Markets showed cautious strength in early August as expectations for U.S. interest rate cuts continued to grow following weaker labor data and renewed tariff threats.

The euro pushed above $1.16 with the Fed expected to act ahead of the ECB, while gold and silver reached multi-week highs amid safe-haven demand. The yen held steady after the Bank of Japan flagged inflation risks despite falling real wages. Meanwhile, the British pound recovered slightly ahead of the Bank of England's expected rate cut.

| Time | Cur. | Event | Forecast | Previous |

| 11:00 | GBP | BoE Interest Rate Decision (Aug) | %4.0 | %4.25 |

| 12:30 | USD | Initial Jobless Claimless | 221K | 218K |

| 17:00 | USD | 30-Year Bond Auction | - | 4.889% |

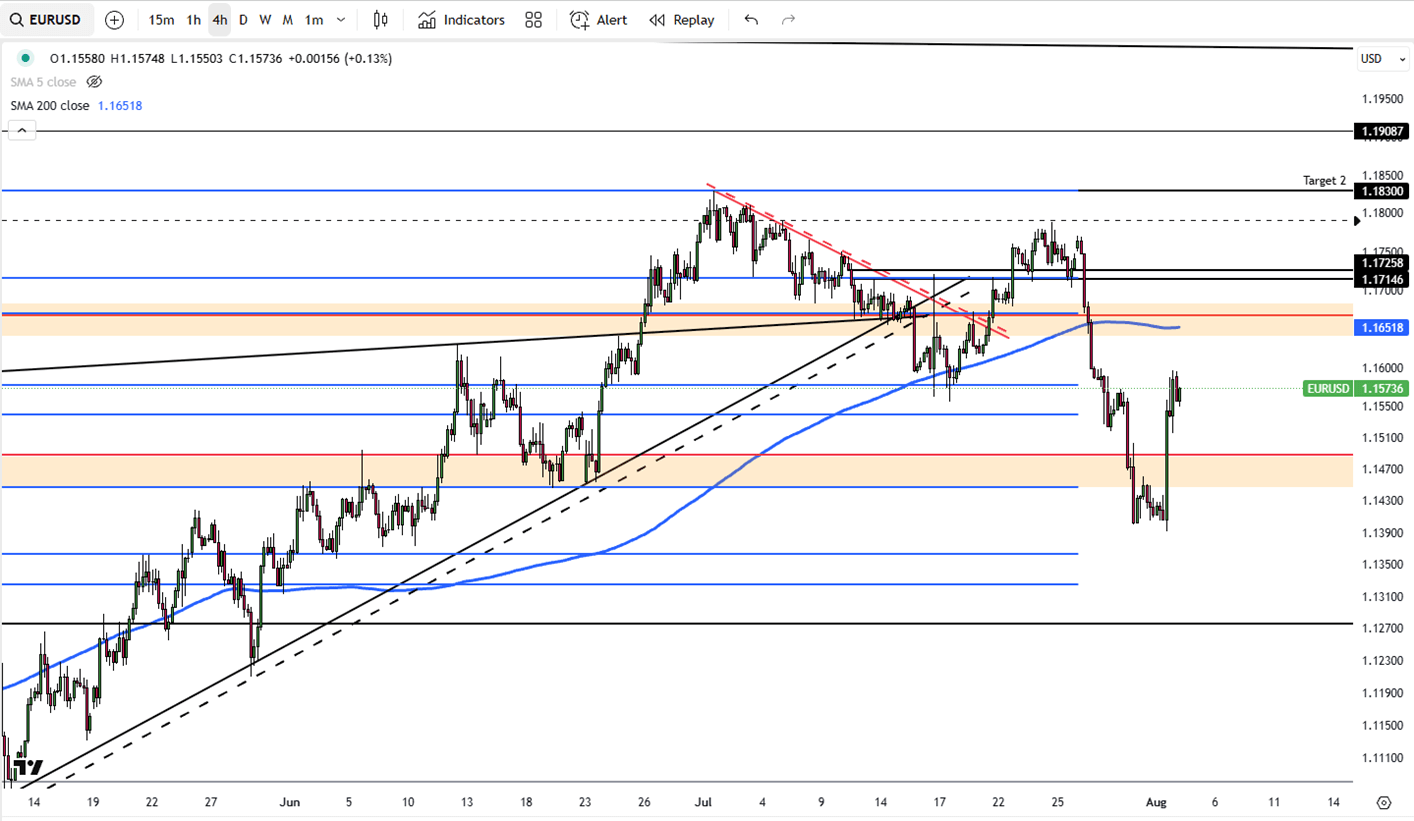

The euro climbed above $1.16 in early August, recovering from a recent low, as investors anticipated rate cuts from both the Federal Reserve and the European Central Bank, with the Fed expected to move sooner. Softer U.S. employment data increased expectations for a Fed rate cut by September. At the same time, markets are pricing in a 60% likelihood of an ECB cut by year-end. Eurozone inflation remained steady at 2.0% in July, slightly above forecasts.

EUR/USD now eyes resistance at 1.1695, while support holds at 1.1590.

