Wall Street futures traded narrowly as investors weighed the US military action in Venezuela and Maduro’s arrest. Muted risk appetite reflects concerns over geopolitical fallout and oil supply, with focus now shifting to Friday’s US jobs report for Fed policy cues.

The euro held near recent highs after a strong 2025, supported by steady ECB policy and expectations of a more dovish Federal Reserve later this year. The yen weakened to multi-week lows as dollar strength persisted, while gold and silver surged on rising geopolitical tensions tied to Venezuela. Sterling remained stable after its best annual gain in years, underpinned by expectations that the BoE will ease more slowly than the Fed.

| Time | Cur. | Event | Forecast | Previous |

| 15:00 | USD | ISM Manufacturing PMI (Dec) | 48.3 | 48.3 |

| 15:00 | USD | ISM Manufacturing Prices (Dec) | 59.0 | 58.5 |

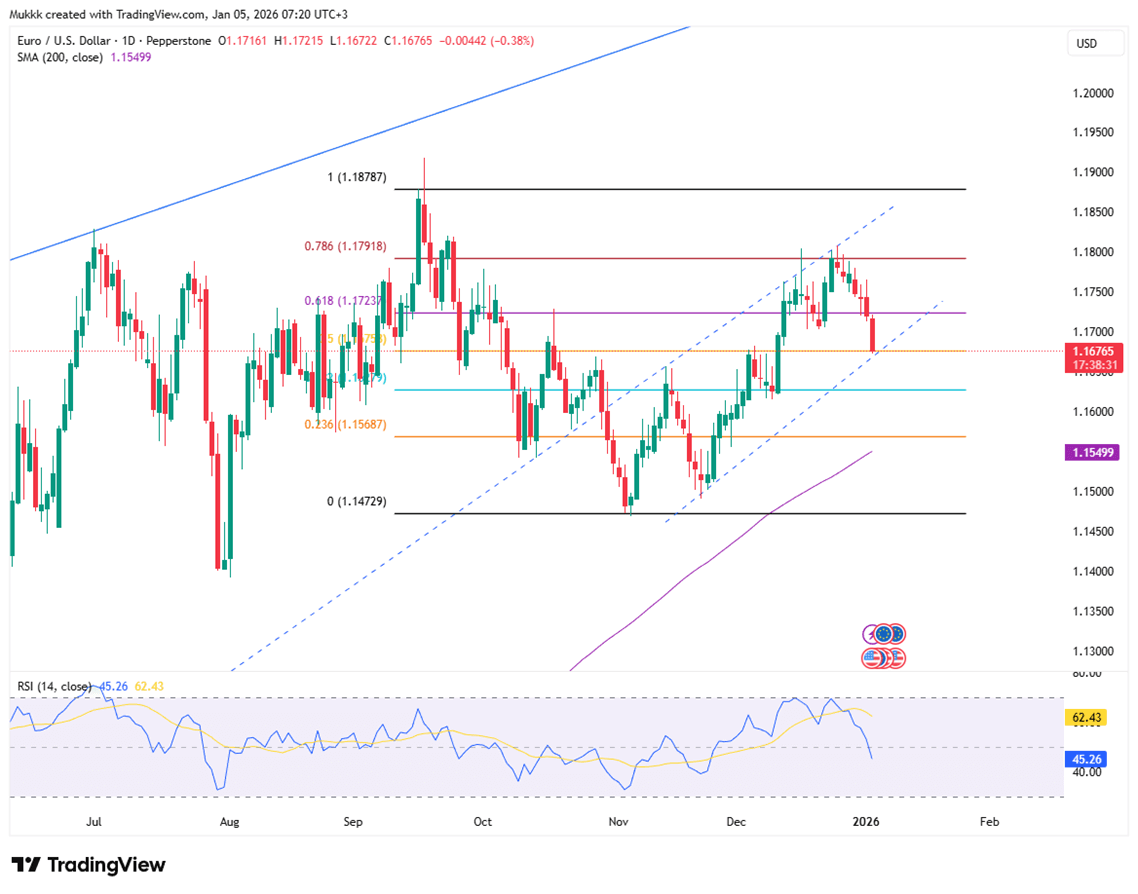

The euro traded near $1.1670 in early 2026, following an impressive 13.5% climb last year. Investors are currently weighing steady ECB policy against shifting expectations in the U.S. While the ECB has signaled a pause due to resilient growth and stable inflation, the dollar remains under pressure. This trend is driven by anticipation of a more dovish Federal Reserve leadership and two projected U.S. rate cuts later this year.

