Traders await Trump-Putin talks, US CPI data, and central bank signals, with major currencies, gold, and silver seeing measured moves.

The euro hovered near $1.16 as traders awaited Friday’s Trump-Putin meeting on the Ukraine conflict and US CPI data for Fed policy clues, while the yen stayed range-bound with diverging BoJ-Fed outlooks. Gold eased to $3,350 after a US tariff exemption calmed import cost fears, and silver dipped to $37.7 on profit-taking ahead of inflation data. The pound consolidated following the BoE’s narrow rate cut to 4%, with markets pricing a 76% chance of another move in December.

| Time | Cur. | Event | Forecast | Previous |

| 12:30 | USD | Core CPI (MoM) (Jul) | 0.3% | 0.2% |

| 12:30 | USD | CPI (MoM) (Jul) | 0.2% | 0.3% |

| 12:30 | USD | CPI (YoY) (Jul) | 2.8% | 2.7% |

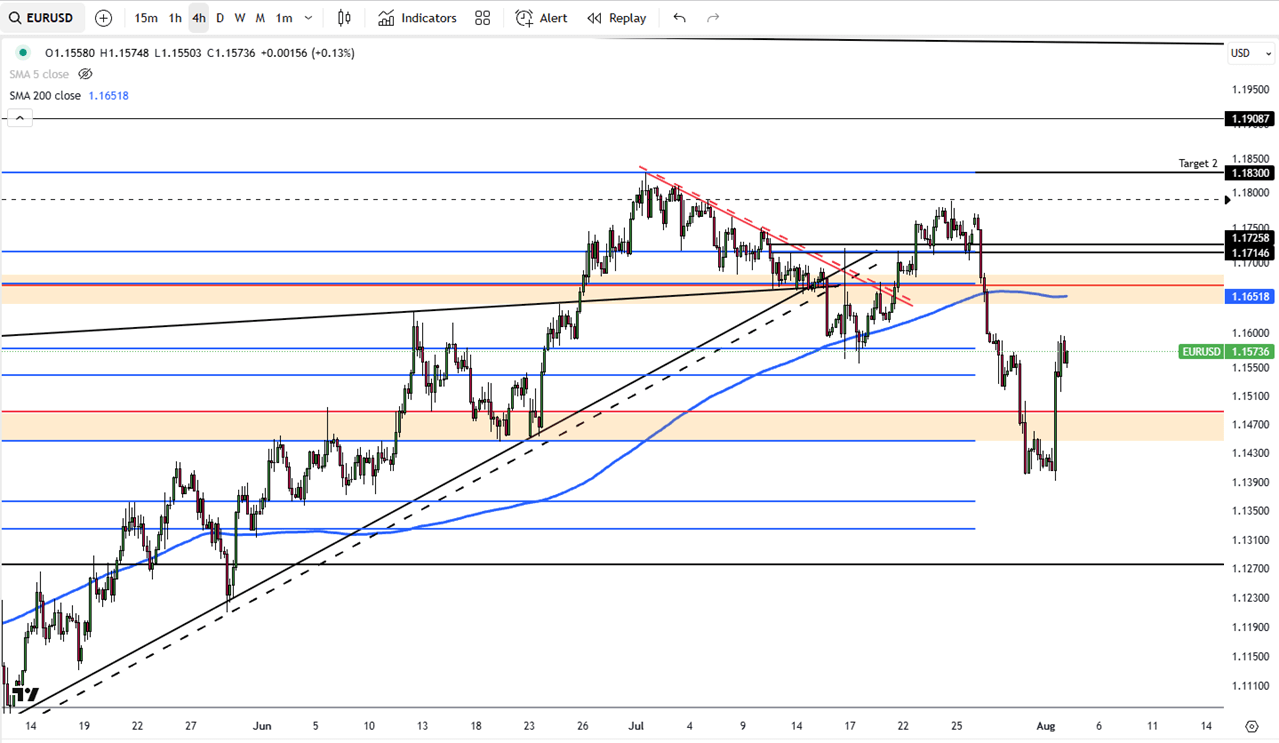

In mid-August, the euro hovered near $1.16, just shy of its July 2021 high, as traders weighed economic, political, and monetary developments. Attention is now fixed on Friday’s planned meeting between US President Trump and Russian President Putin, expected to address the Ukraine conflict. Reports suggest Ukrainian President Zelenskyy will not attend.

In the US, weaker payroll figures and a soft ISM Services PMI have reinforced expectations for Federal Reserve rate cuts. Investors are now awaiting US CPI data at 12:30 GMT for further policy signals.

