The focus is on the cautious market sentiment as major currencies and metals respond to potential inflationary pressures from a possible second Trump term and key U.S. data releases.

With CPI, PPI, and retail sales reports on the horizon, as well as Fed Chair Powell's upcoming speech, traders are closely watching for signals that could shape the outlook for rate cuts. The EUR/USD remains near a one-year low, while the yen weakens and gold gains modestly amid evolving inflation expectations.

| Time | Cur. | Event | Forecast | Previous |

| 09:45 | GBP | BoE MPC Member Mann | - | - |

| 13:30 | USD | Core CPI (MoM) (Oct) | 0.3% | 0.3% |

| 13:30 | USD | Core CPI (YoY) (Oct) | 3.3% | 3.3% |

| 13:30 | USD | FOMC Member Kashkari Speaks | - | - |

| 13:30 | USD | CPI (MoM) (Oct) | 0.2% | 0.2% |

| 13:30 | USD | CPI (YoY) (Oct) | 2.6% | 2.4% |

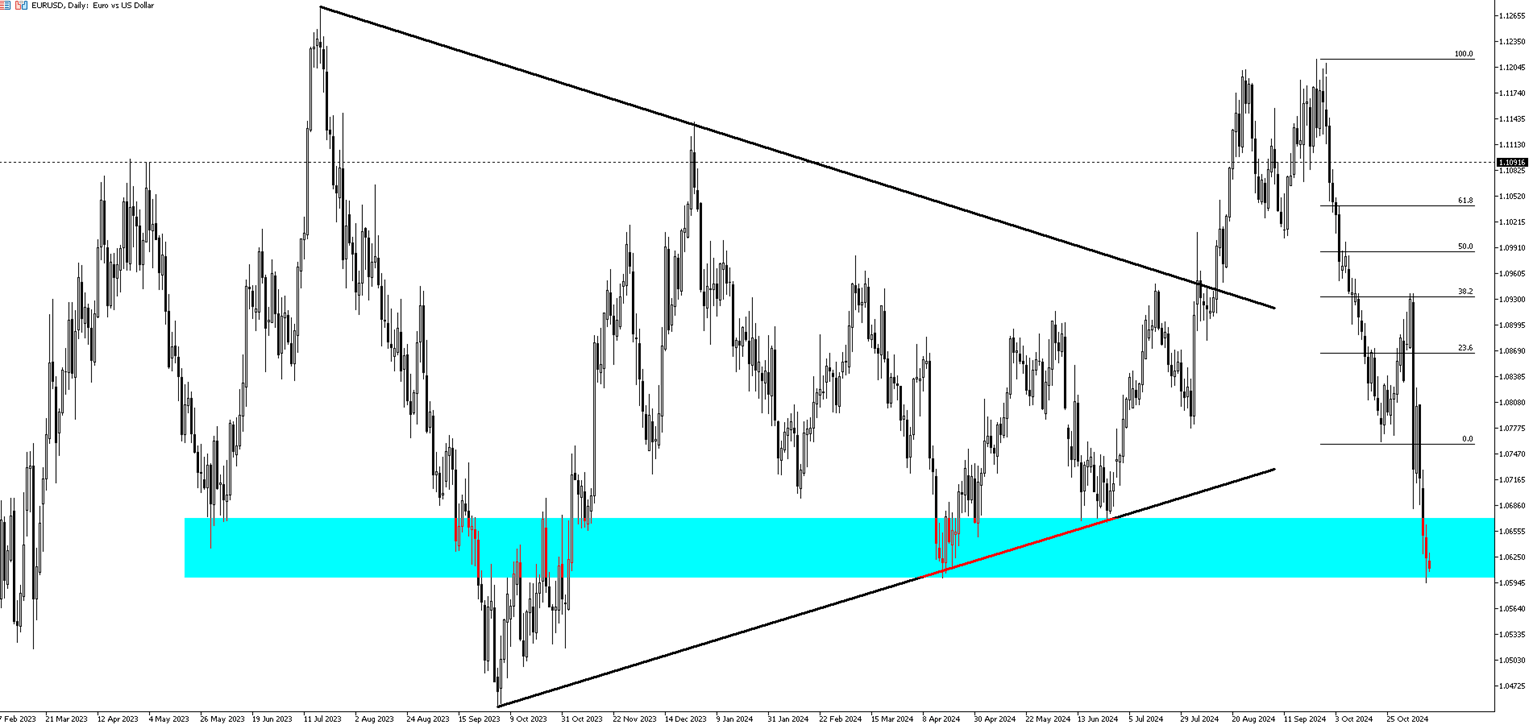

The EUR/USD traded around 1.0610 on Wednesday, while the dollar index held near a six-month high at 105.9, as investors awaited key U.S. economic data. The October CPI report, due soon, could shape expectations for Fed rate cuts, with additional attention on Thursday's PPI report, Friday's retail sales, and a speech from Fed Chair Powell. The dollar remains strong, fueled by "Trump trades" betting on inflationary policies under a possible second term, which could limit Fed rate cuts. Currently, markets see a 60% chance of a December rate cut, down from 84.4% last month. The euro has dropped to a one-year low.

EUR/USD resistance levels are 1.0650, 1.0700, and 1.0750; support is at 1.0590, with further levels at 1.0550 and 1.0500.