Technically, 1.1620 is the key support, while resistance is seen at 1.1750.

| R1: 1.1750 | S1: 1.1620 |

| R2: 1.1800 | S2: 1.1570 |

| R3: 1.1890 | S3: 1.1500 |

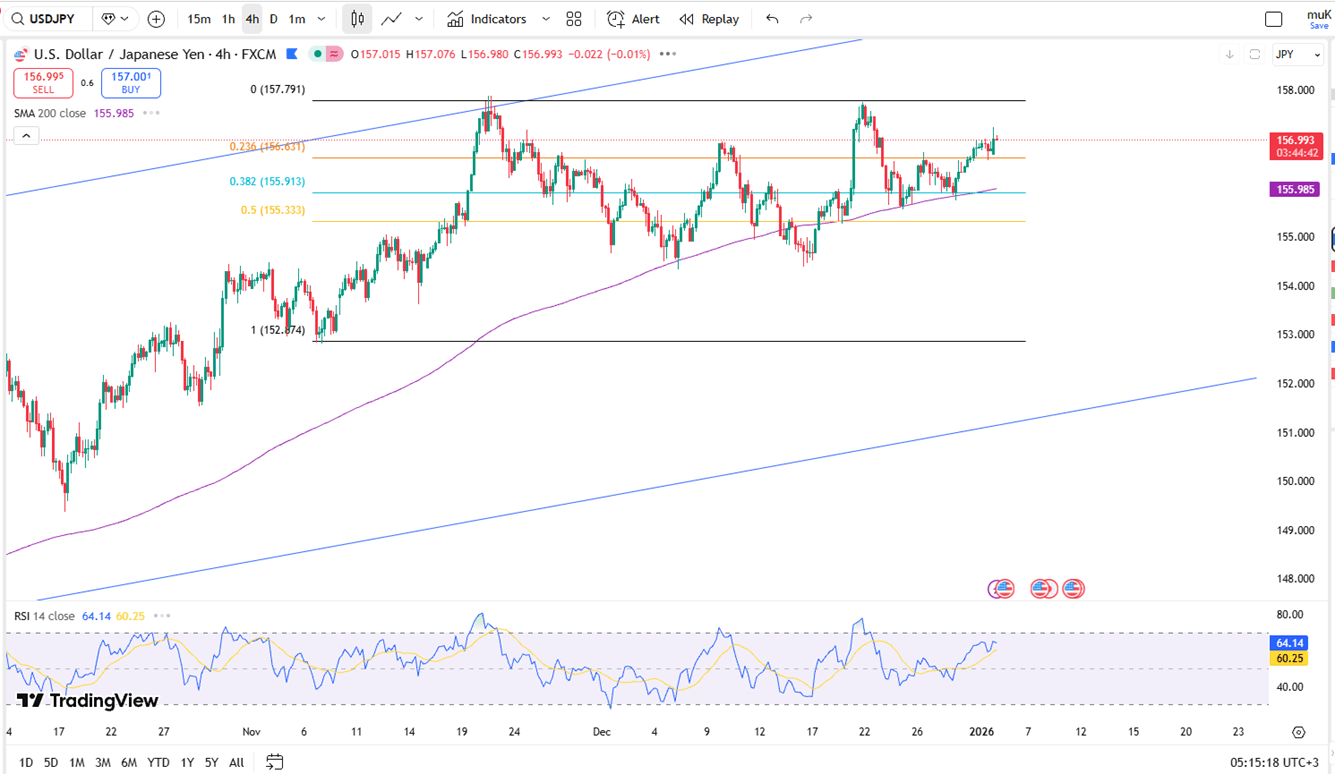

The Japanese yen fell for a fourth straight session as USD/JPY climbed toward 157.20 on Monday. A stronger dollar and lingering questions about the Bank of Japan’s tightening timeline continue to weigh on the currency. While geopolitical tensions have increased dollar demand, the potential for Japanese intervention or upcoming Fed rate cuts could prevent the yen from sliding much further.

Technically, resistance stands near 157.50, while support is firm at 156.70.

