Markets shifted slightly on Friday as strong U.S. labor data and easing trade fears influenced sentiment across major assets.

The euro slipped to 1.1750 despite the ECB holding rates, while the yen weakened after Tokyo inflation came in below expectations. Gold remained under pressure near $3,360 with resilient jobless claims, though it's on track for a weekly gain. The British pound retreated from 1.3600 following weak UK PMI data, and silver held above $39, supported by a softer dollar and optimism around upcoming trade agreements.

| Time | Cur. | Event | Forecast | Previous |

| 06:00 | GBP | Retail Sales MoM | 1.5% | -2.7 |

| 06:00 | GBP | Retail Sales YoY | 2.1% | -1.3% |

| 08:00 | EUR | ECB Survey of Professional Forecasters | ||

| 12:30 | USD | Durable Goods Orders MoM | -9% | 16.4% |

| 12:30 | USD | Durable Goods Orders Ex Transp. MoM | -0.1% | 0.5% |

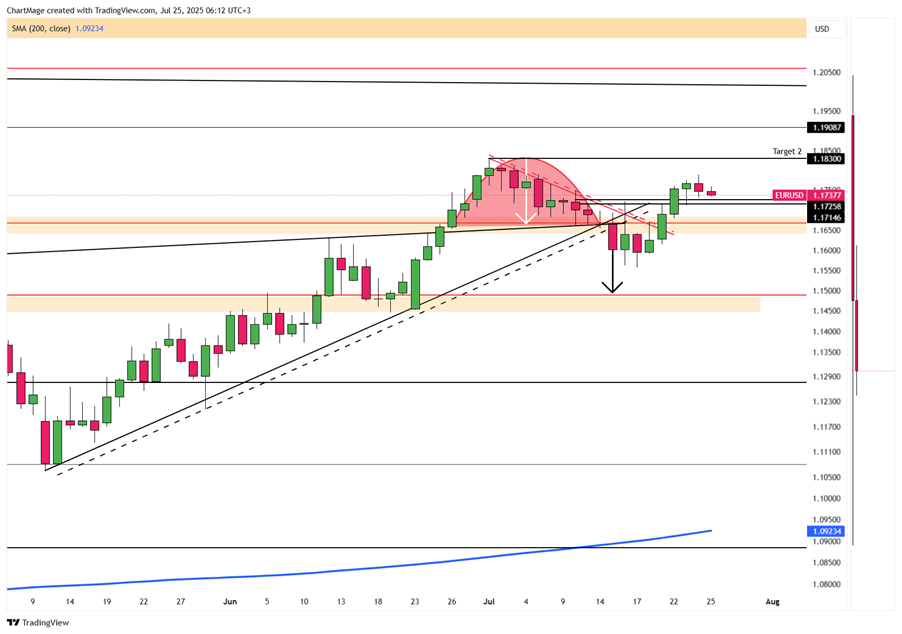

The euro dipped toward 1.1750, erasing earlier gains sparked by the ECB’s decision to keep interest rates unchanged. EUR/USD fell over 0.20%, currently trading at 1.1749 after peaking at 1.1789.

The move came as U.S. initial jobless claims dropped more than expected, highlighting labor market strength, even though continuing claims held steady, signaling ongoing challenges for the unemployed in securing new work.

EUR/USD faces resistance at 1.1830, with support at 1.1660.

