Markets are almost fully pricing in another Federal Reserve rate cut this week, yet the US bond market continues to move in the opposite direction.

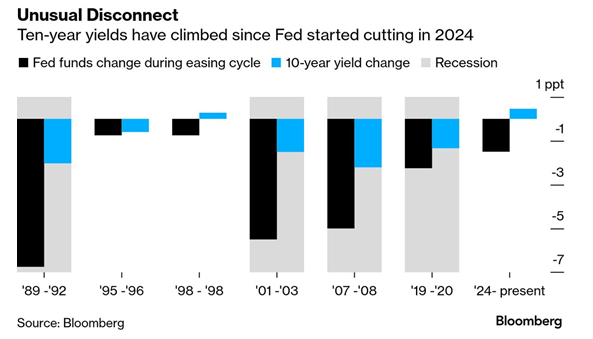

Instead of falling alongside policy easing, Treasury yields have been climbing since September 2024. Bloomberg notes that a divergence of this magnitude hasn’t appeared since the 1990s, raising questions about what today’s yield curve is really signaling.

Analysts are split on what the rising yields mean. The main interpretations include:

The bond market’s behavior also contradicts former President Donald Trump’s repeated claim that faster and deeper rate cuts would quickly pull down long-term borrowing costs. Instead, the 10-year Treasury yield has risen nearly 50 bps to around 4.1% since the Fed began cutting, and the 30-year has climbed more than 80 bps. Rather than easing financial conditions, the rate-cut cycle has coincided with tighter long-term financing.

Attention is increasingly turning to the Fed’s long-run credibility as Trump prepares to nominate a successor to Jerome Powell once the chair’s term ends. Analysts warn that appointing a politically driven chair, or pressuring the current Committee into sharper easing, could lift inflation expectations. Instead of pulling yields down, such a shift might push them even higher and disturb broader financial stability.

Markets expect a quarter-point reduction this week and two more cuts in 2026, bringing the policy rate toward 3%. Yet the bond market’s refusal to follow the Fed’s easing path suggests that short-term policy is no longer the dominant force at play. Rising fiscal deficits, expanding Treasury issuance, and questions about long-term inflation control now appear to be shaping yield behavior more powerfully than the Fed’s actions.

Global markets remained cautious as investors weighed the economic impact of the ongoing Middle East conflict and volatile energy prices.

Currency markets remained volatile as ongoing Middle East tensions continued to shape global sentiment.

Hormuz Blockade Rattles Markets (09 - 13 March)

Hormuz Blockade Rattles Markets (09 - 13 March)Global sentiment was dominated this week by the second week of the war with Iran and the effective blockade of the Strait of Hormuz, driving Brent crude prices above $100/barrel. Despite a catastrophic US labor report showing a loss of 92,000 jobs in February, safe-haven demand pushed the US Dollar Index to 99.1. The energy shock has ignited fears of "stagflation," particularly in Europe and Japan, as soaring fuel costs threaten to reverse recent disinflationary trends.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!