| R1: 157.50 | S1: 156.70 |

| R2: 158.00 | S2: 156.00 |

| R3: 158.50 | S3: 155.50 |

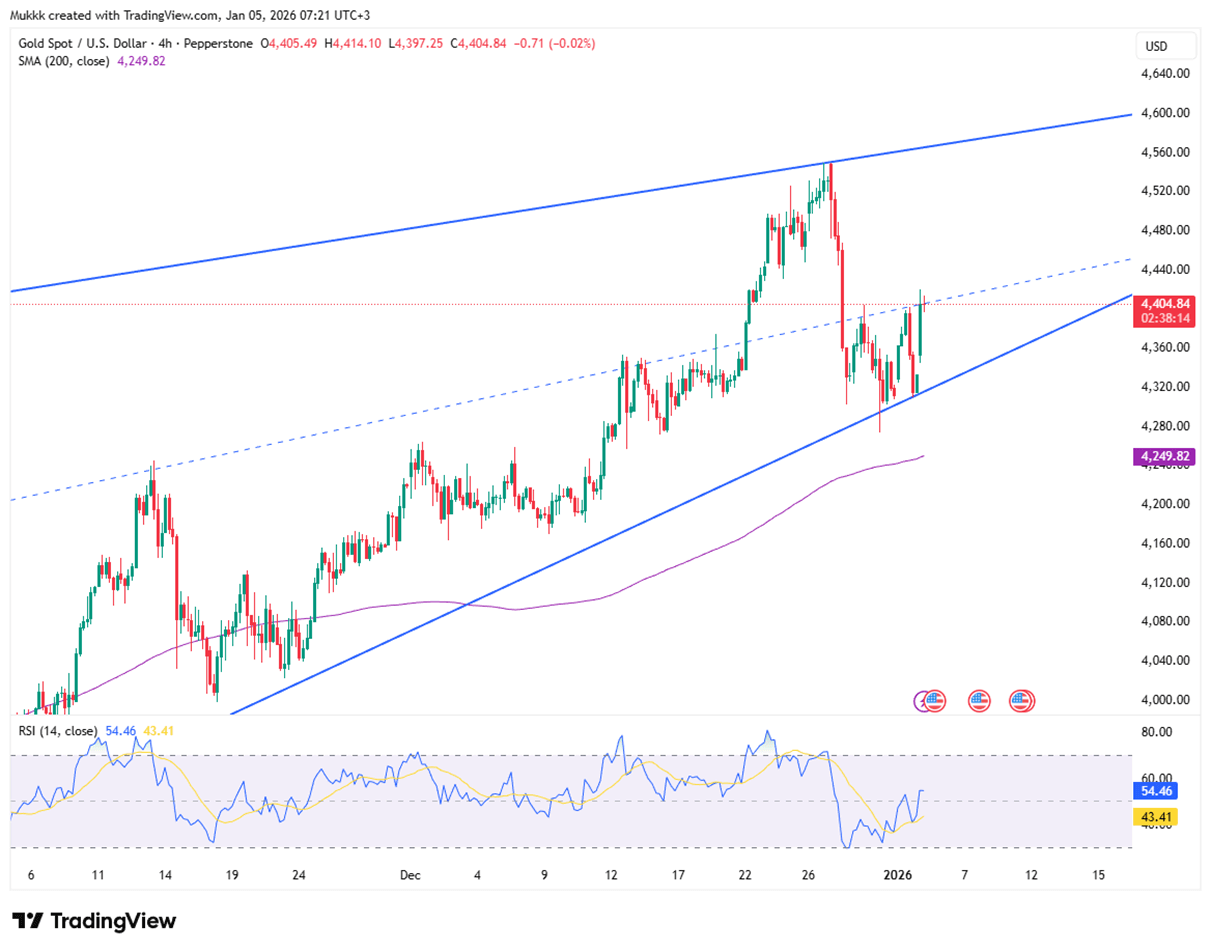

Gold rose over 1% on Monday, trading above $4,400 per ounce as investors sought safe-haven protection. This rally follows the U.S. ouster of Venezuelan President Nicolás Maduro, an event that has heightened geopolitical uncertainty and dampened risk sentiment. While markets await Friday’s nonfarm payrolls report for interest rate clues, gold continues to build on its best year since 1979. This momentum is sustained by ongoing monetary easing, strong central bank buying, and significant inflows into gold-backed ETFs.

Gold sees support near $4320, while resistance is around $4450.

