Global markets are reacting to evolving trade and monetary policy signals. The euro rebounded to $1.03 on reports of phased tariff increases from Trump’s team, while the yen strengthened to 155.5 on expectations of a BOJ rate hike.

Gold climbed above $2,750 per ounce driven by safe-haven demand amid trade war fears and geopolitical uncertainty, whereas the pound weakened to $1.22 amid fiscal challenges. Silver advanced to $31.70, supported by hopes of Fed rate cuts and easing tariff pressures. Investors now await further inflation data and central bank cues to steer market direction.

| Time | Cur. | Event | Forecast | Previous |

| 12:15 | GBP | BoE Gov Bailey Speaks | | |

| 13:30 | CAD | Building Permits (MoM) (Dec) | 1.60% | -5.90% |

| 15:00 | USD | Fed Chair Powell Testifies | | |

| 20:30 | USD | FOMC Member Bowman Speaks | | |

| 20:30 | USD | FOMC Member Williams Speaks | | |

| 21:30 | USD | API Weekly Crude Oil Stock | | 5.025M |

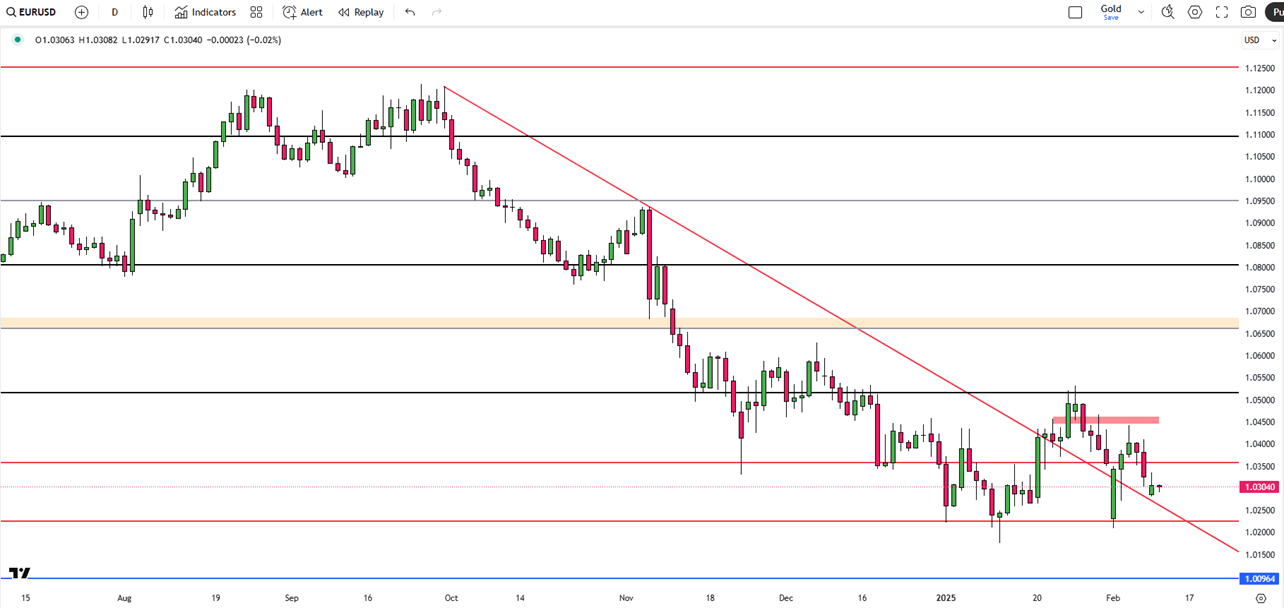

The euro fell to $1.03 as a stronger US dollar and Trump’s global steel and aluminum tariffs pressured the currency. Expectations of a widening US-Europe interest rate gap grew, with strong US jobs data supporting the Fed’s steady policy, while the ECB recently cut rates and hinted at more easing in March. Concerns over deflation from US tariffs increased bets on further ECB cuts, with markets eyeing a deposit rate of 1.87% by December. German Chancellor Scholz warned the EU could retaliate swiftly, while trade officials signaled openness to lowering the bloc’s 10% vehicle import tax to avoid a trade war.