| R1: 1.1830 | S1: 1.1660 |

| R2: 1.1900 | S2: 1.1590 |

| R3: 1.2000 | S3: 1.1500 |

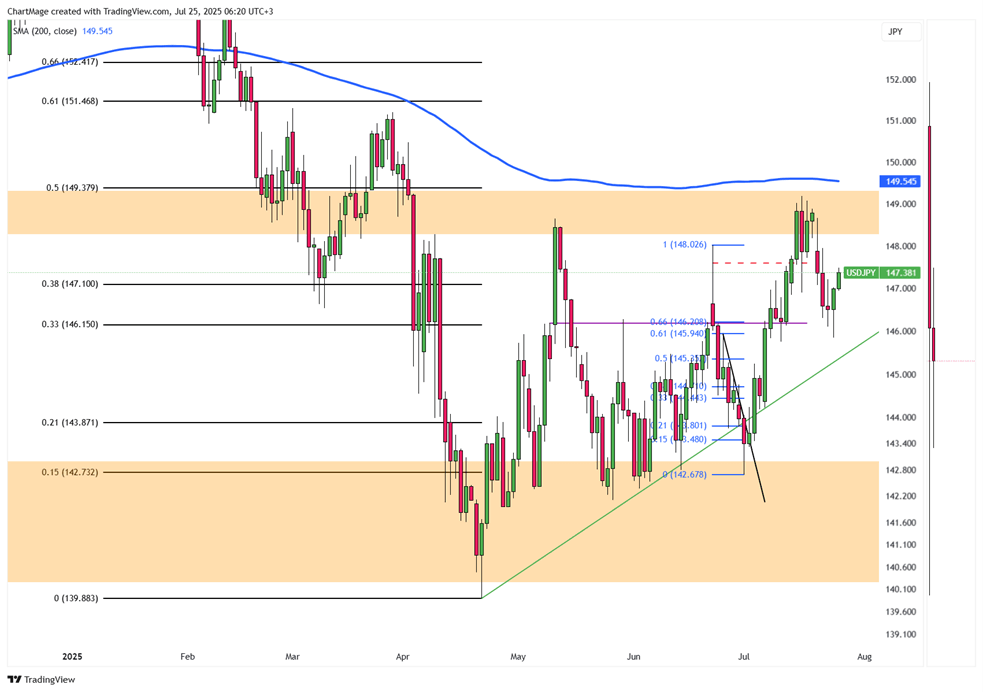

The Japanese yen pulled back for a second straight session on Friday, retreating from a two-week high against the U.S. dollar. Tokyo’s July inflation data came in softer than expected, complicating the Bank of Japan’s policy path and dampening yen sentiment. Political uncertainty around Prime Minister Ishiba further weighed on the currency.

Meanwhile, improved global risk appetite and optimism over trade developments reduced safe-haven demand, though the recent U.S.-Japan trade deal helps contain downside risk for the yen. Concerns about Fed independence may also temper dollar strength, keeping USD/JPY somewhat capped.

The pair is seeing resistance at 147.75, with support at 146.15.