| R1: 4450 | S1: 4320 |

| R2: 4500 | S2: 4270 |

| R3: 4550 | S3: 4240 |

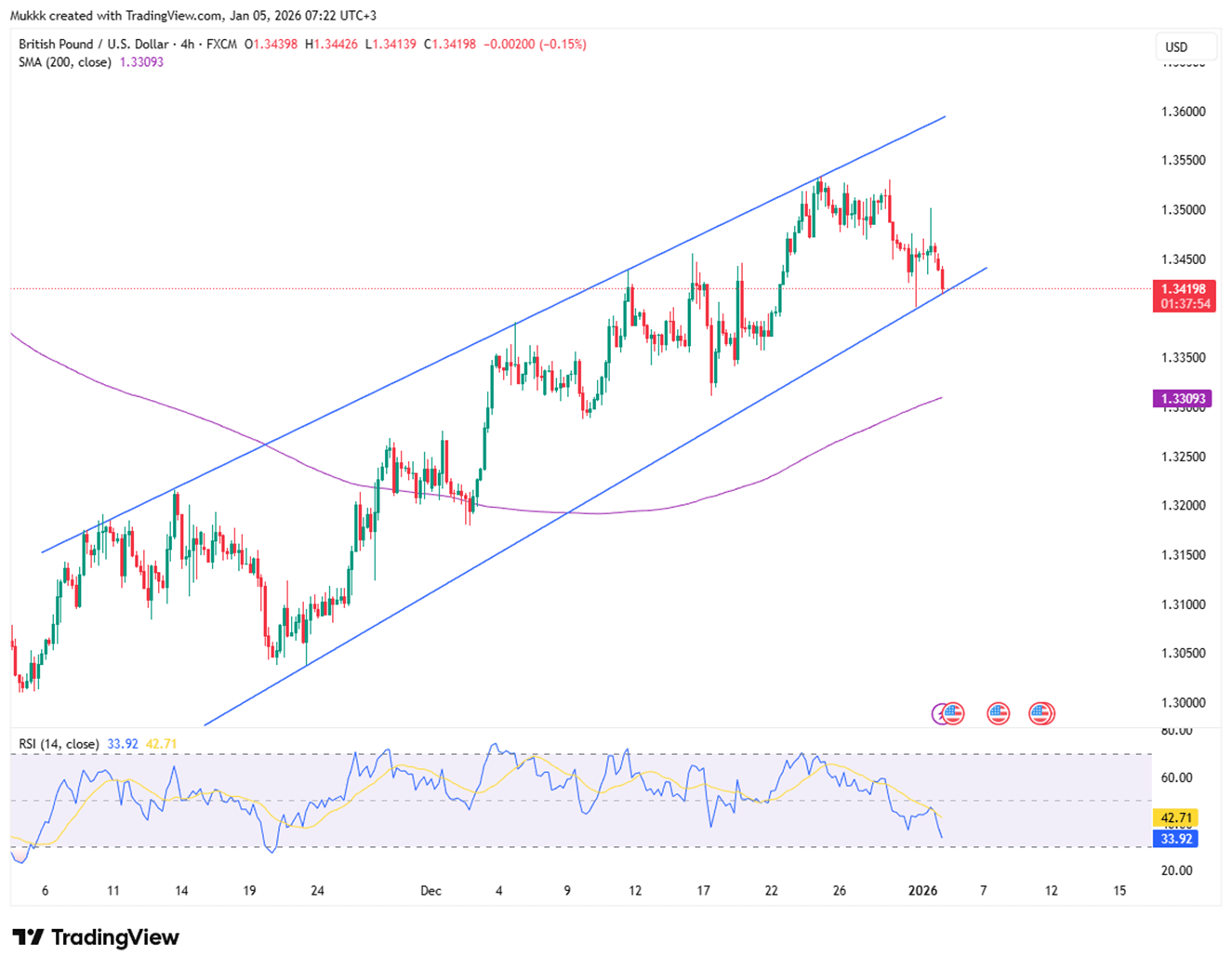

The British pound traded near $1.3415 on Monday, maintaining momentum after its strongest annual rise since 2017. Sterling’s 7.5% gain in 2025 was largely driven by expectations that the Bank of England will maintain a slower pace of rate cuts compared to the U.S. Federal Reserve. While weak UK growth and political uncertainty have limited further upside, the prospect of additional U.S. rate cuts in 2026 continues to provide a supportive floor for the currency.

From a technical view, support stands near 1.3380, with resistance around 1.3470.