EUR/USD is targeting resistance at 1.1725, with support at 1.1550.

| R1: 1.1725 | S1: 1.1550 |

| R2: 1.1795 | S2: 1.1500 |

| R3: 1.1830 | S3: 1.1350 |

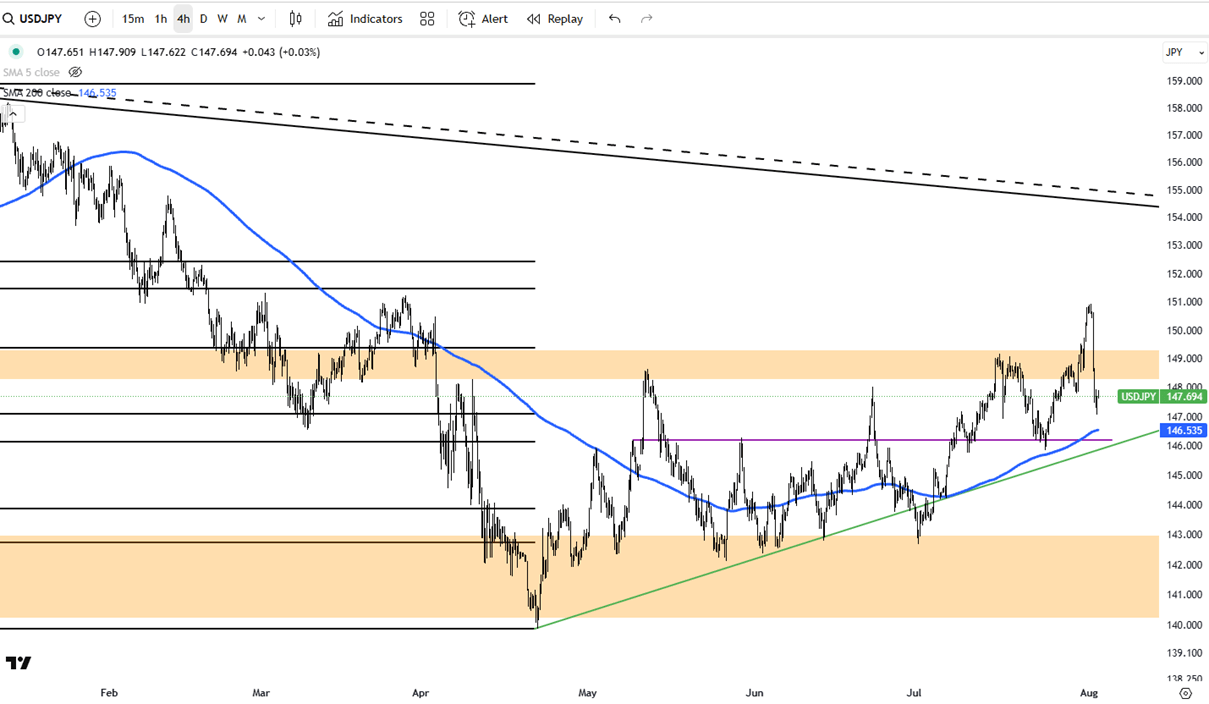

During Monday’s early European trade, the Japanese yen moved within a narrow range against the US dollar, caught between rising risk appetite and uncertainty over the Bank of Japan’s next rate hike. While the BoJ’s cautious tone has tempered speculation of imminent tightening, differences between BoJ and Fed policy paths have kept traders from pushing the yen significantly lower.

USD/JPY faces resistance at 149.00, with support at 147.00.

