Markets remain volatile as trade tensions and inflation concerns dominate sentiment.

The U.S. dollar strengthened amid renewed tariff threats from President Trump, while the euro slipped ahead of key economic data releases. Gold surged past $2,980, reaching a record high, as investors sought safe-haven assets amid growing expectations of Fed rate cuts. The yen weakened slightly but held near a five-month high, supported by speculation of future BOJ rate hikes. Meanwhile, silver hovered around $33.80, with softer U.S. inflation data keeping rate cut bets intact. Traders now focus on upcoming economic reports and central bank signals for further market direction.

| Time | Cur. | Event | Forecast | Previous |

| 07:00 | GBP | GDP MoM | 0.1% | 0.4% |

| 07:00 | GBP | United Kingdom Manufacturing Production MoM | -0.2% | 0.7% |

| 13:15 | EUR | ECB Cipollone speech | ||

| 14:00 | USD | United States Michigan Consumer Sentiment | 63.2 | 64.7 |

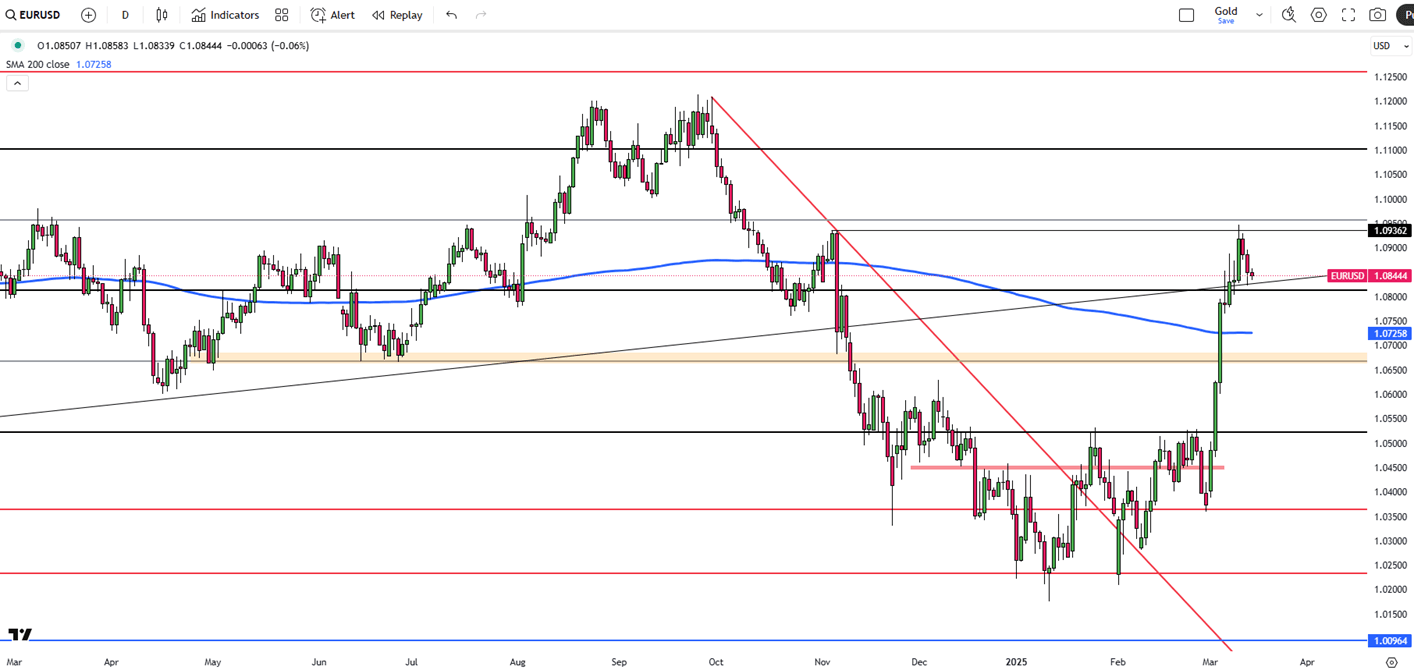

The EUR/USD pair declined to around 1.0835 during Friday’s Asian session, as the Euro (EUR) weakened against the US Dollar (USD) amid rising trade tensions between the U.S. and the European Union. Later in the day, market focus will shift to key economic releases, including Germany’s February Harmonized Index of Consumer Prices (HICP) and the preliminary Michigan Consumer Sentiment Index for March.

