The US dollar held steady after June’s NFP report showed 147,000 new jobs, easing recession fears while supporting calls for future Fed cuts due to slowing private hiring. EUR/USD remained near 1.1760 in quiet holiday trading, while the yen hovered around 145 amid tariff uncertainty.

Gold edged up above $3,330, poised for a weekly gain, as Trump’s tax and tariff plans raised deficit concerns. Silver held near 13-year highs, supported by safe-haven demand and supply tightness. The pound consolidated around 1.3660, backed by UK fiscal stability ahead of expected BoE rate cuts in August.

| Time | Cur. | Event | Forecast | Previous |

| USD | Independence Day | |||

| 07:30 | EUR | ECB President Lagarde Speech |

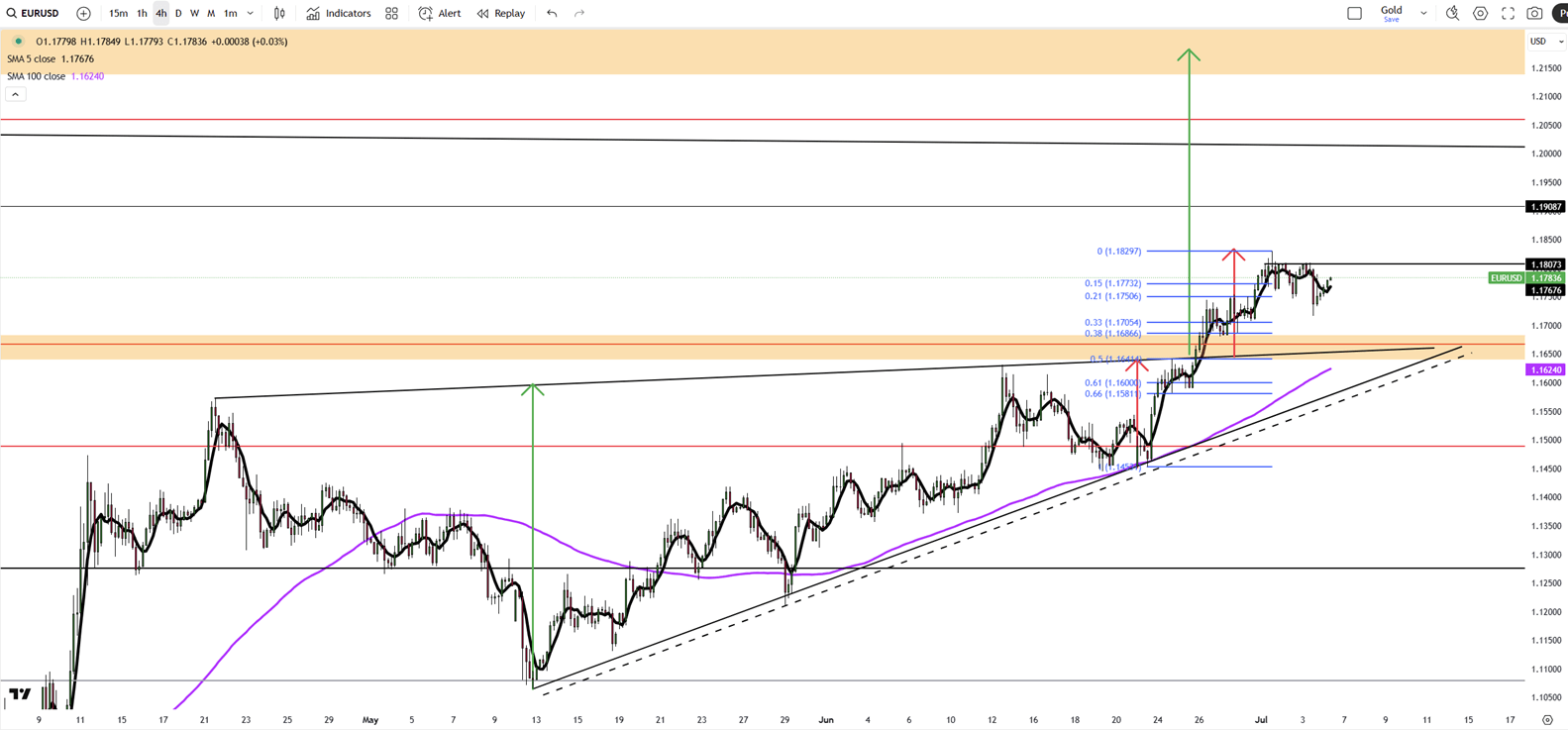

The EUR/USD stayed in a narrow range around 1.1760 during Friday’s Asian session, with limited movement as US markets were closed for Independence Day.

The US dollar gained modestly after Thursday’s NFP data showed 147,000 new jobs in June, beating the expected 110,000.

However, private sector job growth slowed, adding only 74,000 jobs in June versus a three-month average of 115,000. This trend supports Fed officials like Vice Chair Bowman, who recently called for rate cuts due to labor market risks.

Resistance for the pair is at 1.1830, while support is at 1.1730.