| R1: 149.00 | S1: 147.00 |

| R2: 151.50 | S2: 143.00 |

| R3: 152.40 | S3: 140.00 |

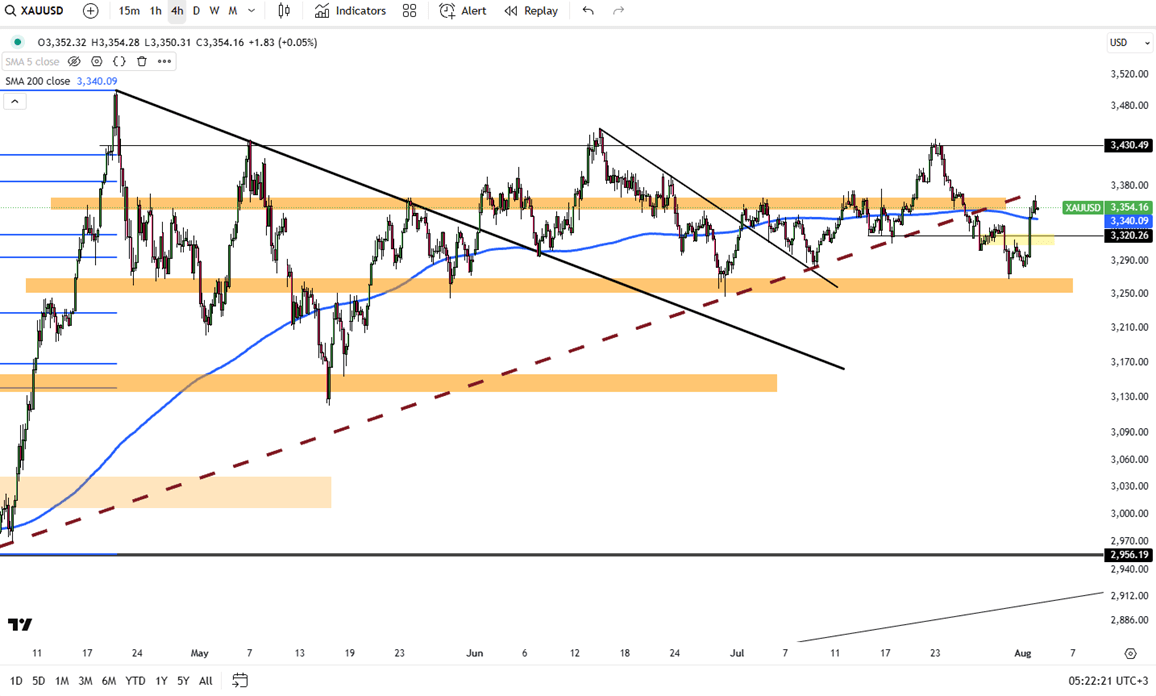

Gold eased after Trump confirmed the metal would be exempt from tariffs, easing concerns over higher import costs. Previously, US Customs had proposed a 39% tariff on 1-kilogram and 100-ounce Swiss gold bars, which would have also applied to imports from other countries under current US rules. Trump also extended the 90-day trade deal deadline with China, increasing risk sentiment before his August 15 meeting with Putin.

Gold is testing resistance at $3,400, with support at $3,320.

| R1: 3400 | S1: 3320 |

| R2: 3460 | S2: 3270 |

| R3: 3500 | S3: 3230 |

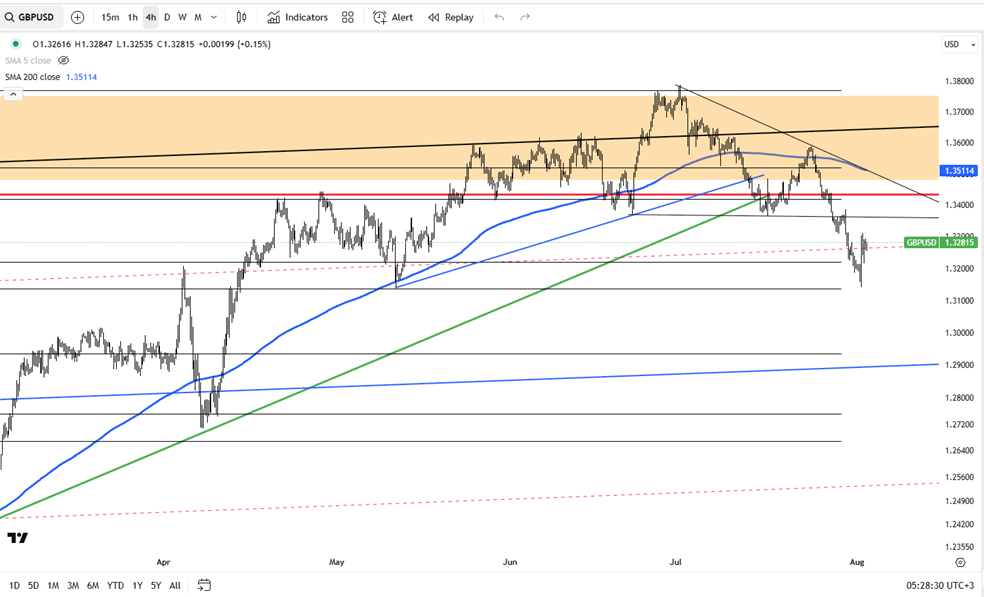

The British pound eased from last week’s high of $1.345 as markets await UK labor and GDP figures. The Bank of England recently cut rates by 25 bps to 4% in a narrow vote, with four MPC members opposed, signaling that further easing could slow with sticky inflation. Traders currently price a 76% chance of another cut in December.

