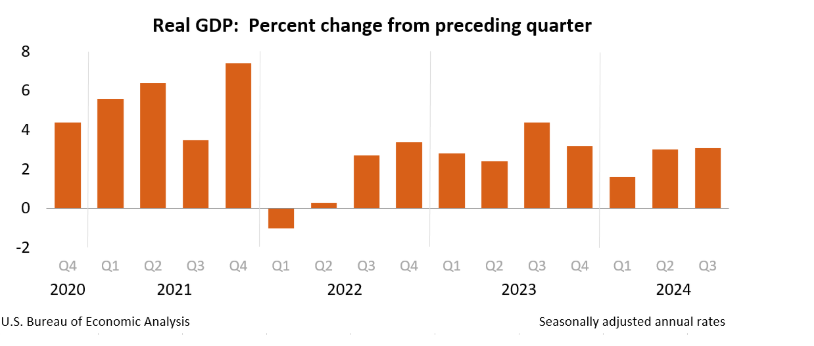

The U.S. economy expanded at an annualized rate of 3.1% in the third quarter of 2024, according to the "third" estimate released by the U.S. Bureau of Economic Analysis (BEA).

The U.S. economy expanded at an annualized rate of 3.1% in the third quarter of 2024, according to the "third" estimate released by the U.S. Bureau of Economic Analysis (BEA). This marks a slight improvement from the previously reported 2.8% in the "second" estimate and follows a 3.0% growth rate in the second quarter. The upward revision reflects stronger consumer spending and exports, offset slightly by downward adjustments to private inventory investment.

The increase in real GDP was primarily fueled by:

While these components boosted GDP, the rise in imports, which are subtracted from GDP calculations, and declines in private inventory and residential fixed investment partially offset the gains.

The acceleration in GDP growth from Q2 to Q3 was driven by:

These factors outweighed the larger declines in private inventory and residential fixed investment during the quarter.

In current dollar terms, GDP rose by 5.0%, or $358.2 billion, to reach $29.37 trillion, representing a $20.6 billion upward revision from the prior estimate.

The price index for gross domestic purchases increased by 1.9%, unchanged from the previous estimate. The personal consumption expenditures (PCE) price index rose by 1.5%, while the core PCE index, excluding food and energy, was revised upward by 0.1 percentage points to 2.2%.

The updated data highlights a strong U.S. economy in the third quarter, supported by solid domestic and international demand.

Source: Bureau of Economic Analysis

Bond Market Pushback Takes Center Stage

Bond Market Pushback Takes Center StageMarkets are almost fully pricing in another Federal Reserve rate cut this week, yet the US bond market continues to move in the opposite direction.

Detail Central Bank Expectations Reset the Tone (8-12 December)

Central Bank Expectations Reset the Tone (8-12 December)Traders adjusted positioning before the Federal Reserve’s December decision and evaluated fresh signals from the ECB, BoE and BOJ.

Detail Futures Stall, 10-Year Yield Pushes Above 4.1% (12.08.2025)US stock futures were flat on Monday ahead of the Fed’s meeting, with markets pricing an 88% chance of a 25 bp cut on Wednesday.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!