On June 6, global markets were mixed as investors awaited the U.S. nonfarm payrolls report and kept a close eye on geopolitical tensions.

U.S. equities dipped, driven by a sharp decline in Tesla shares following a high-profile clash between Elon Musk and President Trump. European and Asian markets reflected cautious optimism, while gold rose on safe-haven demand and oil prices edged lower. The U.S. dollar weakened, boosting the euro and British pound.

| Time | Cur. | Event | Forecast | Previous |

| 09:00 | EUR | GDP (YoY) | 1.2% | 1.2% |

| 09:00 | EUR | GDP (QoQ) (Q1) | 0.3% | 0.2% |

| 12:30 | USD | Average Hourly Earnings (MoM) (May) | 0.3% | 0.2% |

| 12:30 | USD | Nonfarm Payrolls (May) | 127K | 177K |

| 12:30 | USD | Unemployment Rate (May) | 4.2% | 4.2% |

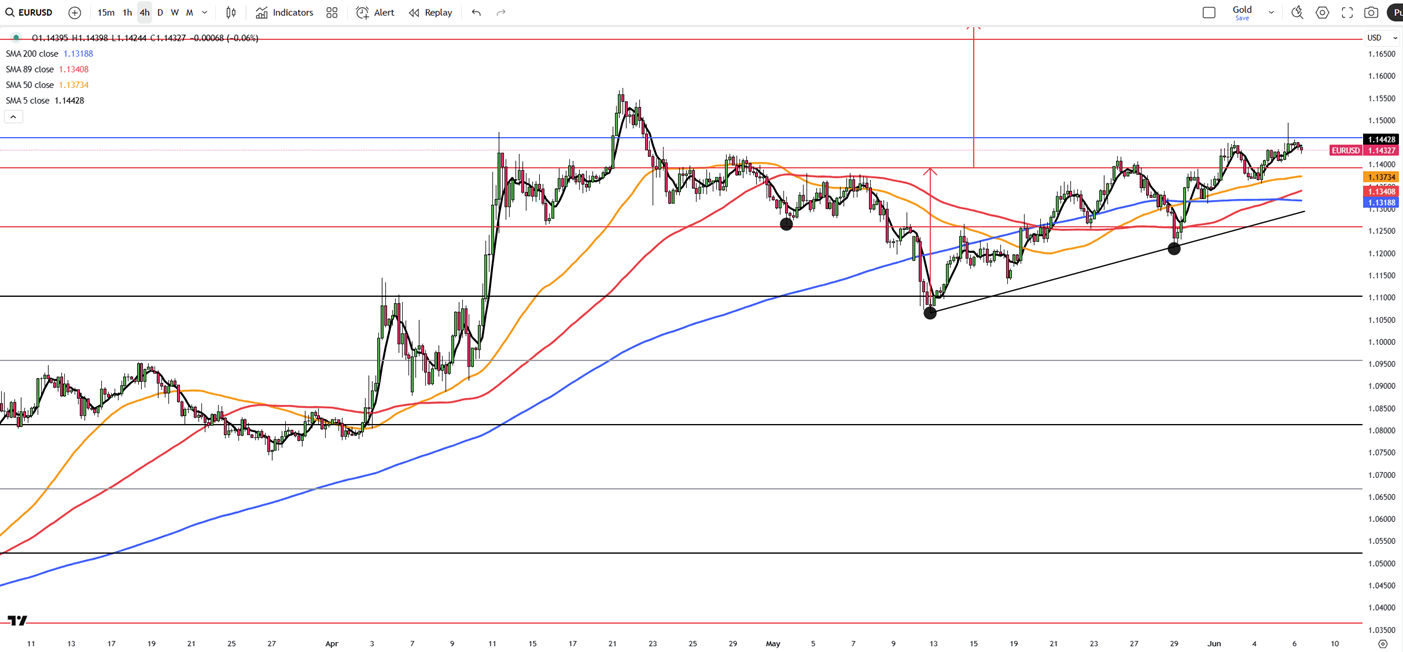

The euro remained firm above 1.144, supported by a weaker dollar and the ECB’s widely expected rate cut. President Lagarde hinted the bank may be nearing the end of its easing cycle. Updated forecasts show headline inflation averaging 2.0% in 2025, dropping to 1.6% in 2026, and returning to 2.0% by 2027, revised downward due to falling energy prices and a stronger euro. Core inflation projections were mostly unchanged. GDP growth is projected to rise gradually from 0.9% in 2025 to 1.3% in 2027.