| R1: 1.1695 | S1: 1.1590 |

| R2: 1.1725 | S2: 1.1500 |

| R3: 1.1830 | S3: 1.1350 |

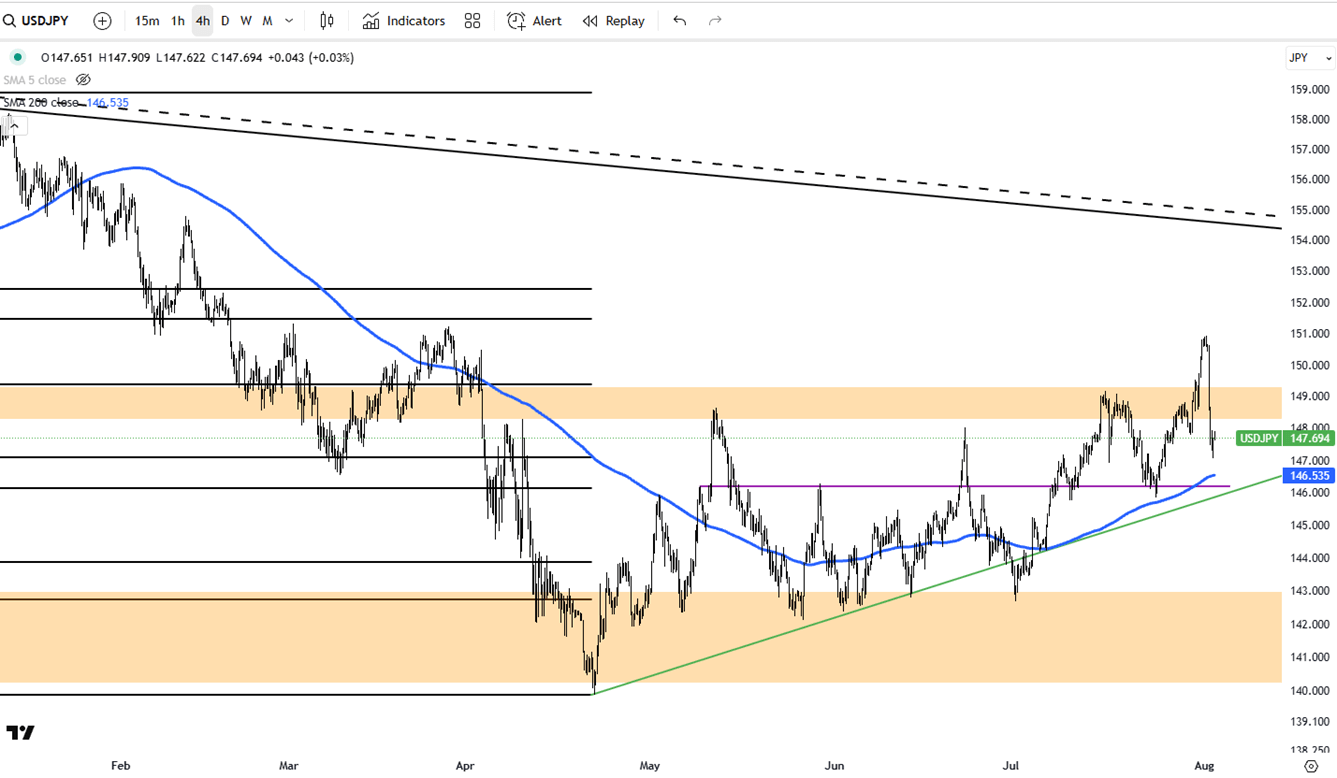

The yen hovered around 147.5 per dollar as markets assessed the Bank of Japan’s policy outlook. While the BOJ held rates steady last week, it raised its inflation forecast and noted global risks. June meeting minutes showed openness to further tightening if conditions improve. Meanwhile, Japan’s real wages fell for a sixth straight month, with inflation still outpacing earnings.

USD/JPY faces resistance at 148.50, with support at 146.00.

