Global markets turned cautious on Friday as risk sentiment weakened, led by a sharp drop in U.S. tech futures after Amazon’s heavy AI spending plans rattled investors.

In currencies, the euro found support after the ECB kept rates unchanged and expressed confidence in the inflation outlook, while the yen continued to weaken amid election-related fiscal concerns in Japan. Sterling slipped following a dovish-leaning Bank of England hold. In commodities, gold stabilized as softer U.S. labor data revived June rate-cut expectations, while silver remained highly volatile after a historic selloff erased its earlier gains.

| Time | Cur. | Event | Forecast | Previous |

| U.S. President Trump Speaks |

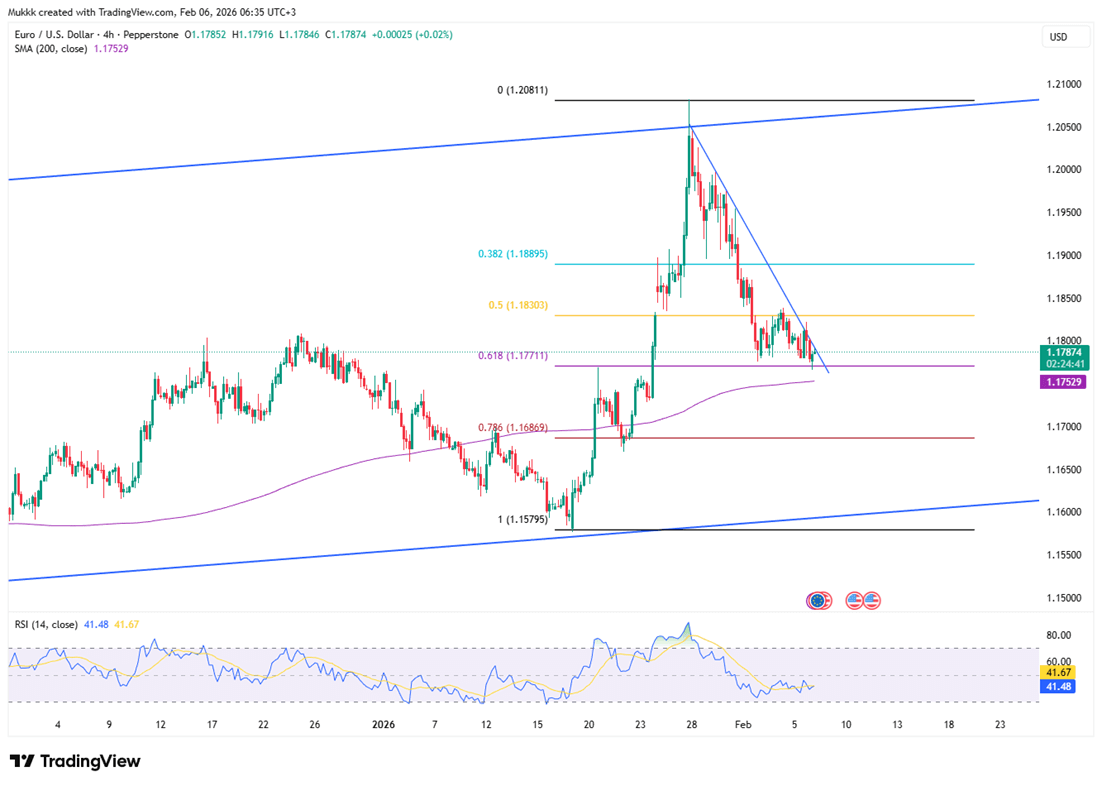

The euro traded near $1.1790 on Friday, rebounding after the European Central Bank kept interest rates unchanged. The bank expressed confidence that inflation will stabilize near its 2% target. President Lagarde described the current inflation outlook as encouraging and suggested the eurozone economy remains resilient despite global trade friction. Recent data confirmed this trend, with January inflation slowing to 1.7% and core prices easing to 2.2%, supporting the bank's steady approach.