| R1: 1.1830 | S1: 1.1730 |

| R2: 1.1910 | S2: 1.1690 |

| R3: 1.2015 | S3: 1.1630 |

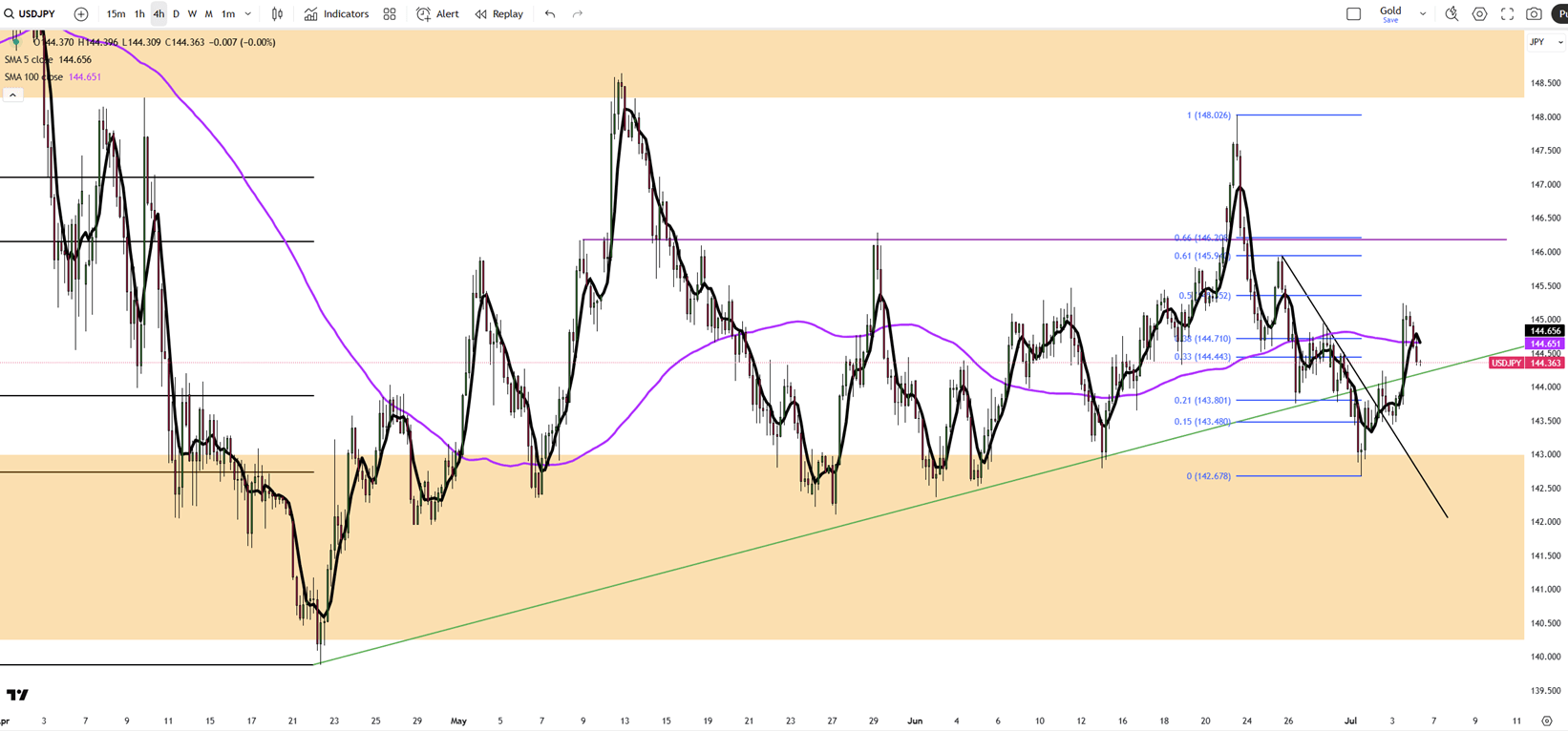

The yen hovered around 145 per dollar Friday after a nearly 1% drop in the previous session, pressured by trade uncertainties as Tokyo seeks a deal with Washington before next week’s deadline. Trump may announce new tariffs or extend deadlines today, having previously threatened tariffs up to 35% on Japanese goods over low US rice and car imports.

The yen also weakened as a stronger US dollar followed a better June jobs report, easing recession fears and reducing near-term Fed cut chances. In Japan, May household spending grew more than forecast, supported by government efforts to increase demand.

The key resistance is at $145.35, meanwhile the major support is located at $143.55.