| R1: 1.0650 | S1: 1.0590 |

| R2: 1.0700 | S2: 1.0550 |

| R3: 1.0750 | S3: 1.0500 |

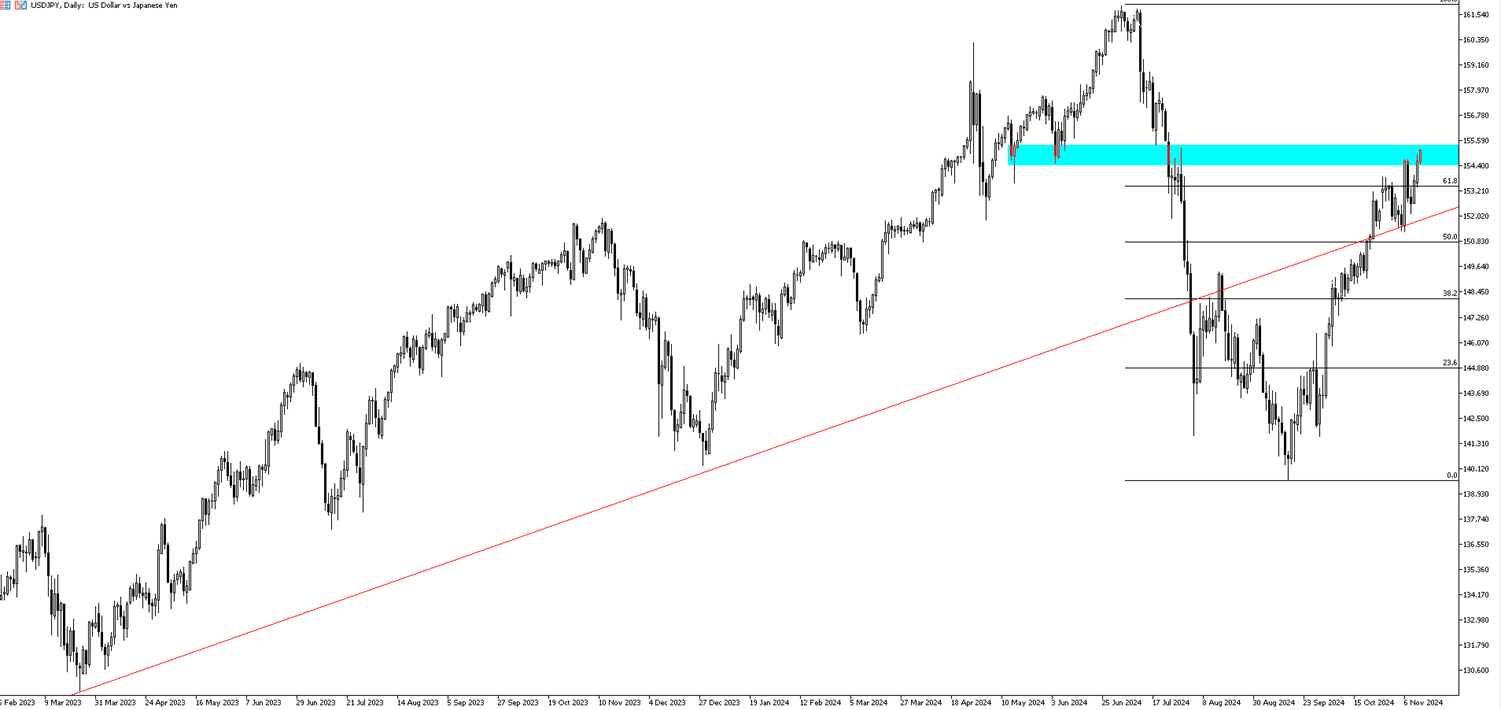

The Japanese yen weakened toward 155 per dollar, hitting a three-month low as the U.S. dollar gained on "Trump trades" that anticipate inflationary policies limiting Fed rate cuts. Japan’s producer prices surged in October, marking the largest rise in 14 months and highlighting inflation pressures. Investors await Friday's Q3 GDP data for further economic insights. Meanwhile, Bank of Japan meeting minutes showed policymakers divided on future rate hikes, though the bank maintains a 1% rate target by late 2025.

For USD/JPY, support levels are at 154.50 (200-day moving average), 153.40, and 152.30, while resistance is at 155.30, 156.00, and 156.50.

