Markets now see a 92% chance of a 25-bps Fed cut on Sept. 19, with some betting on 50 bps amid labor market weakness.

U.S. wholesale inflation slipped 0.1% in August, easing pressure ahead of Thursday’s CPI, expected to show a 0.3% monthly rise and 2.9% annual increase, with core steady at 3.1%.

Equities pushed higher, with the S&P 500 and Nasdaq setting new records on tech strength and Oracle’s earnings. Treasury yields fell to five-month lows, the 10-year at 4.04%, while the dollar index held at 97.8.

The ECB is expected to hold rates steady after 200 bps of cuts since mid-2024, with growth seen at 1.2% this year, though political strains in France and Spain weigh on sentiment.

Oil remained volatile, with Brent near $67.50 and WTI at $64.34, as OPEC+ scaled back supply hikes and geopolitical tensions offset signs of weaker demand.

| Time | Cur. | Event | Forecast | Previous |

| 12:15 | EUR | Deposit Facility Rate (Sep) | 2.00% | 2.00% |

| 12:15 | EUR | ECB Interest Rate Decision (Sep) | 2.15% | 2.15% |

| 12:30 | USD | Core CPI (MoM) (Aug) | 0.3% | 0.3% |

| 12:30 | USD | CPI (YoY) (Aug) | 2.9% | 2.7% |

| 12:30 | USD | CPI (MoM) (Aug) | 0.3% | 0.2% |

| 12:30 | USD | Initial Jobless Claims | 235K | 237K |

| 12:45 | EUR | ECB Press Conference | ||

| 17:00 | USD | 30-Year Bond Auction | 4.813% |

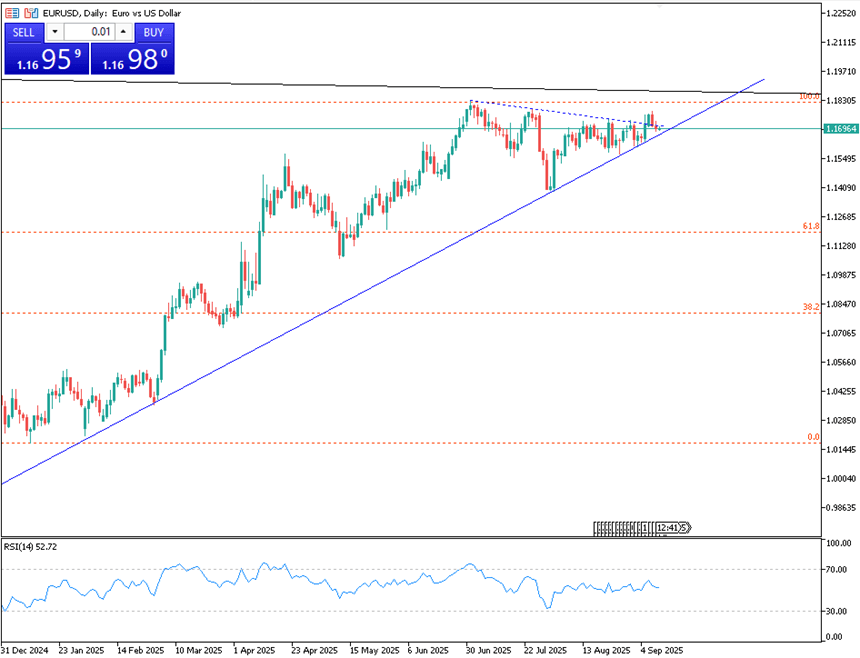

The euro held near $1.17 on Thursday as investors looked to the ECB meeting and U.S. inflation data for monetary policy direction. The ECB is expected to keep rates unchanged, while softer U.S. labor figures strengthened bets on a September Fed cut, with some room for a larger move depending on CPI results.

In Europe, French President Emmanuel Macron appointed Sébastien Lecornu as prime minister, while geopolitical risks lingered as Donald Trump pressed the EU to impose tariffs on India and China over Russian oil, and Poland intercepted Russian drones breaching its airspace.

