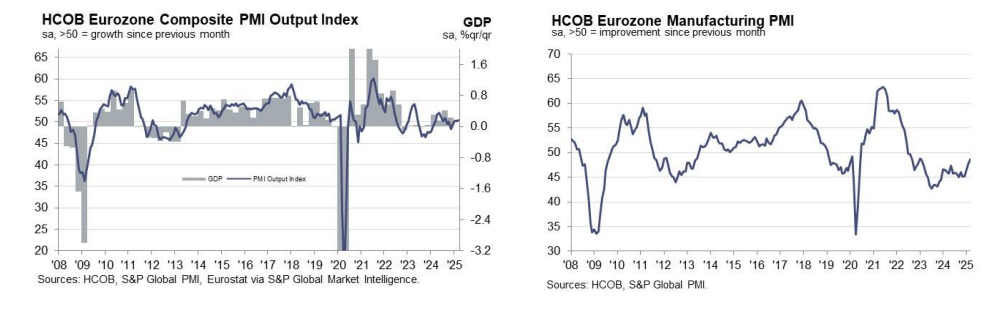

Provisional HCOB Flash PMI data showed that business activity in the Eurozone continued to grow in March, marking the third month of expansion.

While the pace of growth remained modest, it slightly improved compared to the first two months of the year.

The HCOB Flash Eurozone Composite PMI Output Index rose to 50.4, up from 50.2 in February, hitting a 7-month high. The improvement reflects a balanced contribution from both manufacturing and services, with manufacturing making a notable return to growth.

The HCOB Flash Eurozone Manufacturing PMI Output Index climbed to 50.7, up from 48.9 in February, marking the highest level in 34 months. The broader Manufacturing PMI also increased to 48.7, compared to 47.6 in February, reaching a 26-month high. This signals a significant shift, as manufacturing output rose for the first time in two years, ending a prolonged period of contraction.

The HCOB Flash Eurozone Services PMI Business Activity Index stood at 50.4, down slightly from 50.6 in February, reaching a 4-month low. Despite the dip, the index remained above the 50.0 threshold, indicating continued growth in the service sector.

While overall output expanded, new orders declined, suggesting demand remains fragile across the bloc. Nonetheless, employment levels held steady, signaling that firms remain cautious but are not yet reducing workforce numbers.

On the inflation front, input costs and output prices continued to rise in March, but at a slower pace. This moderation in price pressures may provide some relief amid ongoing concerns about inflation dynamics within the Eurozone.

Source: SP Global

Bond Market Pushback Takes Center Stage

Bond Market Pushback Takes Center StageMarkets are almost fully pricing in another Federal Reserve rate cut this week, yet the US bond market continues to move in the opposite direction.

Detail Central Bank Expectations Reset the Tone (8-12 December)

Central Bank Expectations Reset the Tone (8-12 December)Traders adjusted positioning before the Federal Reserve’s December decision and evaluated fresh signals from the ECB, BoE and BOJ.

Detail Futures Stall, 10-Year Yield Pushes Above 4.1% (12.08.2025)US stock futures were flat on Monday ahead of the Fed’s meeting, with markets pricing an 88% chance of a 25 bp cut on Wednesday.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!