For EUR/USD, the initial resistance is at 1.1820, while the closest support level stands at 1.1760.

| R1: 1.1820 | S1: 1.1760 |

| R2: 1.1900 | S2: 1.1720 |

| R3: 1.1970 | S3: 1.1680 |

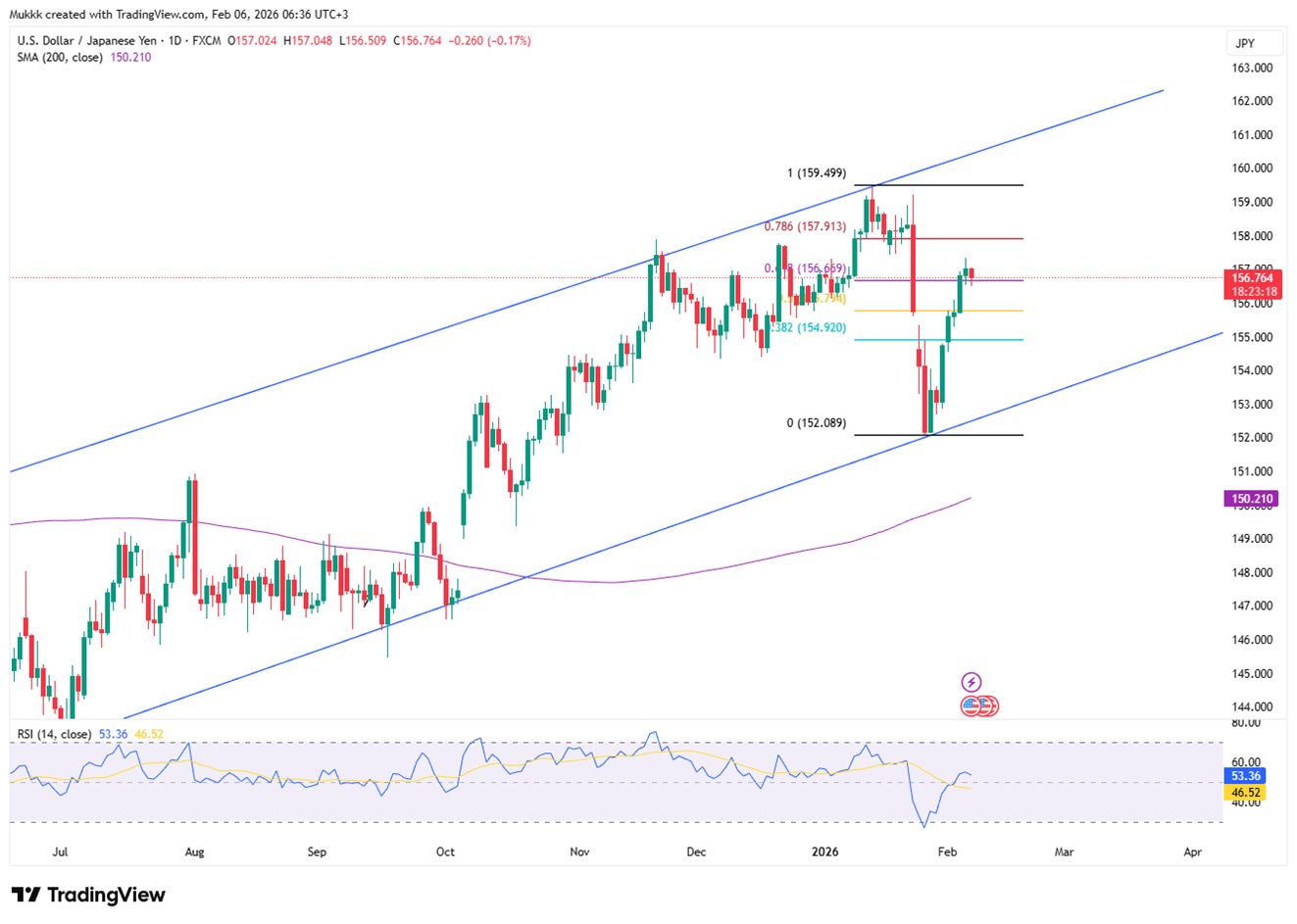

The Japanese yen traded around 156.8 per dollar on Friday, marking a weekly loss of more than 1%. Investors are increasingly nervous about Sunday’s election. There are growing expectations that Prime Minister Sanae Takaichi will introduce aggressive spending and tax cuts, which could strain Japan’s finances. As traders wait for next week’s GDP data, the gains made in January from intervention rumors have almost entirely disappeared.

