Markets opened the week with mixed performance as traders weighed expectations of Fed rate cuts against deepening global trade tensions.

The euro edged higher while the pound softened amid risk aversion. The yen fluctuated sharply as safe-haven demand surged, and gold steadied near a three-week low. Silver rebounded from recent losses on renewed safe-haven interest. Uncertainty over global growth and tariff risks continues to keep major assets range-bound.

| Time | Cur. | Event | Forecast | Previous |

| 09:00 | EUR | German Industrial Production (MoM) (Feb) | -0.9% | 2.0% |

| 12:00 | GBP | Mortgage Rate (GBP) (Mar) | 7.33% | |

| 22:00 | USD | Consumer Credit (Feb) | 15.20B | 18.08B |

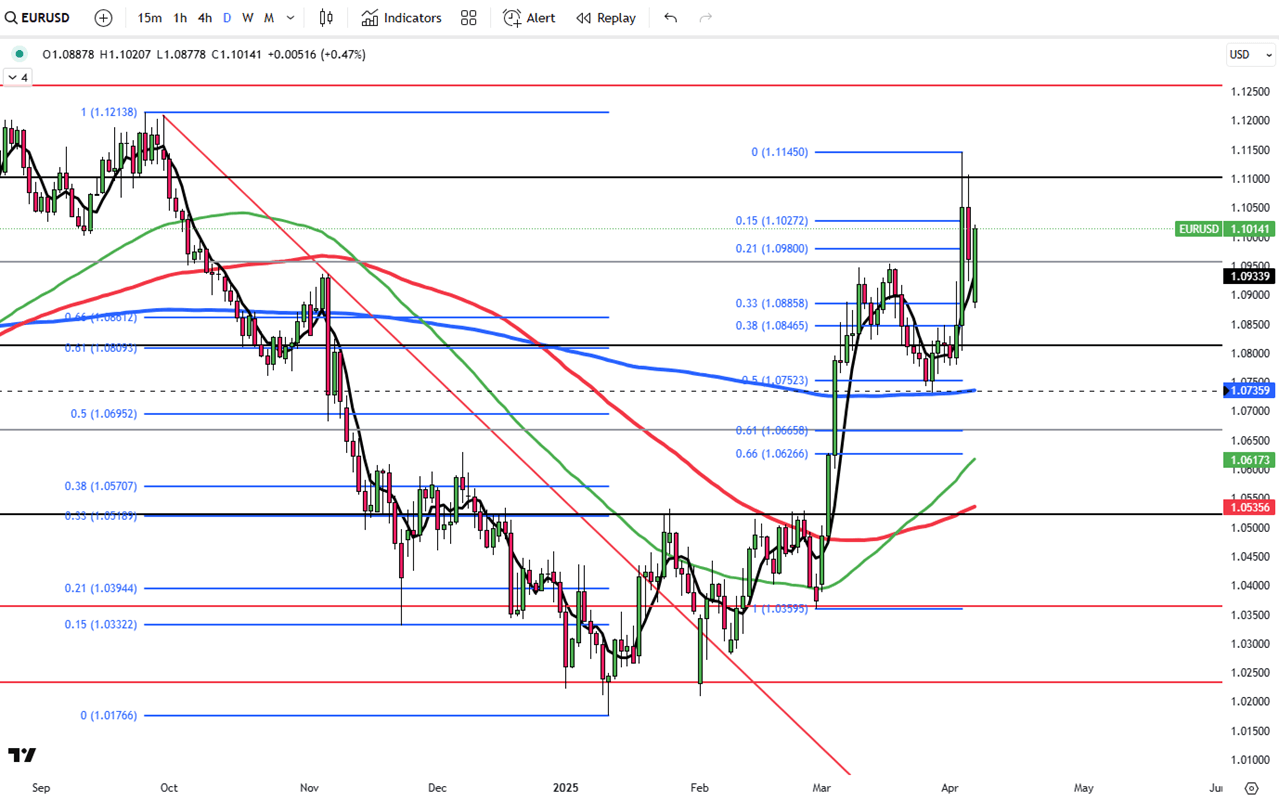

The EUR/USD rose 0.03% to $1.0967 in Asian trade, supported by expectations of Fed rate cuts amid U.S.-China trade tensions. However, gains were limited by concerns over European growth and global trade disruptions. Without signs of market stability, the pair may stay range-bound under risk aversion pressure.

