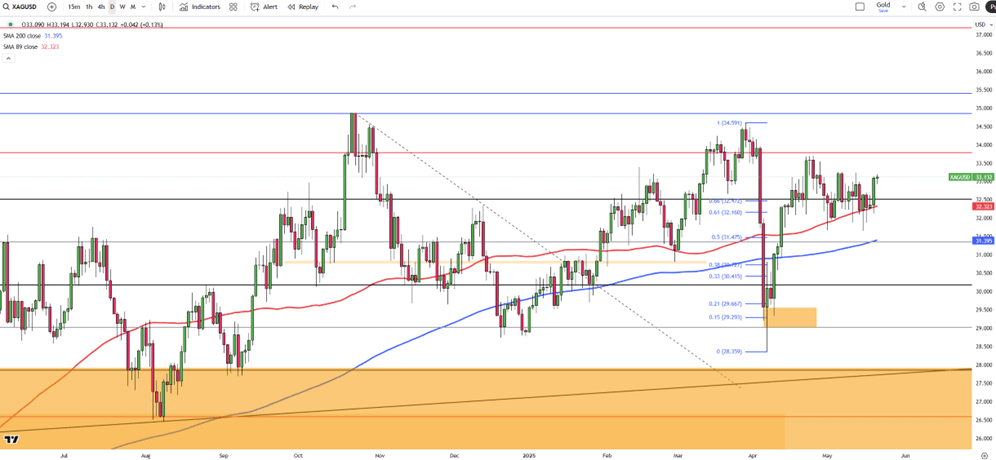

Silver hovered near $33.10 on Wednesday after a strong Tuesday rally, supported by broad dollar weakness and renewed demand for the metal. Uncertainty over U.S. trade policy, Moody’s downgrade of U.S. debt, and fiscal concerns have all contributed to the metal’s gains.

Despite easing slightly from session highs, silver maintains upside potential in the near term.

Resistance is located at $33.80, with further targets at $34.20 and $34.90. First support is found at $32.30, followed by $31.40 and $30.20.

| R1: 33.80 | S1: 32.30 |

| R2: 34.20 | S2: 31.40 |

| R3: 34.90 | S3: 30.20 |

Bond Market Pushback Takes Center Stage

Bond Market Pushback Takes Center StageMarkets are almost fully pricing in another Federal Reserve rate cut this week, yet the US bond market continues to move in the opposite direction.

Detail Central Bank Expectations Reset the Tone (8-12 December)

Central Bank Expectations Reset the Tone (8-12 December)Traders adjusted positioning before the Federal Reserve’s December decision and evaluated fresh signals from the ECB, BoE and BOJ.

Detail Futures Stall, 10-Year Yield Pushes Above 4.1% (12.08.2025)US stock futures were flat on Monday ahead of the Fed’s meeting, with markets pricing an 88% chance of a 25 bp cut on Wednesday.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!