Global markets are preparing for the upcoming U.S. PCE report, with the dollar stabilizing ahead of this key inflation measure. The EUR/USD pair is gaining momentum as risk currencies strengthen, while the yen has weakened following Tokyo's easing inflation data and the Bank of Japan's cautious approach. Gold remains near record highs, supported by safe-haven demand amid economic uncertainties and geopolitical tensions, while silver edges closer to its 2023 peak as China's rate cuts improve market sentiment. The pound holds steady, with traders eyeing the impact of U.S. inflation data on the dollar index, which could influence GBP/USD movements.

The dollar index stabilized around 100.7 on Friday as traders prepared for the upcoming PCE price index report, the Federal Reserve’s preferred measure of inflation. On Thursday, the index faced pressure as the yuan and other risk currencies strengthened following China’s commitment to increase fiscal and monetary support. Additionally, recent data revealed that weekly jobless claims fell to a four-month low, indicating a robust labor market. GDP growth was confirmed at 3% for Q2, with Q1 figures revised higher, and full-year growth estimates for both 2023 and 2022 also increased. Furthermore, durable goods orders remained flat last month, defying expectations for a significant 2.6% decline. Markets are currently divided on whether the Fed will implement another 50 basis point rate cut in November or choose a more modest 25 basis point reduction.