Key resistance is at 1.0950, followed by 1.1000 and 1.1050. Support stands at 1.0800, with further levels at 1.0730 and 1.0650.

| R1: 1.0950 | S1: 1.0800 |

| R2: 1.1000 | S2: 1.0730 |

| R3: 1.1050 | S3: 1.0650 |

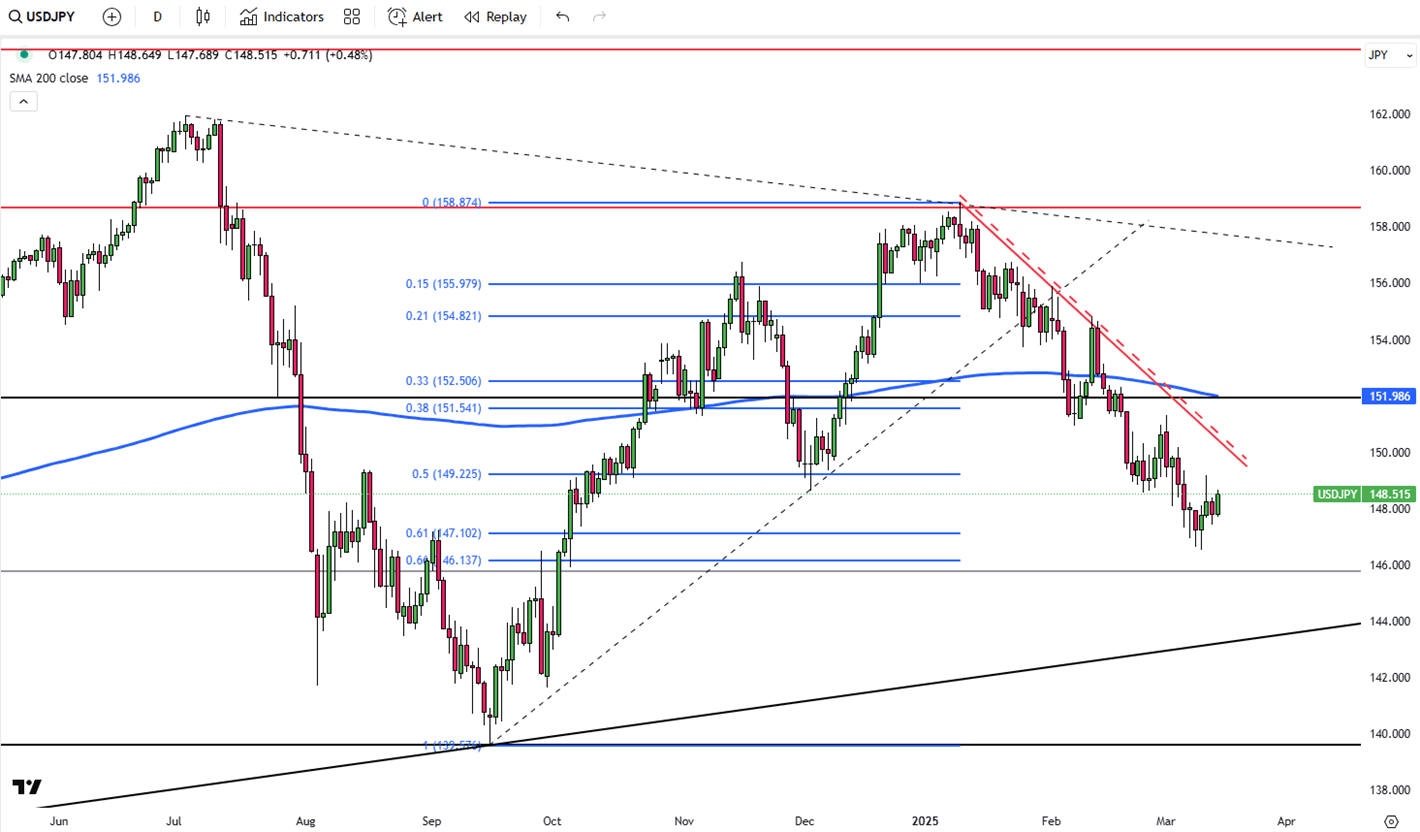

The yen fell below 148 per dollar on Friday, reversing gains as trade tensions increased the dollar. Trump reaffirmed plans for reciprocal tariffs starting April 2. Despite this drop, the yen remains near a five-month high, backed by expectations of BOJ rate hikes. Japanese firms agreed to wage increases for a third year, aiming to offset inflation and labor shortages. Higher wages may spur spending and inflation, giving the BOJ room for future hikes. While rates are expected to remain unchanged next week, policymakers may pursue hikes later this year.

