The US dollar strengthened on Friday after President Trump announced a 35% tariff on Canadian imports and signaled potential EU tariffs, increasing safe-haven demand.

EUR/USD fell below 1.167, while the yen weakened to near 147 as Japan warned of economic impacts. Gold rose toward $3,330 on trade tensions and Fed rate cut speculation, while silver topped $37 amid falling yields and tariff-driven uncertainty. The pound slipped near 1.355 as dollar strength weighed ahead of UK GDP data.

| Time | Cur. | Event | Forecast | Previous |

| 06:00 | GBP | UK GDP(MoM)(May) | 0.10% | -0.30% |

| 06:45 | EUR | French CPI(MoM)(Jun) | 0.30% | -0.10% |

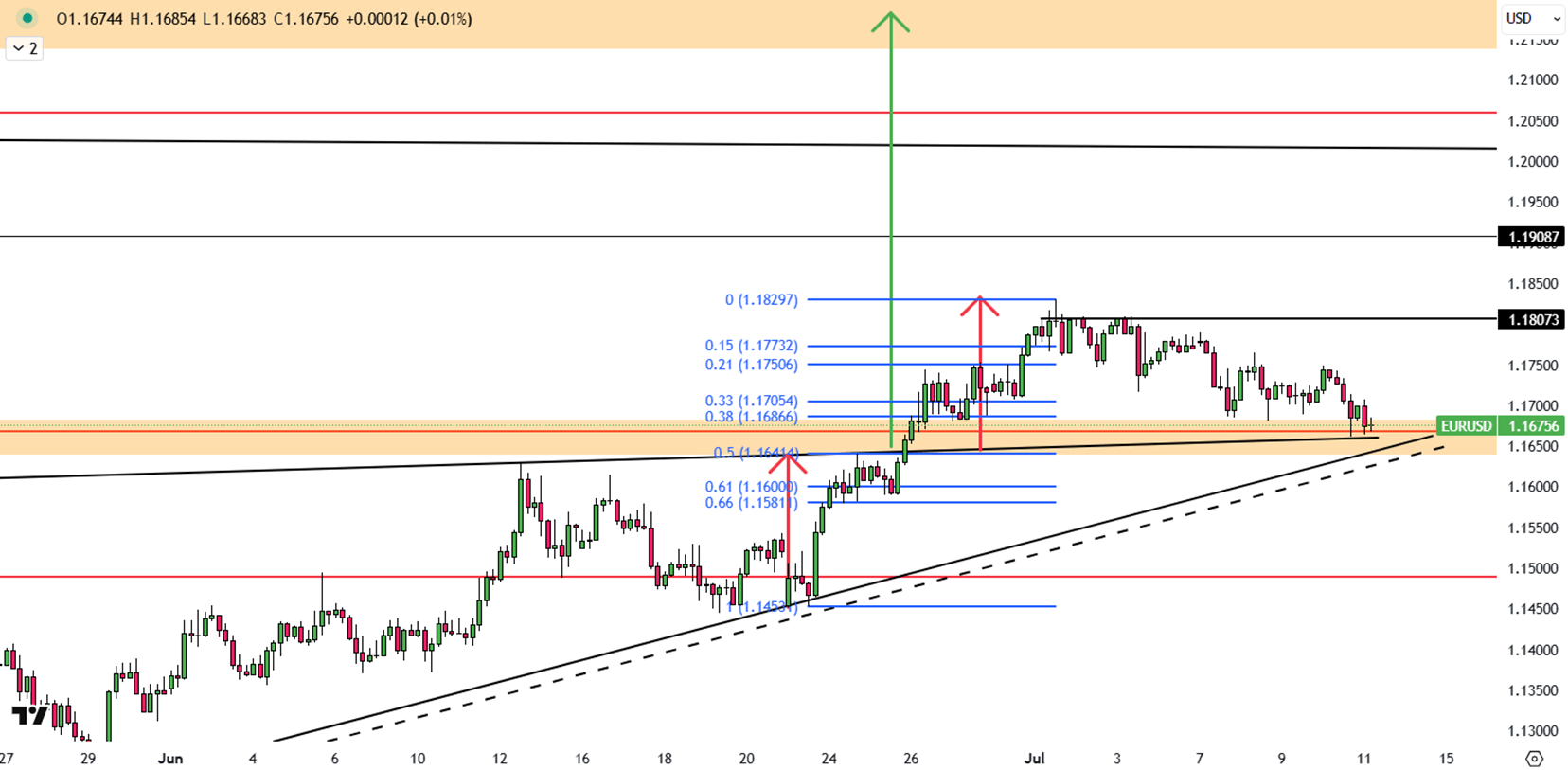

EUR/USD declined by 0.3% to 1.1668 on Friday as the U.S. dollar gained after President Trump announced a 35% tariff on Canadian imports and signaled potential tariffs on the EU. Rising trade tensions increased safe-haven demand for the dollar, while stronger U.S. jobless claims data added support. Meanwhile, the euro slipped as investors grew cautious over the eurozone’s vulnerability to U.S. tariffs and possible countermeasures.

