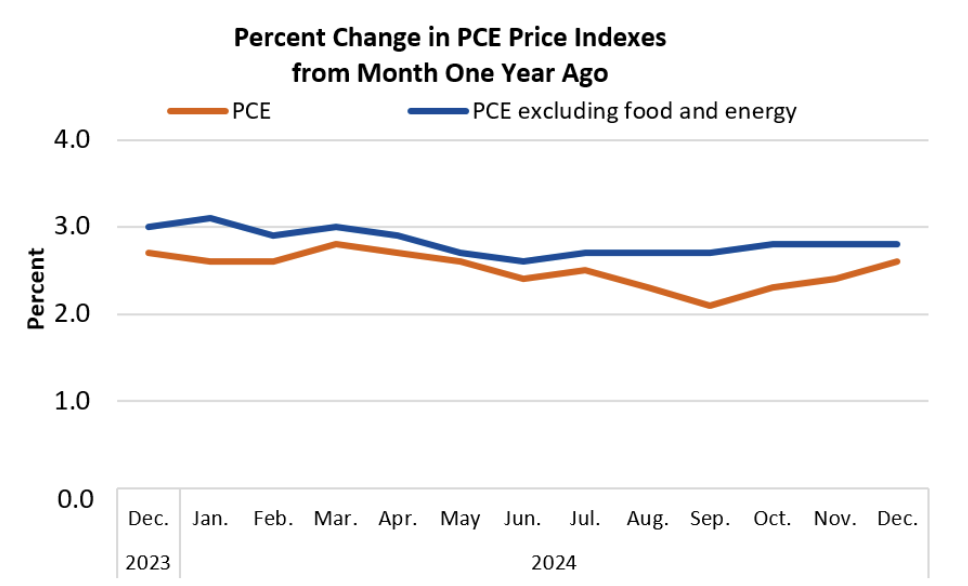

The U.S. core Personal Consumption Expenditures (PCE) price index, which excludes food and energy costs, increased by 0.2% in December 2024, according to data from the Bureau of Economic Analysis.

This marks a slight uptick from the 0.1% rise in November, which had been the lowest in six months. The increase aligned with market expectations, indicating steady underlying inflation pressures.

On an annual basis, core PCE inflation remained at 2.8% for the second consecutive month, well above the Federal Reserve’s 2% target. The persistence of elevated inflation reinforces the Fed’s cautious stance on monetary policy, as policymakers weigh future rate adjustments while monitoring inflationary trends.

The December data suggests that inflationary pressures remain moderate but stubbornly above the Fed’s preferred range. While the slight monthly uptick does not indicate a significant resurgence in inflation, the steady 2.8% annual rate could influence the Fed’s decision-making in the coming months, particularly regarding the timing and extent of potential interest rate cuts in 2025.

Source: Bureau of Economic Analysis

A US court rejected Trump's tariff refund delay as the Dollar (98.5) and 10 year yield (4.04%) held gains amid Middle East escalation and inflation fears.

After Khamenei: Who Will Lead Iran Next?

After Khamenei: Who Will Lead Iran Next?Following the death of Supreme Leader Ali Khamenei, Iran has entered a pivotal transition phase. Senior officials in Tehran are acting swiftly to uphold the existing structure of the Islamic Republic, prioritizing continuity to head off potential internal instability. Despite these efforts, the sudden leadership vacuum has sparked intense political and military maneuvering behind the scenes.

Detail March Starts With Geopolitical Turmoil (2-6 March)

March Starts With Geopolitical Turmoil (2-6 March)Global markets began the week in a state of high alert following coordinated US and Israeli strikes on Iran over the weekend, which resulted in the death of Supreme Leader Ayatollah Ali Khamenei.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!