The US Dollar weakened on Friday as speculation grew over potential changes in Fed leadership and future interest rate cuts.

EUR/USD climbed toward 1.1700, its highest since 2021, after President Trump criticized Fed Chair Powell and hinted at naming a replacement soon, raising concerns about Fed independence. The yen held near two-week highs on dovish expectations, while gold slipped to a four-week low as investors weighed mixed signals from the Fed. GBP/USD remained above 1.3700, though gains were capped by cautious tones from the Bank of England.

| Time | Cur. | Event | Forecast | Previous |

| 12:30 | USD | Core PCE Price Index (MoM) (May) | 0.1% | %0.1 |

| 12:30 | USD | Core PCE Price Index (YoY) | 2.6% | 2.5% |

| 14:00 | USD | Michigan 1-Year Inflation Expectations | 5.1% | 6.6% |

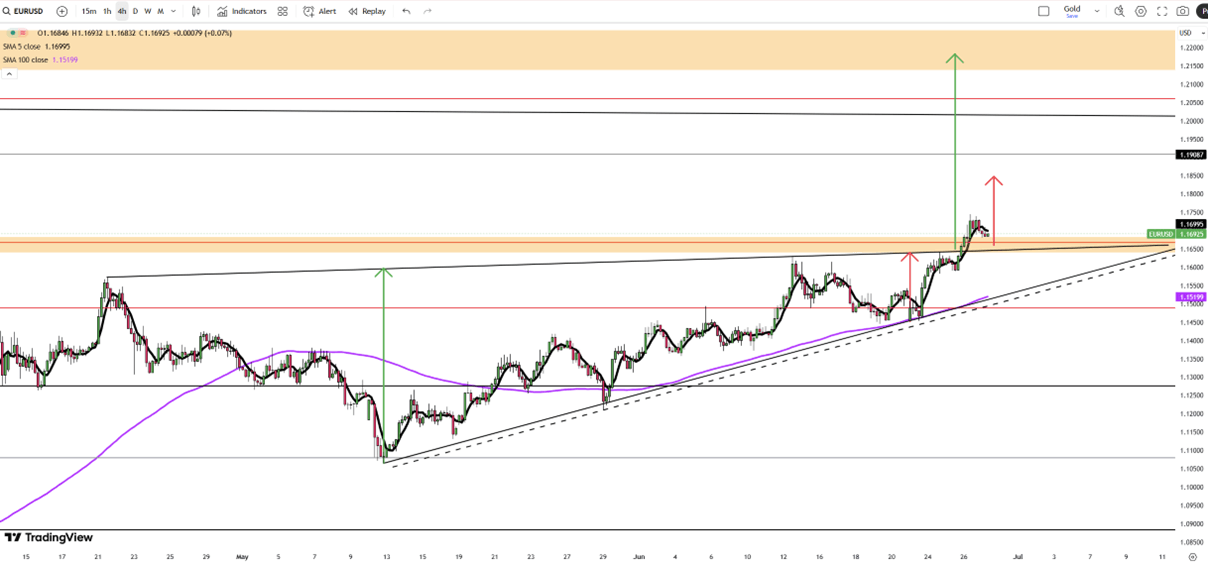

EUR/USD extended its rally early Friday, trading near 1.1700, its highest since 2021, driven by renewed pressure on the US Dollar. The Greenback weakened following President Donald Trump’s remarks at the NATO summit, where he criticized Fed Chair Jerome Powell and hinted at naming a replacement by September or October, raising concerns over the Fed’s independence.

Chicago Fed President Austan Goolsbee pushed back, stressing that monetary policy remains data-driven. In Europe, French President Macron warned of retaliation if the US enforces its proposed 10% tariff, while ECB officials highlighted risks to inflation and growth. ECB Vice President Luis de Guindos also suggested the euro’s global role may grow with continued EU reforms.

