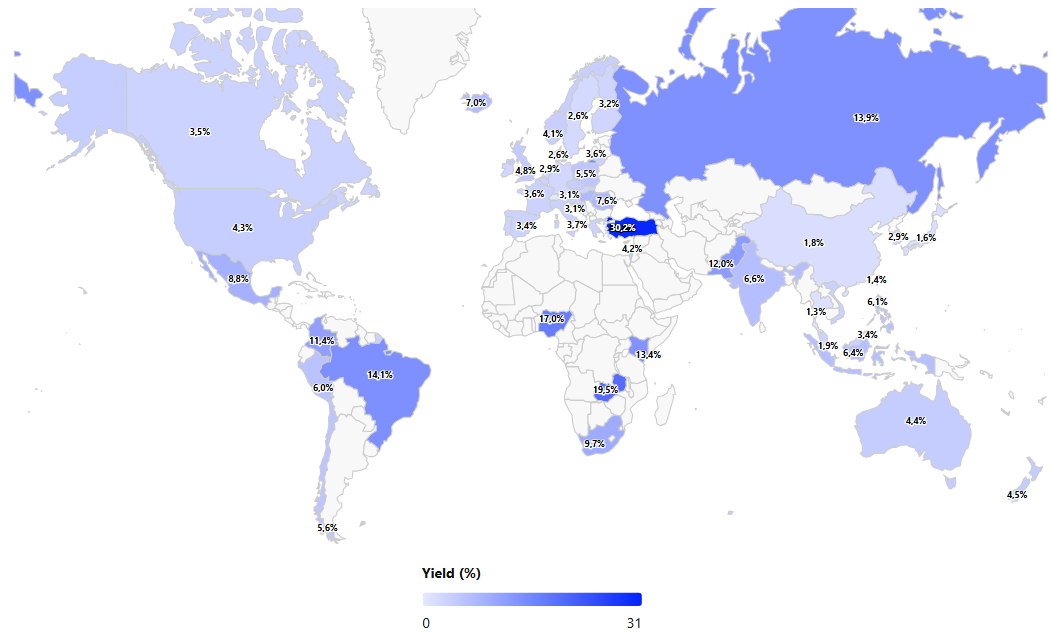

Global bond markets are under strain as long-term yields surge to multi-decade highs.

Global bond markets came under renewed pressure on Wednesday as long-term yields climbed sharply, reflecting investor unease over rising government debt burdens and strained fiscal positions. The moves highlight a disconnect between central banks’ recent easing cycles and market sentiment, with investors demanding higher compensation for holding sovereign debt.

In the United Kingdom, the yield on 30-year gilts rose to its highest level since 1998, underscoring concerns about widening budget deficits and the sustainability of fiscal policy.

Similar dynamics emerged in Asia, where Japan’s 20-year government bond yield reached its highest level since 1999. The development signals growing anxiety over debt sustainability in one of the world’s most heavily indebted economies.

The United States also saw a sharp shift. The 30-year Treasury yield edged closer to the 5% threshold, a level not tested in years. The move reflects growing concerns that Washington’s expanding deficit and substantial issuance program could continue to exert upward pressure on borrowing costs.

For markets, such levels carry wide implications, from higher mortgage rates to tighter corporate financing conditions, potentially dampening global risk appetite.

The surge in long-dated yields signals a broader repricing of risk across global markets. While central banks continue to pursue stabilization through rate cuts and liquidity support, the bond market is painting a different picture, one of structural fiscal stress and reduced investor confidence.

Key Highlights:

Unless governments implement credible measures to reassure markets about their debt trajectories, pressure on long-term yields may persist. For policymakers, this leaves limited room to maneuver as fiscal stress competes with monetary easing.

Global markets entered 2026 with a cautiously optimistic tone, as major currencies stabilized while precious metals extended their exceptional rallies.

Global markets ended the year with mixed performance as the euro held near 1.1740 during thin year-end trading, supported by the ECB’s pause on rate cuts and expectations of a softer US rate path under a potential Fed leadership change.

Detail Policy Expectations Support FX (12.30.2025)Global markets saw holiday volatility as the euro held near $1.18 on ECB-Fed policy divergence and the pound hit a three-month high above $1.35 against a weaker dollar.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!