| R1: 155.30 | S1: 154.50 |

| R2: 156.00 | S2: 153.40 |

| R3: 156.50 | S3: 152.30 |

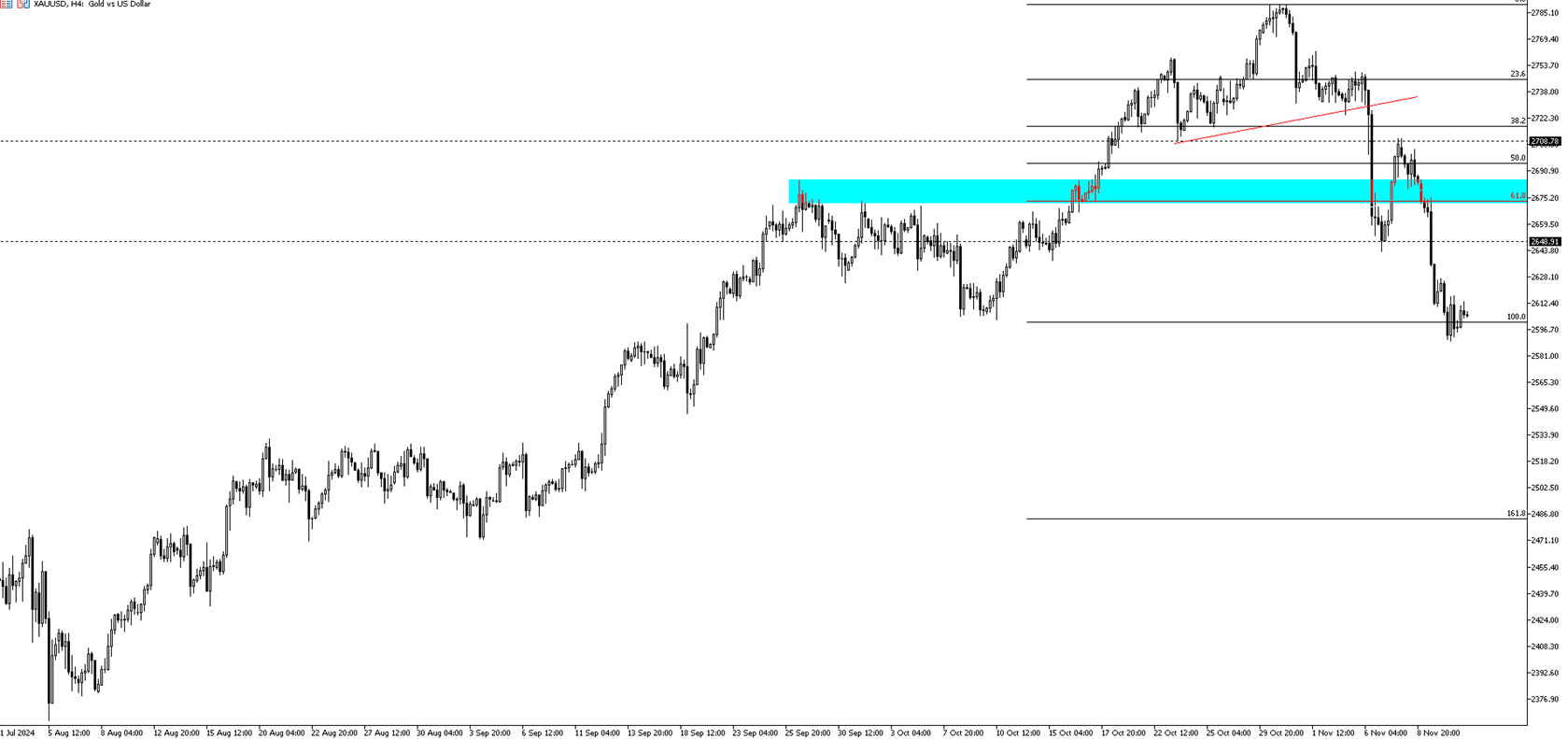

Gold rose to around $2,610 per ounce on Wednesday, rebounding slightly from a two-month low as investors focused on key U.S. economic data for Fed policy clues. This week’s reports include consumer inflation, PPI, jobless claims, and retail sales. Expectations for Fed rate cuts have waned, with a December cut probability now at 60%, down from 80% before last week’s election, due to potential inflationary tariffs under Trump’s administration. Meanwhile, global gold ETFs saw outflows of $809 million in early November, mainly from North America, partly offset by inflows from Asia.

Gold’s support levels are $2,600, $2,550, and $2,500; resistance levels are $2,615, $2,655, and $2,685.