Resistance is located at 1.1745, while support is seen at 1.1630.

| R1: 1.1745 | S1: 1.1630 |

| R2: 1.1800 | S2: 1.1550 |

| R3: 1.1900 | S3: 1.1450 |

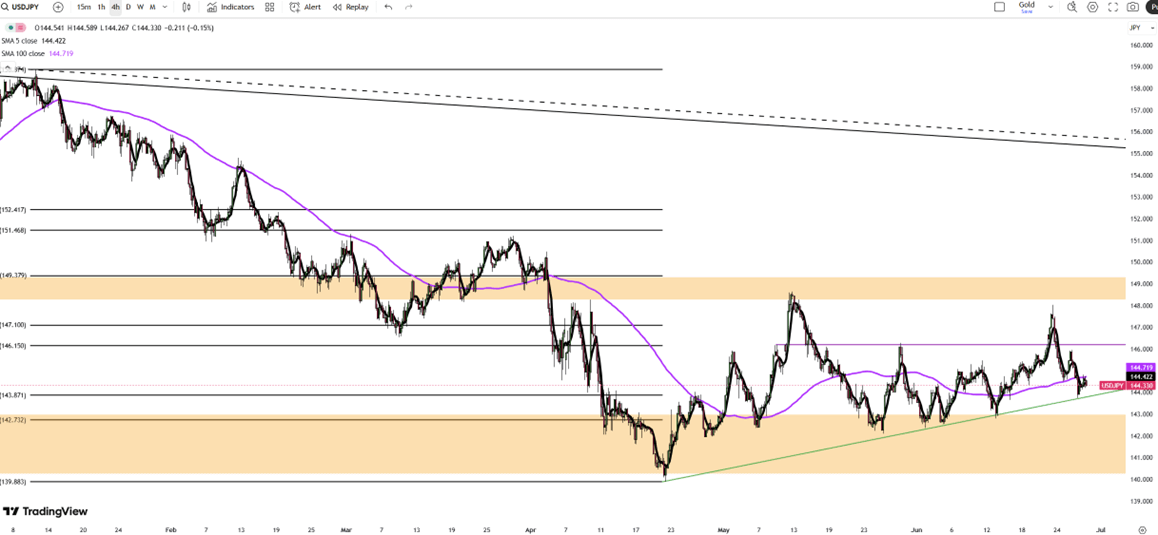

The Japanese yen held firm near 144.3, maintaining gains from earlier this week as the dollar remained under pressure. Market speculation over deeper Fed rate cuts intensified after reports suggested President Trump could soon name Powell’s successor, potentially steering policy in a more dovish direction.

The key resistance is at $145.70 meanwhile the major support is located at $143.55.