| R1: 145.35 | S1: 143.55 |

| R2: 146.20 | S2: 142.45 |

| R3: 147.00 | S3: 141.00 |

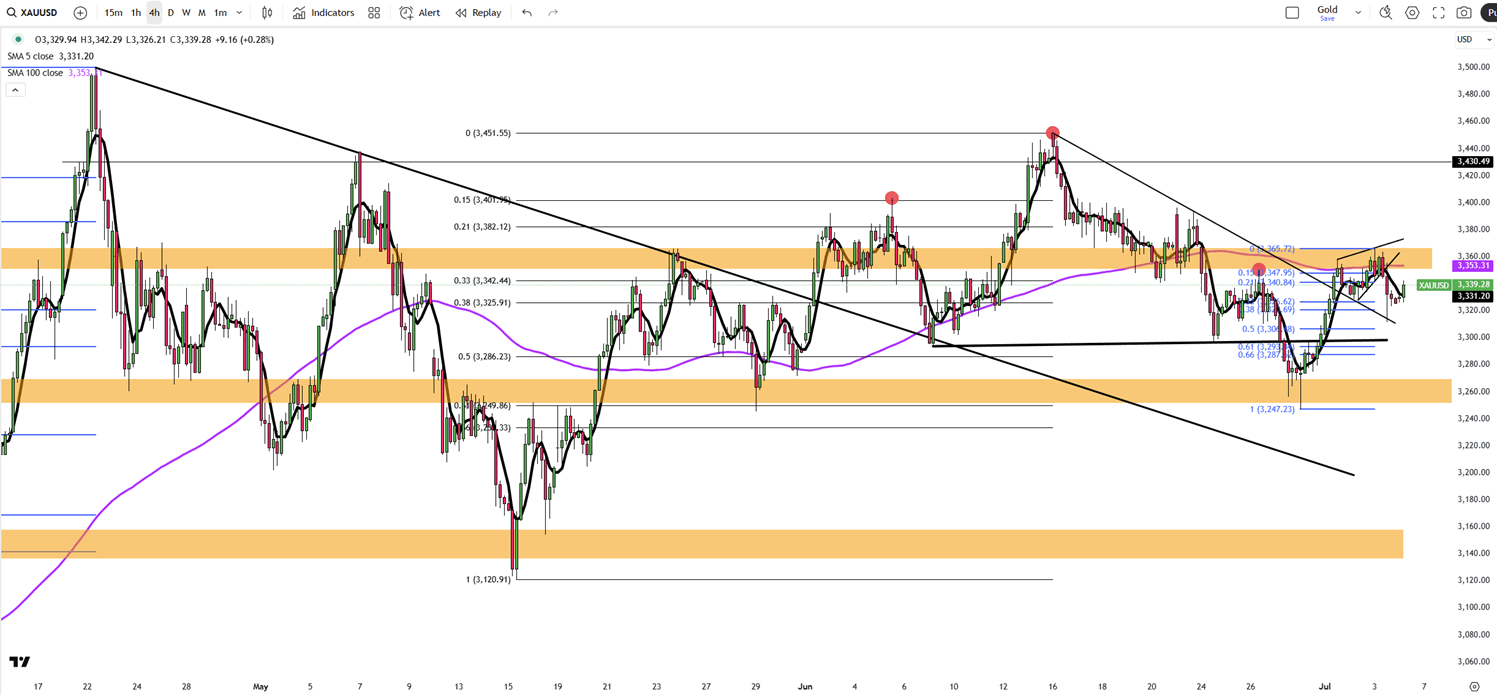

Gold rose slightly to around $3,330 on Friday, set for a weekly gain as US deficit worries and tariff uncertainties increased safe-haven demand. The House passed Trump’s tax and spending cuts, expected to add over $3 trillion to the deficit in ten years. Trump also said he would begin issuing formal tariff notices Friday. Gold’s gains were capped by strong US jobs data, with 147,000 jobs added in June and unemployment falling to 4.1%, supporting the Fed’s current rate stance.

Gold is on track to end the week up over 1%, recovering after two weeks of declines.

Resistance is at $3,365, while support holds at $3,300.