The key resistance is at 1.1460, while the first support stands at 1.1320.

| R1: 1.1460 | S1: 1.1320 |

| R2: 1.1500 | S2: 1.1260 |

| R3: 1.1580 | S3: 1.1210 |

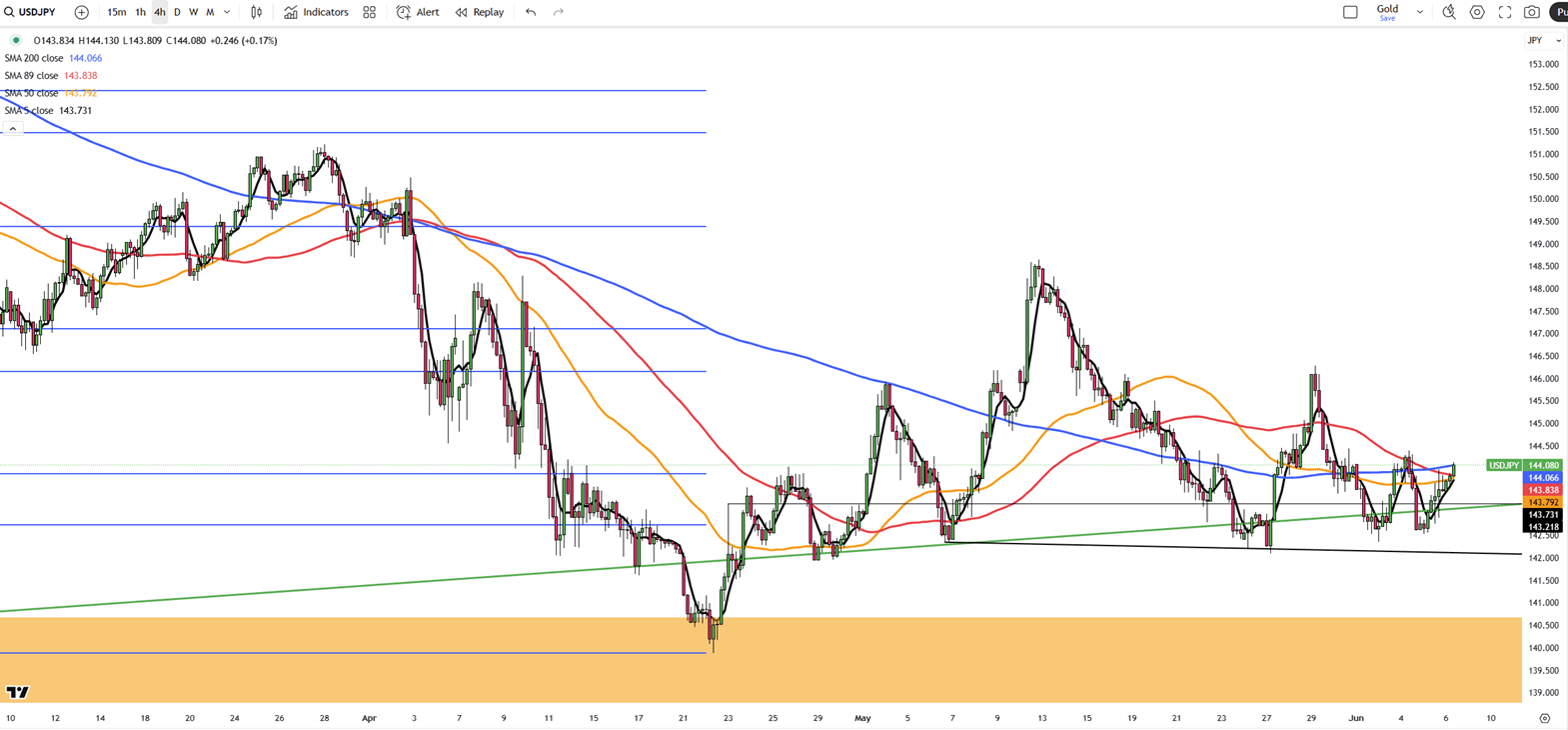

The Japanese yen slipped toward 144 per dollar on Friday as markets remained cautious ahead of the U.S. nonfarm payrolls report. A phone call between Presidents Trump and Xi revived trade talks but produced no concrete results. Meanwhile, Japan’s household spending declined in April with rising prices, pressuring the BOJ Governor Ueda reaffirmed the bank’s readiness to raise rates if conditions allow.

Resistance is seen at 144.40, while support lies at 142.50.