Key resistance is at 149.20, with further levels at 152.00 and 154.90. Support stands at 147.00, followed by 145.80 and 143.00.

| R1: 149.20 | S1: 147.00 |

| R2: 152.00 | S2: 145.80 |

| R3: 154.90 | S3: 143.00 |

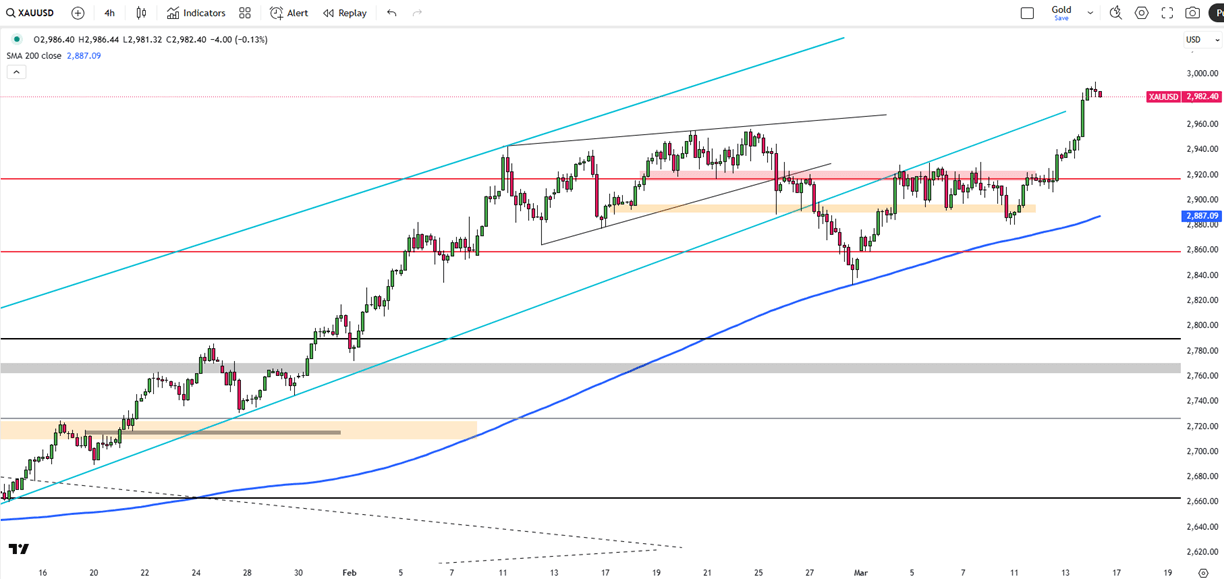

Gold surged above $2,980 per ounce on Friday, hitting a record high and poised for a 2% weekly gain amid risk aversion and rising Fed rate cut expectations. Trump escalated trade tensions, threatening a 200% tariff on European wines after the EU imposed a 50% tax on U.S. whiskey. February's PPI and CPI data signaled easing inflation, increasing Fed flexibility for rate cuts and boosting gold’s appeal. Strong ETF inflows and continued central bank purchases, with China extending its buying for a fourth month, further supported prices.

Key resistance stands at $2,985, with further levels at $3000 and $3,050. Support is at $2,930, followed by $2,900 and $2,860.