| R1: 1.3470 | S1: 1.3380 |

| R2: 1.3530 | S2: 1.3340 |

| R3: 1.3590 | S3: 1.3290 |

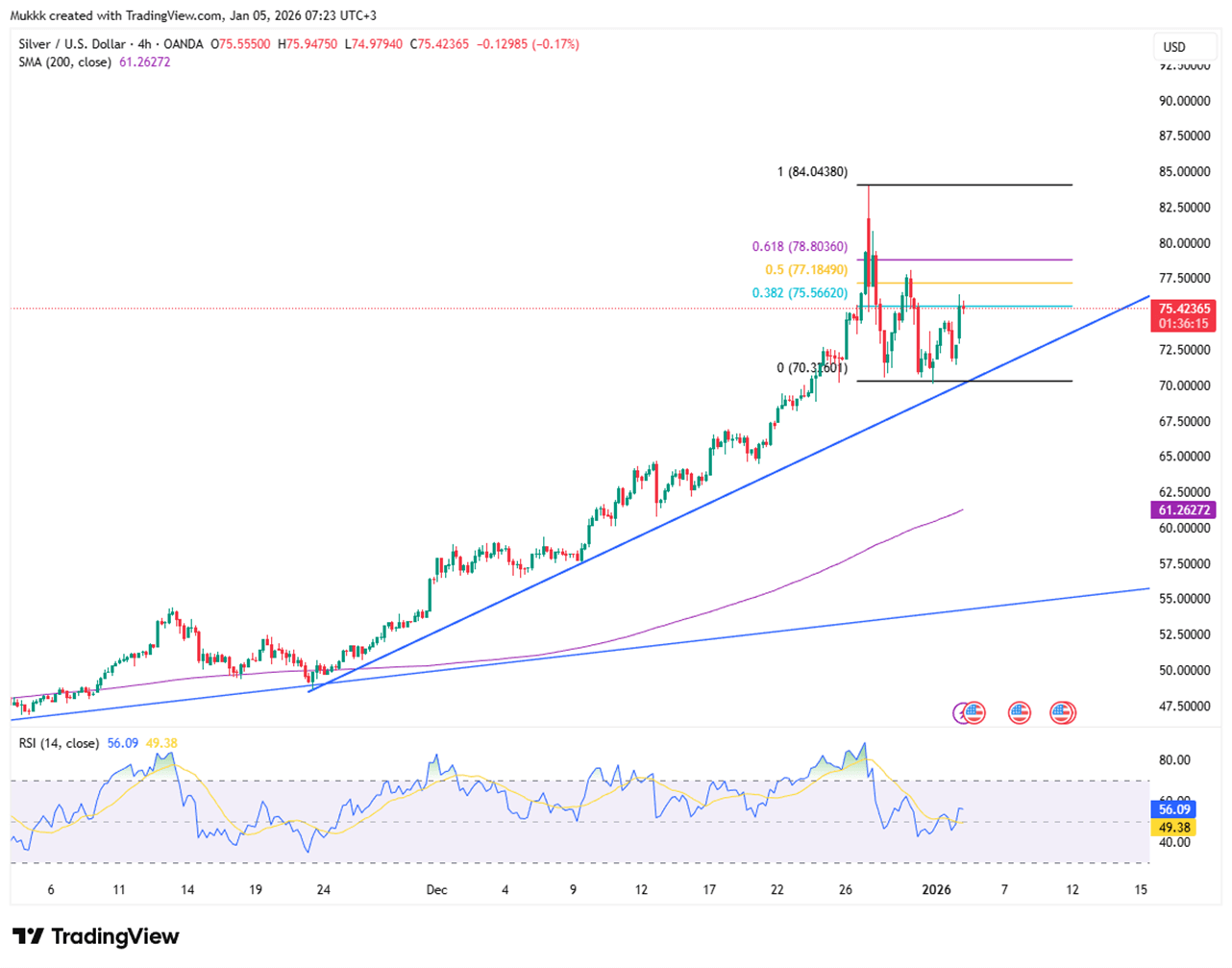

Silver surged nearly 4% to approximately $73 per ounce on Monday as the U.S. intervention in Venezuela fueled safe-haven demand. Investors are now looking toward Friday’s jobs report for insights into future Federal Reserve policy. This rally follows a historic year where silver gained nearly 150% due to chronic supply shortages, strong industrial interest, and Chinese export restrictions that have intensified the global structural deficit.

From a technical view, resistance stands near $76.50 while support is located around $74.50.

| R1: 76.50 | S1: 74.50 |

| R2: 77.80 | S2: 73.10 |

| R3: 80.20 | S3: 71.40 |

Global markets remain dominated by geopolitical risk as escalating conflict between the United States, Israel, and Iran fuels a strong shift toward safe-haven assets. The dollar index hit 99.3 Wednesday, rising for a third day as conflict concerns fueled inflation and shifted Fed rate cut expectations from July to September.

A US court rejected Trump's tariff refund delay as the Dollar (98.5) and 10 year yield (4.04%) held gains amid Middle East escalation and inflation fears.

After Khamenei: Who Will Lead Iran Next?

After Khamenei: Who Will Lead Iran Next?Following the death of Supreme Leader Ali Khamenei, Iran has entered a pivotal transition phase. Senior officials in Tehran are acting swiftly to uphold the existing structure of the Islamic Republic, prioritizing continuity to head off potential internal instability. Despite these efforts, the sudden leadership vacuum has sparked intense political and military maneuvering behind the scenes.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!