The euro approached a three-year high on diverging policy paths between the ECB and Fed, while the Japanese yen gained ground with renewed U.S. tariff threats.

Gold surged to $3,370 on Middle East tensions and softer U.S. inflation, which also weakened the dollar and lifted the pound near its highest level since 2021. Silver retreated from multi-year highs as investors took profits, though long-term industrial demand remains strong. Traders now await upcoming U.S. PPI data and central bank decisions for further direction.

| Time | Cur. | Event | Forecast | Previous |

| 06:00 | GBP | GDP (MoM) (Apr) | -0.3%(Act) | 0.2% |

| 12:30 | USD | Initial Jobless Claims | 242K | 247K |

| 12:30 | USD | PPI (MoM) (May) | 0.2% | -0.5% |

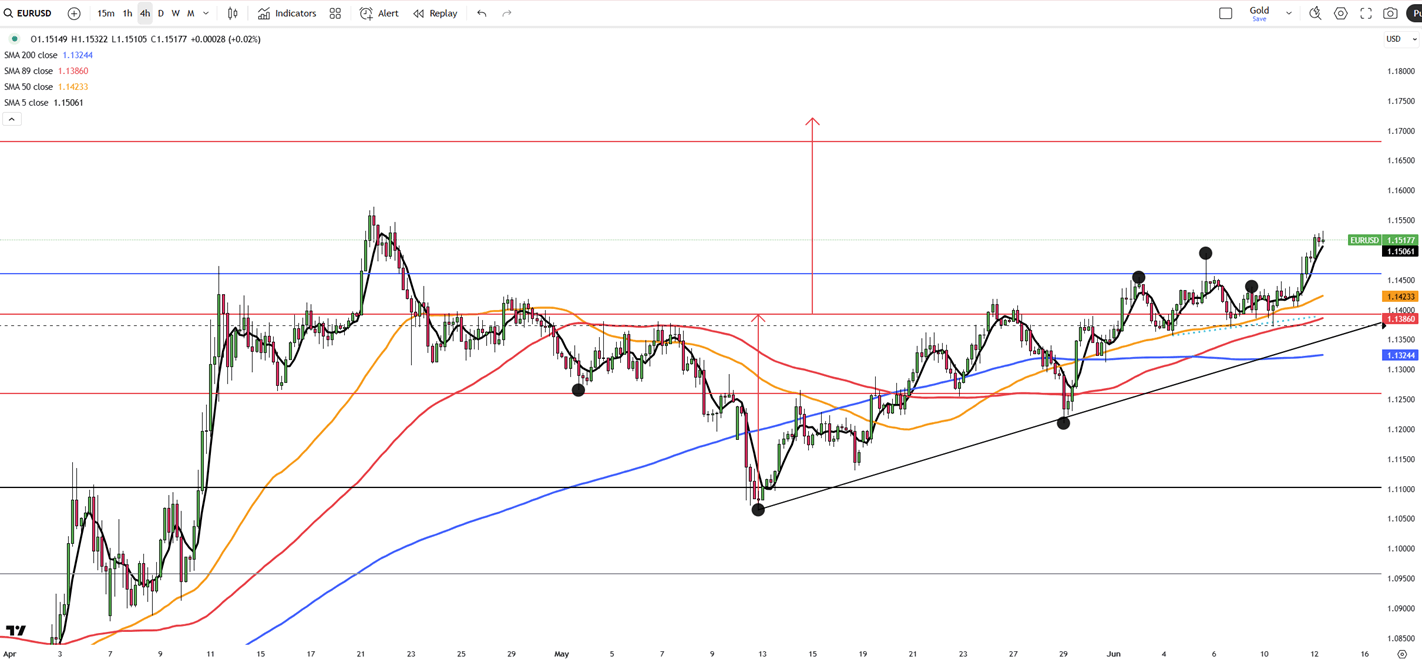

The euro stayed strong above $1.14, nearing a three-year high, as diverging signals from the ECB and Fed shaped sentiment. While the ECB delivered its eighth rate cut in a row, bringing the deposit rate to 2%, officials hinted at a pause to assess the impact of U.S. tariffs. Meanwhile, Eurozone inflation eased to 1.9% and GDP rose 0.6% in Q1, the best since late 2022. In contrast, softer U.S. CPI data heightened speculation that the Fed could begin cutting rates by September, though resilient labor markets and tariff risks keep uncertainty high.