Key resistance is at 1.1100, followed by 1.1150 and 1.1215. Support lies at 1.1000, then 1.0850 and 1.0730.

| R1: 1.1100 | S1: 1.1000 |

| R2: 1.1150 | S2: 1.0850 |

| R3: 1.1215 | S3: 1.0730 |

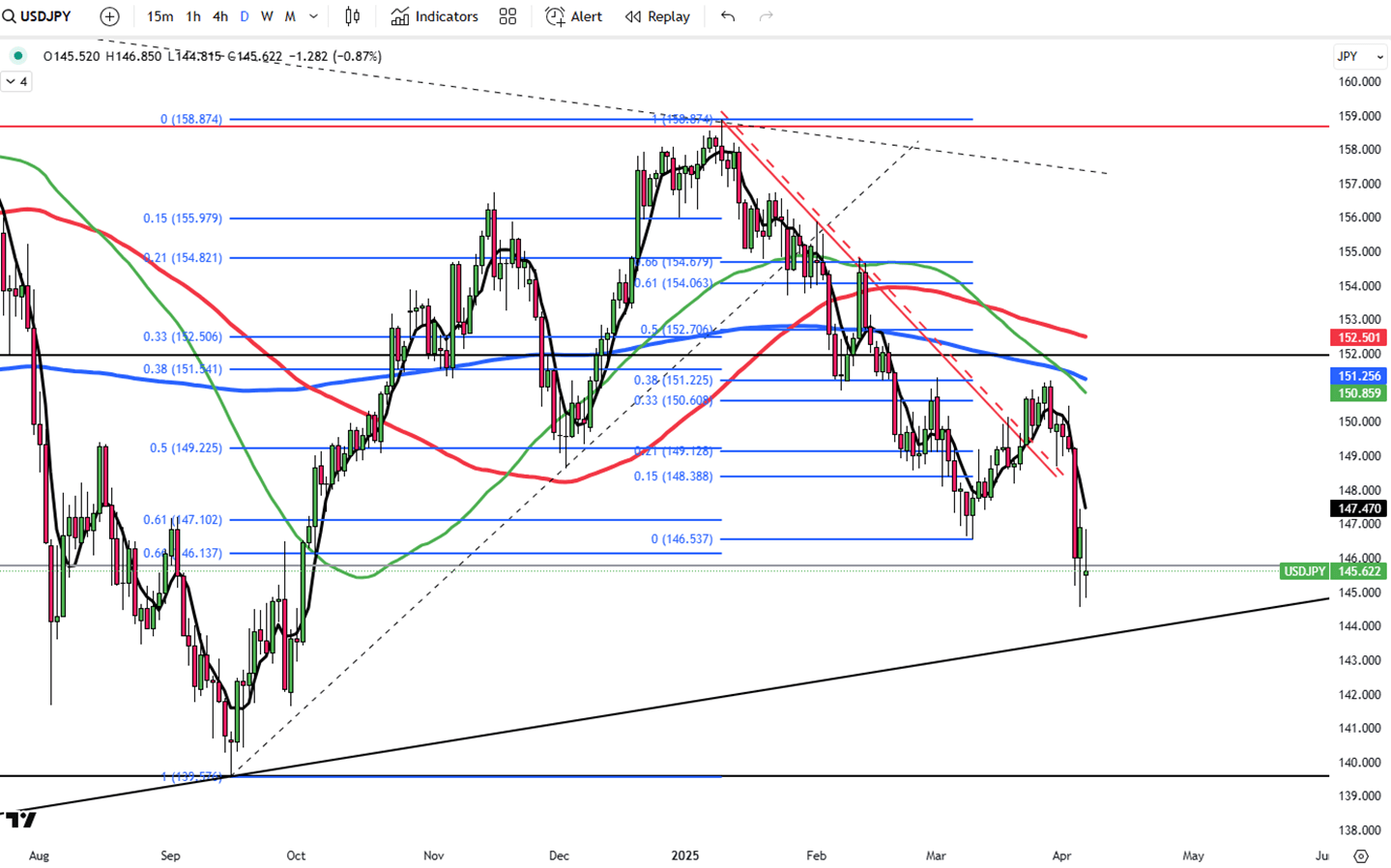

The yen fluctuated on Monday, rising to 145 per dollar before easing to 147, as global trade tensions and reciprocal tariffs triggered market volatility. Fears of a global recession drove demand for safe havens like the yen, Swiss franc, and bonds. Japan’s February wage growth offered some optimism, and the Bank of Japan is still expected to raise rates this year despite ongoing uncertainty.