| R1: 3365 | S1: 3300 |

| R2: 3395 | S2: 3250 |

| R3: 3430 | S3: 3200 |

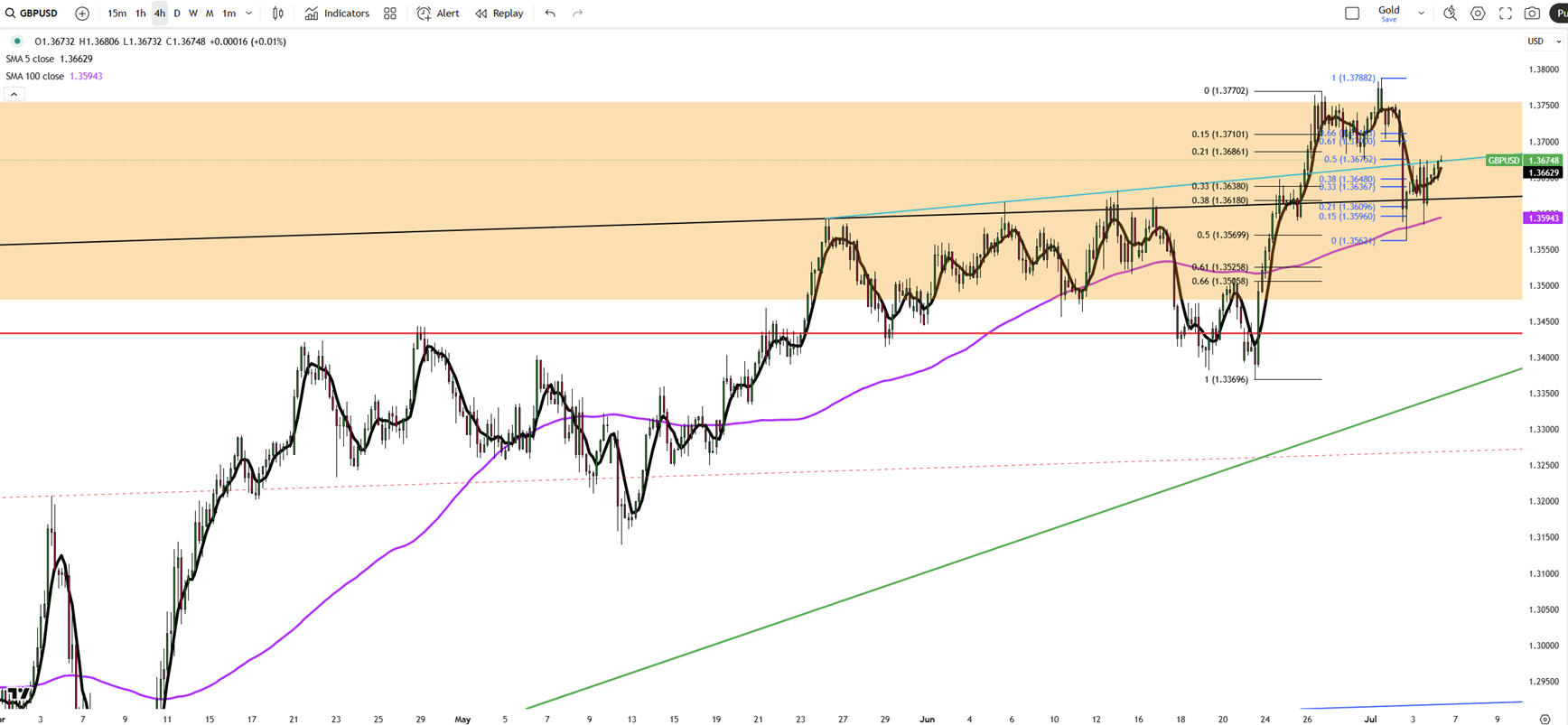

GBP/USD held around 1.3660 during Friday’s Asian session, marking a second day of consolidation as the dollar weakened on caution over Trump’s planned tariffs. Trump said he would start sending tariff letters Friday, targeting ten countries with rates of 20–30%. The pound was supported after PM Starmer backed Chancellor Reeves, easing market concerns over a possible replacement with looser fiscal policies.

The BoE is expected to cut rates in August, likely to 4%, following dovish signals from officials, including Governor Bailey, who said rates should gradually decline as inflation eases.

Resistance is at 1.3700, while support holds at 1.3600.