Resistance is located at 1.1530, while support is seen at 1.1460.

| R1: 1.1530 | S1: 1.1460 |

| R2: 1.1580 | S2: 1.1390 |

| R3: 1.1600 | S3: 1.1350 |

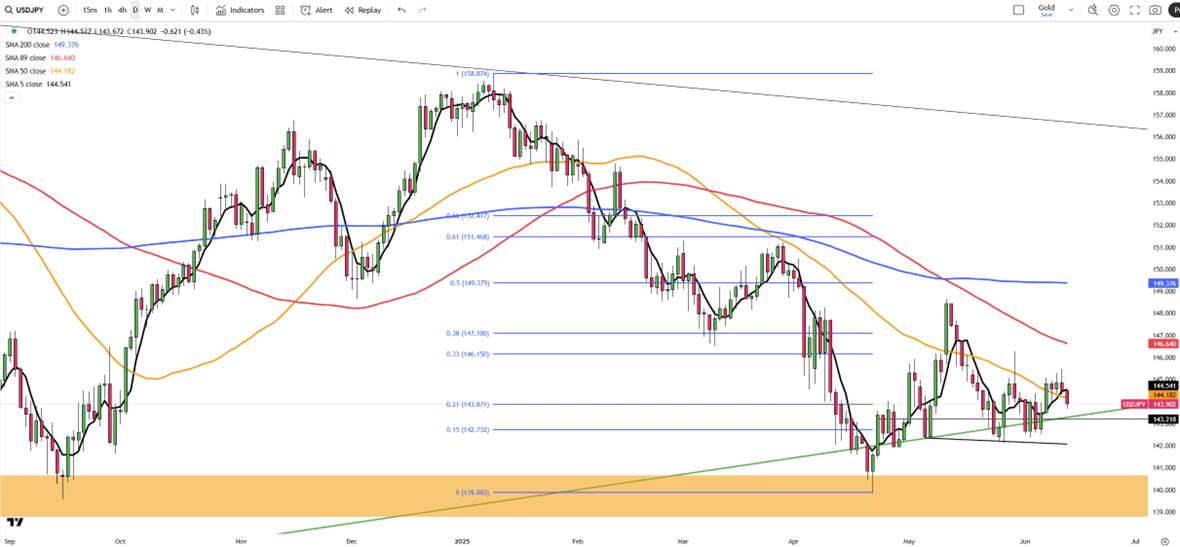

The yen strengthened to around 144 per dollar as investors turned to trusted assets following new U.S. tariff threats. President Trump announced that new tariffs would be imposed unilaterally to advance trade deals, rattling global markets. Japanese business confidence dropped further in Q2. Despite remaining cautious, BoJ Governor Kazuo Ueda said rate hikes are still on the table if inflation nears the 2% goal.

Resistance is at 145.30, while support stands near 142.50.