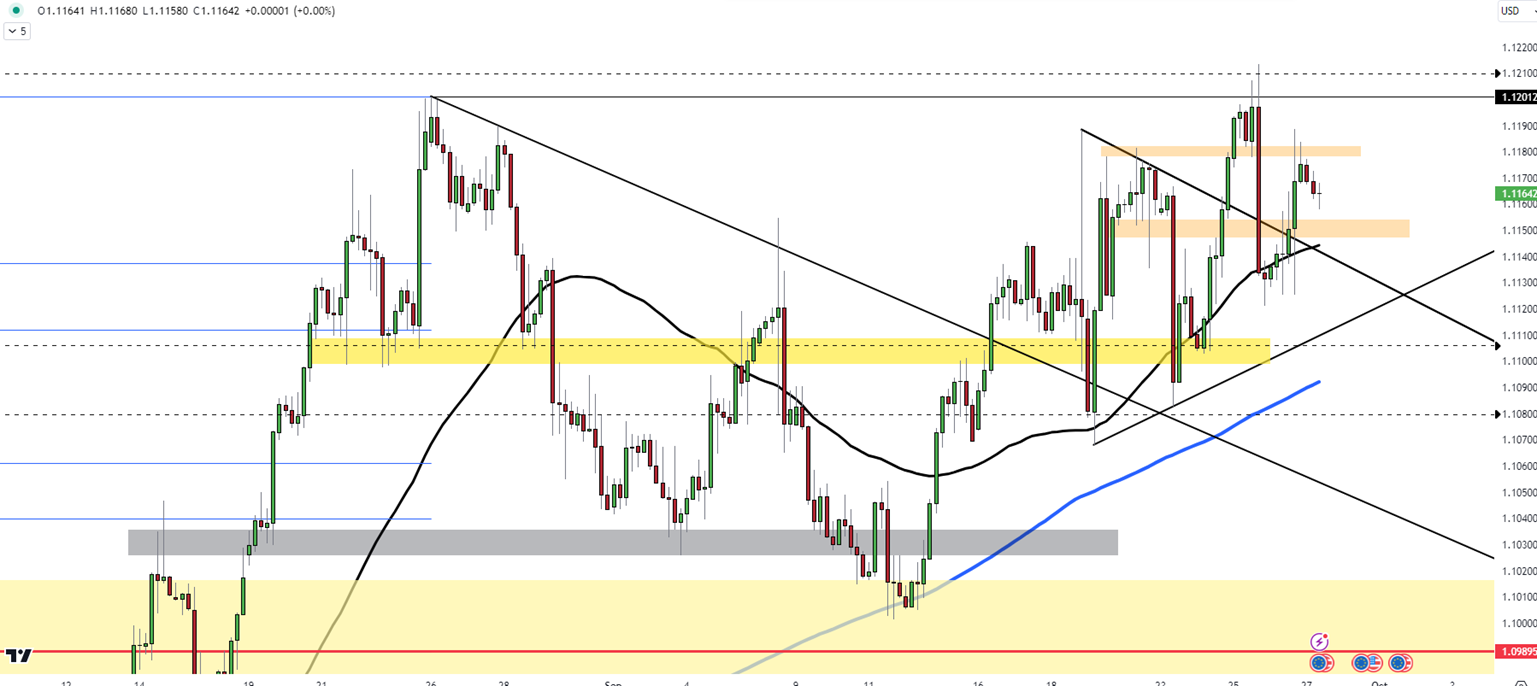

In the EUR/USD pair, the initial resistance will be at 1.1220 followed by 1.1250 and 1.1300 if this level is surpassed. On the downside, the first support is at 1.1150, with subsequent supports at 1.1100 and 1.1050 below that.

| R1: 1.1220 | S1: 1.1150 |

| R2: 1.1250 | S2: 1.1100 |

| R3: 1.1300 | S3: 1.1050 |

The Japanese yen dropped below 145 per dollar on Friday, hitting its lowest level in over three weeks as investors assessed Tokyo's inflation report, a crucial indicator of national price trends. Data revealed that Tokyo’s core inflation rate decreased to 2% in September, down from 2.4% in August, aligning with expectations and reinforcing the Bank of Japan's cautious stance on rate hikes. Minutes from the BOJ’s September meeting indicated that members emphasized vigilance regarding upside inflation risks while cautioning against excessive market expectations for future rate increases. BOJ Governor Kazuo Ueda recently noted that the bank has time to assess market and economic developments before making any policy adjustments, indicating no immediate urgency for further rate hikes. Additionally, the yen weakened significantly against the yuan, while other risk currencies gained strength following China's commitment to enhance fiscal and monetary support measures.

In USD/JPY, the first support is at 145.20, with subsequent levels at 144.20 and 143.30 below that. On the upside, the initial resistance is at 146.50, followed by 147.20 and 148.00 if this level is breached.