| R1: 144.40 | S1: 142.50 |

| R2: 144.70 | S2: 142.10 |

| R3: 146.10 | S3: 141.50 |

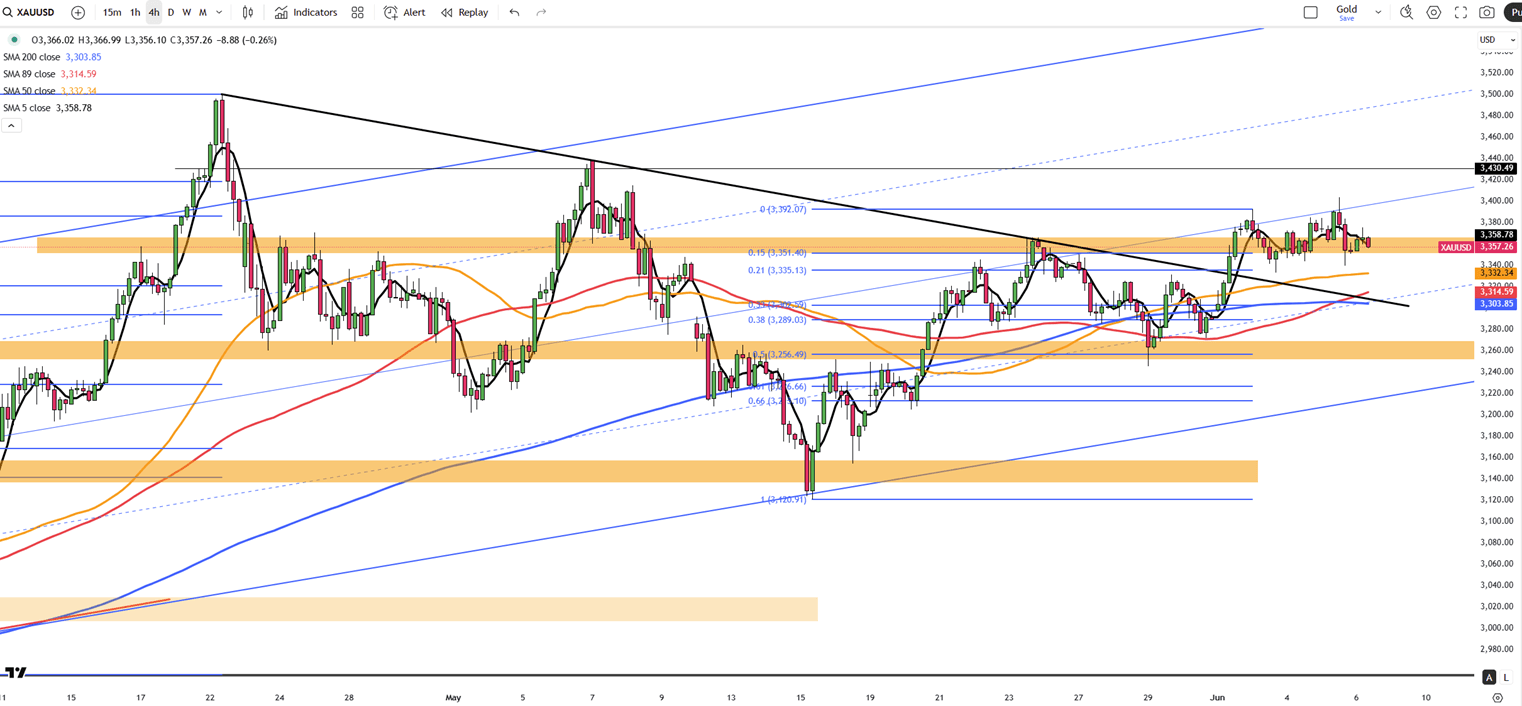

Gold climbed to around $3,360 per ounce on Friday, rebounding after Thursday’s dip. Demand increased following weak U.S. data and dovish signals from the Fed ahead of the NFP report. Jobless claims hit their highest since October 2024, Q1 productivity was revised down, and services sector data surprised with a contraction. A narrower trade deficit suggested weaker imports. Optimism over resumed U.S.-China trade talks limited further gains, though no firm outcomes were reached. Gold is on track for a 2% weekly rise.