Technically, resistance stands near 157.30, while support is firm at 156.20.

| R1: 157.30 | S1: 156.20 |

| R2: 158.50 | S2: 155.50 |

| R3: 159.20 | S3: 154.70 |

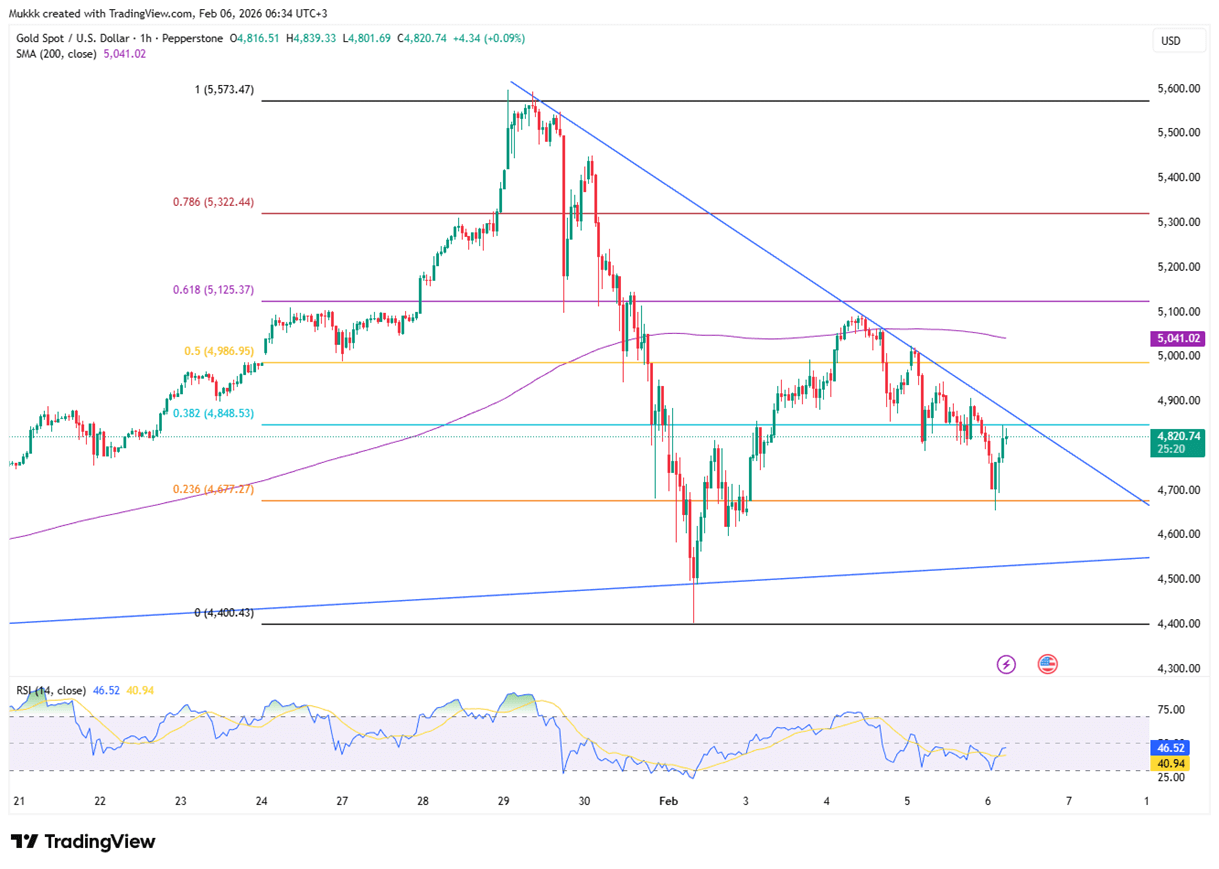

Gold stayed around $4,830 on Friday as it recovered from its recent dip. The metal has retreated from its January record highs as investors lock in profits. However, new U.S. data showing higher layoffs and jobless claims has increased the chances of a Federal Reserve rate cut in June. While tensions regarding Iran are still causing caution, they provided only a small lift to prices during today’s trading session.

Gold sees support near $4720, while resistance is around $4900.

