With Fed officials warning of inflationary risks from trade policies, the broader market sentiment remains policy-driven.

The euro slipped toward 1.1620 with Brussels pausing tariff retaliation amid Trump’s sweeping 10–20% tariff plans targeting over 150 countries. The yen dropped after Japan’s June trade surplus missed forecasts, sparking recession fears. Gold retreated to $3,340 as Fed leadership speculation faded and risk appetite returned, while the pound softened despite a UK inflation surprise. Silver held firm near $38, strengthened by safe-haven demand as new U.S. tariffs loom.

| Time | Cur. | Event | Forecast | Previous |

| 09:00 | EUR | CPI (YoY) (Jun) | 2.0% | 1.9% |

| 12:30 | USD | Core Retail Sales (MoM) | 0.3% | -0.3% |

| 12:30 | USD | Initial Jobless Claims | 233K | 227K |

| 12:30 | USD | Philadelphia Fed Manufacturing Index (July) | -1.2 | -4.0 |

| 12:30 | USD | Retail Sales (MoM) (Jun) | 0.1% | -0.9% |

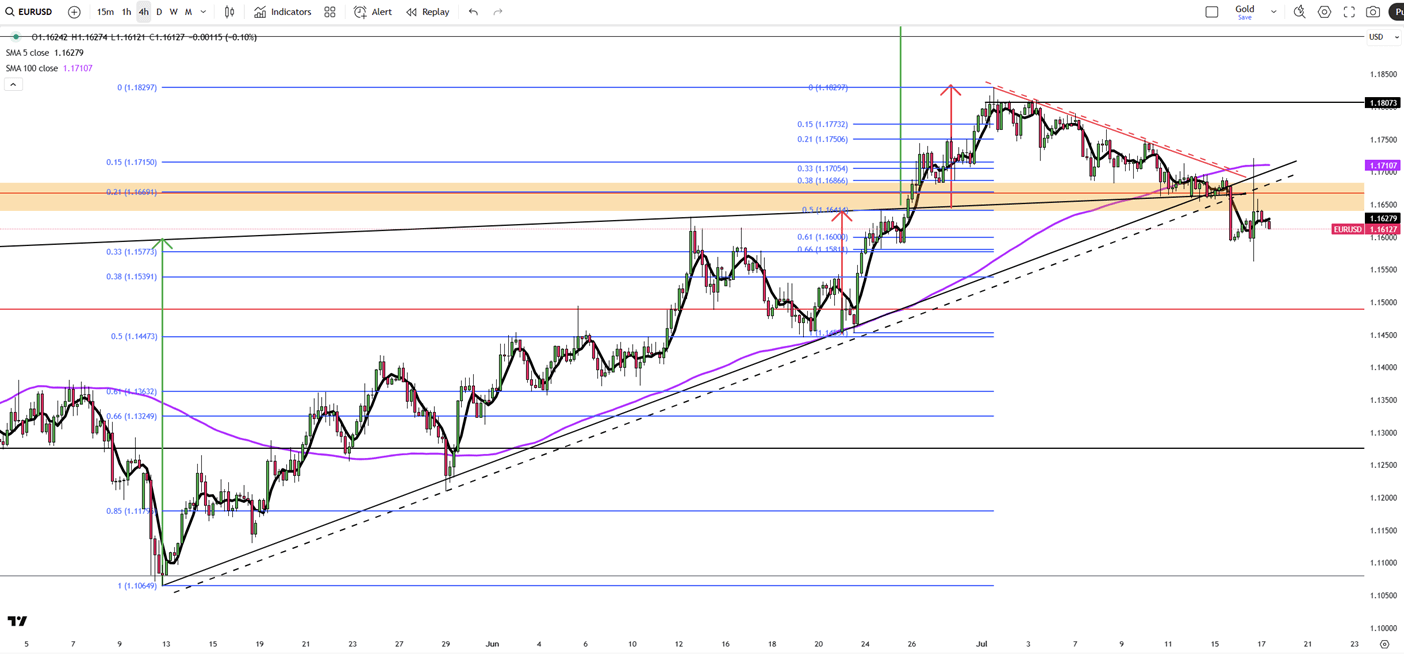

EUR/USD is pulling back toward 1.1620 in Thursday’s Asian session as markets await Eurozone HICP data, with eyes on US June retail sales later in the day. The dollar stays firm on expectations that the Fed will hold rates at 4.25%-4.50% in July amid tariff-driven uncertainty.

President Trump announced plans to notify over 150 countries of a 10% tariff, possibly rising to 15-20%, targeting those with minimal U.S. trade ties. He criticized Fed Chair Powell but admitted removing him might destabilize markets, while floating possible trade deals with Europe and India.