| R1: 145.30 | S1: 142.50 |

| R2: 146.10 | S2: 142.10 |

| R3: 148.15 | S3: 141.50 |

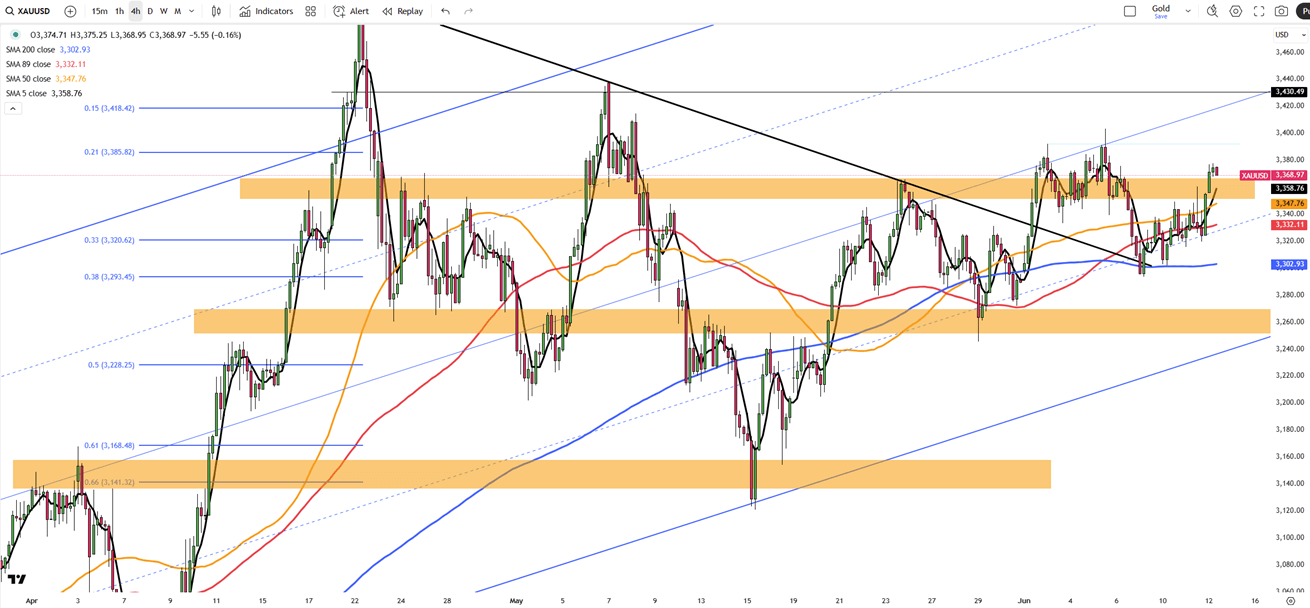

Gold rallied to around $3,370 per ounce on rising geopolitical tensions and increased speculation over U.S. rate cuts. The U.S. evacuated embassy staff in Baghdad over threats linked to Iran, and Trump’s new tariff plans added to the uncertainty. Soft U.S. CPI data increased bets on a Fed rate cut by September, with 50 basis points now priced in for 2024. Traders await PPI figures and next week’s Fed meeting for further direction.

Resistance is seen at $3,392, while support holds at $3,350.

| R1: 3392 | S1: 3350 |

| R2: 3430 | S2: 3300 |

| R3: 3500 | S3: 3250 |

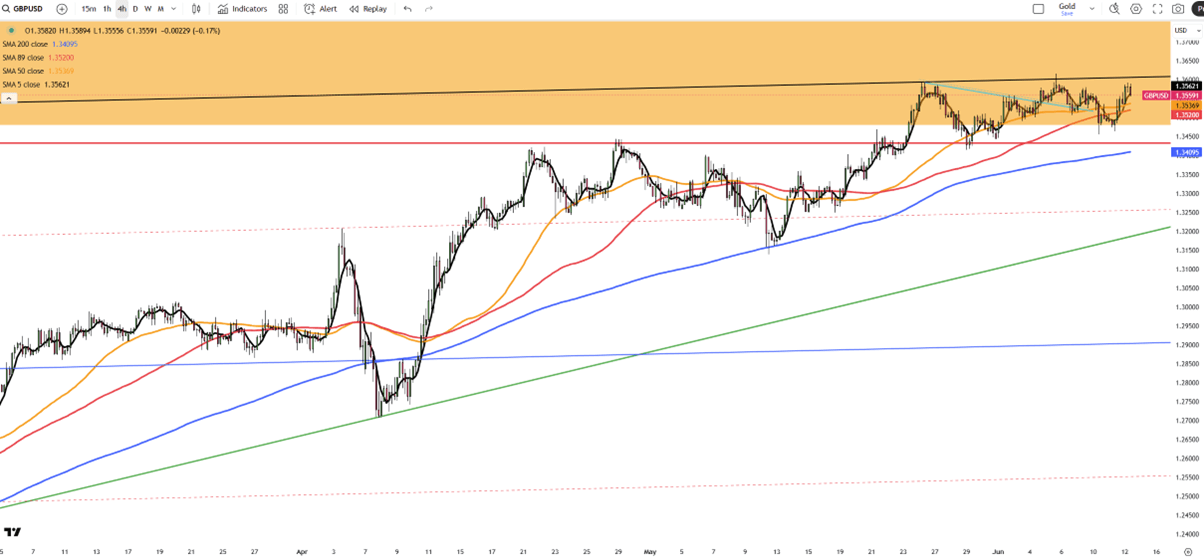

The pound climbed to $1.353, approaching a three-year high, as a weaker U.S. dollar lifted global risk sentiment. Domestically, Chancellor Rachel Reeves unveiled a multi-year £2 trillion spending plan. While it enhances public services, limited fiscal space may necessitate future tax increases. Despite signs of rising unemployment and slowing wage growth, markets expect the BoE to hold rates steady. A preliminary U.S.-China trade deal also supported the overall market mood.

