EUR/USD edged higher near 1.1230, supported by a weaker dollar but capped by ECB rate cut expectations. The yen slipped past 145 as a preliminary US-UK trade deal and Fed hawkishness lifted the greenback.

EUR/USD edged higher near 1.1230, supported by a weaker dollar but capped by ECB rate cut expectations. The yen slipped past 145 as a preliminary US-UK trade deal and Fed hawkishness lifted the greenback. Gold and silver both eased, with gold dipping toward $3,290 and silver trading near $32.50 on waning safe-haven demand. GBP/USD held around 1.3240 after initial gains from a BoE rate cut faded with concerns over lingering US tariffs.

| Time | Cur. | Event | Forecast | Previous |

| 08:40 | GBP | BoE Governor Bailey Speaks | - | - |

| 09:30 | USD | FOMC Member Williams Speaks | - | - |

| 12:30 | USD | Fed Waller Speaks | - | - |

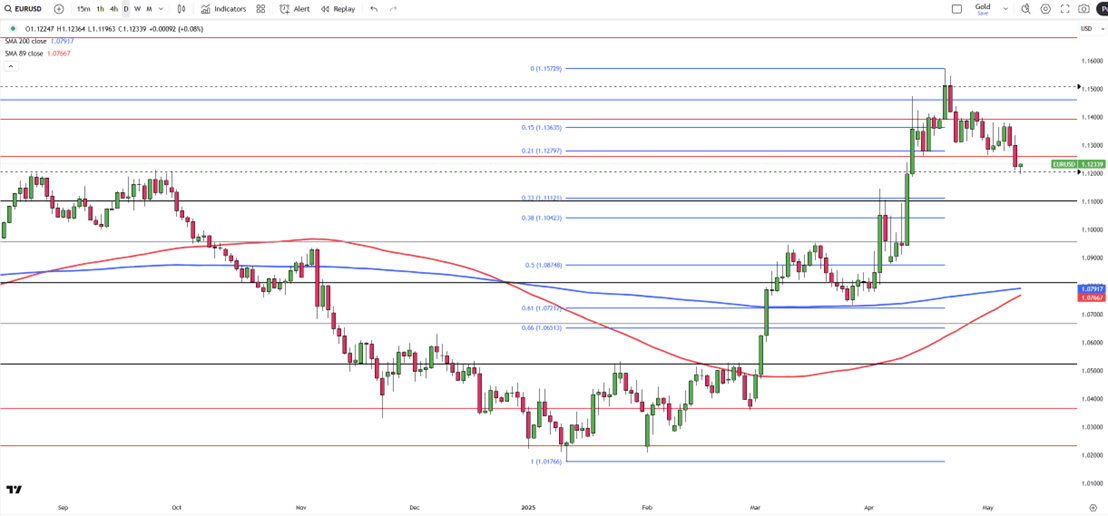

EUR/USD edged up to 1.1230 in Friday’s Asian session, paring earlier losses caused by stronger U.S. data and easing trade tensions that supported the dollar. The euro remains under pressure as markets price in possible ECB rate cuts by June, though officials maintain confidence in inflation reaching the 2% target by year-end.

The pair faces resistance at 1.1260, with further upside capped near 1.1460 and 1.1580. On the downside, support is seen at 1.1150, followed by 1.1100 and 1.1050.