| R1: 147.75 | S1: 146.15 |

| R2: 148.30 | S2: 145.30 |

| R3: 149.30 | S3: 144.65 |

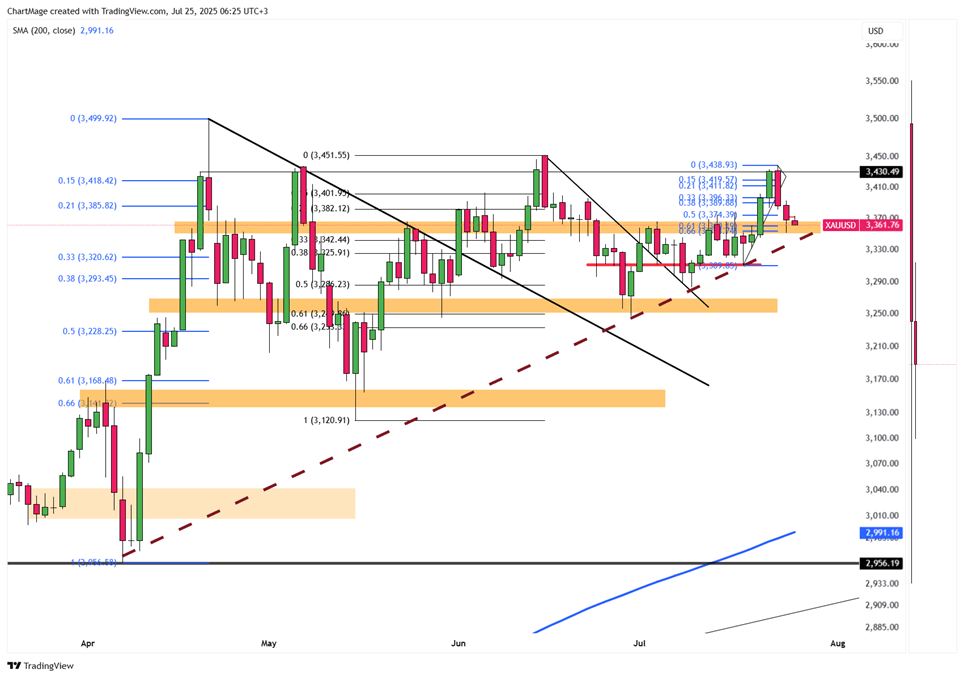

Gold remained under pressure around $3,360 per ounce on Friday, extending its two-day decline. Optimism over a possible U.S.-EU trade deal, following Washington’s recent agreement with Japan, reduced the appeal of safe-haven assets.

The U.S. labor market also showed resilience, with jobless claims declining for the sixth week, the longest streak since 2022, raising expectations that the Fed will hold rates steady next week. While tensions between Trump and Powell surfaced again, with the President criticizing Fed spending, gold still looks set to end the week with a modest 0.6% gain.

Gold is testing resistance at $3,400, with support at $3,350.

| R1: 3400 | S1: 3350 |

| R2: 3430 | S2: 3310 |

| R3: 3500 | S3: 3285 |

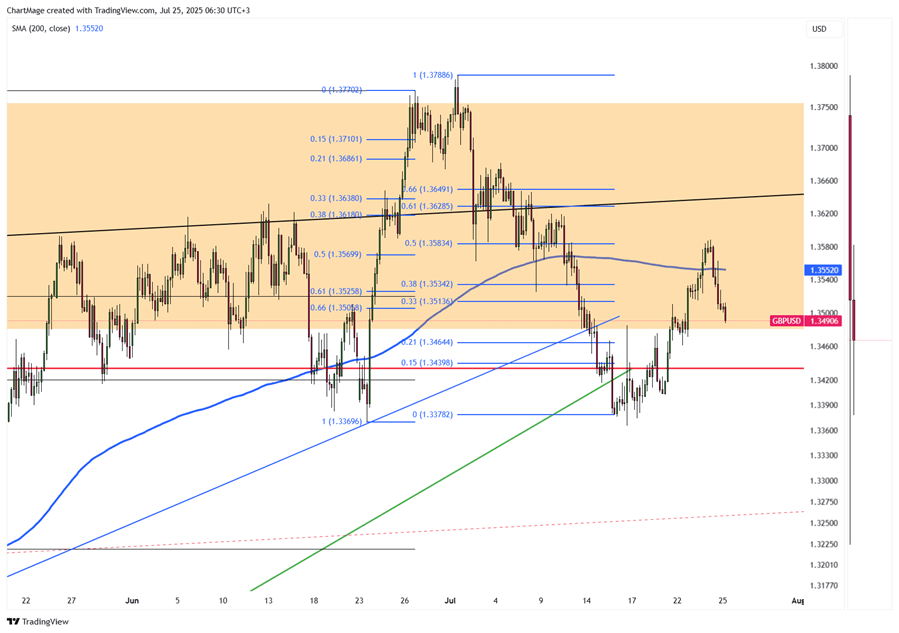

GBP/USD ended its three-day climb on Thursday, falling from 1.3600 to around 1.3500. The pair was weighed down by weak UK PMI figures for June, while the U.S. Services PMI surprised to the upside, reinforcing dollar strength.