GBP/USD is seeing resistance at 1.3530, with initial support at 1.3340.

| R1: 1.3350 | S1: 1.3340 |

| R2: 1.3590 | S2: 1.3260 |

| R3: 1.3650 | S3: 1.3000 |

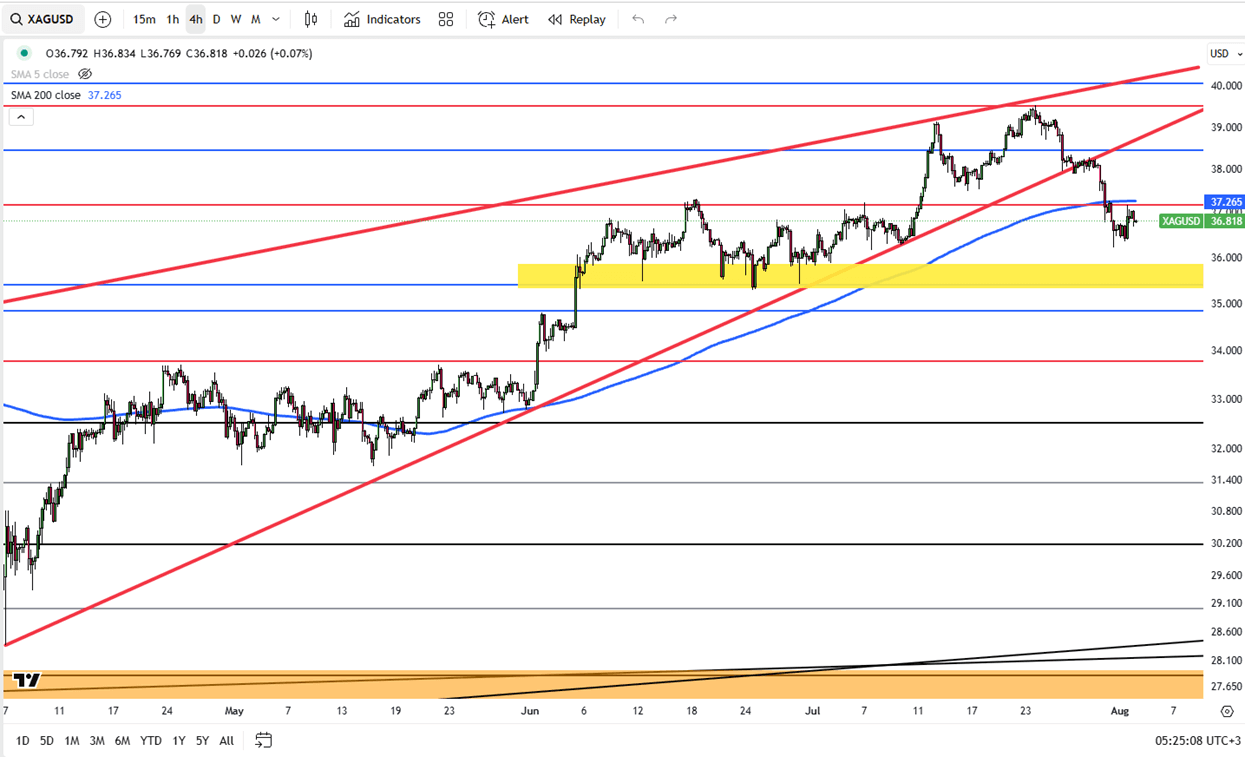

Silver dipped to $37.7 per ounce, trimming last week’s gains as investors booked profits before the US inflation data. Markets are increasingly confident of a September Fed rate cut, with another move in December also in play, amid signs of a softer labor market.

Silver is testing resistance at $39.00, with support at $36.50.

| R1: 39.00 | S1: 36.50 |

| R2: 40.50 | S2: 35.50 |

| R3: 41.20 | S3: 33.90 |

Markets traded cautiously ahead of key inflation data and amid ongoing trade and geopolitical uncertainty.

Markets remained cautious as a new 10% U.S. global tariff weighed on risk sentiment. The euro and pound stayed under pressure near recent lows, while the yen rebounded on renewed speculation around Bank of Japan tightening.

Global markets remained cautious as a new 10% U.S. global tariff came into force, keeping trade uncertainty at the center of investor focus.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!