Strong June CPI has reignited concerns about prolonged high rates. Dallas Fed’s Lorie Logan and New York Fed’s John Williams both warned that tariffs may keep inflation elevated, reinforcing the case for keeping rates steady.

Resistance for the pair is at 1.1670, while support is at 1.1580.

| R1: 1.1670 | S1: 1.1580 |

| R2: 1.1700 | S2: 1.1540 |

| R3: 1.1750 | S3: 1.1500 |

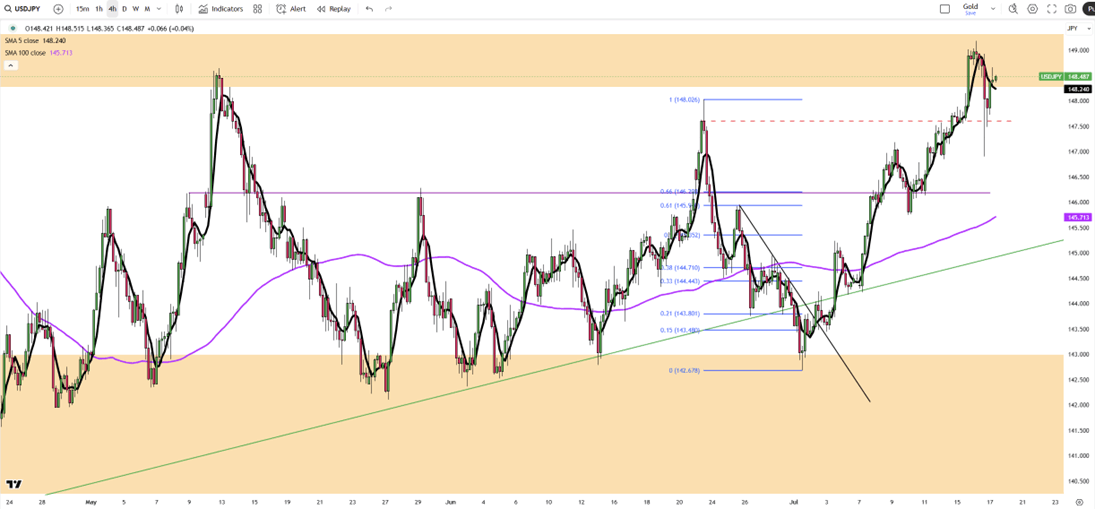

The Japanese yen weakened to around 148 per dollar on Thursday after disappointing trade data fueled concerns of a technical recession. June’s trade surplus came in at JPY 153.1 billion, well below the JPY 353.9 billion forecast and JPY 221.3 billion from a year earlier. Exports dropped 0.5% YoY, the second straight monthly decline, mainly due to the fallout from U.S. tariffs.

These signs have heightened fears of another quarterly contraction for Japan.

Resistance is at 147.75, with major support at 146.15.