| R1: 2985 | S1: 2930 |

| R2: 3000 | S2: 2900 |

| R3: 3050 | S3: 2860 |

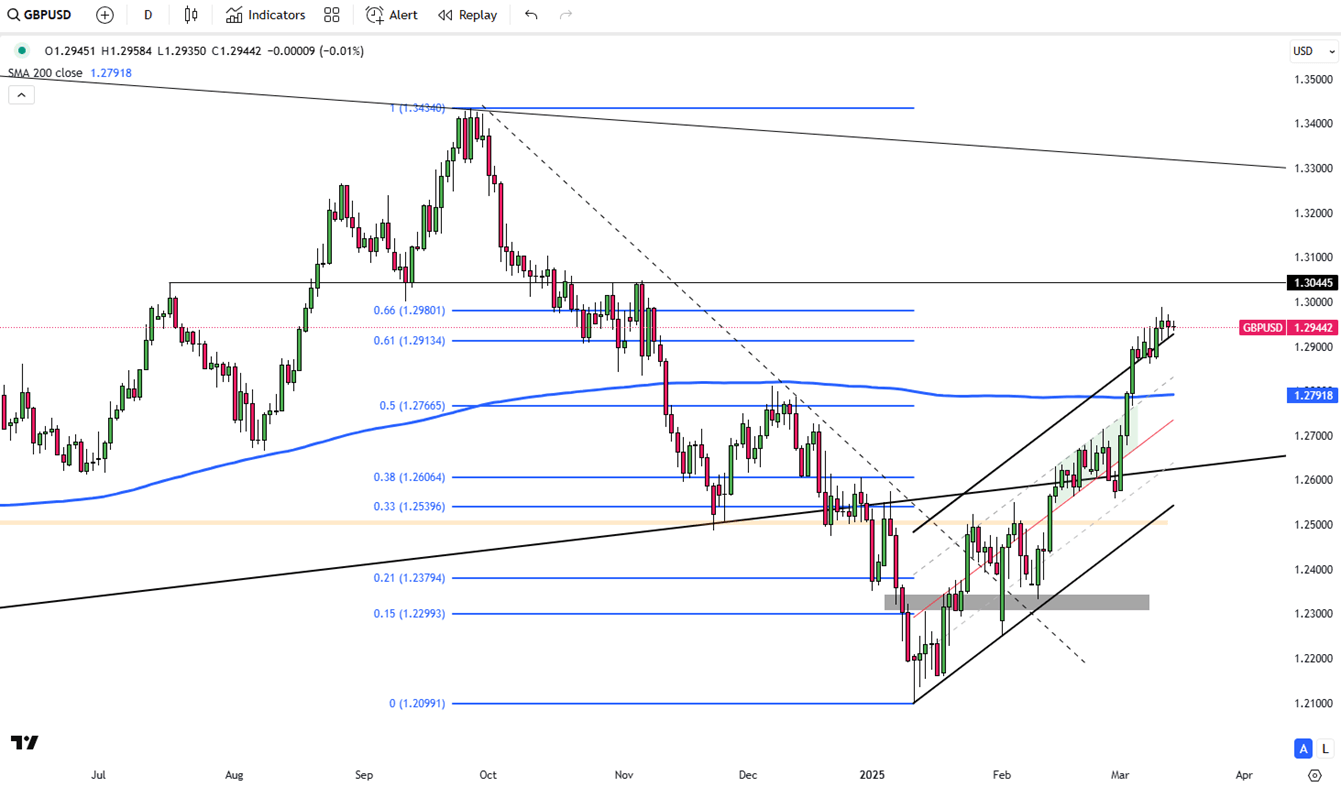

GBP/USD extends its decline for the second consecutive session, hovering around 1.2940 during Friday's Asian trading hours. The currency pair faces difficulties as the Pound Sterling (GBP) weakens due to a negative risk sentiment, which has been further worsened by worries over global trade following US President Donald Trump's threat to impose a 200% tariff on European wines and champagne, creating market instability.

If GBP/USD breaks above 1.2980, the next resistance levels are 1.3050 and 1.3100. On the downside, support stands at 1.2860, with further levels at 1.2760 and 1.2660 if selling pressure increases.