| R1: 4900 | S1: 4720 |

| R2: 4980 | S2: 4625 |

| R3: 5090 | S3: 4550 |

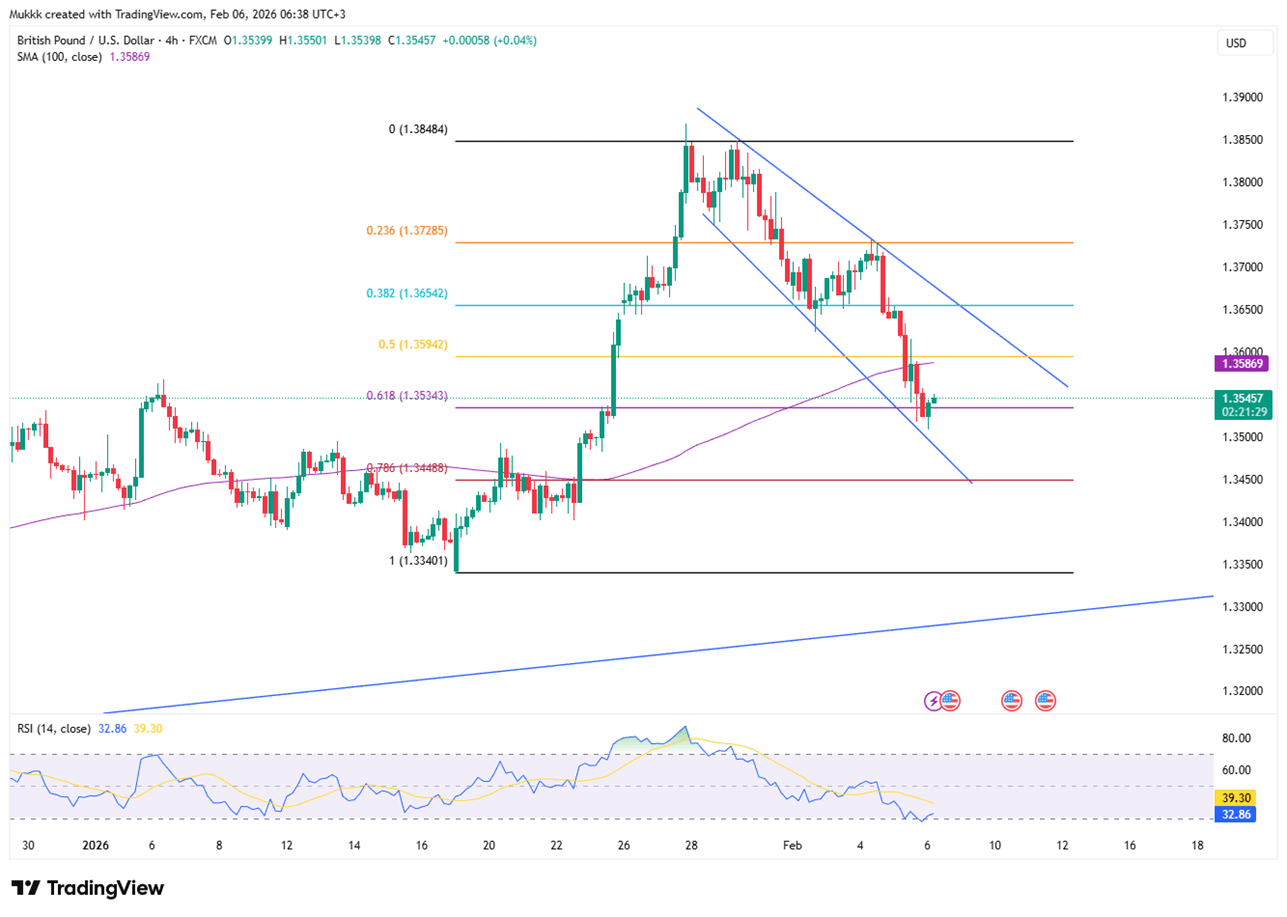

The British pound fell to roughly $1.3550 on Friday, reaching its lowest point in two weeks. This decline followed the Bank of England's decision to keep rates at 3.75%. However, the outlook was more dovish than anticipated. The vote was a tight 5–4 split, with four members already pushing for a cut. Easing inflation and weak demand, combined with local political uncertainty, continue to pressure the currency lower.

From a technical view, support stands near 1.3490, with resistance around 1.3600.