Resistance is at 1.1750, with key support at 1.1660.

| R1: 1.1750 | S1: 1.1660 |

| R2: 1.1775 | S2: 1.1620 |

| R3: 1.1780 | S3: 1.1580 |

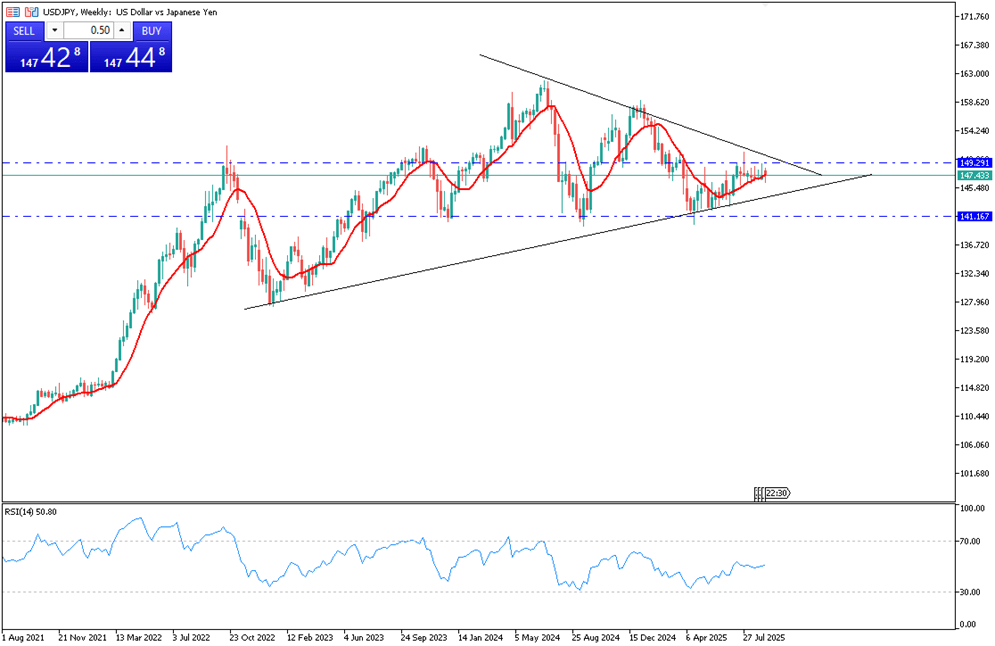

The Japanese yen traded around 147.5 per dollar, marking a third session of stability before the U.S. CPI release, which could shape expectations for deeper Fed cuts. U.S. producer prices declined in August, easing inflation concerns, while Japan’s Q3 business sentiment improved on strong exports ahead of new 15% U.S. tariffs. Producer prices rose 2.7% year-on-year, up from 2.5% in July. Political attention remained on Prime Minister Shigeru Ishiba’s resignation after party divisions.

For USD/JPY, the nearest resistance is at 148.50, while the immediate support is at 146.70.