| R1: 2615 | S1: 2600 |

| R2: 2655 | S2: 2550 |

| R3: 2685 | S3: 2500 |

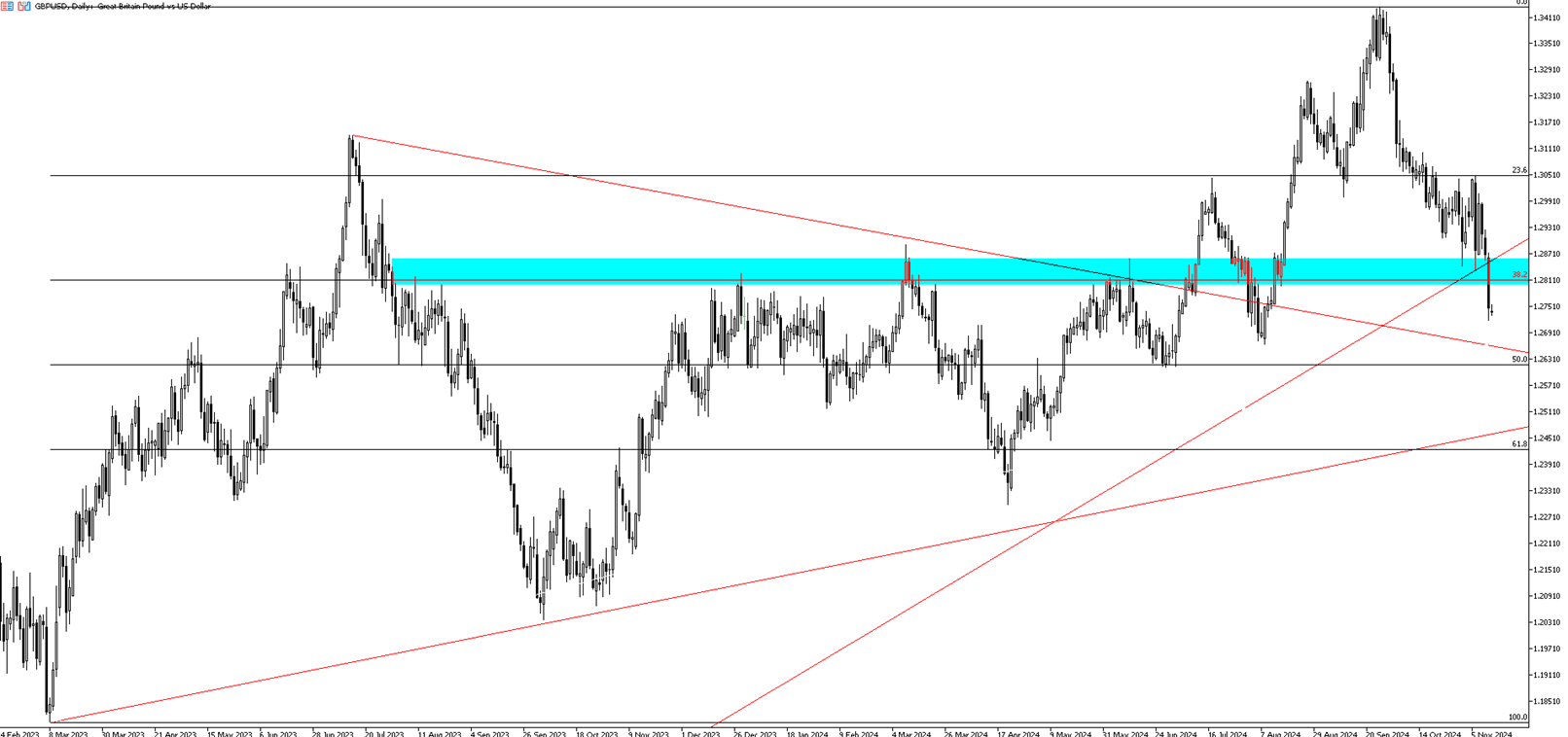

The British pound dropped to $1.2740, a three-month low, as the dollar strengthened amid expectations that Trump’s policies could increase inflation, limiting Fed rate cuts. In the UK, labor data supported the Bank of England’s cautious stance on rate cuts. Regular pay growth, excluding bonuses, eased to 4.8% in the three months to September, while total pay growth rose. However, unemployment climbed to 4.3%, and job vacancies hit their lowest since May 2021. Last week, the Bank of England cut rates by 25 basis points and maintained a cautious outlook. Key UK data, including Q3 GDP, is expected this week.

GBP/USD support levels are 1.2700, 1.2650, and 1.2600; resistance levels are 1.2800, 1.2830, and 1.2880.