| R1: 145.70 | S1: 143.55 |

| R2: 146.20 | S2: 142.45 |

| R3: 147.00 | S3: 141.00 |

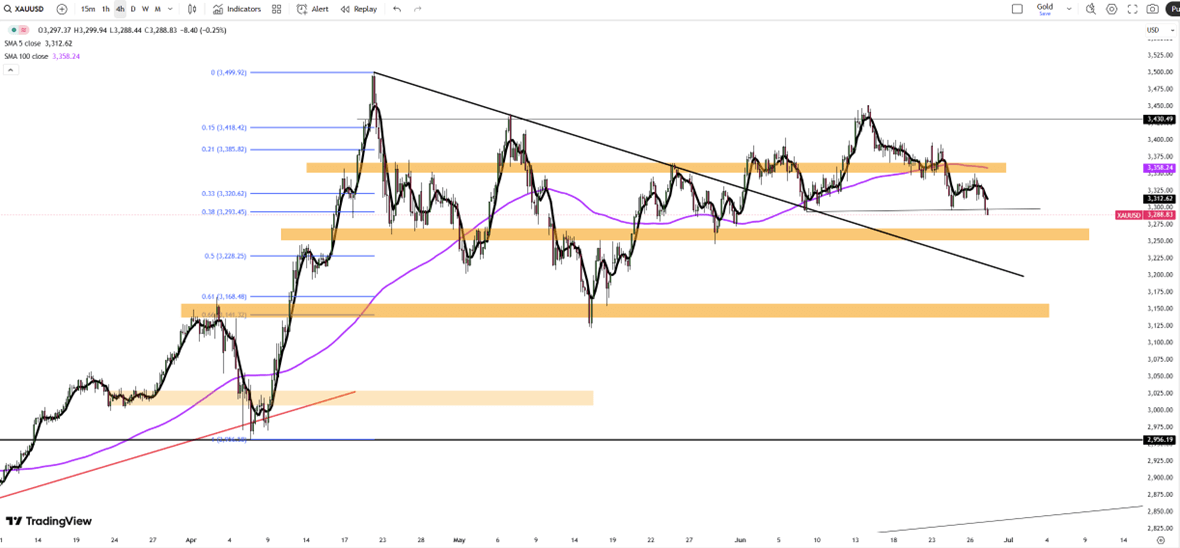

Gold dipped to around $3,293 on Friday, approaching a four-week low, even as the dollar eased. The decline comes on uncertainty over the Fed’s next move. While Trump’s potential Fed Chair announcement may signal a pivot to looser policy, investors are still digesting mixed Fed signals and waiting for clarity.

Resistance is seen at $3,355, while support holds at $3,270.

| R1: 3355 | S1: 3270 |

| R2: 3385 | S2: 3235 |

| R3: 3430 | S3: 3205 |

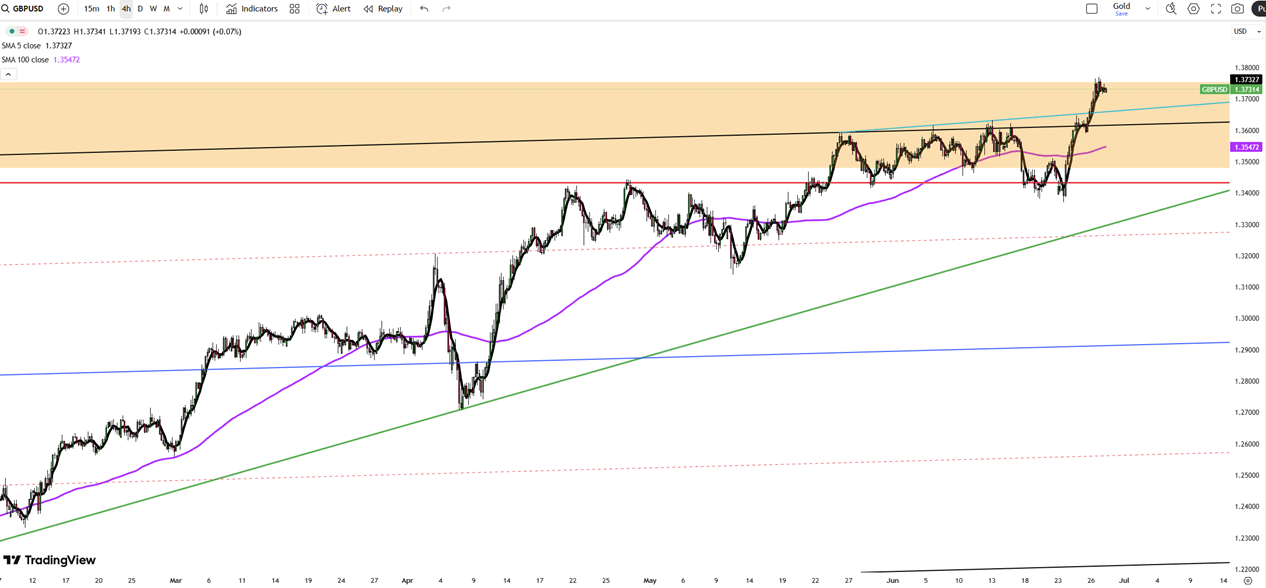

GBP/USD traded around 1.3735 in Friday’s Asian session, supported by a weaker dollar and easing geopolitical tensions. The pair gained after President Trump reiterated plans to replace Powell, boosting bets on rate cuts.

However, the BoE’s dovish stance may cap further upside. Governor Andrew Bailey flagged softness in the UK labor market, and three MPC members voted to cut rates in June despite holding steady at 4.25%. Meanwhile, weak Q1 US GDP data and anticipation around May PCE figures keep the market cautious.