Key resistance is at 147.00, with further levels at 152.70 and 157.70. Support stands at 145.60, followed by 143.00 and 141.80.

| R1: 147.00 | S1: 145.60 |

| R2: 152.70 | S2: 143.00 |

| R3: 157.70 | S3: 141.80 |

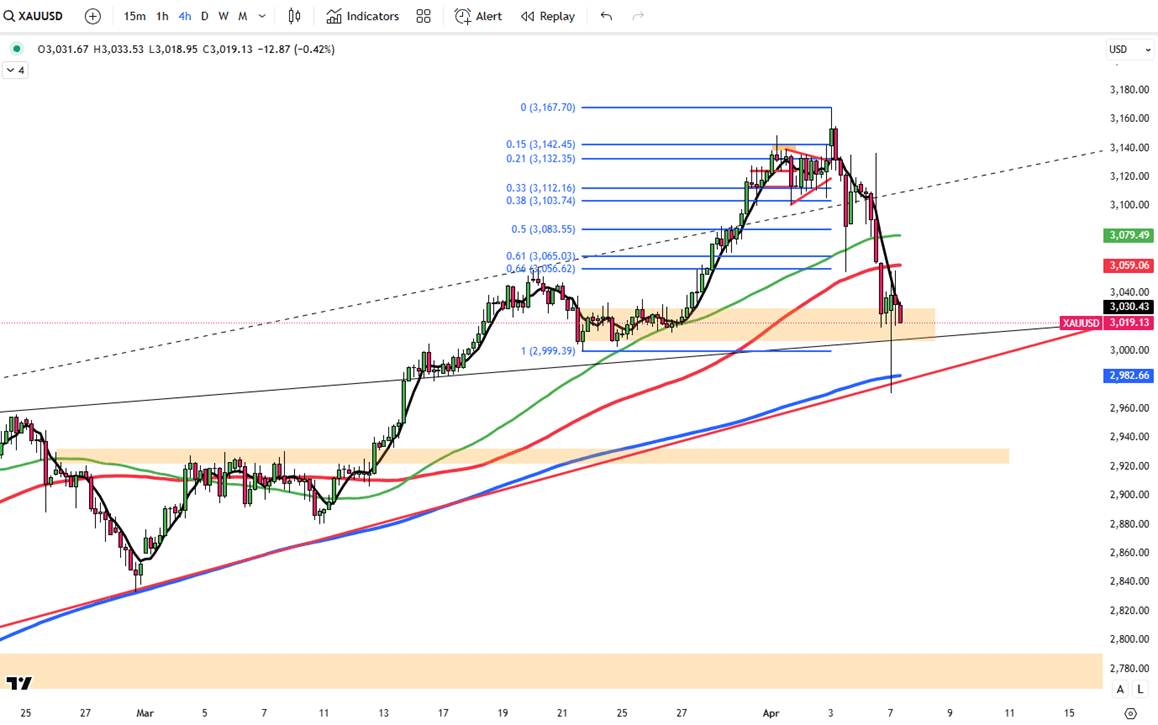

Gold steadied around $3,030 per ounce on Monday after falling over 1% to a three-week low. The drop sparked speculation that investors were taking profits or covering losses amid broader market declines driven by recession fears from escalating trade tensions. Fed Chair Jerome Powell warned that tariffs could raise inflation and slow growth, underscoring challenges for policymakers.

Key resistance is at $3,050, followed by $3,085 and $3,105. Support stands at $2,980, then $2,930 and $2830.