| R1: 146.50 | S1: 145.20 |

| R2: 147.20 | S2: 144.20 |

| R3: 148.00 | S3: 143.30 |

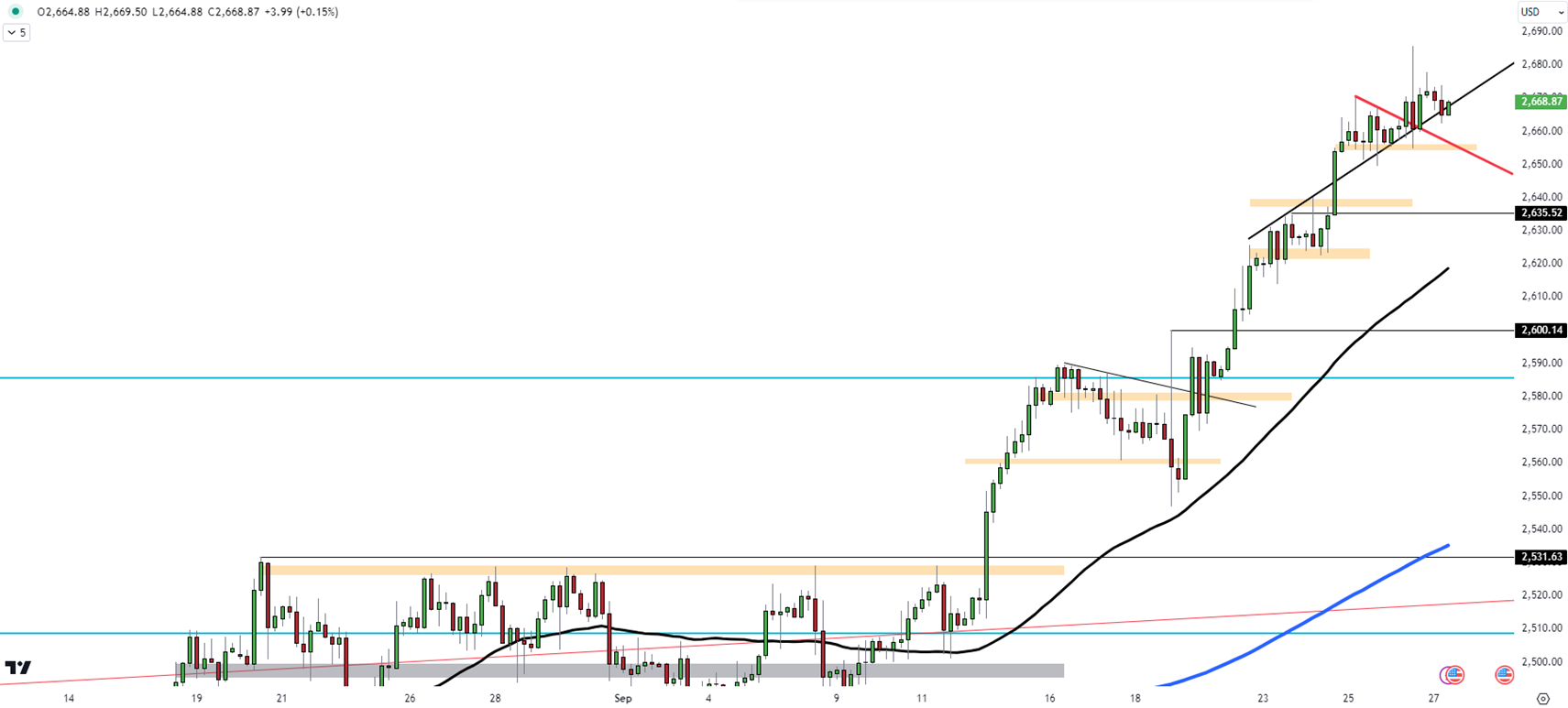

Gold hovered around $2,670 per ounce on Friday, maintaining record levels as markets awaited the crucial U.S. PCE report for insights into the Federal Reserve’s monetary policy outlook. The Fed’s preferred measure of inflation will be closely watched later today, especially after strong economic data on Thursday raised doubts about a rapid rate-cutting cycle. U.S. GDP growth was confirmed at an annualized 3% for the second quarter, with jobless claims unexpectedly falling and durable goods orders remaining stable. Nevertheless, fed funds futures suggest a 49% likelihood of another 50 basis point cut in November. Meanwhile, China's new fiscal stimulus and rising tensions in the Middle East are further enhancing gold’s appeal. For the week, bullion is set to record its third consecutive gain.

In gold, the first support is at 2630, with subsequent levels at 2600 and 2550 below that. Above, the initial resistance is at 2685, followed by 2700 and 2730 if this level is surpassed.

| R1: 2685 | S1: 2630 |

| R2: 2700 | S2: 2600 |

| R3: 2730 | S3: 2550 |

The pound opened at 1.3390 on Friday morning. It has been a quiet week in terms of data, but key factors influencing the pound's direction have been the economic reports from the U.S. Today's PCE data is expected to create volatility in the dollar index, which will also impact the GBP/USD exchange rate.

In GBP/USD, the first support is at 1.3330, with subsequent levels at 1.3300 and 1.3250 below that. On the upside, the initial resistance is at 1.3400, followed by 1.3430 and 1.3470 if this level is surpassed.

| R1: 1.3400 | S1: 1.3330 |

| R2: 1.3430 | S2: 1.3300 |

| R3: 1.3470 | S3: 1.3250 |

Silver opened at $31.80 on Friday morning, testing this year's peak once again. The recent reduction in China’s 7-day repo and reverse repo rates has positively impacted silver by lowering capital adequacy ratios. The upcoming U.S. PCE data, set to be released later today, will play a crucial role in determining the market's direction.

In silver, the first support is at 31.60, with subsequent levels at 31.30 and 30.50 below that. On the upside, the initial resistance is at 32.20, followed by 32.50 and 33.00 if this level is surpassed.

| R1: 32.20 | S1: 31.60 |

| R2: 32.50 | S2: 31.30 |

| R3: 33.00 | S3: 30.50 |

Bond Market Pushback Takes Center Stage

Bond Market Pushback Takes Center StageMarkets are almost fully pricing in another Federal Reserve rate cut this week, yet the US bond market continues to move in the opposite direction.

Detail Central Bank Expectations Reset the Tone (8-12 December)

Central Bank Expectations Reset the Tone (8-12 December)Traders adjusted positioning before the Federal Reserve’s December decision and evaluated fresh signals from the ECB, BoE and BOJ.

Detail Futures Stall, 10-Year Yield Pushes Above 4.1% (12.08.2025)US stock futures were flat on Monday ahead of the Fed’s meeting, with markets pricing an 88% chance of a 25 bp cut on Wednesday.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!