The first resistance is at $3,392, with initial support at $3,320.

| R1: 3392 | S1: 3320 |

| R2: 3435 | S2: 3290 |

| R3: 3500 | S3: 3250 |

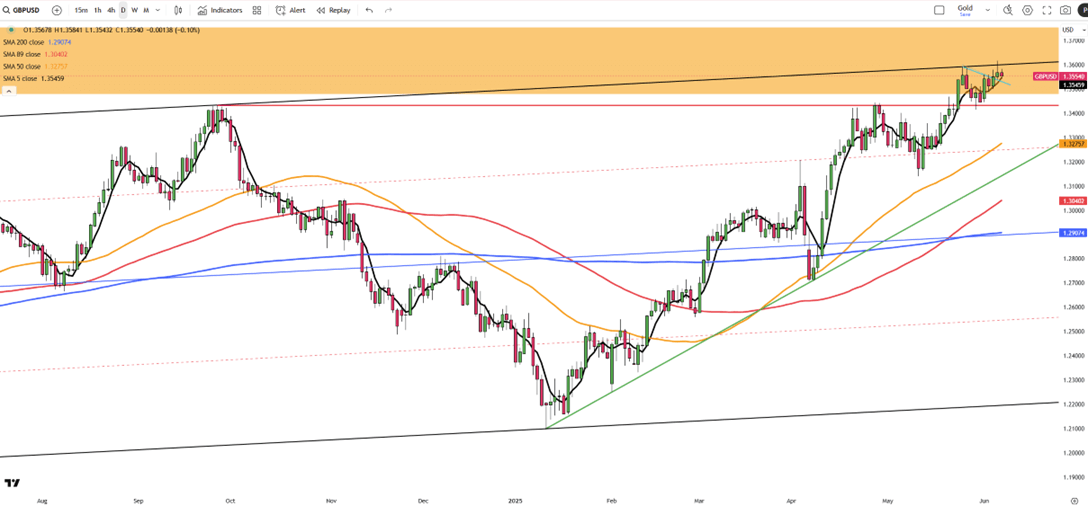

Sterling traded around $1.3576 on June 6, hovering near a three-year high. Support came from the UK’s exemption from U.S. steel and aluminum tariffs and the Bank of England’s cautious stance amid ongoing inflation concerns. The dollar weakened following soft U.S. economic data and rising trade uncertainty. Traders are now focused on the U.S. jobs report for further direction.

