In mid-November, the US manufacturing sector exhibited signs of approaching stabilization.

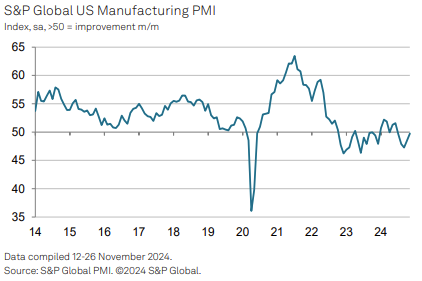

The decline in new orders slowed considerably, and improved confidence in the future led companies to expand their workforce, although production levels continued to decline. The S&P Global US Manufacturing Purchasing Managers' Index (PMI) stayed below the neutral 50.0 threshold but rose to 49.7, reflecting a modest contraction in the sector's health compared to 48.5 in October. This marked the highest reading in the ongoing five-month stretch of weakening business conditions.

The near-stabilization of the sector was largely driven by a much slower drop in new orders, which recorded only a slight decline—the smallest in five months. Some manufacturers noted an improvement in domestic demand, attributed to the outcomes of the Presidential Election. However, new export orders experienced a steep decline, contracting at the fastest rate since June 2023 due to weakening international demand.

While the slowdown in new orders helped ease the pace of production decline, manufacturing output continued to fall for the fourth consecutive month. Contributing factors included disruptions caused by hurricanes, rising prices, and lingering uncertainty following the election. These challenges led to an accelerated decline in output compared to October.

Despite reduced production levels, business sentiment for the year ahead saw a notable surge, reaching its highest point in over two and a half years. Nearly half of the surveyed businesses anticipated growth, fueled by expectations of a more favorable business climate under the incoming administration, as well as hopes for improved economic conditions, increased new orders, and expanded capacity.

This growing optimism prompted firms to increase their workforce in November, breaking a three-month trend of job cuts. The rise in staffing, despite continued declines in new orders, enabled companies to clear their backlogs of work at the fastest rate in 16 months. Additionally, inventories of finished goods continued to climb, marking the fifth consecutive month of increases.

Purchasing activity and input inventories continued to decline in November, albeit at a slower pace. While some manufacturers increased their input purchases in anticipation of future output growth, others acted cautiously to prepare for potential tariffs.

Input cost inflation eased for the third consecutive month, reaching its lowest rate in a year. In contrast, output price inflation saw a slight uptick, staying marginally above pre-pandemic levels.

Meanwhile, suppliers' delivery times lengthened for the second consecutive month. The modest increase in lead times, the most significant since October 2022, was attributed to labor shortages at suppliers and ongoing transportation logistics challenges.

Source: SP Global

PPI Tidak Berubah di Bulan Februari, Inflasi Tahunan di 3,2%

PPI Tidak Berubah di Bulan Februari, Inflasi Tahunan di 3,2%Indeks Harga Produsen (PPI) untuk permintaan akhir tetap tidak berubah di bulan Februari, disesuaikan secara musiman, menurut Biro Statistik Tenaga Kerja AS.

Detail Gold and Silver Gain on Fed Speculation (03.13.2025)EUR/USD fell to 1.0880 amid US-EU tariff disputes but found support as US recession concerns weighed on the dollar.

Detail Dollar Decline Drives Gains Across Markets (03.12.2025)The euro surged past $1.09, driven by deficit spending plans and ECB signals of a less restrictive policy.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!