Resistance is at 1.3600, with support around 1.3425.

| R1: 1.3600 | S1: 1.3425 |

| R2: 1.3750 | S2: 1.3165 |

| R3: 1.3850 | S3: 1.2890 |

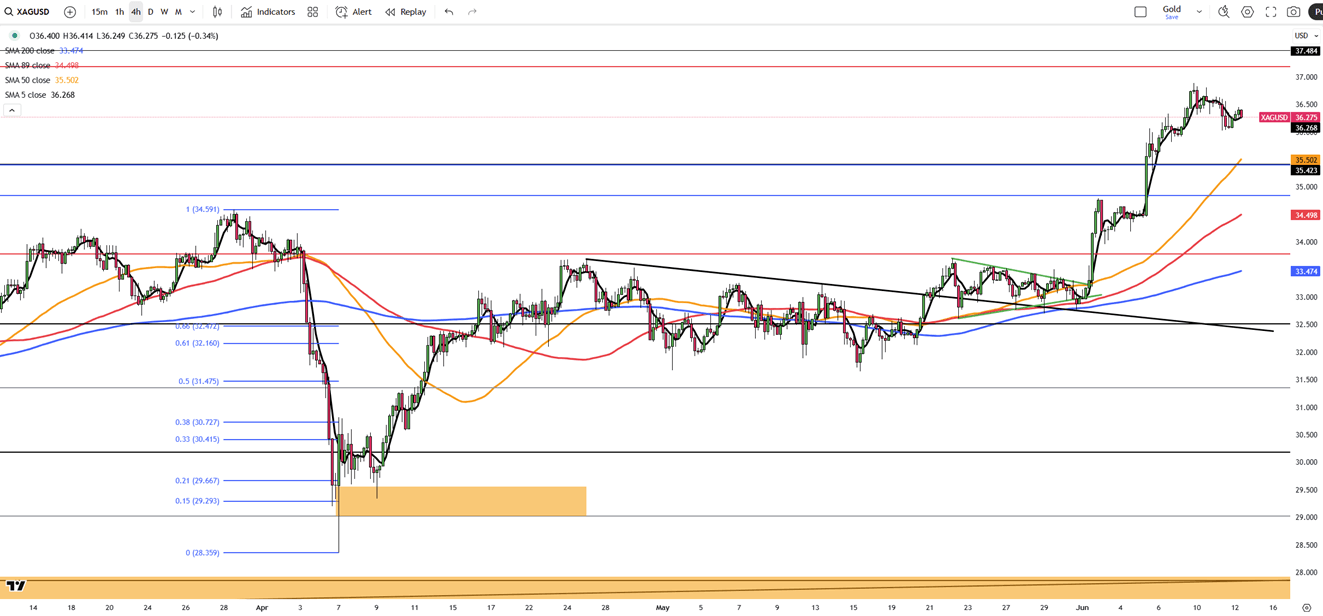

Silver slipped to around $36 per ounce after reaching a 13-year high, as traders locked in gains. Still, long-term fundamentals remain bullish. Industrial demand, especially from solar energy and electronics, now makes up over half of global consumption. The market faces a fifth straight year of supply deficits, though the shortfall is expected to shrink by 21% in 2025. Weaker U.S. inflation has also reinforced expectations of Fed rate cuts, supporting precious metals overall.

Resistance is set at 36.90, while support stands at 35.40.

| R1: 36.90 | S1: 35.40 |

| R2: 37.20 | S2: 34.85 |

| R3: 37.50 | S3: 33.80 |

Global markets remain dominated by geopolitical risk as escalating conflict between the United States, Israel, and Iran fuels a strong shift toward safe-haven assets. The dollar index hit 99.3 Wednesday, rising for a third day as conflict concerns fueled inflation and shifted Fed rate cut expectations from July to September.

A US court rejected Trump's tariff refund delay as the Dollar (98.5) and 10 year yield (4.04%) held gains amid Middle East escalation and inflation fears.

After Khamenei: Who Will Lead Iran Next?

After Khamenei: Who Will Lead Iran Next?Following the death of Supreme Leader Ali Khamenei, Iran has entered a pivotal transition phase. Senior officials in Tehran are acting swiftly to uphold the existing structure of the Islamic Republic, prioritizing continuity to head off potential internal instability. Despite these efforts, the sudden leadership vacuum has sparked intense political and military maneuvering behind the scenes.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!