Resistance for the pair is at 1.1750, while support is at 1.1685.

| R1: 1.1750 | S1: 1.1685 |

| R2: 1.1810 | S2: 1.1600 |

| R3: 1.1830 | S3: 1.1545 |

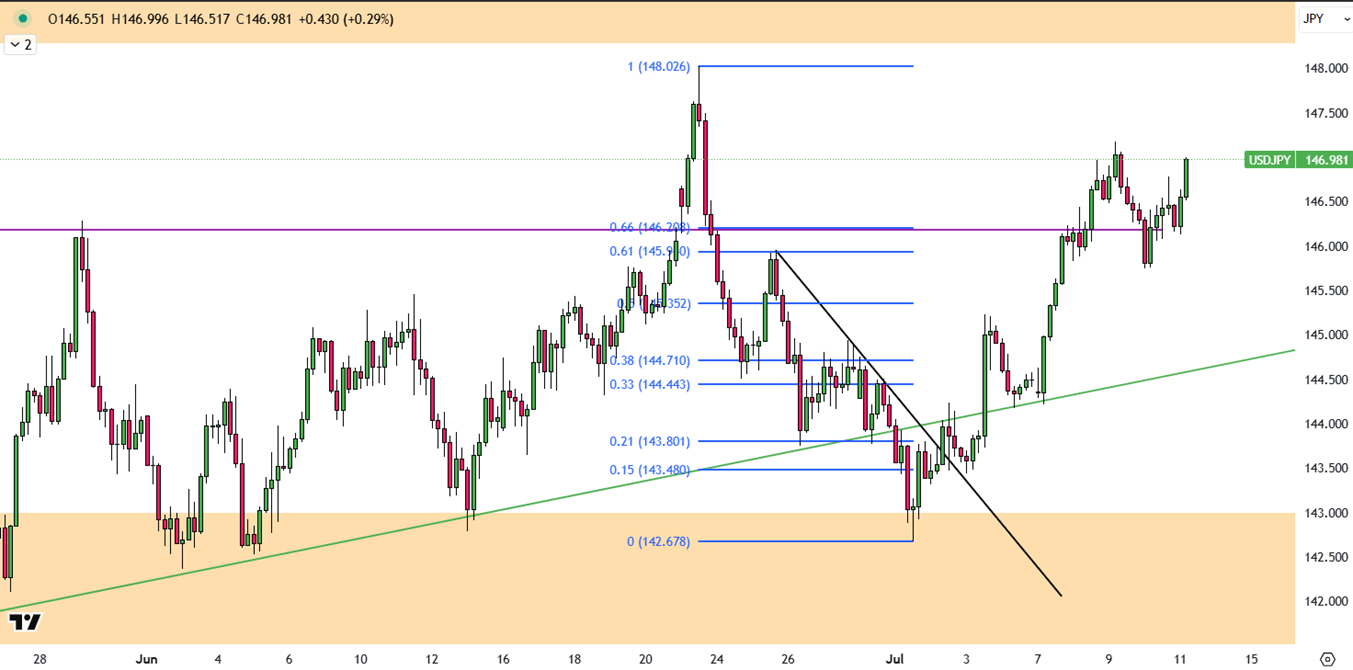

The yen weakened toward 147 per dollar on Friday, and neared a three-week low as the U.S. dollar strengthened amid rising trade tensions. President Trump’s new tariffs, including a 25% duty on Japanese goods, added strain to U.S.-Japan relations. Prime Minister Ishiba urged reducing dependence on the U.S., while a think tank warned the tariffs could lower Japan’s GDP by 0.8% in 2025.