| R1: 3050 | S1: 2980 |

| R2: 3085 | S2: 2930 |

| R3: 3105 | S3: 2830 |

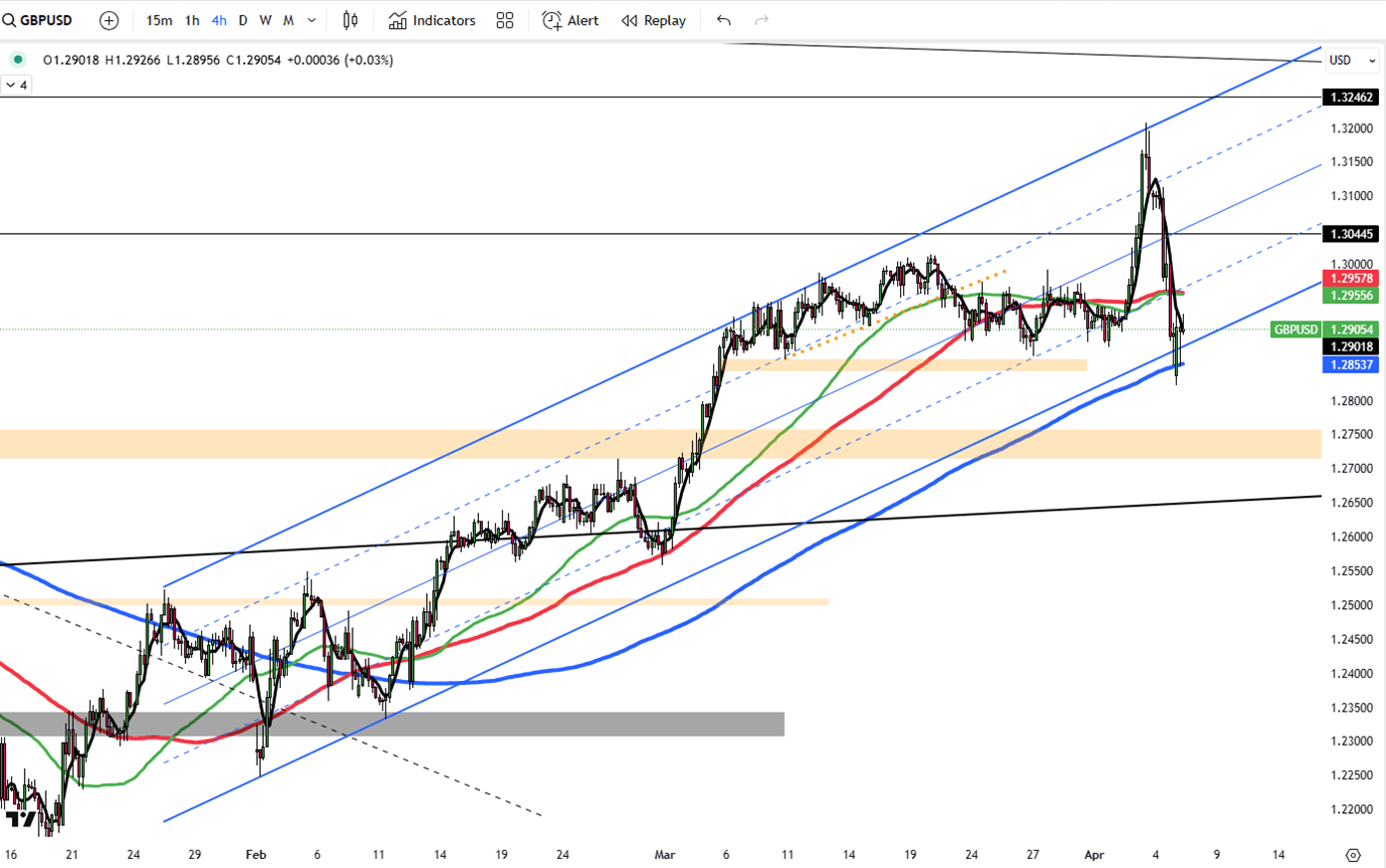

The GBP/USD pair dipped 0.11% to $1.289 in Asian trading, pressured by global recession fears and rising U.S.-China trade tensions. While expectations of Fed rate cuts have weighed on the dollar, the pound remains weak amid economic uncertainty and an unclear Bank of England outlook. With no strong catalysts, GBP/USD may stay vulnerable, especially if risk aversion intensifies.

If GBP/USD breaks above 1.3000, resistance levels are at 1.3050 and 1.3120. Support is at 1.2900, followed by 1.2850 and 1.2800.