Resistance is seen at 1.3760, while support holds at 1.3660.

| R1: 1.3760 | S1: 1.3660 |

| R2: 1.3835 | S2: 1.3590 |

| R3: 1.3900 | S3: 1.3500 |

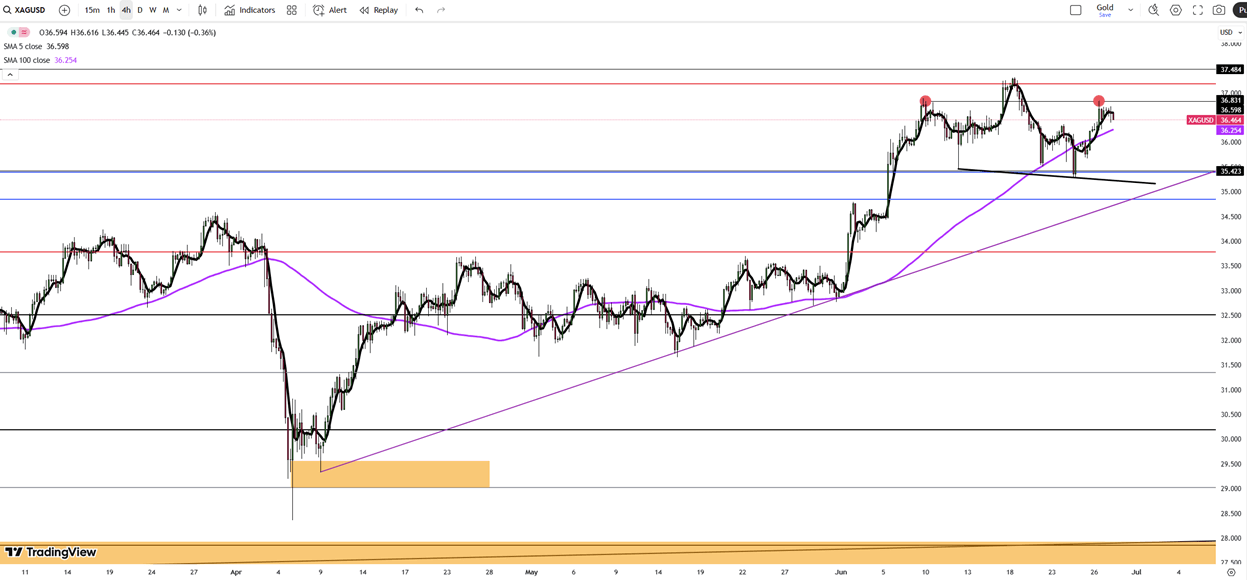

Silver remained steady above $36.50, extending gains for a third session. The dollar's weakness, combined with growing rate cut expectations, continues to support the metal. Fed Chair Powell’s dovish tone and speculation over Trump’s upcoming Fed nomination are keeping markets alert.

On the macro front, the White House downplayed the urgency of looming tariff deadlines, easing trade fears. Silver also enjoys support from robust industrial demand and tight supply, outperforming gold with an 11% rise in June.

Resistance is seen at 37.50, while support holds at 35.40.

| R1: 37.50 | S1: 35.40 |

| R2: 39.00 | S2: 34.85 |

| R3: 41.00 | S3: 33.80 |

Bond Market Pushback Takes Center Stage

Bond Market Pushback Takes Center StageMarkets are almost fully pricing in another Federal Reserve rate cut this week, yet the US bond market continues to move in the opposite direction.

Detail Central Bank Expectations Reset the Tone (8-12 December)

Central Bank Expectations Reset the Tone (8-12 December)Traders adjusted positioning before the Federal Reserve’s December decision and evaluated fresh signals from the ECB, BoE and BOJ.

Detail Futures Stall, 10-Year Yield Pushes Above 4.1% (12.08.2025)US stock futures were flat on Monday ahead of the Fed’s meeting, with markets pricing an 88% chance of a 25 bp cut on Wednesday.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!