| R1: 1.1260 | S1: 1.1150 |

| R2: 1.1460 | S2: 1.1100 |

| R3: 1.1580 | S3: 1.1050 |

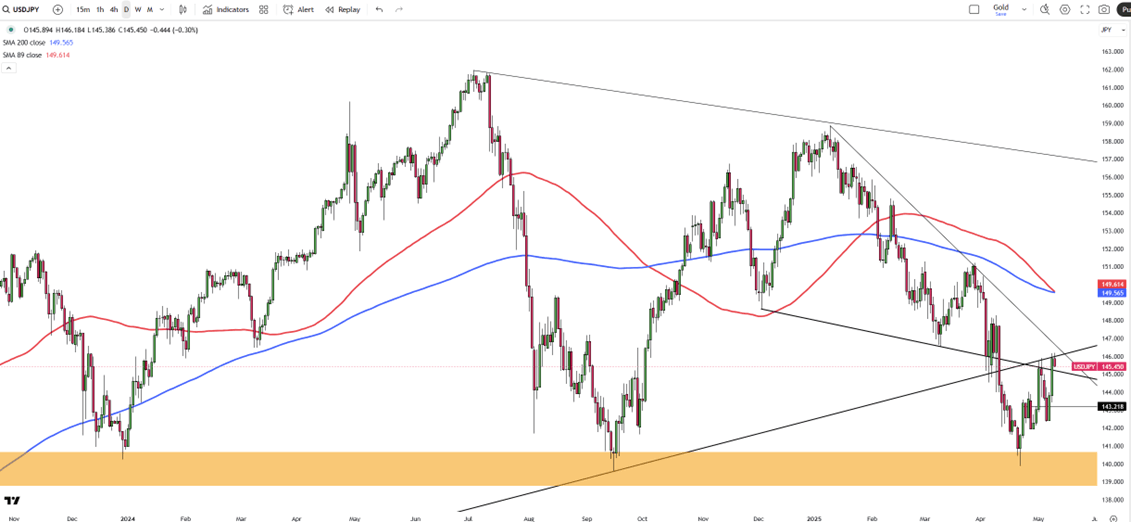

The Japanese yen weakened past 145 per dollar, hovering near a one-month low as the U.S. dollar strengthened with improving global trade sentiment and diminishing expectations of near-term U.S. rate cuts. The greenback gained momentum after President Trump announced a preliminary trade deal with the UK, the first since broad U.S. tariffs were introduced last month. He also signaled that tariffs on China could be eased, depending on the outcome of high-level trade talks set for this weekend in Switzerland.

Adding pressure on the yen, Fed Chair Powell dismissed the idea of a preemptive rate cut, citing persistent inflation risks and labor market concerns. In Japan, personal spending rose more than expected in March, suggesting resilience in consumption, though a third straight monthly drop in real wages highlighted broader economic challenges.

Resistance stands at 145.90, with further levels at 146.75 and 149.80. Support is found at 139.70, then 137.00 and 135.00.