| R1: 1.2980 | S1: 1.2860 |

| R2: 1.3050 | S2: 1.2760 |

| R3: 1.3100 | S3: 1.2660 |

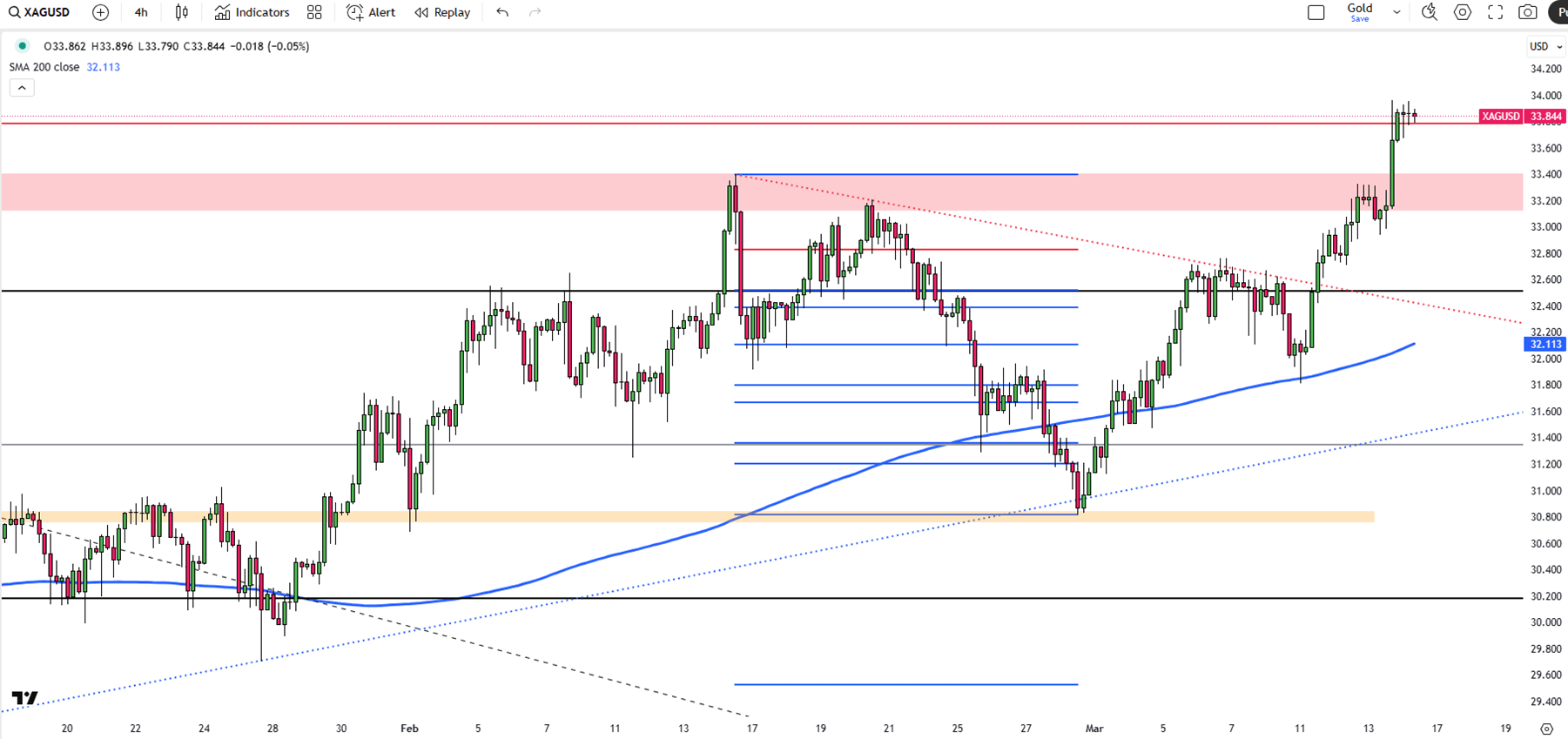

Silver edged lower to approximately $33.80 during early Asian trading on Friday, losing momentum. However, the downside may remain limited, as softer U.S. consumer and producer inflation data could provide room for the Federal Reserve to consider an interest rate cut in June, offering some support for the metal.

Additionally, concerns over U.S. President Donald Trump's protectionist policies potentially pushing the world's largest economy into a recession could further support silver's appeal.

If silver breaks above $34.00, the next resistance levels are $34.85 and $35.00. On the downside, support is at $33.80, with further levels at $33.15 and $32.75 if selling pressure increases.

| R1: 34.00 | S1: 33.80 |

| R2: 34.85 | S2: 33.15 |

| R3: 35.00 | S3: 32.75 |

Hormuz Blockade Rattles Markets (09 - 13 March)

Hormuz Blockade Rattles Markets (09 - 13 March)Global sentiment was dominated this week by the second week of the war with Iran and the effective blockade of the Strait of Hormuz, driving Brent crude prices above $100/barrel. Despite a catastrophic US labor report showing a loss of 92,000 jobs in February, safe-haven demand pushed the US Dollar Index to 99.1. The energy shock has ignited fears of "stagflation," particularly in Europe and Japan, as soaring fuel costs threaten to reverse recent disinflationary trends.

Detail Oil Shock Drives Dollar Higher (03.09.2026)Global markets opened the week under pressure as escalating Middle East tensions and disruptions in the Strait of Hormuz pushed oil prices above $100 per barrel.

Trump Signals Extended Military Campaign

Trump Signals Extended Military CampaignGeopolitical tensions in the Middle East have intensified following recent remarks from Donald Trump suggesting that the ongoing military campaign against Iran may last longer than anticipated. While Trump stated that early operational objectives were achieved ahead of schedule, he acknowledged that broader strategic goals could require additional time and sustained military pressure.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!