| R1: 1.2800 | S1: 1.2700 |

| R2: 1.2830 | S2: 1.2650 |

| R3: 1.2880 | S3: 1.2600 |

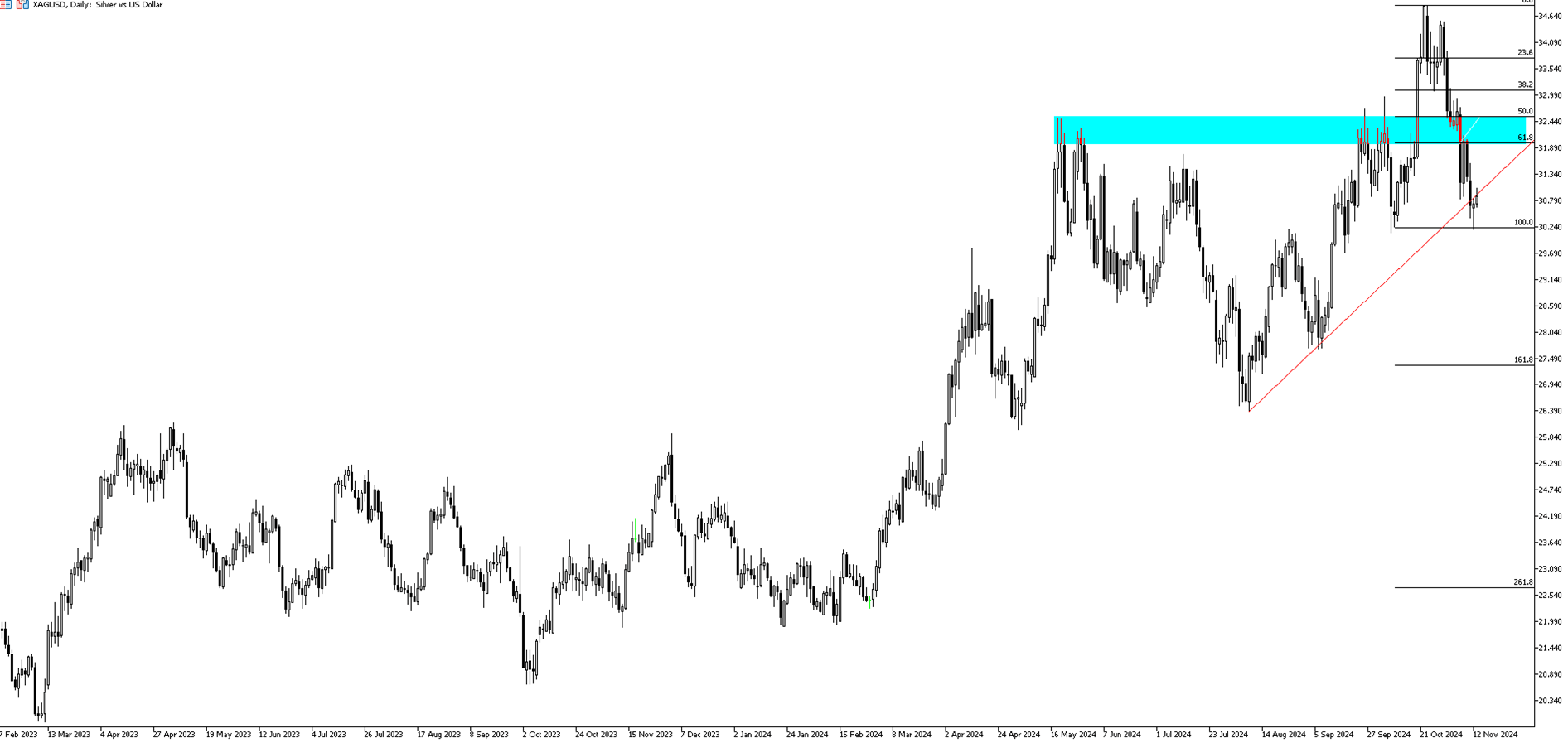

Silver prices rose toward $31 per ounce on Wednesday, likely due to a technical rebound after reaching a one-month low. Investors are positioning ahead of a key U.S. inflation report that could influence Fed rate cut expectations. Lower inflation data might boost demand for silver, though the metal faces pressure from a stronger dollar fueled by potential inflationary policies under a second Trump term, which may restrict Fed rate cuts. Concerns about demand persist due to weak Chinese economic data and a lack of stimulus, along with uncertainty over tariffs affecting silver's use in electrification and solar panels.

Resistance levels are at 31.00, 31.65, and 32.00, while support is at 30.40, with further levels at 29.85 and 28.80.

| R1: 30.00 | S1: 30.40 |

| R2: 31.65 | S2: 29.85 |

| R3: 32.00 | S3: 28.80 |

Global markets remained dominated by dollar strength as geopolitical tensions and rising energy prices reshaped monetary expectations.

Oil Tanker Attacks Create Volatility

Oil Tanker Attacks Create VolatilityRecent strikes on oil tankers in the Persian Gulf have exposed the extreme vulnerability of global energy supplies. Footage of burning vessels near the Iraqi coastline has saturated financial media, serving as a reminder to market participants of the risks inherent in the region. Whenever tensions escalate in this region, energy traders immediately begin pricing in the possibility of supply disruptions.

Detail Dollar Leads as Markets Reprice Risk (03.12.2026)Currency markets remained under pressure as energy-driven inflation concerns and ongoing geopolitical tensions continued to support the U.S. dollar.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!