| R1: 147.75 | S1: 146.15 |

| R2: 148.30 | S2: 145.30 |

| R3: 149.30 | S3: 144.65 |

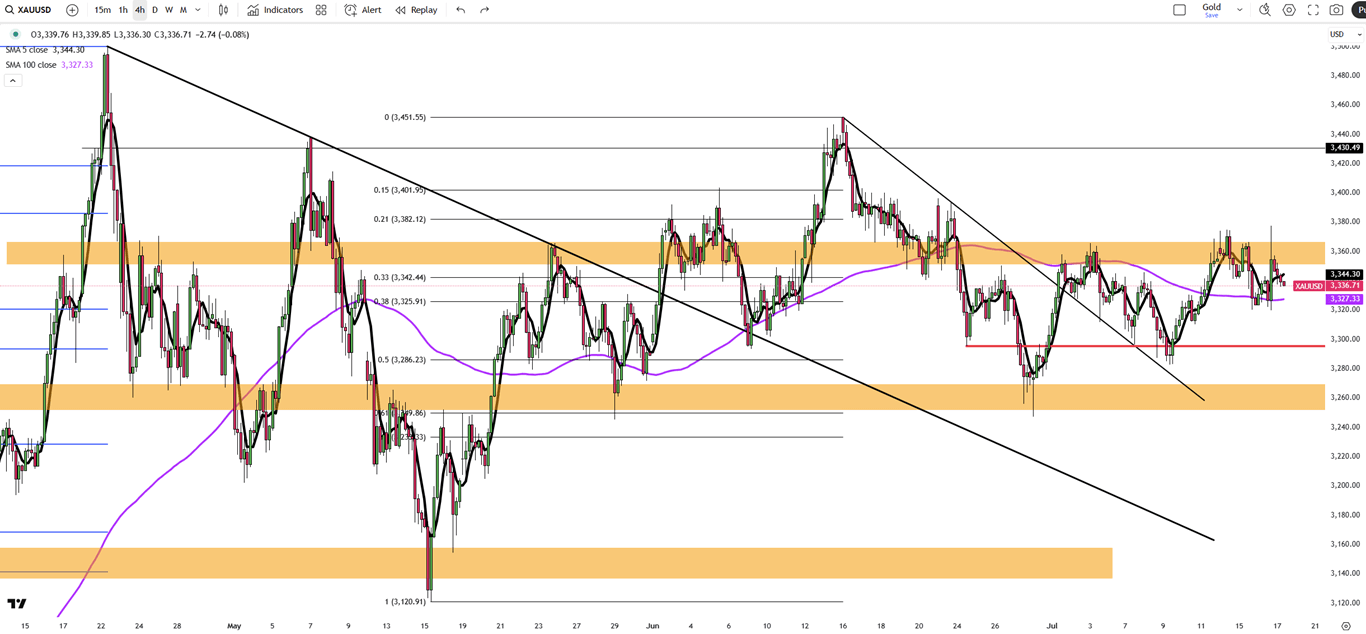

Gold fell to around $3,340 per ounce on Thursday, erasing recent gains as the U.S. dollar bounced back amid easing concerns over Powell’s role at the Fed. Trump denied reports of plans to remove Powell but reiterated criticism of rate policy.

June’s flat PPI reading hinted at subdued wholesale inflation, possibly reflecting muted economic impact from tariffs, despite the earlier CPI spike.

Meanwhile, the EU’s trade chief is in Washington for talks, and tensions with China eased following the lifting of the AI chip ban and a new trade deal with Indonesia, all reducing gold’s safe-haven demand.

Resistance is at $3,370, while support holds at $3,320.

| R1: 3370 | S1: 3320 |

| R2: 3400 | S2: 3295 |

| R3: 3430 | S3: 3250 |

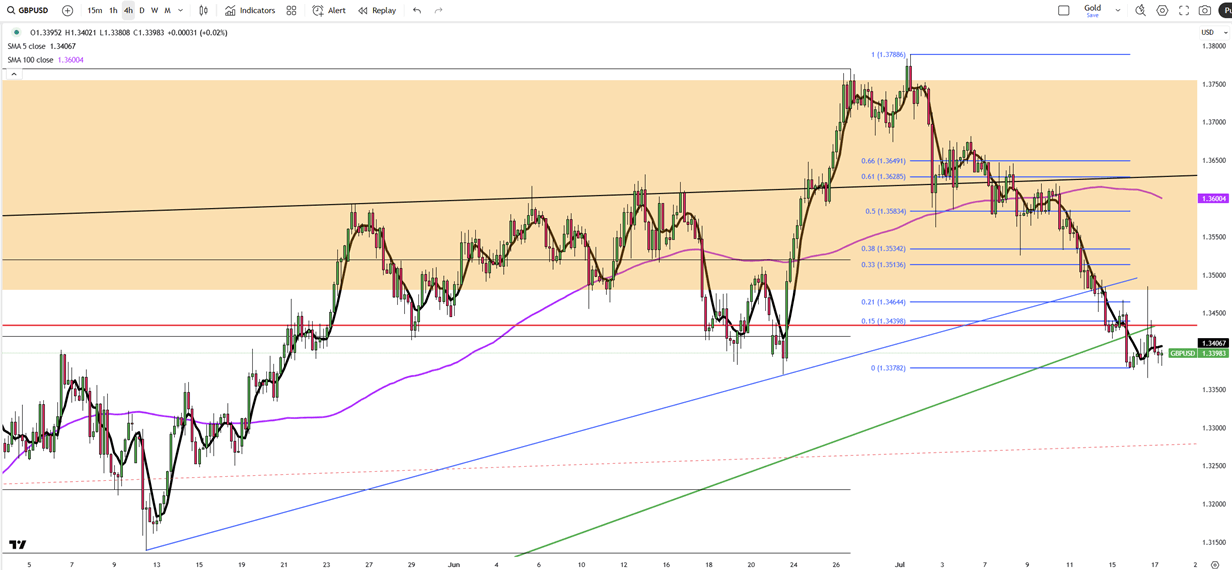

GBP/USD slipped to 1.3390 during Thursday’s session, paring gains as investors await UK labor data. Strong UK inflation figures may support a hawkish BoE stance, though August’s rate decision could be shaped by slowing labor conditions.