Looking ahead, markets await UK retail sales data, which are projected to rebound 1.2% in June after a -2.7% drop in May. A stronger print could offer support and revive upside momentum for the pound heading into the weekend.

The pair faces resistance at 1.3600, with initial support at 1.3480.

| R1: 1.3600 | S1: 1.3480 |

| R2: 1.3630 | S2: 1.3270 |

| R3: 1.3680 | S3: 1.3140 |

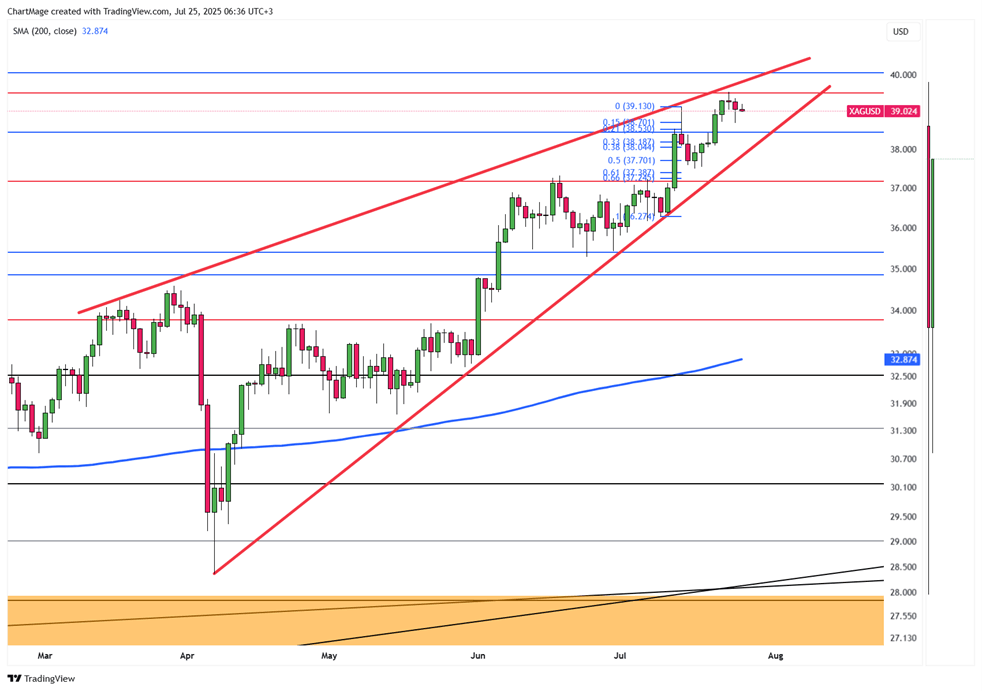

Silver held firm around $39 per ounce on Friday, supported by positive trade sentiment and a softer U.S. dollar. Markets reacted to reports that the U.S. and EU are nearing a 15% tariff agreement with potential exemptions, similar to a recent U.S.-Japan deal that avoided harsher penalties.

U.S.-China talks are expected to continue next week, potentially extending the current tariff truce. Jobless claims showed the labor market remains resilient, while the Fed is likely to hold rates steady next week with inflation concerns.

Silver faces resistance at $39.50, with support at $37.40.

| R1: 39.50 | S1: 37.40 |

| R2: 40.10 | S2: 35.50 |

| R3: 41.90 | S3: 33.90 |

Russia-Ukraine peace efforts remain stalled.

Detail Trump Pressures Fed as Dollar Slips After Cut (12.11.2025)The Federal Reserve ended 2025 with a 25-bps cut to 3.50-3.75%, maintaining guidance for one cut in 2026.

Detail Fed Day Takes Shape, Chair Decision Nears (12.10.2025)Income strategies are under pressure as lower yields reduce the appeal of short-term Treasuries, pushing investors toward riskier segments such as high yield, emerging-market debt, private credit, and catastrophe bonds.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!