| R1: 148.50 | S1: 146.00 |

| R2: 151.50 | S2: 143.00 |

| R3: 152.40 | S3: 140.00 |

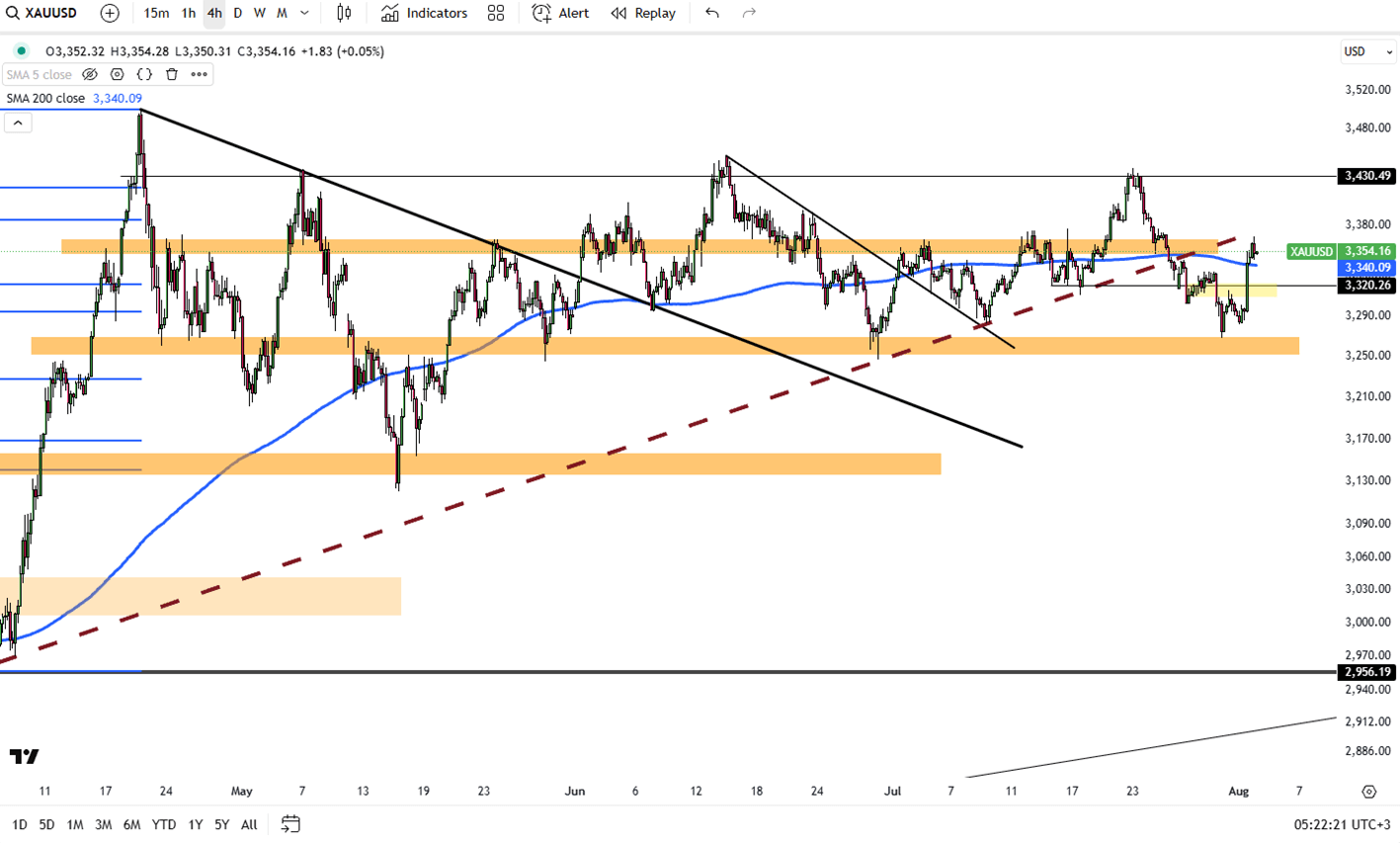

Gold rose toward $3,380 per ounce, reaching a two-week high, as renewed U.S. tariff threats and growing expectations of Fed rate cuts supported demand. President Trump announced significant new tariffs on semiconductors, as well as imports from India and Brazil. Soft U.S. economic data and signs of labor market weakness increased the likelihood of rate cuts in September and December. Trump also plans to nominate a new Fed Governor and is considering replacing Chair Powell, raising concerns about the Fed’s independence.

Gold is testing resistance at $3,400, with support at $3,340.