On the U.S. side, rising CPI has reinforced expectations for the Fed to hold rates steady. Fed officials Logan and Williams pointed to tariff-related inflation risks, while the Fed’s Beige Book reported solid activity but growing cost pressures.

June PPI came in flat, while core PPI slowed to 2.6% YoY. U.S. retail sales, jobless claims, and the Philly Fed index are next on watch.

Resistance is at 1.3535, while support holds at 1.3380.

| R1: 1.3535 | S1: 1.3380 |

| R2: 1.3580 | S2: 1.3270 |

| R3: 1.3630 | S3: 1.3140 |

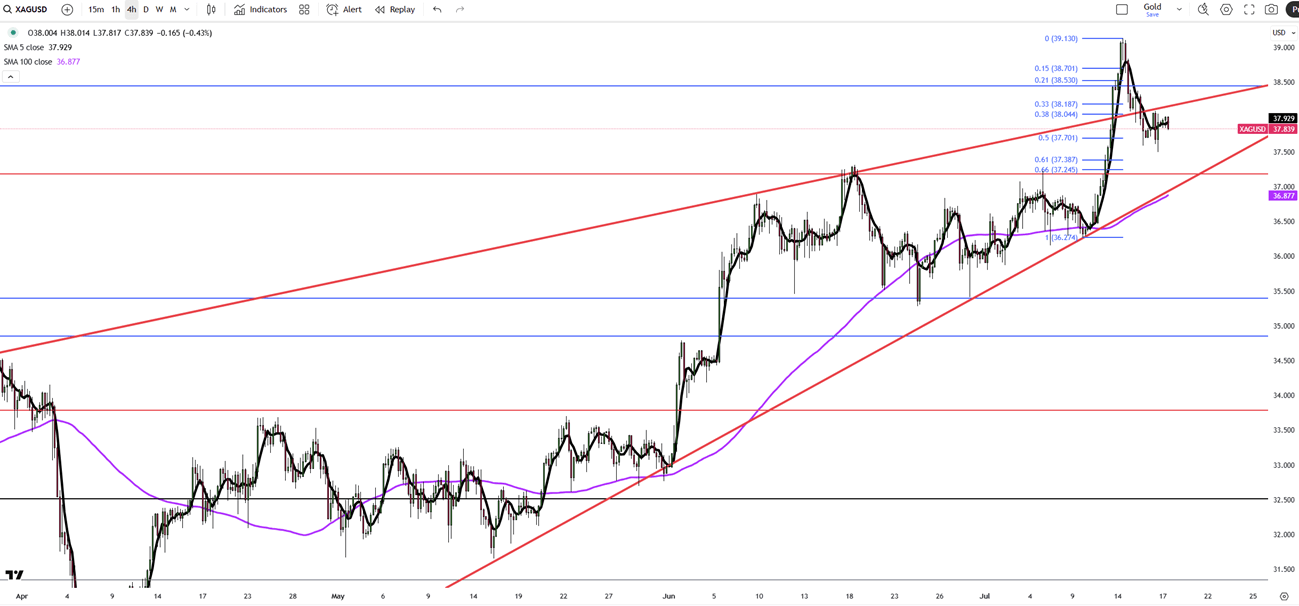

Silver is hovering near $38 during Thursday’s Asian session as markets digest U.S.-EU trade developments and Fed inflation commentary.

President Trump said deals with the EU and India are within reach, softening immediate trade fears. Still, the potential August 1 tariffs and inflationary risks continue to support silver’s appeal as a safe-haven asset.

Fed officials Williams and Bostic noted that although tariff impacts are modest now, they expect rising inflationary pressure in the coming months.

Resistance is at 38.50, while support holds at 37.20.

| R1: 38.50 | S1: 37.20 |

| R2: 39.50 | S2: 36.85 |

| R3: 40.10 | S3: 35.50 |

Markets remained cautious as a new 10% U.S. global tariff weighed on risk sentiment. The euro and pound stayed under pressure near recent lows, while the yen rebounded on renewed speculation around Bank of Japan tightening.

Pasar global tetap berhati-hati seiring berlakunya tarif global baru AS sebesar 10%, yang membuat ketidakpastian perdagangan tetap menjadi pusat perhatian investor.

Detail Geopolitics and Trade Drive Volatility (02.24.2026)Global markets are navigating a renewed wave of uncertainty as shifting U.S. trade policy and geopolitical tensions reshape risk sentiment. The Trump administration’s move to reintroduce a global tariff framework, starting at 10% with the option to raise it to 15%, has unsettled investors and prompted swift responses from major economies.

Bergabunglah dengan Channel Telegram Kami dan Berlangganan Sinyal Trading Kami secara Gratis!

Bergabunglah dengan Telegram!