Resistance is at 147.00, with major support at 144.85.

| R1: 147.00 | S1: 144.85 |

| R2: 148.15 | S2: 143.55 |

| R3: 148.65 | S3: 142.40 |

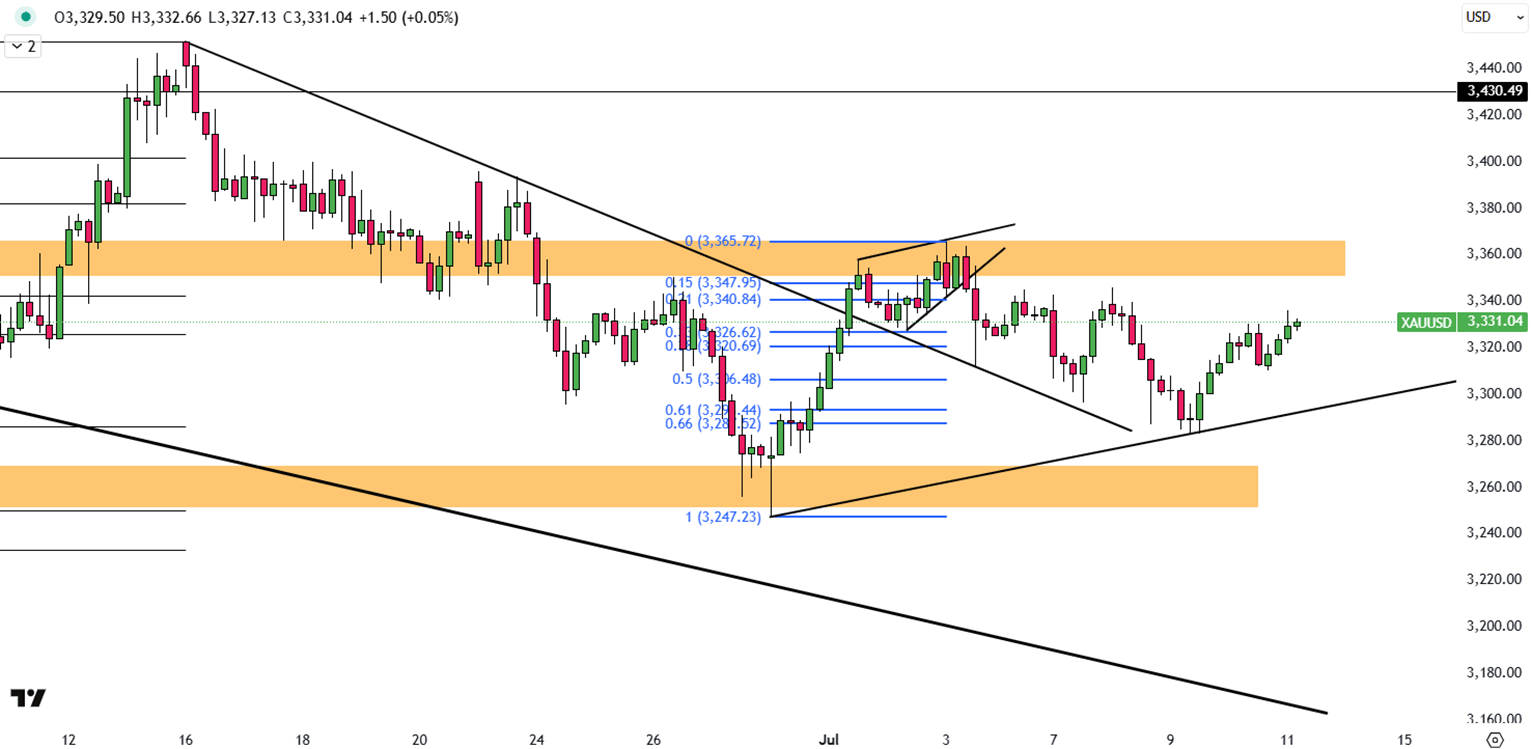

Gold climbed to around $3,330 per ounce on Friday, marking a third day of gains as safe-haven demand increased amid rising trade tensions. President Trump announced a 35% tariff on Canadian imports and hinted at broader 15–20% tariffs on other partners, adding to earlier threats on Brazil and sectors like copper and semiconductors. His call for a 300 bps rate cut fueled speculation about a dovish Fed pick and inflation risks. Meanwhile, jobless claims fell again, highlighting labor market strength. Despite recent gains, gold is on track to end the week flat.

