Gold trading has long been a popular option for investors looking to take advantage of price fluctuations in this precious metal, which has historically been considered a safe haven. This commodity holds an important place in financial markets, with its price experiencing large swings due to global economic developments, geopolitical risks, and central bank monetary policies. As a result, gold trading is attractive to both long-term investors and short-term speculators.

Gold is especially seen as a safe haven during periods of economic uncertainty, causing its price to move independently from other assets. Additionally, its role as a store of value during times of inflation has drawn the attention of many investors.

Gold trading is primarily a type of investment aimed at profiting from fluctuations in the metal's price. It can be done through physical assets or derivative products. Various tools such as spot market transactions, futures, options, ETFs, and CFDs allow investors to trade using different strategies.

The gold market encompasses the financial platforms where the buying and selling of this precious metal take place worldwide. It includes both physical gold trading and various investment vehicles such as futures, options, ETFs, and CFDs traded through derivative products.

The market operates across different global exchanges, with major hubs like the London Bullion Market (LBMA) and the New York Mercantile Exchange (NYMEX) being key centers for this trade.

Due to the global nature of the market, gold prices are traded 24 hours a day and are influenced by several factors including supply-demand dynamics, central bank reserve policies, inflation expectations, and geopolitical risks.

The gold market offers investors both a safe-haven asset and speculative profit opportunities. During periods of global uncertainty, market volatility increases, and investors tend to engage in gold trading to benefit from its safe-haven characteristics.

There are many different factors that affect the price of gold. It is directly influenced by both global economic developments and supply-demand dynamics. The metal's status as a safe haven can cause its prices to move independently from other assets.

The main factors that affect gold prices are:

Gold trading can be conducted through various financial instruments. Since each investor has a different risk tolerance and trading strategy, it is possible to trade in the market using different methods.

Below, we have provided a detailed explanation of the most common tools used in gold trading:

Gold CFDs allow traders to profit from price movements without owning physical gold. CFD trading provides the opportunity to gain from both rising and falling prices, enabling investors to open both long (buy) and short (sell) positions, offering two-way trading opportunities.

Leverage is commonly used in CFD trading, allowing investors to open larger positions with less capital. However, while leverage increases potential gains, it also amplifies risks. Poorly managed trades can result in big losses, making risk management strategies essential.

Gold CFDs can be traded 24 hours a day, providing flexibility for investors to take positions based on different time zones and market conditions. However, one important factor to consider in CFD trading is the additional costs, such as swaps (overnight holding fees).

Gold futures are financial contracts in which traders commit to buying or selling gold at a specific price on a predetermined date. They are often used for speculative purposes to profit from future price movements.

Gold futures are traded on organized exchanges, such as the New York Mercantile Exchange (NYMEX). These exchanges standardize futures contracts and ensure transaction security.

A standard gold futures contract typically represents 100 ounces of gold, making it attractive to investors looking to open large speculative positions.

Another important feature of futures contracts is their expiration date. Each contract has a set maturity date, and when it expires, the trader must close their position or take physical delivery of the gold, depending on the contract terms. This makes futures trading more suitable for short- and medium-term investors.

Gold options give traders the right, but not the obligation, to buy or sell gold at a specified price within a certain period. Investors are free to choose whether or not to exercise this right.

Options contracts are divided into two main categories:

One of the biggest advantages of options trading is the limited risk. Traders only pay a fee known as the option premium, and their losses are capped at this amount. However, if the option expires worthless, the premium paid is entirely lost.

Spot price is the current market price for immediate delivery of gold. Traders can either purchase the metal physically in the spot market or benefit directly from price movements.

Spot market transactions offer investors the opportunity to take physical delivery of gold, such as in the form of bars or coins, or to trade on platforms to profit from price fluctuations. Physical delivery typically involves bars or coins, and investors need to store the metal securely.

Spot gold prices are traded globally 24 hours a day, providing traders with the ability to instantly react to market movements. However, during periods of high volatility, spot prices can change rapidly and unexpectedly. Traders should closely monitor market developments and macroeconomic data when trading in spot markets.

The shares of gold mining companies offer investors a way to invest in the sector. The performance of mining companies generally moves in parallel with the price of the metal, as rising prices typically lead to higher revenues for these companies.

However, stock performance is not solely dependent on gold prices. Factors such as the company's management quality, production costs, and operational efficiency also influence stock performance. Therefore, when investing in gold mining shares, it's important to consider the financial health of the company and the capabilities of its management.

ETFs track a basket of assets. Gold ETFs provide traders with the opportunity to invest in gold without the need to deal with physical storage, security, and insurance costs. Additionally, ETFs can be easily bought and sold on stock exchanges, offering investors high liquidity.

ETFs also provide traders with diversification opportunities. Some ETFs invest solely in physical gold, while others invest in gold mining company stocks or derivative products. This allows investors to spread their risk and develop different strategies.

| Trading Tool | Ownership | Leverage | Liquidity | Risk | Time Horizon | Trading Hours |

| Gold CFDs | No physical ownership | High leverage | High | High | Short-term | 24 hours |

| Gold Futures | No physical ownership | High leverage | High | High | Short to Medium-term | Set exchange hours |

| Gold Options | No physical ownership | Moderate leverage | Moderate | Moderate | Short-term | Set exchange hours |

| Gold Spot Prices | Physical or financial | No leverage | High | Moderate | Any | 24 hours |

| Gold Stocks | Indirect ownership | No leverage | Moderate | Moderate | Long-term | Set exchange hours |

| Gold ETFs | Indirect ownership | No leverage | High | Low to Moderate | Any | Set exchange hours |

Each trader can choose a strategy that suits their risk tolerance and trading goals to trade effectively in the gold market. Below are some of the most commonly used strategies in gold trading, along with detailed explanations:

Position trading can be considered a long-term strategy. It involves opening buy or sell positions in line with the general trend of prices. In this strategy, traders analyze economic indicators, central bank policies, and global market dynamics to predict how prices may move in the future.