| R1: 1.3700 | S1: 1.3600 |

| R2: 1.3760 | S2: 1.3500 |

| R3: 1.3800 | S3: 1.3430 |

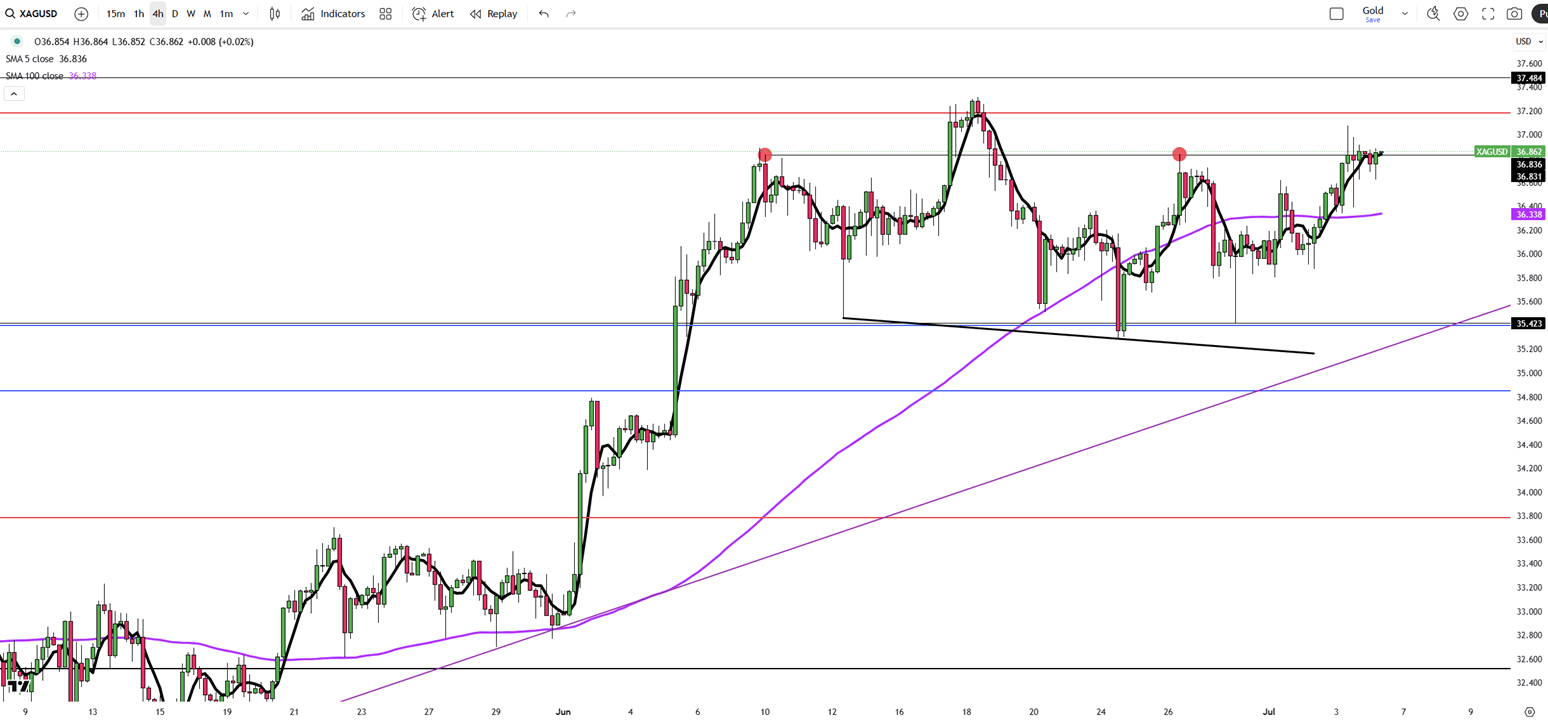

Silver held above $36.80 Friday, near 13-year highs, as renewed trade tensions supported safe-haven demand. Markets grew cautious after Trump announced plans to send tariff letters, and as the House passed his tax and spending bill, expected to widen the deficit by over $3 trillion. Silver’s gains were capped by a surprisingly stronger June US jobs report, which eased recession fears and reduced near-term Fed rate cut pressure.

Resistance is at 37.50, while support holds at 35.40.

| R1: 37.50 | S1: 35.40 |

| R2: 39.00 | S2: 34.85 |

| R3: 41.00 | S3: 33.80 |

Bond Market Pushback Takes Center Stage

Bond Market Pushback Takes Center StageMarkets are almost fully pricing in another Federal Reserve rate cut this week, yet the US bond market continues to move in the opposite direction.

Detail Central Bank Expectations Reset the Tone (8-12 December)

Central Bank Expectations Reset the Tone (8-12 December)Traders adjusted positioning before the Federal Reserve’s December decision and evaluated fresh signals from the ECB, BoE and BOJ.

Detail Futures Stall, 10-Year Yield Pushes Above 4.1% (12.08.2025)US stock futures were flat on Monday ahead of the Fed’s meeting, with markets pricing an 88% chance of a 25 bp cut on Wednesday.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!