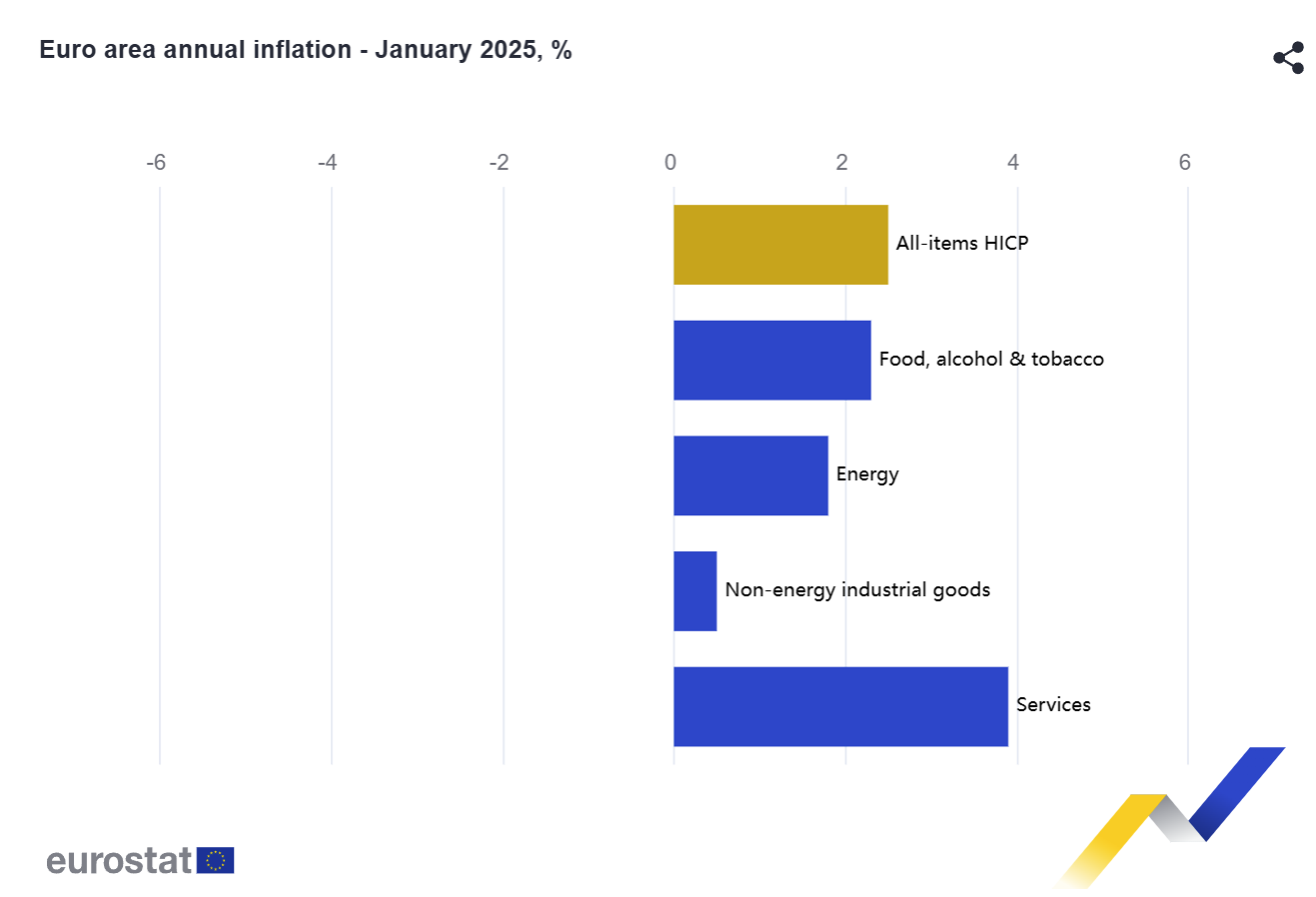

The annual inflation rate in the Eurozone increased to 2.5% in January 2025, up from 2.4% in December, according to a preliminary estimate.

This figure slightly surpassed market expectations of 2.4% and marked the highest inflation rate since July 2024.

A key factor behind this rise was the substantial increase in energy costs, which surged to 1.8% in January, compared to just 0.1% in December. This sharp rise in energy prices contributed notably to the overall inflation rate.

The core inflation rate, which excludes volatile food and energy prices, remained unchanged at 2.7% for the fifth month in a row. This figure was slightly above the market forecast of 2.6% but still represented the lowest level since early 2022. The latest inflation data will likely be observed by the European Central Bank (ECB) for future monetary policy decisions.

Source: Eurostat

A US court rejected Trump's tariff refund delay as the Dollar (98.5) and 10 year yield (4.04%) held gains amid Middle East escalation and inflation fears.

After Khamenei: Who Will Lead Iran Next?

After Khamenei: Who Will Lead Iran Next?Following the death of Supreme Leader Ali Khamenei, Iran has entered a pivotal transition phase. Senior officials in Tehran are acting swiftly to uphold the existing structure of the Islamic Republic, prioritizing continuity to head off potential internal instability. Despite these efforts, the sudden leadership vacuum has sparked intense political and military maneuvering behind the scenes.

Detail March Starts With Geopolitical Turmoil (2-6 March)

March Starts With Geopolitical Turmoil (2-6 March)Global markets began the week in a state of high alert following coordinated US and Israeli strikes on Iran over the weekend, which resulted in the death of Supreme Leader Ayatollah Ali Khamenei.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!