The euro area’s trade surplus with non-EU countries fell to €9.9 billion in April 2025, down from €13.6 billion a year earlier, according to Eurostat. This marks a sharp drop from March’s €37.3 billion surplus, largely driven by a 1.4% decline in exports to €243.0 billion. Imports remained steady at €233.1 billion.

A significant contributor to the decline was the chemicals sector. Its trade surplus shrank to €22.1 billion in April, nearly half of the €42.8 billion recorded in March. Additionally, the surplus in the machinery and vehicles category also fell year-over-year, further dampening the trade balance.

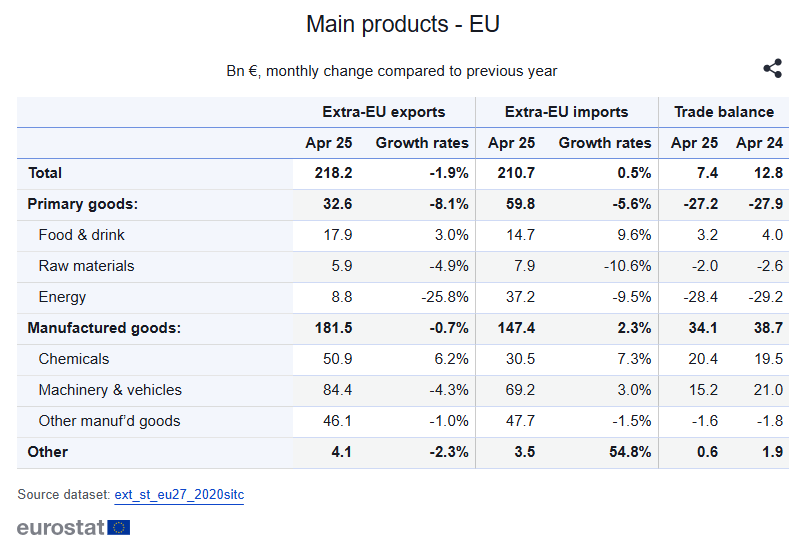

The broader European Union also experienced a trade surplus reduction. In April, the EU27 recorded a €7.4 billion surplus with non-EU countries, compared to €12.8 billion in April 2024. Exports rose 1.1% to €228.4 billion, but imports increased at a faster rate of 3.7%, reaching €221.0 billion.

Despite the weaker April figures, the first four months of 2025 indicate overall resilience. The euro area posted a €71.0 billion cumulative trade surplus, up from €68.6 billion in the same period last year. The EU’s year-to-date surplus reached €58.9 billion, slightly below 2024’s €63.7 billion.

Year-on-year, both exports and imports grew more than 5 percent across the euro area and the EU. This suggests that while sector-specific pressures have emerged, global demand has remained relatively strong so far in 2025.

Global markets remain dominated by geopolitical risk as escalating conflict between the United States, Israel, and Iran fuels a strong shift toward safe-haven assets. The dollar index hit 99.3 Wednesday, rising for a third day as conflict concerns fueled inflation and shifted Fed rate cut expectations from July to September.

A US court rejected Trump's tariff refund delay as the Dollar (98.5) and 10 year yield (4.04%) held gains amid Middle East escalation and inflation fears.

After Khamenei: Who Will Lead Iran Next?

After Khamenei: Who Will Lead Iran Next?Following the death of Supreme Leader Ali Khamenei, Iran has entered a pivotal transition phase. Senior officials in Tehran are acting swiftly to uphold the existing structure of the Islamic Republic, prioritizing continuity to head off potential internal instability. Despite these efforts, the sudden leadership vacuum has sparked intense political and military maneuvering behind the scenes.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!