Resistance is at $3,365, while support holds at $3,285.

| R1: 3365 | S1: 3285 |

| R2: 3395 | S2: 3250 |

| R3: 3430 | S3: 3205 |

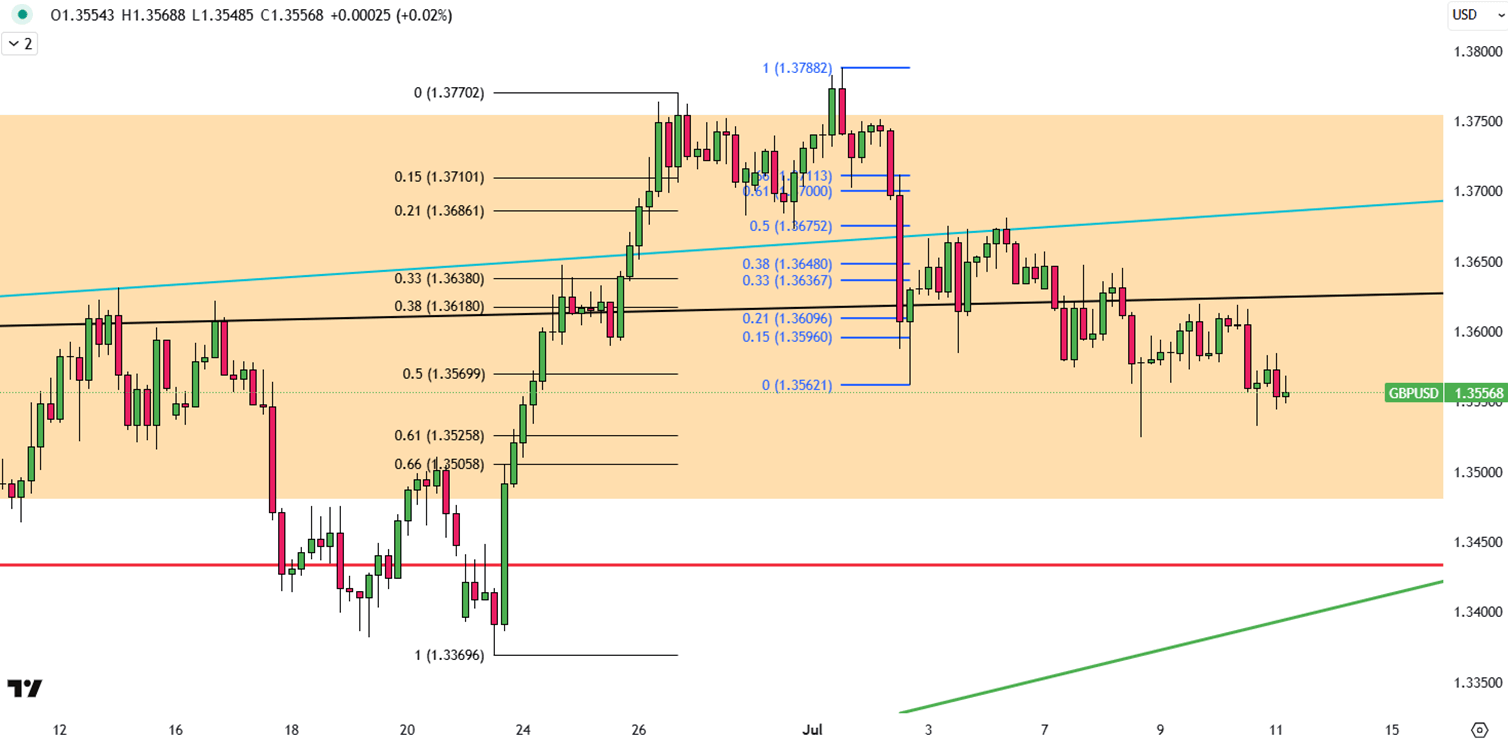

GBP/USD is trading around 1.355, down 0.15%, as risk sentiment softens following Trump’s tariff threats on Canada and the EU, which lifted the dollar. The pound remains under pressure ahead of the UK GDP release, which may offer brief support if the data exceeds expectations. However, persistent trade tensions and solid U.S. economic signals are likely to keep the dollar strong, limiting any significant recovery in sterling.

Resistance is at 1.3600, while support holds at 1.3500.