| R1: 148.50 | S1: 146.70 |

| R2: 150.90 | S2: 145.80 |

| R3: 154.50 | S3: 144.00 |

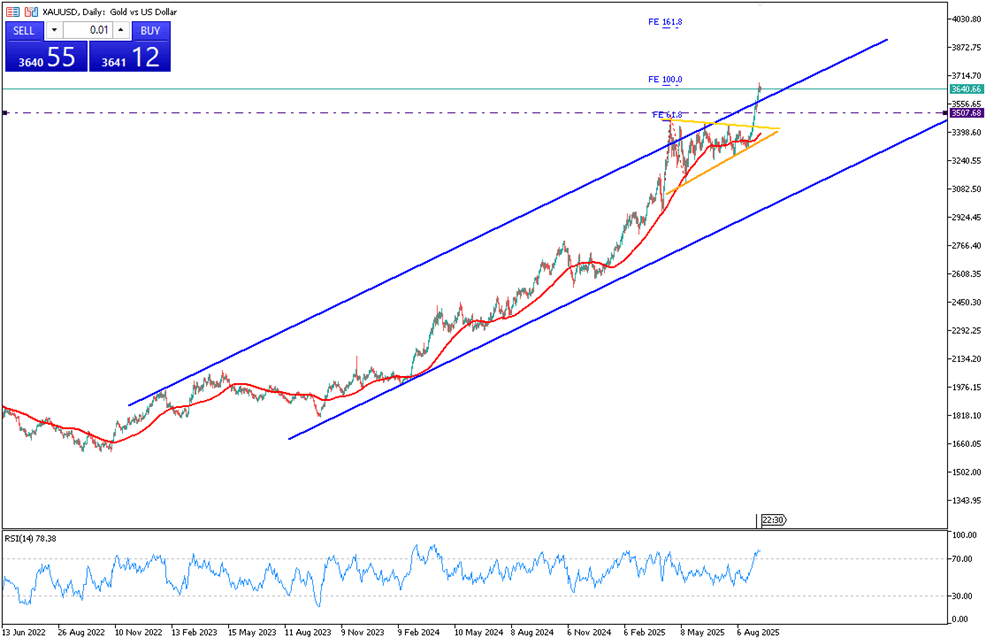

Gold traded near $3,640 per ounce, just below record levels, supported by expectations of Fed cuts and demand. The decline in August U.S. producer prices and signs of labor market weakness reinforced easing bets ahead of CPI. Political and geopolitical risks, including Trump’s tariff push on China and India, renewed Middle East tensions, and Poland's shooting down of Russian drones, added to safe-haven flows.

Gold is currently facing resistance around $3,660, with strong support near $3,620.

| R1: 3660 | S1: 3620 |

| R2: 3700 | S2: 3560 |

| R3: 3730 | S3: 3500 |

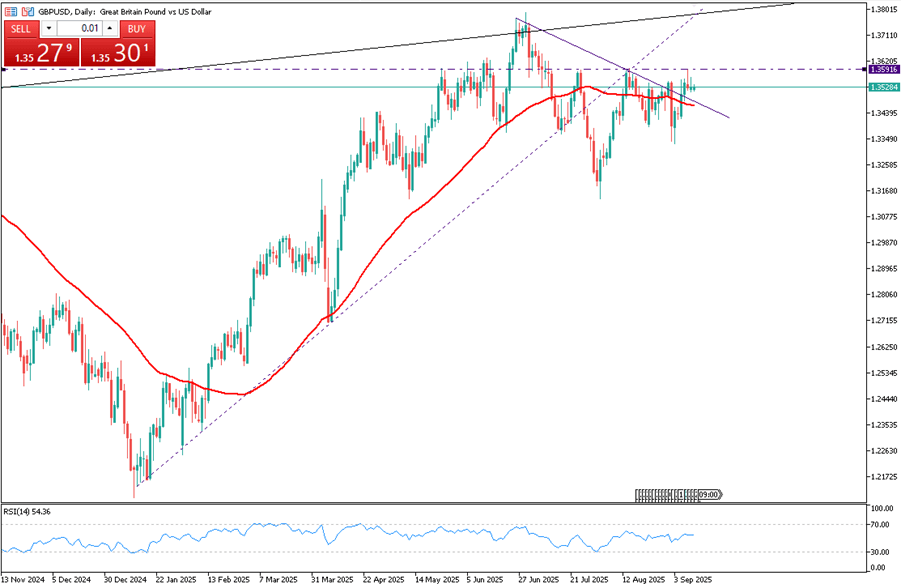

The British pound edged higher to $1.3545, up 0.13% on Wednesday, while the FTSE 100 slipped 0.2%. Losses came from Associated British Foods (-13.2%) after weaker Primark sales, alongside declines in Serica Energy and Warpaint London. Gains in Anglo American (+1.7% on merger news) and Wickes (steady profit outlook) offered partial support. The pound reflected cautious optimism despite uneven corporate earnings and regional political developments.