| R1: 145.90 | S1: 139.70 |

| R2: 146.75 | S2: 137.00 |

| R3: 149.80 | S3: 135.00 |

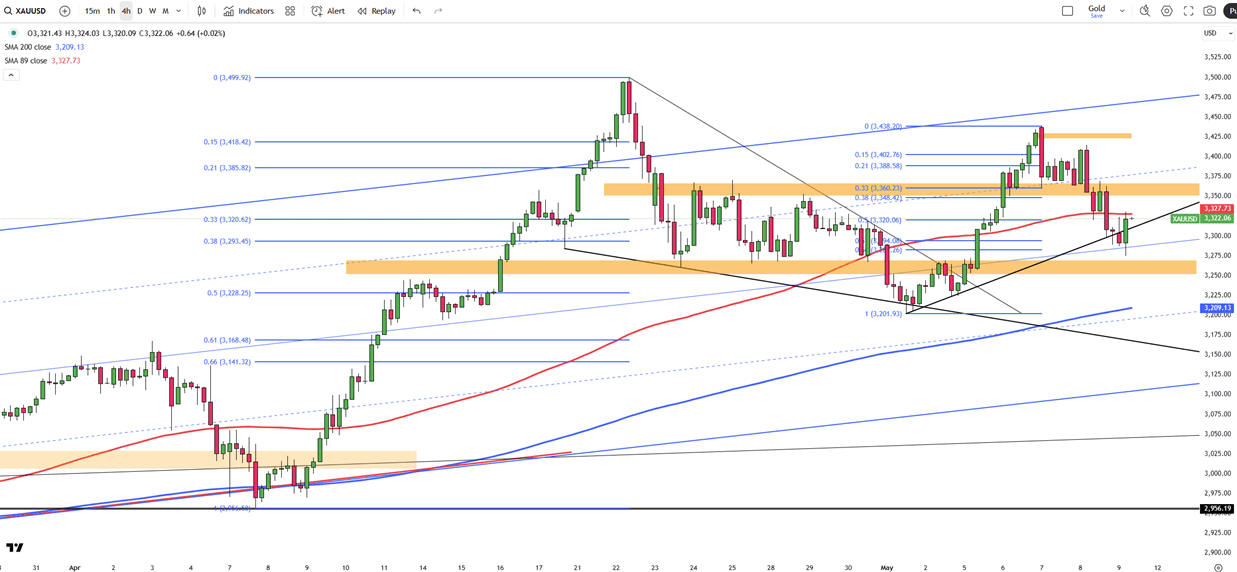

Gold extended losses for a third day, dropping toward $3,290 as market appetite for risk improved ahead of U.S.-China trade talks. The announcement of a U.S.-UK trade deal also contributed to reduced safe-haven demand. The Fed held rates steady as expected, warning of risks to inflation and jobs but avoiding any hint of preemptive cuts. Still, gold is poised for a weekly gain.

Resistance is seen at $3,360, $3,430, and $3,500, while support holds at $3,270, $3,200, and $3,165.

| R1: 3360 | S1: 3270 |

| R2: 3430 | S2: 3200 |

| R3: 3500 | S3: 3165 |

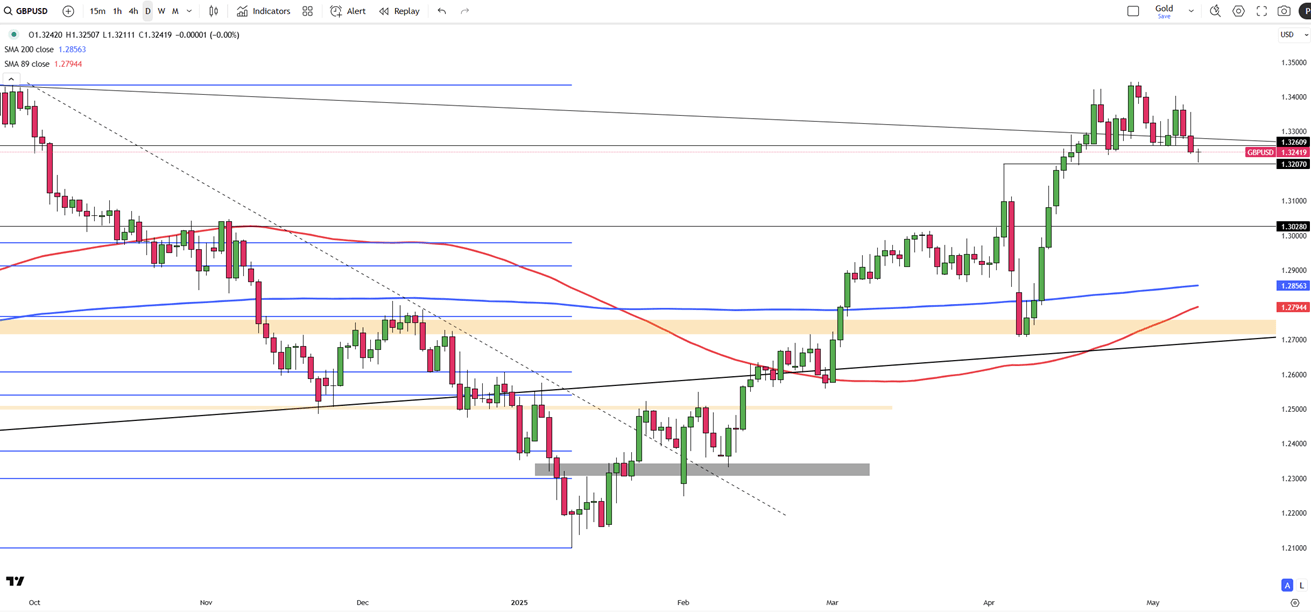

The GBP/USD pair opened Thursday with gains following the Bank of England’s expected 25 basis point rate cut, but the pound’s momentum faded as attention turned to U.S. trade developments. By Friday morning, the pair was trading around 1.3240.