From a technical perspective, the first resistance level is at 1.0400, with further resistance levels at 1.0460 and 1.0515 if the price breaks above. On the downside, the initial support is at 1.0275, followed by additional support levels at 1.0220 and 1.0180.

| R1: 1.0400 | S1: 1.0275 |

| R2: 1.0460 | S2: 1.0220 |

| R3: 1.0515 | S3: 1.0180 |

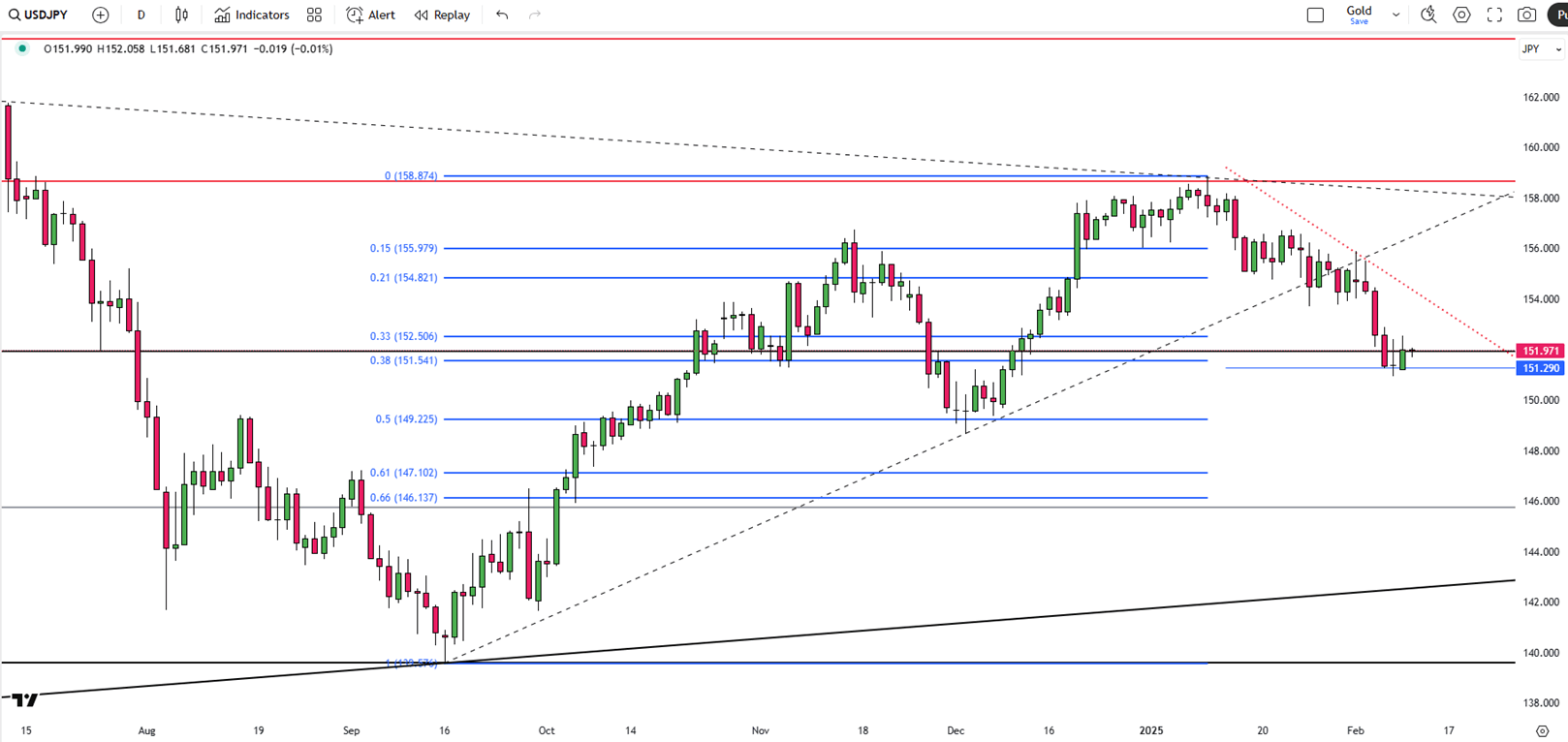

The yen held around 152 per dollar on Tuesday after a previous decline, pressured by the dollar's strength following new US tariffs. Trump’s 25% steel and aluminum tariff, imposed without exceptions, raised fears of an inflation-driven trade war, potentially limiting Fed rate cuts. The yen gained over 2% last week on expectations of more BOJ hikes. BOJ board member Naoki Tamura signaled a policy rate increase to at least 1% in fiscal 2025, while strong wage and household spending data reinforced the hawkish outlook.

The key resistance level appears to be 153.85, with a break above it potentially targeting 154.90 and 156.00. On the downside, 151.90 is the first major support, followed by 151.25 and 149.20 if the price moves lower.