| R1: 3400 | S1: 3340 |

| R2: 3440 | S2: 3270 |

| R3: 3500 | S3: 3250 |

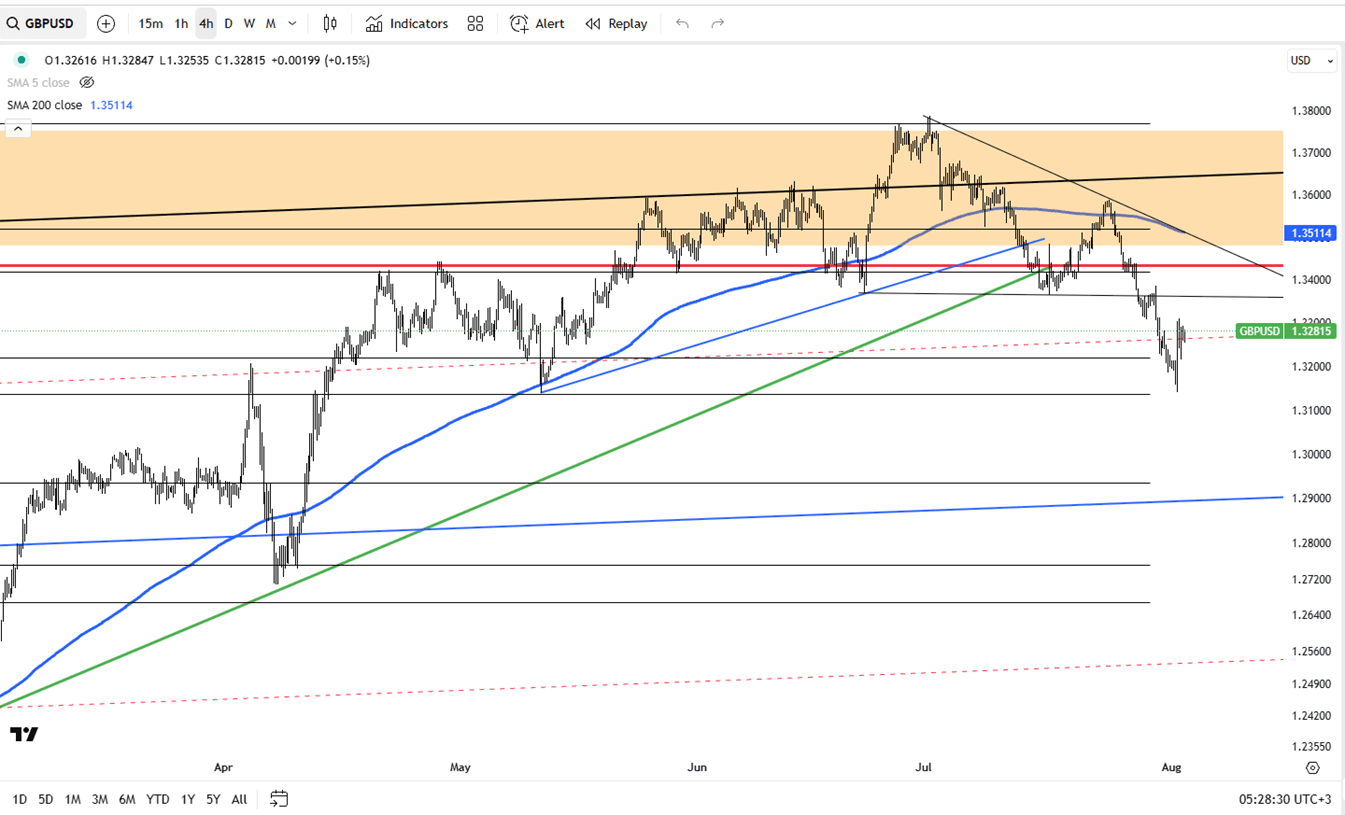

The British pound climbed to $1.328 from an 11-week low of $1.321 after weak U.S. jobs data weighed on the dollar. Despite this recovery, the pound declined by 3.8% in July, marking its worst monthly performance since September 2022, as concerns about the UK economy persisted. Investors now turn their attention to the Bank of England's anticipated 25 basis point rate cut decision today.

GBP/USD is seeing resistance at 1.3330, with initial support at 1.3240.