In position trading, long-term trends are prioritized over short-term price fluctuations. For example, during times of economic uncertainty, investors may open long positions, relying on gold's role as a safe haven.

News trading is a strategy that analyzes the impact of economic and political events on gold prices. Investors using this strategy closely monitor key economic news and global events, such as central bank announcements, employment data, and inflation reports.

Since news trading aims to profit from short-term price movements, reacting quickly is essential. For example, if the U.S. Federal Reserve lowers interest rates, this could lead to a rise in gold prices, and investors might buy in response to this news.

Trend trading is a strategy applied when you believe the market is moving in a particular direction. Traders using this approach open positions by analyzing bullish or bearish trends.

Moving averages, trendlines, and indicators like the MACD are commonly used in trend trading. The basic principle is to open a buy position in an uptrend or a sell position in a downtrend.

Day trading is a strategy aimed at making profits from positions opened and closed within the same day. Investors using this strategy seek to capitalize on short-term fluctuations in gold prices.

In day trading, transaction durations are quite short. It is key to react quickly to sudden price movements. Indicators like short-term charts (5-minute or 15-minute charts) and technical tools such as RSI and Bollinger Bands are often used.

Price action trading aims to make trades based on the patterns left by gold prices on the chart. Traders employing this method analyze candlestick patterns, support-resistance levels, and chart formations.

In price action strategies, it is particularly important to catch sudden upward or downward signals. For instance, when gold prices approach a critical support level, a buy position can be opened, or when they reverse from a resistance level, a sell position might be executed.

Copy trading is a strategy based on replicating the trades of successful traders exactly. Investors who use this strategy aim to achieve the same gains by automatically copying the positions of more experienced or successful traders.

Copy trading is especially appealing for beginners or those who do not have the time to analyze the market thoroughly. Once you find a reliable platform, you can review the trading history of top-performing traders and choose one that suits you.

Gold trading can be conducted 24 hours a day across many different exchanges worldwide. However, each exchange has its specific trading hours.

Below, you can find the trading hours for some popular exchanges where gold is traded:

Which moving average is best for gold trading?

The most commonly used moving averages in gold trading are the 50-day and 200-day simple moving averages. The 50-day moving average is preferred for analyzing short-term trends, while the 200-day moving average helps to track longer-term trends. The intersection of the 50 and 200-day moving averages can indicate potential trend changes.

Who regulates the gold market?

The gold market is regulated by different institutions in each country. For instance, in the United States, gold trading is regulated by the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC). The London Bullion Market Association (LBMA) plays a significant role in global gold trading.

What is the highest price of gold in history?

Gold reached its all-time high in August 2020, with prices around $2,070 per ounce. This peak occurred amid economic uncertainties and low interest rates during the COVID-19 pandemic.

What is the market symbol for gold?

Gold is typically traded under the symbol XAU in the markets. In currency pairs, it is represented as XAU/USD, showing the price of gold in U.S. dollars.

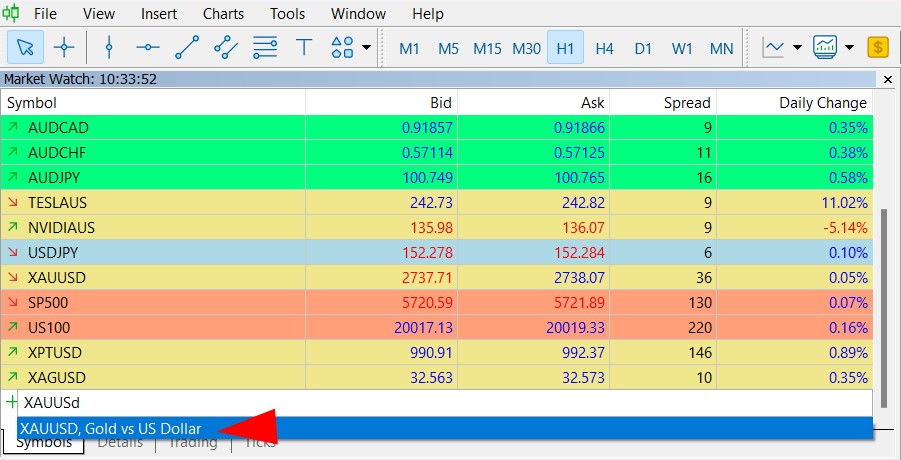

Can I trade gold on MetaTrader 5?

Yes, you can trade gold on the MetaTrader 5 platform. MT5 offers investors the ability to trade gold, other precious metals, currencies, stocks, and commodities.

Silver Rally Ahead? Supply Deficit Meets Rising Demand

Silver Rally Ahead? Supply Deficit Meets Rising Demand

A new silver rally may be forming as supply deficits deepen and China’s demand grows. Here’s what is driving the momentum.

Detail Fed Rate Cuts 2026: How to Position Now

Fed Rate Cuts 2026: How to Position Now

Fed rate cuts in 2026 could reshape markets. See expectations, asset impact, and positioning strategies for bonds, gold, stocks, and USD.

Detail Analyzing the U.S. Labor Market Outlook for 2026

Analyzing the U.S. Labor Market Outlook for 2026

Year’s first jobs report looked reassuring. A closer breakdown, however, tells a more layered story about the direction of the labor market.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!