| R1: 153.85 | S1: 151.90 |

| R2: 154.90 | S2: 151.25 |

| R3: 156.00 | S3: 149.20 |

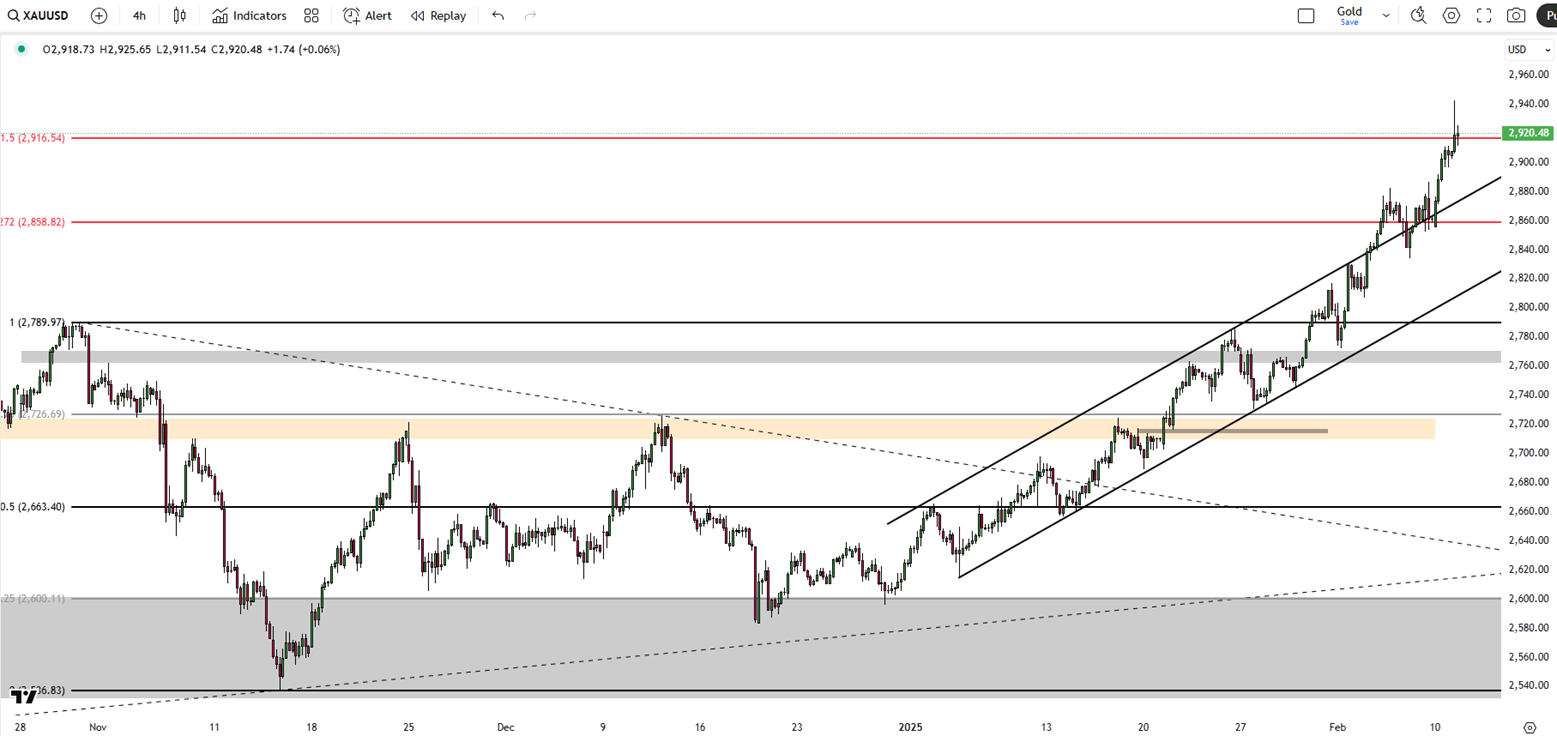

Gold held above $2,910 per ounce on Tuesday, staying near record highs as safe-haven demand grew amid trade tensions and economic uncertainty. Trump imposed broad tariffs on steel and aluminum and hinted at more this week. Geopolitical risks also rose as Hamas halted hostage releases, citing alleged Israeli ceasefire violations. Meanwhile, expectations for looser monetary policies supported gold, with markets pricing in two Fed rate cuts in 2024. The BoE and RBI recently made dovish cuts, following the ECB, Riksbank, and BoC. Central bank gold purchases, including China's third consecutive monthly increase, also supported bullion.

Technically, the first resistance level will be 2949 level. In case of this level’s breach, the next levels to watch would be 2975 and 3000. On the downside, 2885 will be the first support level. 2830 and 2760 are the next levels to monitor if the first support level is breached.