The first resistance is at 1.3600, while key support is at 1.3425.

| R1: 1.3600 | S1: 1.3425 |

| R2: 1.3750 | S2: 1.3165 |

| R3: 1.3850 | S3: 1.2890 |

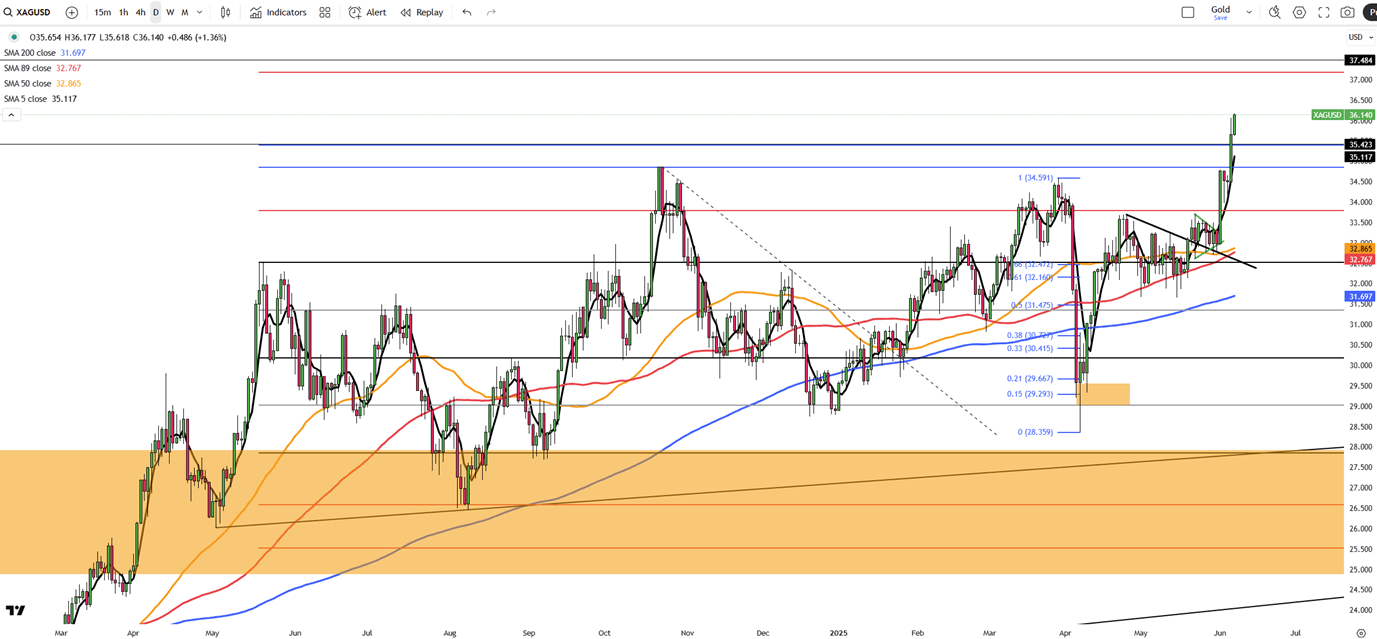

Silver surged to $36 per ounce on Friday, its highest level since February 2012, driven by weak U.S. data and rising expectations of a Fed rate cut in September. Higher jobless claims, weak private hiring, and a surprise contraction in services signaled labor market softness, prompting safe-haven flows. Geopolitical concerns added pressure, as Trump doubled tariffs on steel and aluminum imports to 50%, despite resuming trade talks with Xi.

Resistance is seen at 36.50, while support stands at 35.40.

| R1: 36.50 | S1: 35.40 |

| R2: 37.20 | S2: 34.85 |

| R3: 37.50 | S3: 33.80 |

Global markets remained dominated by dollar strength as geopolitical tensions and rising energy prices reshaped monetary expectations.

Oil Tanker Attacks Create Volatility

Oil Tanker Attacks Create VolatilityRecent strikes on oil tankers in the Persian Gulf have exposed the extreme vulnerability of global energy supplies. Footage of burning vessels near the Iraqi coastline has saturated financial media, serving as a reminder to market participants of the risks inherent in the region. Whenever tensions escalate in this region, energy traders immediately begin pricing in the possibility of supply disruptions.

Detail Dollar Leads as Markets Reprice Risk (03.12.2026)Currency markets remained under pressure as energy-driven inflation concerns and ongoing geopolitical tensions continued to support the U.S. dollar.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!