| R1: 1.3330 | S1: 1.3240 |

| R2: 1.3480 | S2: 1.3140 |

| R3: 1.3600 | S3: 1.3000 |

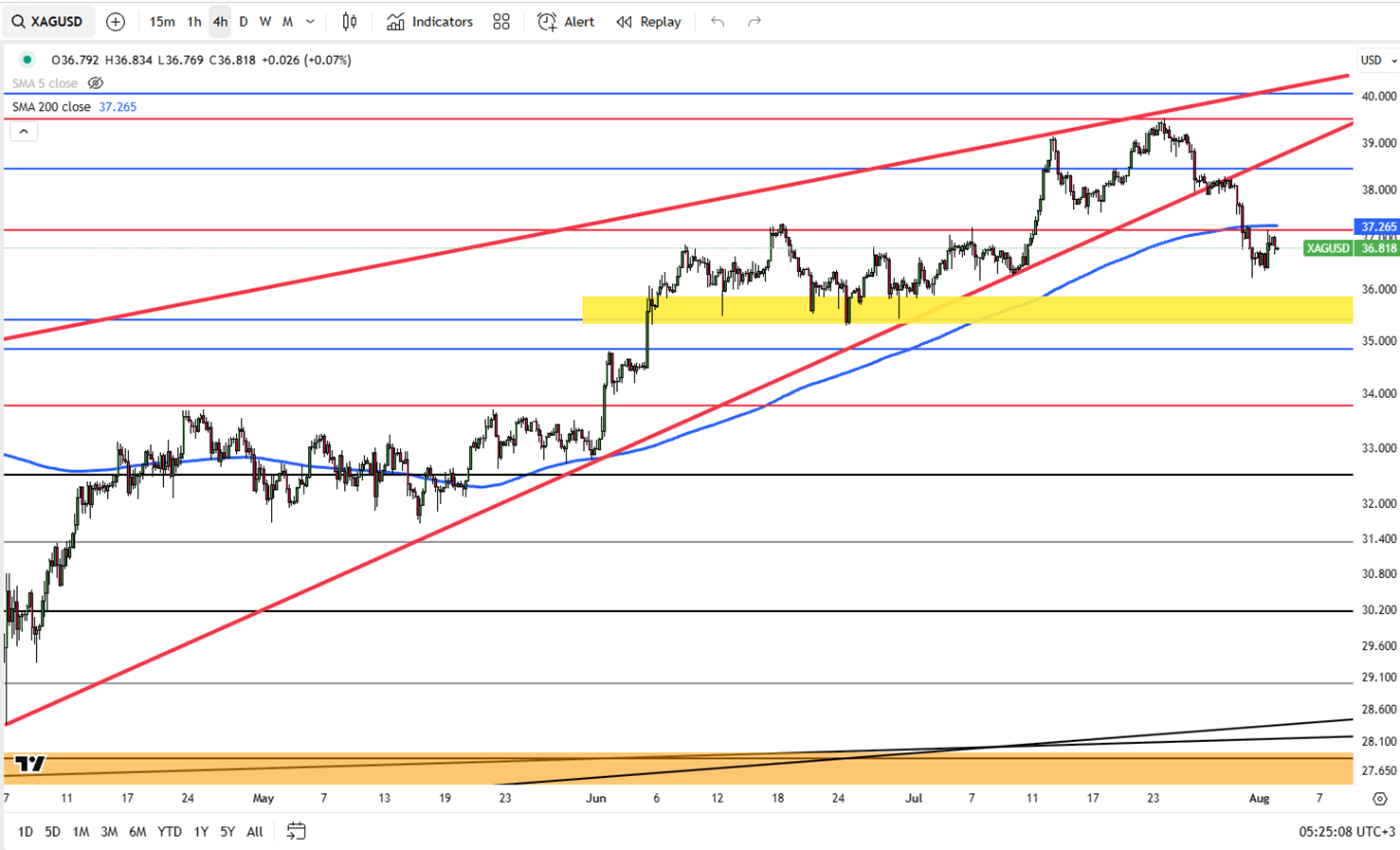

Silver rose above $38 per ounce, reaching a one-week high as expectations for Federal Reserve rate cuts increased, driven by signs of a weakening U.S. labor market. Investors are now looking to jobless claims data for further confirmation. Geopolitical tensions also supported safe-haven demand, as President Trump announced a doubling of tariffs on Indian imports over continued Russian oil purchases and signaled the possibility of meeting with President Putin next week.

Silver is now testing resistance at $38.20, with support holding around $36.50.

| R1: 38.20 | S1: 36.50 |

| R2: 39.50 | S2: 35.50 |

| R3: 40.10 | S3: 33.90 |

A US court rejected Trump's tariff refund delay as the Dollar (98.5) and 10 year yield (4.04%) held gains amid Middle East escalation and inflation fears.

After Khamenei: Who Will Lead Iran Next?

After Khamenei: Who Will Lead Iran Next?Following the death of Supreme Leader Ali Khamenei, Iran has entered a pivotal transition phase. Senior officials in Tehran are acting swiftly to uphold the existing structure of the Islamic Republic, prioritizing continuity to head off potential internal instability. Despite these efforts, the sudden leadership vacuum has sparked intense political and military maneuvering behind the scenes.

Detail March Starts With Geopolitical Turmoil (2-6 March)

March Starts With Geopolitical Turmoil (2-6 March)Global markets began the week in a state of high alert following coordinated US and Israeli strikes on Iran over the weekend, which resulted in the death of Supreme Leader Ayatollah Ali Khamenei.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!