The first resistance is seen at 1.3600, with nearby support beginning at 1.3440.

| R1: 1.3600 | S1: 1.3440 |

| R2: 1.3680 | S2: 1.3350 |

| R3: 1.3770 | S3: 1.3300 |

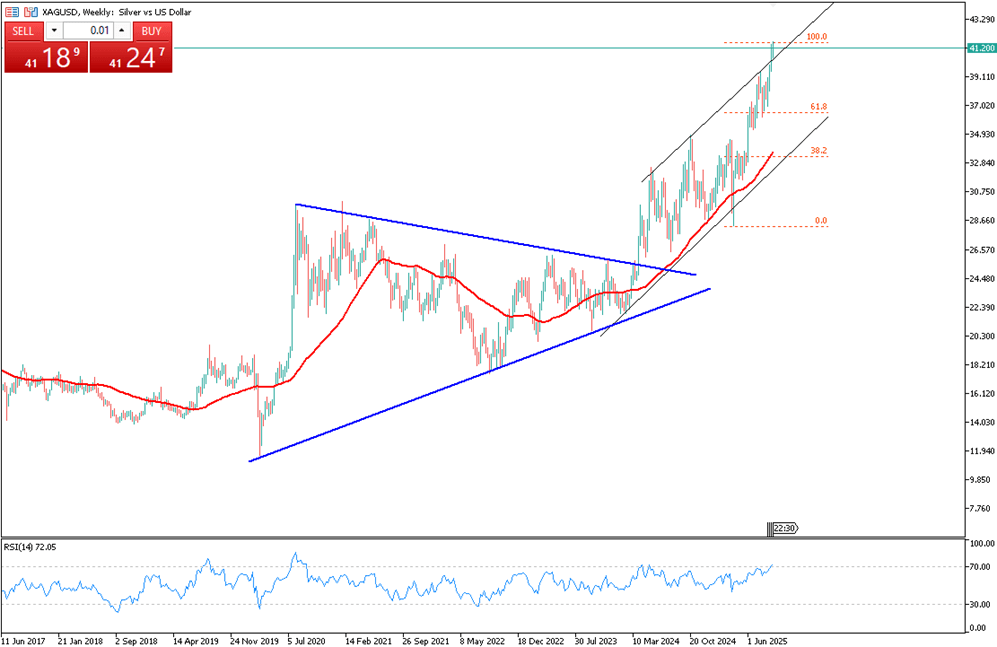

Silver hovered around $41 per ounce, close to a 14-year peak, with investors awaiting U.S. CPI data that could cement Fed easing expectations. August producer prices fell 0.1% after a revised 0.7% gain in July, with markets fully pricing a 25-bps cut and a slim chance of 50 bps. Safe-haven demand was underpinned by Trump’s tariff threats toward China and India, while industrial demand from solar, EVs, and electronics kept supply conditions tight.

The first resistance is at $41.50, and the support is at $40.60.

| R1: 41.50 | S1: 40.60 |

| R2: 42.20 | S2: 39.60 |

| R3: 43.40 | S3: 38.20 |

Oil Tanker Attacks Create Volatility

Oil Tanker Attacks Create VolatilityRecent strikes on oil tankers in the Persian Gulf have exposed the extreme vulnerability of global energy supplies. Footage of burning vessels near the Iraqi coastline has saturated financial media, serving as a reminder to market participants of the risks inherent in the region. Whenever tensions escalate in this region, energy traders immediately begin pricing in the possibility of supply disruptions.

Detail Dollar Leads as Markets Reprice Risk (03.12.2026)Currency markets remained under pressure as energy-driven inflation concerns and ongoing geopolitical tensions continued to support the U.S. dollar.

Global markets remained cautious as investors weighed the economic impact of the ongoing Middle East conflict and volatile energy prices.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!