Sentiment shifted toward the U.S. dollar after the Trump administration announced an upcoming trade deal with the UK, helping Britain avoid steep reciprocal tariffs originally set to resume on July 9. While some relief came from Trump’s earlier ‘Liberation Day’ delay, a broad 10% tariff on all UK imports to the U.S. remains on track, potentially weighing on sentiment. Refined ethanol has been fully exempted, though U.S. import data shows none has been sourced from the UK in over 15 years.

If GBP/USD breaks above 1.3280, resistance levels come in at 1.3450 and 1.3550. Support lies at 1.3160, followed by 1.3000 and 1.2960.

| R1: 1.3280 | S1: 1.3160 |

| R2: 1.3450 | S2: 1.3000 |

| R3: 1.3550 | S3: 1.2960 |

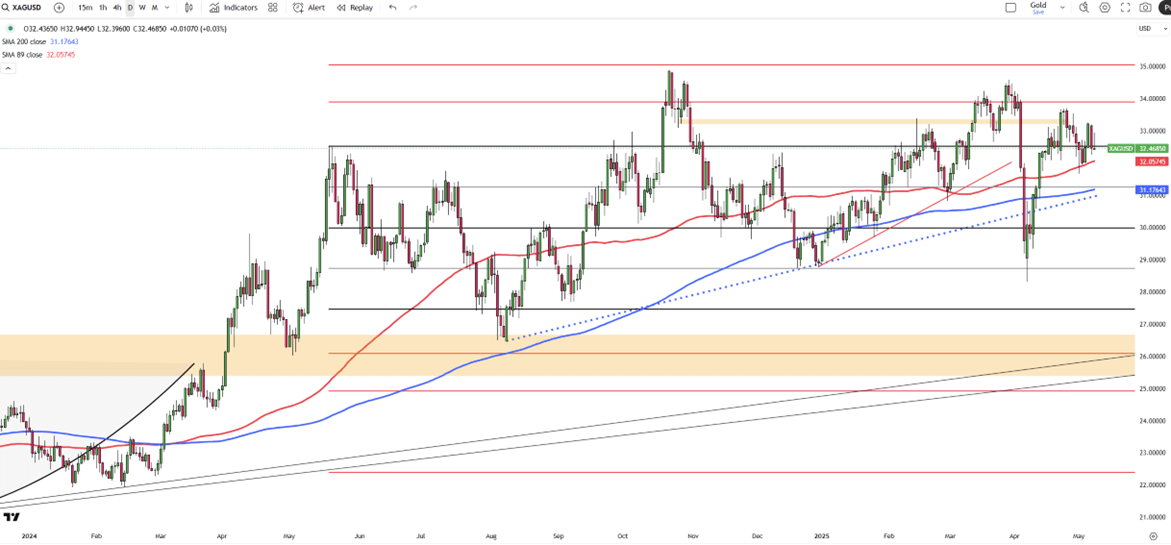

Silver hovered around $32.50 Friday, easing from earlier highs as optimism around U.S.-UK trade progress and upcoming talks with China reduced precious metals demand. The Fed’s hold on interest rates and cautious tone also weighed on precious metals. Still, silver remains on track for a weekly gain.

Technically, resistance is seen at $33.80, followed by $34.20 and $34.85, while support levels are noted at $32.00, $31.40, and $30.20.

| R1: 33.80 | S1: 32.00 |

| R2: 34.20 | S2: 31.40 |

| R3: 34.85 | S3: 30.20 |

Global markets remain dominated by geopolitical risk as escalating conflict between the United States, Israel, and Iran fuels a strong shift toward safe-haven assets. The dollar index hit 99.3 Wednesday, rising for a third day as conflict concerns fueled inflation and shifted Fed rate cut expectations from July to September.

A US court rejected Trump's tariff refund delay as the Dollar (98.5) and 10 year yield (4.04%) held gains amid Middle East escalation and inflation fears.

After Khamenei: Who Will Lead Iran Next?

After Khamenei: Who Will Lead Iran Next?Following the death of Supreme Leader Ali Khamenei, Iran has entered a pivotal transition phase. Senior officials in Tehran are acting swiftly to uphold the existing structure of the Islamic Republic, prioritizing continuity to head off potential internal instability. Despite these efforts, the sudden leadership vacuum has sparked intense political and military maneuvering behind the scenes.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!