| R1: 1.3600 | S1: 1.3500 |

| R2: 1.3700 | S2: 1.3430 |

| R3: 1.3760 | S3: 1.3380 |

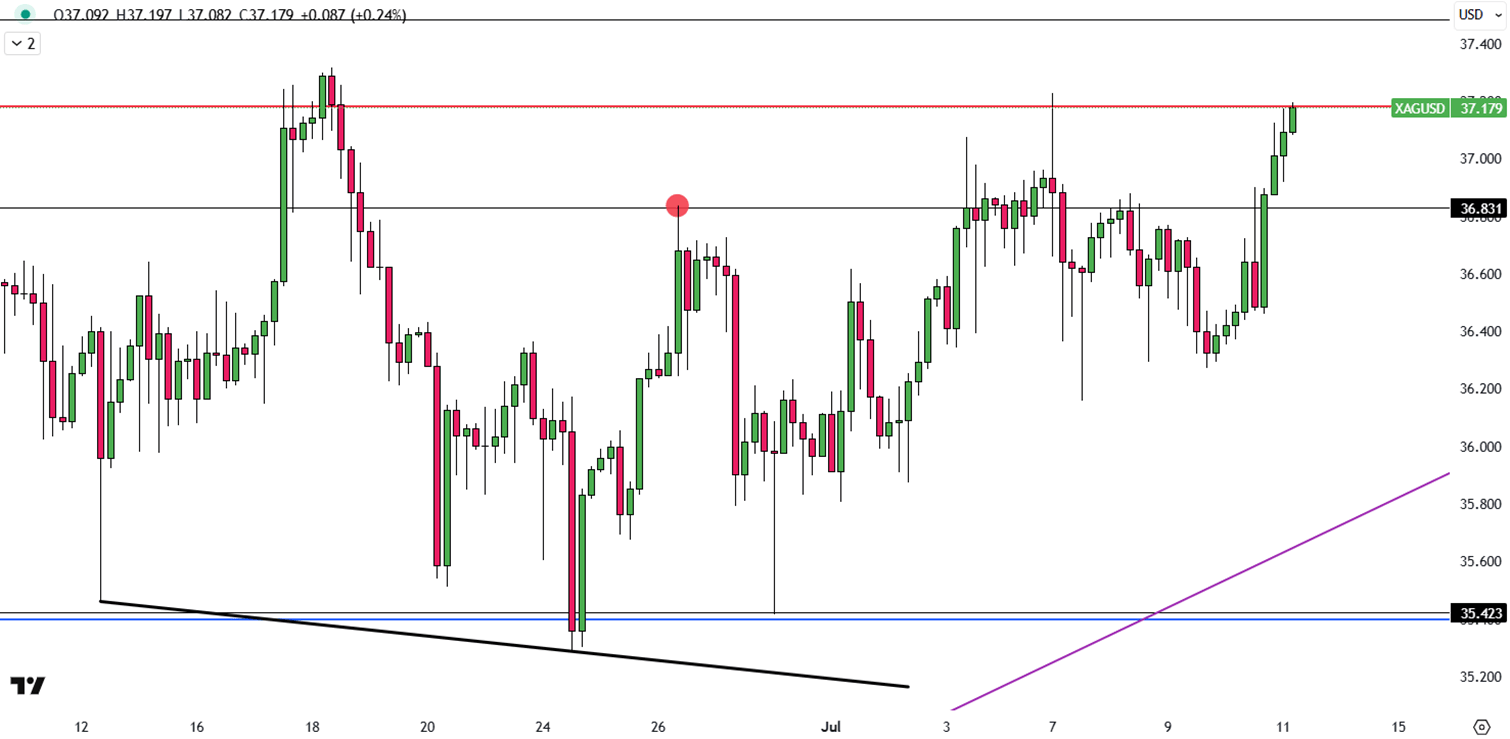

Silver climbed above $37 per ounce on Friday, supported by a weaker U.S. dollar and falling Treasury yields, which lifted demand for precious metals. The gains followed Fed minutes showing most policymakers are open to rate cuts this year. Markets also focused on trade tensions after Trump announced new tariffs on 21 countries, confirmed a 50% tariff on Brazilian imports, and imposed a 50% tariff on copper.

Resistance is at 37.50, while support holds at 35.40.

| R1: 37.50 | S1: 35.40 |

| R2: 39.00 | S2: 34.85 |

| R3: 41.00 | S3: 33.80 |

Currency markets remained volatile as ongoing Middle East tensions continued to shape global sentiment.

Hormuz Blockade Rattles Markets (09 - 13 March)

Hormuz Blockade Rattles Markets (09 - 13 March)Global sentiment was dominated this week by the second week of the war with Iran and the effective blockade of the Strait of Hormuz, driving Brent crude prices above $100/barrel. Despite a catastrophic US labor report showing a loss of 92,000 jobs in February, safe-haven demand pushed the US Dollar Index to 99.1. The energy shock has ignited fears of "stagflation," particularly in Europe and Japan, as soaring fuel costs threaten to reverse recent disinflationary trends.

Detail Oil Shock Drives Dollar Higher (03.09.2026)Global markets opened the week under pressure as escalating Middle East tensions and disruptions in the Strait of Hormuz pushed oil prices above $100 per barrel.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!