| R1: 1.3000 | S1: 1.2900 |

| R2: 1.3050 | S2: 1.2850 |

| R3: 1.3120 | S3: 1.2800 |

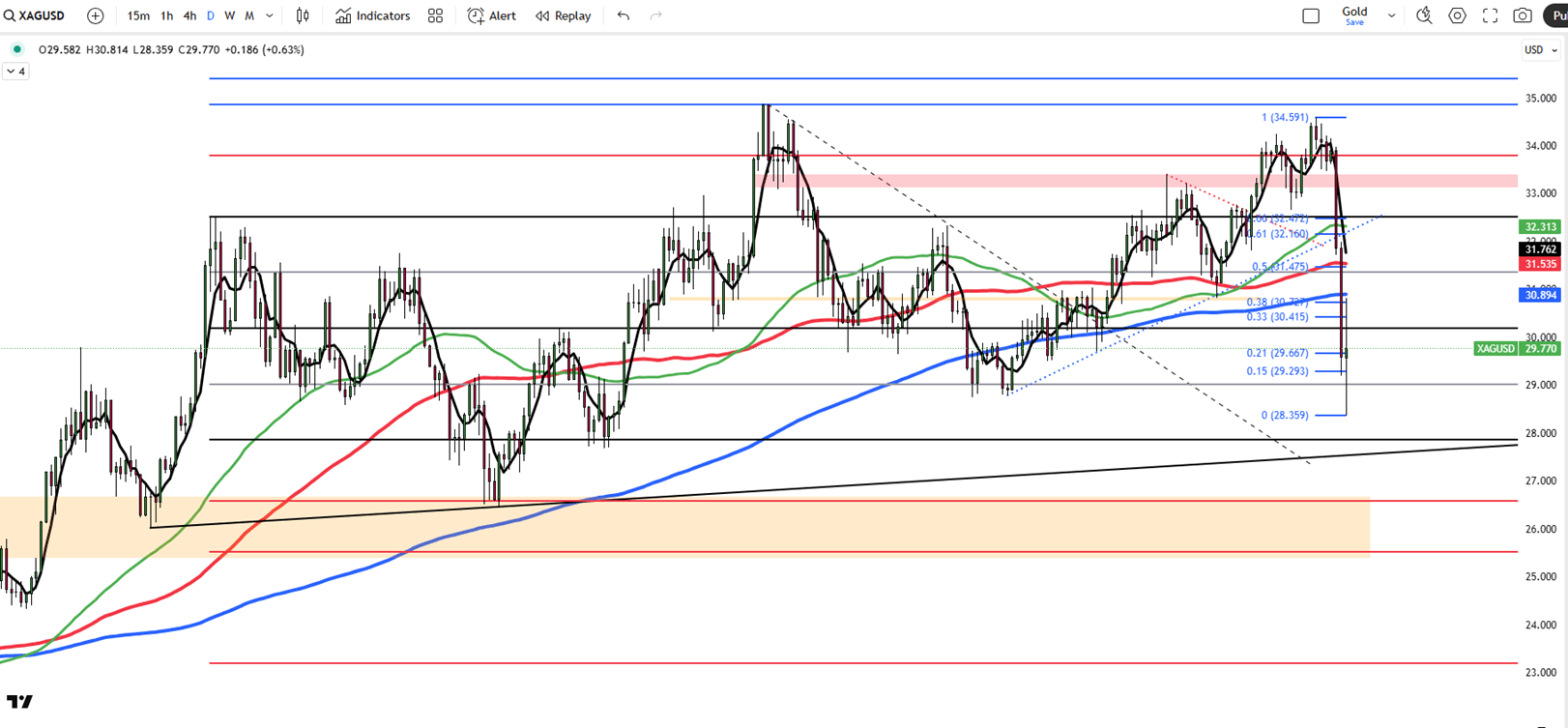

Silver rebounded Monday, rising 2.3% to $30.22 an ounce after hitting a seven-month low. The recovery followed sharp market volatility and recession fears from rising U.S.-China trade tensions. While silver benefits from safe-haven demand, its industrial use remains a weakness. Broader market sell-offs could keep price action choppy, but intensified risk aversion and Fed easing could support silver demand.

If silver breaks above $30.90, resistance levels are at $31.40 and $32.50. Support stands at $29.00, followed by $28.40 and $27.50.

| R1: 30.90 | S1: 29.00 |

| R2: 31.40 | S2: 28.40 |

| R3: 32.50 | S3: 27.50 |

Global markets remained cautious as investors weighed the economic impact of the ongoing Middle East conflict and volatile energy prices.

Currency markets remained volatile as ongoing Middle East tensions continued to shape global sentiment.

Hormuz Blockade Rattles Markets (09 - 13 March)

Hormuz Blockade Rattles Markets (09 - 13 March)Global sentiment was dominated this week by the second week of the war with Iran and the effective blockade of the Strait of Hormuz, driving Brent crude prices above $100/barrel. Despite a catastrophic US labor report showing a loss of 92,000 jobs in February, safe-haven demand pushed the US Dollar Index to 99.1. The energy shock has ignited fears of "stagflation," particularly in Europe and Japan, as soaring fuel costs threaten to reverse recent disinflationary trends.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!