| R1: 2949 | S1: 2885 |

| R2: 2975 | S2: 2830 |

| R3: 3000 | S3: 2760 |

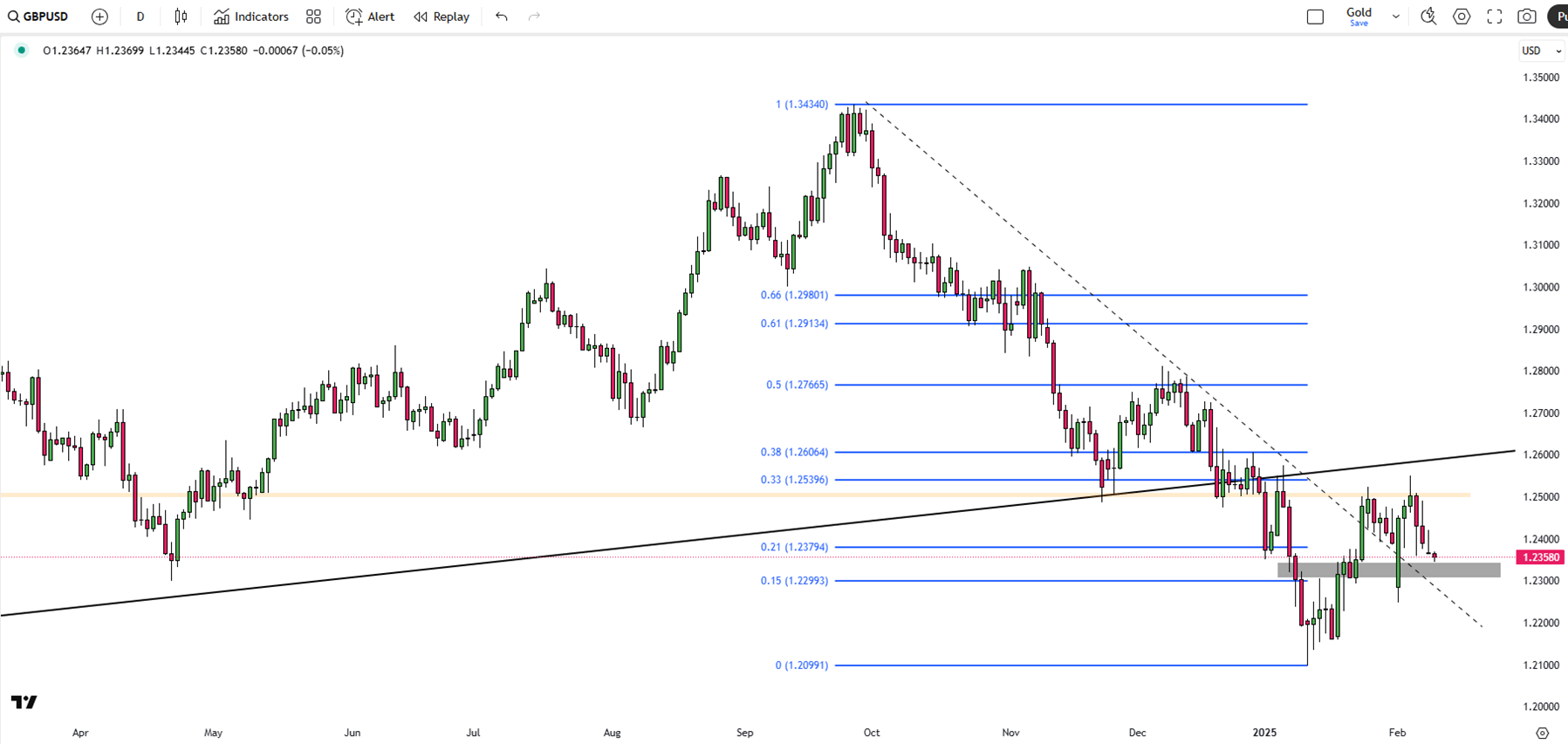

The British pound trades at 1.235 after the BoE cut rates to 4.5% and halved its growth forecast to 0.75%. Governor Bailey downplayed expectations of deeper cuts, but uncertainty persists. The BoE also raised its inflation forecast to 3.7% from 2.8%, highlighting the challenge of balancing rate cuts with price pressures. With three cuts since August, traders still expect 60bps of easing this year. Meanwhile, US markets shrugged off the latest jobs report, supporting the Fed’s stance on a strong labor market with no urgent rate adjustments.

The first resistance level for the pair will be 1.2500. In the event of this level's breach, the next levels to watch would be 1.2600 and 1.2650. On the downside 1.2340 will be the first support level. 1.2265 and 1.2100 are the next levels to monitor if the first support level is breached.

