Manufacturing output contracts as new orders slow and input costs rise; sentiment stays optimistic despite near-term challenges.

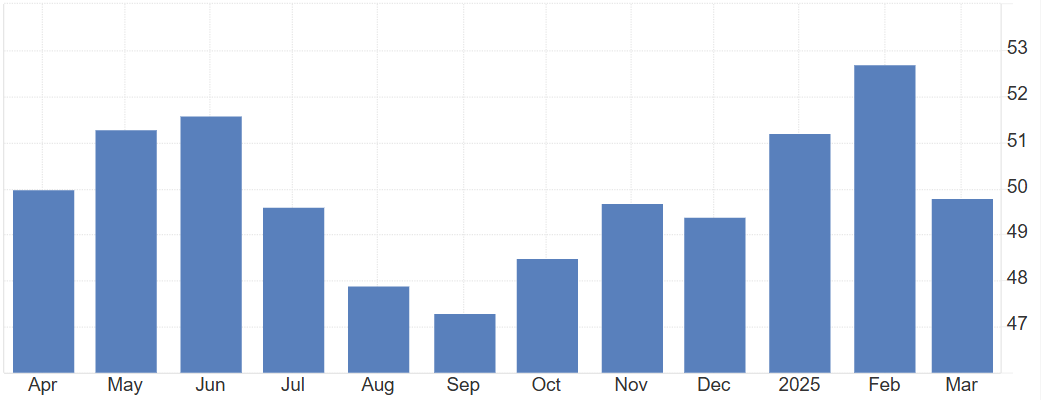

The U.S. manufacturing sector showed signs of strain in March 2025, with the S&P Global US Manufacturing PMI falling to 49.8, down from 52.7 in February. This marks the first contraction in six months and falls short of market expectations of 51.8, according to preliminary estimates released by S&P Global.

The decline was driven by a pullback in output following a sharp surge in February, the strongest monthly expansion in nearly three years. Factories reported fewer instances of ramping up production ahead of anticipated tariffs, which had previously fueled a temporary boost. New order growth also nearly stalled, raising concerns about underlying demand in the sector.

Manufacturing output dipped into contraction territory, as the short-term benefit of tariff-related front-loading faded. The latest data shows a slowdown in both domestic demand and new orders. Meanwhile, input purchasing by manufacturers also declined, reflecting increased caution across the sector.

However, not all indicators were negative. Export sales showed signs of resilience, posting the smallest decline in nine months. Rising orders from international partners, particularly Canada, Germany, and other EU countries suggest that manufacturers may be accelerating shipments ahead of the full implementation of new U.S. trade tariffs.

Employment in the manufacturing sector fell for the first time since October 2024, with companies citing payroll concerns and cost-cutting measures. Rising operational expenses have added pressure to margins, leading some firms to delay hiring or reduce staff.

On the pricing front, input cost inflation surged to its highest level in 31 months, driven by rising prices for raw materials and shipping. In response, manufacturers raised their selling prices at the fastest pace in over two years, contributing to concerns about broader inflationary trends in the economy.

Despite the contraction in output and orders, business sentiment remained elevated, ranking among the most optimistic readings of the past three years. Manufacturers are hopeful that the current challenges will ease in the coming months. This is especially relevant for those linked to tariff uncertainty.

Still, the report highlights the fragility of the manufacturing recovery in early 2025. With global trade dynamics shifting and domestic inflation pressures mounting, the outlook for the sector remains cautiously optimistic but heavily dependent on policy clarity and economic stability in the months ahead.

Source: S&P Global

Bond Market Pushback Takes Center Stage

Bond Market Pushback Takes Center StageMarkets are almost fully pricing in another Federal Reserve rate cut this week, yet the US bond market continues to move in the opposite direction.

Detail Central Bank Expectations Reset the Tone (8-12 December)

Central Bank Expectations Reset the Tone (8-12 December)Traders adjusted positioning before the Federal Reserve’s December decision and evaluated fresh signals from the ECB, BoE and BOJ.

Detail Futures Stall, 10-Year Yield Pushes Above 4.1% (12.08.2025)US stock futures were flat on Monday ahead of the Fed’s meeting, with markets pricing an 88% chance of a 25 bp cut on Wednesday.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!