| R1: 1.3600 | S1: 1.3490 |

| R2: 1.3670 | S2: 1.3400 |

| R3: 1.3740 | S3: 1.3340 |

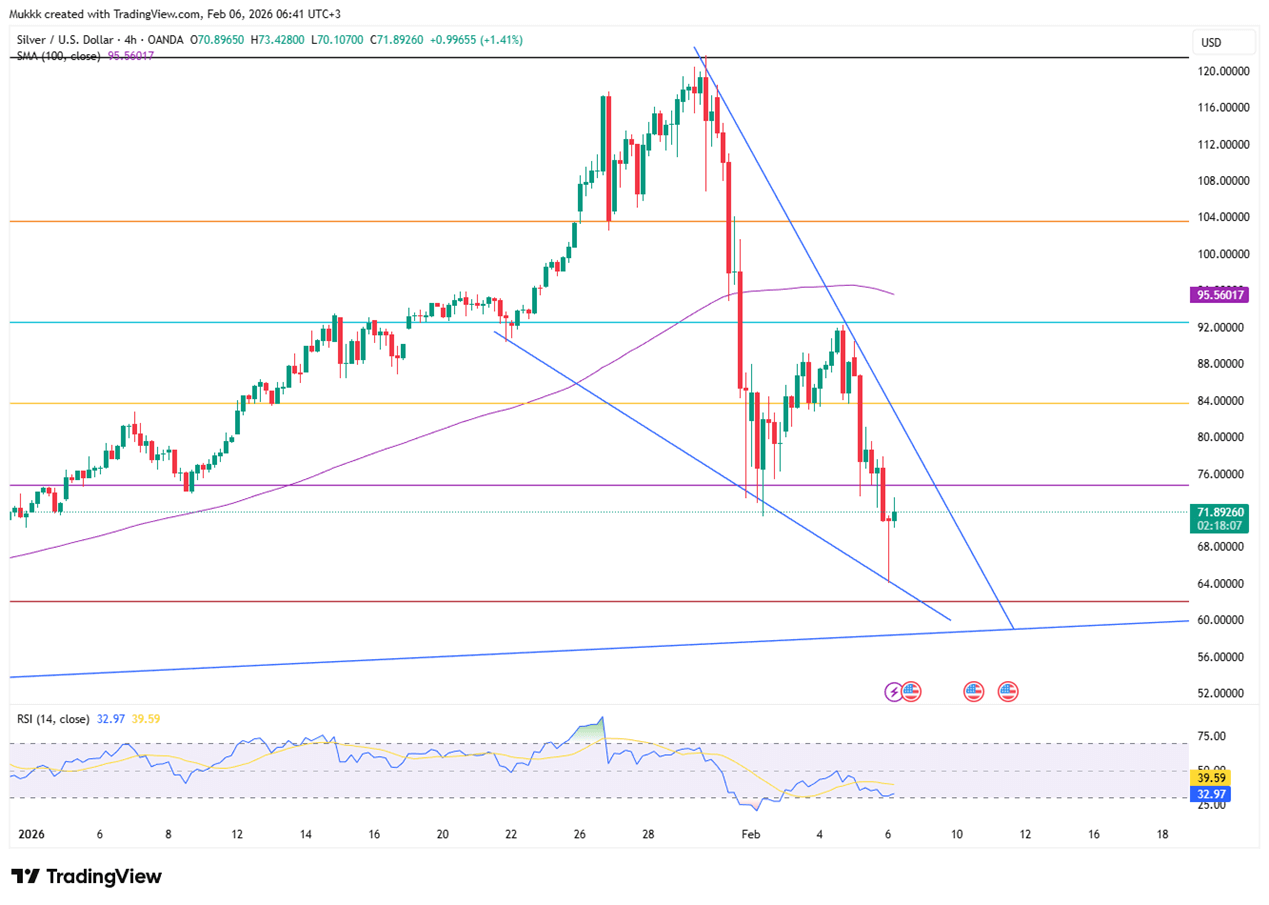

Silver dropped to nearly $64.1 on Friday before bouncing back above $70. This move came as massive deleveraging shook the market. The metal has plunged over 40% from its late-January peak, erasing all gains for the year in its sharpest decline in decades. Last month's rally was driven by geopolitical fear and speculation. However, that trend quickly collapsed as a stronger dollar and expectations of a hawkish Federal Reserve left the volatile silver market highly exposed.

From a technical view, resistance stands near $75.50 while support is located around $70.00.

| R1: 75.50 | S1: 70.00 |

| R2: 77.90 | S2: 64.50 |

| R3: 80.30 | S3: 58.50 |

A US court rejected Trump's tariff refund delay as the Dollar (98.5) and 10 year yield (4.04%) held gains amid Middle East escalation and inflation fears.

After Khamenei: Who Will Lead Iran Next?

After Khamenei: Who Will Lead Iran Next?Following the death of Supreme Leader Ali Khamenei, Iran has entered a pivotal transition phase. Senior officials in Tehran are acting swiftly to uphold the existing structure of the Islamic Republic, prioritizing continuity to head off potential internal instability. Despite these efforts, the sudden leadership vacuum has sparked intense political and military maneuvering behind the scenes.

Detail March Starts With Geopolitical Turmoil (2-6 March)

March Starts With Geopolitical Turmoil (2-6 March)Global markets began the week in a state of high alert following coordinated US and Israeli strikes on Iran over the weekend, which resulted in the death of Supreme Leader Ayatollah Ali Khamenei.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!