| R1: 1.2500 | S1: 1.2340 |

| R2: 1.2600 | S2: 1.2265 |

| R3: 1.2650 | S3: 1.2100 |

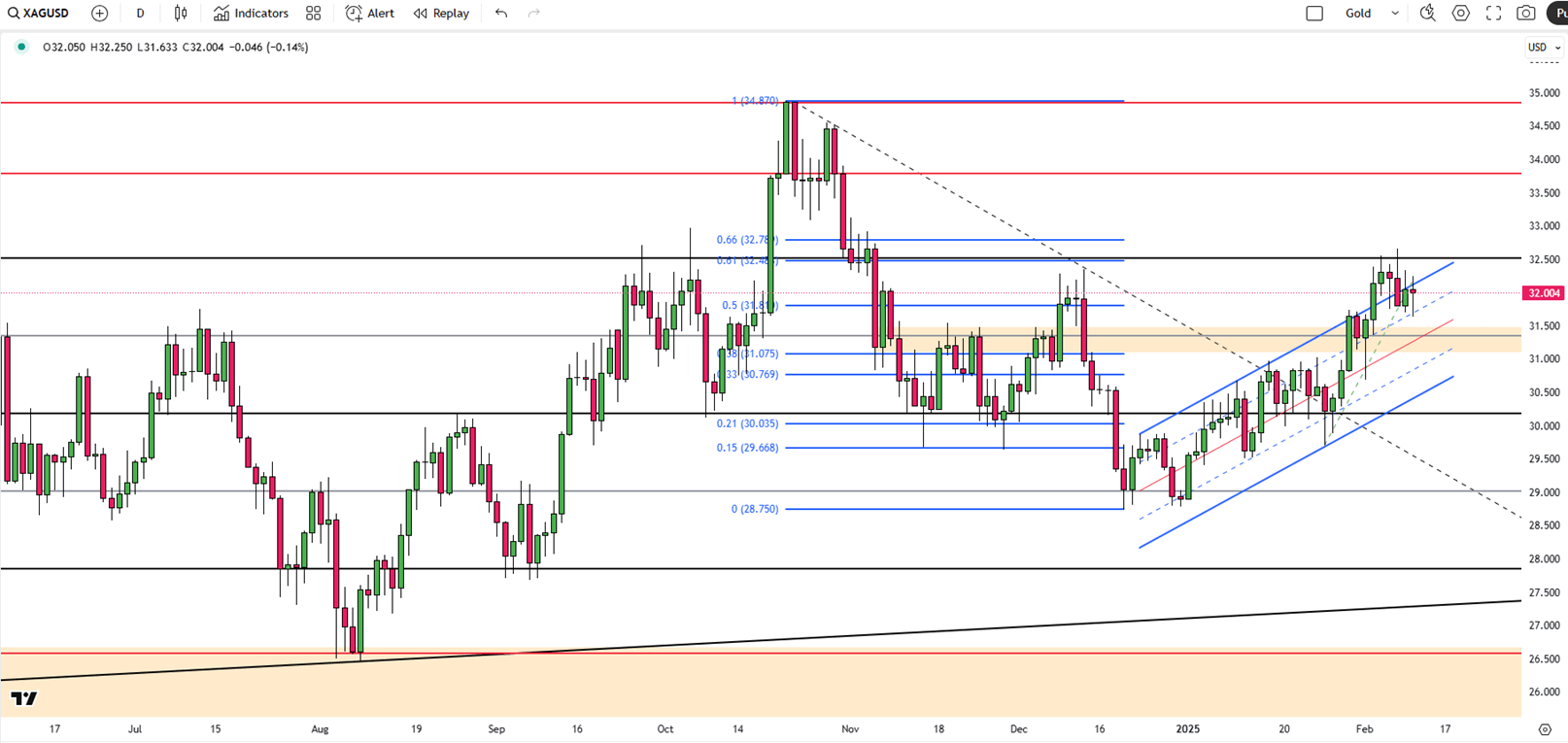

Silver trades around $31.5 per ounce on Tuesday, steady amid rising safe-haven demand after Trump’s 25% steel and aluminum tariffs, set to take effect today. More tariffs are expected midweek, while China’s retaliatory levies also begin today. German Chancellor Scholz warned the EU would respond "within an hour" to US tariffs on European goods. Silver also benefits from strong industrial demand, particularly in renewables, and ongoing supply shortages.

Technically, the first resistance level will be 32.50 level. In case of this level’s breach, the next levels to watch would be 33.00 and 33.50. On the downside, 31.80 will be the first support level. 30.90 and 30.20 are the next levels to observe if the first support level is breached.

| R1: 32.50 | S1: 31.80 |

| R2: 33.00 | S2: 30.90 |

| R3: 33.50 | S3: 30.20 |

Global markets remain dominated by geopolitical risk as escalating conflict between the United States, Israel, and Iran fuels a strong shift toward safe-haven assets. The dollar index hit 99.3 Wednesday, rising for a third day as conflict concerns fueled inflation and shifted Fed rate cut expectations from July to September.

A US court rejected Trump's tariff refund delay as the Dollar (98.5) and 10 year yield (4.04%) held gains amid Middle East escalation and inflation fears.

After Khamenei: Who Will Lead Iran Next?

After Khamenei: Who Will Lead Iran Next?Following the death of Supreme Leader Ali Khamenei, Iran has entered a pivotal transition phase. Senior officials in Tehran are acting swiftly to uphold the existing structure of the Islamic Republic, prioritizing continuity to head off potential internal instability. Despite these efforts, the sudden leadership vacuum has sparked intense political and military maneuvering behind the scenes.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!