The eurozone economy remained in a fragile state at the close of 2024, according to the latest HCOB PMI® survey.

The eurozone economy remained in a fragile state at the close of 2024, according to the latest HCOB PMI® survey. Economic activity contracted for the second consecutive month due to persistent declines in new business and employment, with inflationary pressures intensifying. Despite a slight improvement in business expectations, optimism for the next 12 months remained historically weak.

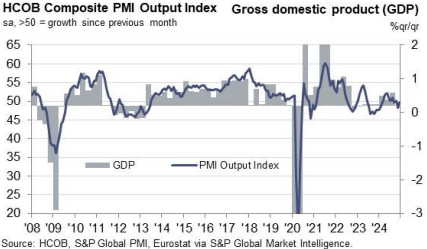

The seasonally adjusted HCOB Eurozone Composite PMI Output Index stood at 49.6 in December, up from November’s 48.3 but still below the neutral 50.0 mark. This indicates a continued decline in economic activity, albeit at a softer pace compared to the previous month.

Among the eurozone’s largest economies:

While firms reported a slight improvement in growth expectations compared to November’s 14-month low, optimism remained historically muted. The December data highlights ongoing economic fragility in the eurozone, driven by manufacturing struggles and subdued recovery in the services sector. Inflationary pressures and weak external demand continue to weigh on the region’s growth prospects.

Source: SP Global

The dollar index stabilized near 98.8 Thursday as a reported U.S. submarine sinking of an Iranian warship near Sri Lanka and the sixth day of the U.S.–Israeli campaign fueled fears of a prolonged, inflationary conflict.

Global markets remain dominated by geopolitical risk as escalating conflict between the United States, Israel, and Iran fuels a strong shift toward safe-haven assets. The dollar index hit 99.3 Wednesday, rising for a third day as conflict concerns fueled inflation and shifted Fed rate cut expectations from July to September.

A US court rejected Trump's tariff refund delay as the Dollar (98.5) and 10 year yield (4.04%) held gains amid Middle East escalation and inflation fears.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!